Introduction

As a dividend growth investor, I seek new investment opportunities in income-producing assets. I often add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital. In this article, I will analyze Lowe’s (NYSE:LOW), a company I already have in my portfolio.

The consumer discretionary sector is interesting, and Lowe’s in particular. As we enter a more challenging business environment with higher rates, companies that tend to be more cyclical may see their shares plunge. That’s when the focus should be on high-quality companies that can weather a storm. I analyzed Low’s a year ago and found it a BUY.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Lowe’s operates as a home improvement retailer in the United States. The company offers products for construction, maintenance, repair, remodeling, and decorating. It also provides home improvement products, such as appliances, seasonal and outdoor living, lawn and garden, lumber, kitchens and baths, tools, paint, millwork, hardware, flooring, rough plumbing, building materials, décor, and electrical. In addition, the company offers installation services through independent contractors in various product categories. It sells its merchandise and private brand products to professional customers, homeowners, and renters.

Fundamentals

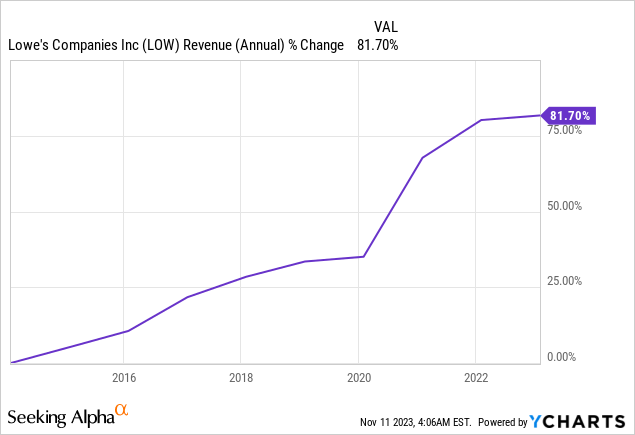

The revenues of Lowe’s have increased by 82% over the last decade. The company is growing mainly organically as it grows the number of stores and sales per store. The significant increase in the company’s sales can be attributed to the pandemic and people staying at home with more time to take care of their immediate environment. In the future, as seen on Seeking Alpha, the analyst consensus expects Lowe’s to show flat sales in the medium term.

The EPS (earnings per share) during that period grew much faster. It is up 375%, compared to the only 82% increase in sales. The company has grown EPS much quicker because of extensive buyback programs and margin improvement as the company lowered costs and increased online sales. In the future, as seen on Seeking Alpha, the analyst consensus expects Lowe’s to keep growing EPS at an annual rate of ~5% in the medium term.

The company is one of a few dividend kings who have increased yearly dividends for over 50 years. The 5% dividend increase in May marked the 62nd annual increase in a row. The company pays a 2.2% dividend, almost the highest it has yielded over the last decade. The current payout ratio is just shy of 33%. Therefore, I believe the dividend is likely safe. A low payout ratio is critical in cyclical business as the EPS may be volatile.

In addition to dividends, companies, including Lowe’s, use buybacks to return capital to shareholders. These share repurchase programs help companies increase EPS by decreasing the outstanding shares. Over the last decade, Lowe’s has been buying its shares aggressively. It has repurchased 45% of its shares. That alone would double the EPS. Buybacks are highly effective when the share price is attractive. Therefore, I believe the management should exploit any weakness in the market for more buybacks.

Valuation

Lowe’s P/E (price to earnings) ratio stands at 14.6 when using the EPS forecasts for 2023. That means investors can buy today’s shares in a growing company for less than 15 times earnings. The current valuation is almost at its lowest over the last twelve months. While investors may be concerned with short-term challenges, long-term investors should find that entry point attractive if they believe in the long-term trajectory.

The graph below from Fast Graphs emphasizes that the shares are attractively valued. The average P/E ratio of the company stood at 19 over the last two decades. It is significantly lower, with a P/E ratio of 14.6. The growth rate was also higher than the forecasts for the short term. However, I don’t believe it justifies the valuation gap. According to the graph below, based on analysts covering the company, we will see a return to growth following an EPS decline this year.

Fast Graphs

Opportunities

Lowe’s holistic approach to home improvement, known as the total home strategy, sets it apart in the market. The company doesn’t merely sell materials. It collaborates with professionals and offers installation services. This comprehensive approach is pivotal in a home improvement market valued at $1 trillion, evenly split between DIY and professionals. By catering to both segments, Lowe’s taps into a massive market share, ensuring a diverse revenue stream and a strategic position in an industry where the synergy between materials, professionals, and services is crucial.

Lowe’s

Lowe’s advantageous collaboration with professionals extends beyond mere sales. These professionals, acting as de facto salespeople, directly access clients and make bulk purchases. With a growing population in the U.S. and over 50% of houses being 40 years or older, working closely with professionals allows Lowe’s to efficiently reach end clients while selling its diverse range of products. The company’s value proposition, encompassing convenient delivery, financing options, and a wide product selection, positions it favorably to capitalize on the increasing demand for home improvement professionals.

Lowe’s

Lowe’s commitment to providing an omnichannel shopping experience for DIY clients enhances its competitiveness. Beyond convenient delivery and financing, the company heavily invests in technology. The Lowe’s app allows users to visualize and estimate various products within their homes, blending the digital and physical realms seamlessly. This attracts more users to online sales and retains the option for in-store visits. As part of its tech-driven strategy, Lowe’s has shifted its workforce towards customer service, allocating 60% of working hours to it compared to 40% in 2018.

Lowe’s

Risks

Lowe’s faces a significant risk associated with interest rates, especially as they reached 5-5.25%. The higher interest rates make borrowing more challenging, a crucial element in large-scale projects like renovations and home building. The company heavily relies on consumers’ ability to finance home improvement endeavors. If borrowing becomes more expensive or less accessible due to rising interest rates, it will negatively impact Lowe’s sales and hinder its customers’ ability to undertake substantial projects.

A notable risk is tied to the overall economic conditions, especially if there is a potential hard landing. The Federal Reserve’s efforts to slow down the economy, particularly if accompanied by higher unemployment rates, may reduce consumer spending on home improvement. A sluggish economy often translates to decreased demand for renovations and discretionary spending on home-related projects.

Lowe’s faces fierce competition in the home improvement retail sector, notably from industry giant Home Depot. Additionally, the competition extends to manufacturers selling directly to professionals and general retail giants like Target and Walmart, which cater to basic DIY needs. The market saturation and aggressive strategies of competitors pose a risk to Lowe’s market share and profitability. That’s why Lowe’s, as a retailer, must continually innovate to provide superior customer experiences and maintain its margins.

Conclusions

Lowe’s is a dividend king that has increased sales and income for decades, leading to over six decades of dividend increases and aggressive buybacks. The company still has many growth opportunities in the medium and long term. It will enjoy both the increase in the market size and its ability to offer a unique and superior value proposition that will allow it to increase its market share in the growing home improvement and home-building markets.

While there are risks to the investment thesis, they revolve mainly around the business environment in general. The competition was always here, and Lowe’s has dealt with that. I believe that the current valuation of the company makes it a BUY. Therefore, I am not changing my rating. A key to long-term returns is the combo of solid fundamentals, several opportunities, and limited risk with a decent valuation.

Read the full article here