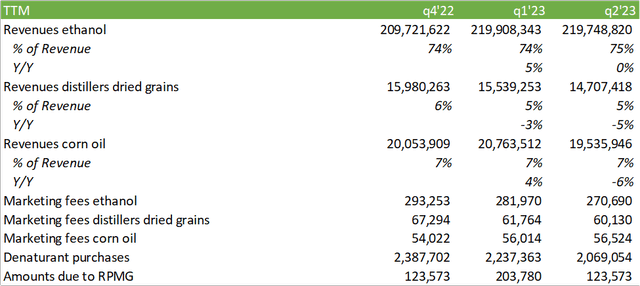

Lake Area Corn Processors (OTC:LKCRU) is a South Dakota-based firm that produces ethanol, corn oil, and distillers grains. 75% of their revenue is derived from ethanol production and sales with the remainder coming from distillers dried grains, distillers modified/wet grains, and corn oil. Through a host of equity investments, Lake Area Corn Processors produces, stores, transports, and markets their products.

LKCRU shares are traded OTC and can either be purchased directly through Home or through major brokerages. LKCRU shares are not actively traded on the open market; however, holding units does offer the benefit of a high dividend distribution yielding 28%. Because of the low liquidity due to the lack of an active trading market, I provide LKCRU shares a HOLD rating with a price target of $4.25/share based on the substantial distribution.

Macro & Financials

Lake Area Corn Processors has a total capacity to produce 100mm gallons of ethanol each year, an increase of 11% from FY22. Through an expansionary project in building out their fermenter, ethanol storage tank, and grain bin, Lake Area Corn Processors has been able to successfully increase their total capacity. On a broader scale, the US currently has 202 ethanol production facilities and produces 17.946b gallons of ethanol each year with the largest producers being Archer Daniels Midland, Green Plains Renewable Energy, POET Biorefining, and Valero Renewables Fuel. To equate this to a common figure, Lake Area Corn Processors produces 0.0055% of the US capacity for ethanol.

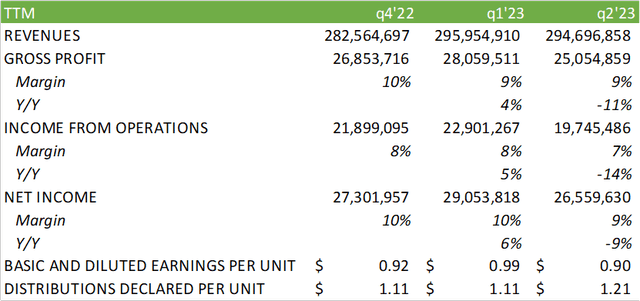

Though this figure sounds miniscule, it has yielded Lake Area Corn Processors $295mm in revenue for the trailing four quarters with an EBITDA of $10mm for a margin of 9%. The two main costs in their production are corn and natural gas. Given this, Lake Area Corn Processors is well hedged in their two biggest commodity inputs with commitments to purchase 6.1mm bushels of corn at an average price of $6.16/bushel and 1,304,000mmBtu of natural gas at an average price of $3.65/MMBtu. Given the current price of $4.90/bushel of corn and natural gas futures priced below $3.00/MMBtu, Lake Area Corn Processors’ hedge book is expected to be reporting a loss for the duration of the year.

Lake Area Corn Processors markets their products through a 3rd party, Renewable Products Marketing Group, whom Lake Area has a 5% equity stake in. This partnership works to their benefit in which RPMG brings their products to the broader market that is typically traded through forwards and futures contracts.

Corn oil is a byproduct of ethanol production and is a $20mm business for Lake Area Corn Processors. This product is typically sold to refineries as an alternative input to soybean oil for the production of biofuels such as biodiesel and renewable diesel. As the refining industry more heavily focuses on renewable diesel for the automotive industry, prices for corn oil and soybean oil should respond positively. According to their SEC reports, corn oil prices will respond positively to price increases in soybean oil.

Distillers grain is their other byproduct from the production of ethanol. Distillers grain produces $15mm in revenue for Lake Area Corn Processors and is typically used as animal feed. The firm produces two types of distillers grain, modified/wet and dry grains. Modified/wet is typically sold to local markets as the product has limited storage life. Dry grains can be sold on a broader scale as it can be transported and stored for longer periods of time. Their biggest export markets include Mexico, South Korea, and Vietnam.

Company Reports

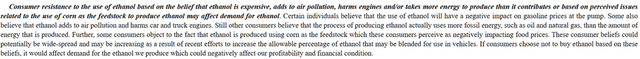

Lake Area Corn Processors’ business is heavily dependent on the macro and geopolitical environment. Through the E10 regulation, 10% of fuel must be blended with ethanol. In total, the US consumes roughly 135b gallons of gasoline each year, equating to 13.5b gallons of ethanol. Given the static growth in fuel blends and fuel consumption, the industry dubs this as the “blend wall” as the market will generally neither grow nor shrink without public policy or an exogenous event. This creates a major challenge for ethanol producers in the long-run as fuel sources turn to more environmentally friendly fuels, such as hydrogen or battery electric. As discerned in my article on PHINIA (PHIN), hydrogen-fueled commercial trucks are expected to grow at a rapid rate beginning in 2027 and reach 850,000 vehicles on the road by 2035. Though this will represent roughly 6.5% of the total commercial vehicles on the road, it will take part in moving the needle for fuel consumption. The same can be said for electric vehicles. According to a J.D. Power study, 8.6% of US new car sales through August 2023 were electric vehicles.

Another challenge outlined by management is the increase in ethanol production in anticipation of country-wide E15 fuel standards. In June 2019, the Trump administration approved the use of E15 year-round; however, the rule was challenged in court and revised to make E15 unavailable in certain markets during certain times of the year. A February 2023 proposed rule that will prevent E15 use during summer months starting in 2024 was brought forth by the EPA, making the higher blends more challenging to market.

Higher fuel blends may be a challenge. According to a report published by Reuters on February 14, 2022, the National Academy of Sciences found that corn-based ethanol fuel blends have been found to be 24% more carbon intensive than pure gasoline, completely contradicting previous research commissioned by the USDA. Whether this study has any effect on the ethanol market has yet to be seen, but it could potentially be impactful to fuel blends as decarbonization becomes heavily focused upon by the automotive and energy industries.

On the geopolitical front, tariffs have become a bigger challenge for producers as China implemented an anti-dumping rule on distillers grains back in 2016 and has extended this tariff through 2028 with a tax premium of 66%. Brazil has done much of the same for ethanol with a 16% tariff through 2023, rising to 18% in 2024. This will likely result in limited-to-no exports of ethanol to Brazil unless the tariffs are lifted.

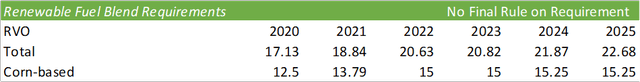

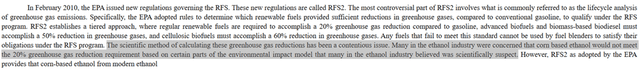

One piece of regulation Lake Area Corn Processors has on their side is the Federal Renewable Fuels Standards which creates a baseline requirement for the amount of renewable fuels produced each year. The EPA began regulating this market in 2022 and may continue the renewable requirements going forward.

Company Reports

One of the biggest challenges faced with this regulation is that the EPA may further increase the non-corn-based renewable fuel requirements as cellulosic biofuels reduces greenhouse gas emissions by -60% when compared to corn-based fuels’ alleged -20%. The ethanol industry as a whole has raised concerns that their 20% target may not be met based on the environmental impact model used to measure emissions.

Company Reports

This has created some challenges for Lake Area Corn Processors as environmental compliance costs increased from $182k in FY22 to an expected $240k for FY23. Whether this charge increases for years to come is to be determined; however, an article cited by Reuters may be the silver lining.

Company Reports

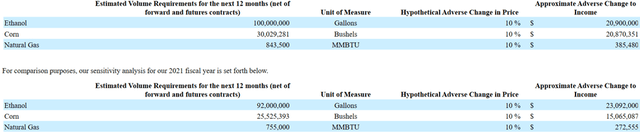

Given the macro effects on the firm’s operations, it is prudent to include management’s market sensitivity metrics to fully understand the effects of price swings.

Company Reports

To summarize this, a 10% price change in ethanol will lead to a 7% increase/decrease in total revenue. A 10% price change in bushels of corn affects COGS by 8% and a 10% price swing in the cost of natural gas will affect COGS by less than 1%.

Company Reports

Valuation & Shareholder Value

Though the outlook for ethanol production is a mixed bag, the firm can be valued similar to the tobacco industry or the midstream industry in which they can continue to produce to meet market demand and distribute proceeds to unitholders. It’s challenging to infer any growth opportunities in this market as fuel utilization changes, whether it’s through battery-electric vehicles, hydrogen fuel cells, hybrid vehicles, or just better fuel economy ICE vehicles. I don’t believe there will be any immediate changes and that this will be a slow burn. Regardless of the outlook, the changing market might create a new market opportunity for Lake Area Corn Processors through the use of corn oil and feedstock.

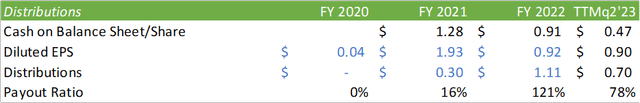

Being a unitholder of LKCRU comes with its perks, including a stable share-base and a distribution upwards of 75% of net income. The downside risk to holding units includes low liquidity in the public market, limited to no exposure to institutional investors, and the potential challenges in exiting a position. The firm has a market cap of $125mm and is valued at 5x EV/EBITDA. The trailing annualized dividend rate as of q2’23 came in at $1.21 for a yield of 28%, which has the ability to both make up for muted capital gains and offers a stable source of income through a turbulent market.

The dividend has paid out relatively high in recent years. Despite the distribution paid in FY22 exceeding net earnings, Lake Area Corn Distributors did hold an excess amount of cash to allocate to unitholders in place of operating cash flow.

Corporate Reports

Two directors of the firm, Todd Brown and Lloyd Hansen Randall acquired 5,000 and 7,500 units, respectively, in October. Todd Brown had also previously increased his holdings by 11,500 units in July to increase his ownership to 423,000 units, or a 1.4% ownership in the firm. With the information provided, I give LKCRU stock a HOLD recommendation with a price target of $4.25/share.

Given how challenging collecting information LKCRU has been, here are a few links relating to the firm: Company Website, AgStockTrade, SEC Filings

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here