Almost everyone knows about dividend growth, the natural byproduct of a strong business, a competent management team, and a saturated end market where it’s tough to find good uses for capital.

There are tons of strong companies that have grown dividends for years and years, growing payouts (and shareholder wealth) over time, in some cases for more than 25 years:

Some Popular Dividend Champions (Dividend Radar)

One great byproduct of companies at this stage is that as they grow their payouts, the yield you get from the capital you put to work actually increases as you remain invested.

A $10,000 position in a given company paying $400 a year means that the stock is yielding 4%.

However, when the company’s management team ups the dividend 50%, your $10,000 position now pays you 6% – without you having to do anything at all.

This is the beauty of dividend growth – and it’s something you can track by looking at a ‘Yield On Cost’ graph.

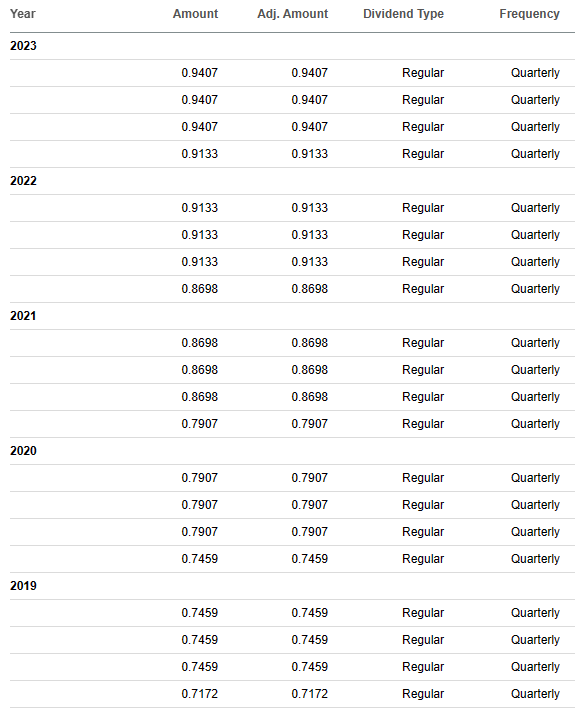

Here’s the dividend report for Proctor & Gamble (PG). It’s a popular dividend growth stock; have a look:

Seeking Alpha

As you can see, right now, the dividend yield is about 2.5%. However, if you invested in PG 5 years ago, you’d be making closer to 4.3% of your capital invested. Some of this is due to the price of PG going up, but a good chunk of this is also explained by the company’s consistent dividend growth policy.

As you can see, payouts have been increasing over time:

Seeking Alpha

But what does this all have to do with the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI)?

In short, we’re worried about the long-term feasibility of JEPI maintaining its yield on cost.

In other words, we’re worried that the fund’s payouts could begin to shrink, based on the amount of your initial capital invested.

Given issues that other funds have experienced, we think that the biggest long-term risk to JEPI is the war its managers will have to fight to keep the yield on cost high.

But how can they do that? How can they keep the yield on cost steady?

Plus, what can we watch out for to know if and when the time is right to jump and find an alternative?

Today, we’re examining JEPI’s prospects, along with where the fund currently sits and the risks its managers will have to monitor in order to maintain its status as an investible fund.

Let’s jump in.

The Fund

If we’re being honest, we’re not big fans of option writing high-income funds in general.

As heavy option traders ourselves, we’re happy that regular folks are getting access to strategies that were once the domain of professional traders only.

However, the implementation of many of these funds has been poor. Look no further than QYLD, an incredibly popular fund that writes ATM calls on the Nasdaq 100 index.

We’ve written at length about the fund and its issues here and here, but one only needs to look at the fund’s miserable-looking yield on the cost chart to get a sense of the issues:

Seeking Alpha

Instead of increasing over time, the fund’s payouts have actually decreased since inception, a period in which general volatility has risen or stayed constant, which should in theory have boosted returns.

Why has this happened?

The issue we’re about to explain is core to most of the option funds out there, but it’s quite simple; they sell options in a mechanical way.

To some degree, we get it. Rules and systems are what is required when a fund hits the market. Strategies need to be laid out and followed in the prospectus, otherwise, it can be hard to scale an offering.

But at the same time, a mechanical approach to selling options is simply not the right way to go about things, in our opinion.

This is because funds that stick to constant distributions, even when the option sales aren’t profitable, do long-term damage to investors.

Here’s how.

How Covered Call Funds Lose Money

To understand how this happens, have a look at the following chart below:

TradingView

Here in blue, you can see QQQ, and in white you can see QYLD, both in September of this year. As time elapses from left to right, you can see how blue outperforms white; it appears as though white has some sort of ceiling that it’s bumping up against.

This is the short call that the covered call fund sold – it’s constraining the fund’s NAV. It’s the cost of the yield.

Then, you can see that on the 15th, the option expires and the price is free to move again. Only, unfortunately for QYLD investors, QQQ, the underlying asset of the fund, ends up tanking. When it drops, QYLD investors bear most of the full brunt of that hit.

Due to the high-beta nature of the underlying index and the non-discretionary nature of the option selling, several rounds of this in the name of ‘income’ will drastically hurt investor value – not by tanking the fund to zero as the index is relatively stable, but by increasing the cost basis of the underlying assets, which is the only logical place the loss goes when a lossmaking, cash-settled option trade is still paid out as a distribution.

This is even more clear to see in TSLY, a single stock version of this fund that sells calls in Tesla:

TradingView

The same issue exists here from left to right, as the upside is constrained, but the fund still participates in the downside of the stock if and when it crops up.

In the time the TSLY fund has been public, the yield on cost has been cut by more than 50%, despite the fact that Tesla is up over that period of time:

Seeking Alpha TradingView

This just goes to show how this flawed, mechanistic selling methodology isn’t a good solution for the long term.

But what about JEPI?

JEPI Is Better

Fortunately, JP Morgan (JPM) seems to have thought of this. In their fund, managers have more discretion over which stocks they are buying:

[The portfolio is made up of] Defensive equity, and we employ a time-tested, bottom-up fundamental research process with stock selection based on our proprietary risk-adjusted stock rankings.

The portfolio is also quality-oriented, which is a significantly lower-beta, higher-sharpe cohort of stocks than stuff like Tesla (TSLA). This means that there are fewer scenarios where the underlying assets run up above the covered call ceiling and cause realized losses to the fund.

Additionally, the fund sells out-of-the-money call options, which gives a much better blend of income and ‘room to move’.

Risks

However, zooming out, the fund still does fundamentally the same thing as many other funds out there; it sells calls. And, if the calls sold are taken out by a similar constituent price in the underlying, then it’s a realized cost to investors.

The issue here is simply a math problem.

If the fund managers need to pay out a distribution consistently to shareholders, and occasionally a loss is incurred from selling calls that get taken out, then JEPI’s share price has a serious headwind on it.

This happens automatically over time, simply as a function of the fund’s setup.

As a result, JEPI’s share price is down since the start of this year, vs. a considerable gain for the S&P 500:

TradingView

This is better performance than most other high-income funds due to the aforementioned benefits that JEPI has on its side, but if the share price begins to go down, then the earnings power of the ETF begins to wane, and it’s a spiral towards reduced income and lower prices, which nobody wants.

Management has done a good job of navigating this yield on the cost issue, which is why JEPI is the largest fund by far when it comes to the income landscape.

However, the yield on the cost chart for the last few years has been oscillating around in an unconvincing way:

Seeking Alpha

Some of this can be explained by the fluctuating market and underlying stock-picking methodology, but it will be incredibly key to keep an eye on distributions going forward for any sustained dip as a result of poor discretionary decisions being made by the managers:

Seeking Alpha

Summary

All in all, JEPI is definitely one of the best income funds out there when it comes to methodology, deployment, and execution, especially when compared to funds like QYLD and TSLY which have serious issues.

That said, management needs to avoid realizing too many losses on option positions in order to keep the yield on cost stable. If they don’t, then share prices may be headed lower, which could constrain earnings power, and so on.

We rate JEPI a ‘Hold’, but a hold we’re keeping a close eye on.

Cheers!

Read the full article here