Co-authored with Hidden Opportunities

If you are currently in the workforce, how often do you get paid? This decision is typically up to your employer (and perhaps due to particular payday requirements in your state). The choice of payday schedule is typically based on the company’s budget, resources, and administrative convenience. In general, there are four options for payroll frequency that employers can choose from. They can pay their employees on a weekly, biweekly, bimonthly, or monthly basis. How does it matter, one may ask? After all, the same pizza is getting sliced differently, right?

There is a significant difference. Getting paid more frequently allows for simpler expense management and helps maintain a more consistent cash flow. It lets you tackle your recurring expenses more efficiently without the stress of stretching your funds until the next payday. It also helps avoid reliance on costly solutions like credit cards or loans, leading to better financial health. Most importantly, frequent paychecks let you utilize the power of compounding to let your money work harder for you. Saving or investing a portion of a weekly paycheck will yield better returns than if done with a monthly paycheck.

Employment is finite; every employee must ultimately retire. The “when” part is variable for each individual, but this is in your hands if you can replace your paycheck with something that doesn’t require your active involvement. This is why I invest for income, so every dollar I invest is working to put more dollars into my account regularly and predictably.

Even within dividend-paying securities, I have a particular affinity for those that pay monthly. This is because I have monthly commitments. My mortgage payments are monthly, and so are my insurance, utility, and telephone bills. My recurring expenses, which represent the lion’s share of my expenses, are all monthly. So getting my dividends every month lets me flexibly to tackle those expenses and earmark a portion to reinvest. And as mentioned above, the power of compounding works better for me with monthly dividends.

1) Monthly Income From Global Real Estate: AWP – Yield 11.9%

On a global level, there are 940 listed REITs (Real Estate Investment Trusts) in 40 countries with a combined equity market cap of ~$2 trillion. Over the past 30 years, this industry has seen tremendous growth; there were only 120 listed REITs in two countries in 1990!

REITs provide access to telecommunications towers, data centers, health care facilities, self-storage facilities, hotels, entertainment and gaming facilities, and others in addition to the traditional property sectors like retail, residential, office, and industrial.

Amidst higher interest rates and an inflation-driven rise in construction and financing costs, the supply of quality properties is tight worldwide.

-

Housing shortages are widespread across leading E.U. nations, Canada, Australia, and New Zealand. The demand for residential and commercial real estate space (except office properties) is strong. However, due to prevailing tight monetary conditions, little attention is paid to how much new supply is forecasted to decline in 2024 and 2025.

-

Property developers across the world are experiencing tighter financial conditions, reporting that new projects are less economically feasible. Industrial construction continues to decelerate for five straight quarters through the end of FY 2023 in major markets.

Amidst the backdrop of a weaker environment for new projects, quality REITs are in a position of strength. Their earnings will prove resilient, supported by rising occupancy, rent increases, and positive spreads upon expirations.

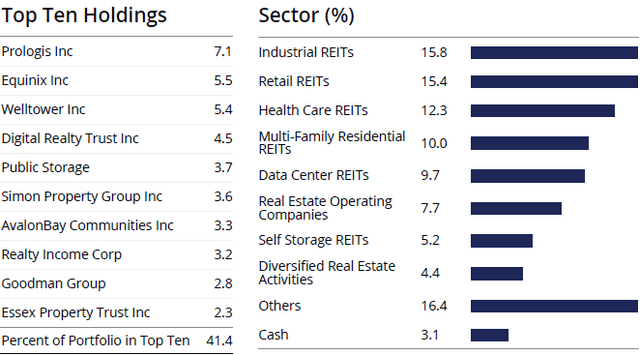

abrdn Global Premier Properties Fund (AWP) presents an attractive CEF (Closed-End Fund) for diversified exposure to the global REIT sector. The fund maintains a portfolio of 66 holdings, with its top ten positions in world-class REITs, constituting 41% of the invested assets. Source

AWP Fact Sheet

Some analysts may be quick to dismiss AWP as a poor investment, discussing its 10- or 15-year price chart without context. Investors must note that AWP wasn’t an abrdn original, but it was acquired from Alpine Woods Capital Investors and brought under the abrdn’s management in mid-2018.

Following the shift from a questionable fund manager, it typically takes time for the fund to reorient and refocus on its strategy to deliver favorable returns. As part of this shift, AWP’s distribution experienced a cut in 2019. But since then, even though the brutal pressures on the REIT sector due to the global pandemic, the CEF has maintained its monthly payments to shareholders. Since that period, the CEF has performed comparably to the REIT benchmark Vanguard Real Estate Investment Fund (VNQ).

AWP operates with a 17% leverage and distributes $0.04/share every month. This calculates to an 11.9% annualized yield. At the end of the first half of its fiscal year, AWP reported $32 million in realized and unrealized gain, reflecting 80% of the CEF’s annual distribution to shareholders.

Investors often mistakenly think that REITs only thrive during times of low interest rates. In 1990, the equity REIT market valuation was $5.6 billion and soared to $135 billion by 1997. Despite high borrowing costs, the strong demand for real estate and increasing property values boosted rental incomes and property appreciation. Additionally, REITs’ tax advantages and their ability to easily pass on inflation costs to tenants made them attractive investments. All this still holds true today. Globally, we are seeing tight rental markets across several industries, and the situation is only set to get worse. This means higher rents and occupancy metrics for leading REITs. With central banks in a few countries having begun rate cuts, and the Federal Reserve likely to follow suit soon, we expect improved sector valuations in the near term. With its massive monthly distribution, AWP makes an attractive choice to ride the recovery.

2) Monthly Income From Utilities: UTG – Yield 8.2%

In the post-pandemic economy, we see an increased adoption of Electric Vehicles. Along with this is the recent surge in the interest in energy-intense Artificial Intelligence technology. Together, these trends bode well for the utility sector with the need for increased output, reliability, and safety. Reaves Utility Income Fund (UTG) is a utility-focused CEF comprising 55 holdings. Its top 10 positions include some of the most prominent providers of energy and telecom services to a vast North American population. Source

UTG June Fact Card

Since its inception in February 2004, UTG has delivered over $1.4 billion in cash distributions to shareholders. This CEF pays $0.19/share every month, which annualizes to an 8.2% yield. Most importantly, UTG has never reduced its monthly payment in its 20-year history.

Utilities never offer promotions or have to try to appease consumers by offering loyalty discounts. Even if you did not consume any units, your bill would not be $0 since there will always be fixed costs like meter and delivery charges. This is basically the utility company trying to keep collecting fees for the upfront expenses they made years ago. The asset monetization potential of this sector is terrific, positioning it to be quite promising for investors to hold through recessions.

3) Monthly Income From Tech: BST – Yield 8.5%

BlackRock Science and Technology Trust (BST) is a CEF that focuses heavily on the tech sector. Since its inception in October 2014, BST has been riding the tech wave, handsomely outperforming the S&P 500 while delivering growing distributions to shareholders.

If you invested $10,000 in BST at its IPO, you would have collected over $11,400 in distributions while maintaining your equity ownership in the income machine.

BST is actively invested in large-cap technology companies, most of which are in the spotlight due to their innovative output. So, whether it is Artificial Intelligence, Virtual Real Estate, Cybersecurity, or SaaS, BST actively manages to allocate its assets to the leading firms. Source

BST Fact Card

Quality tech firms may be richly valued today, but BST provides access to it at a cheaper valuation by virtue of trading at a ~4% discount to par. This means every dollar you invest, you are buying more of these innovative mega-cap corporations.

We see a growing integration of technology into our daily lives and an increasing digital enablement of corporations. It is hard to pinpoint what will be popular five years from now, but with BST’s active management of securities in this space, we can position ourselves to be part of the tailwinds.

Conclusion

Companies worldwide pay dividends at varying frequencies. Some pay annually, bi-annually, quarterly, or monthly. I like to receive my payments as quickly as possible, so I can put them to work immediately. This is the reason behind my affinity for monthly dividend-paying securities; they are the closest to replacing my paycheck!

Our Investing Group maintains a highly diversified portfolio with over 45 securities across the spectrum of industries, targeting a +9% overall yield. While some of our holdings pay quarterly, about 50% of them pay monthly dividends, enhancing the consistency of our cash flows and the efficiency of our budgeting and reinvestments. I rarely log in to check my portfolio because I know exactly when my dividends are going to be credited to my account. This lets me enjoy my day with friends and family and pursing activities that make me happy. This is the art of the Income Method, and the flexibility provided by income investing.

Read the full article here