The following segment was excerpted from this fund letter.

PAR Technology (NYSE:PAR)

On October 5, PAR issued a press release, saying that they had been “selected as the exclusive point of sale (POS) software and services provider with Brink POS® and marketplace order management software with MENU Link, for Burger King® traditional restaurants in North America.”

How did it happen? What does it mean? From the outside, it is difficult to know exactly what happened, but it appears that there is a combination of factors at PAR, Burger King, and within the industry that contributed to this customer win. Jeff

Bezos said, “[a]ll overnight success takes about ten years.” PAR’s journey to landing Burger King started about nine years ago when they purchased the Brink POS system, which was at the time used in just 300 locations.

Brink enjoyed years of rapid growth, but under-investment in the underlying technology and the strategy of promising customized versions to land larger new customers led the software to be unwieldy and difficult to maintain and update across its many versions. When Savneet Singh became CEO in 2019, neither the software nor the company could have serviced or supported a mega Tier 1 customer like Burger King. In fact, PAR’s own customers were screaming at them.

At the time, PAR’s net promoter score, an indicator of how likely a customer is to recommend you, was similar to that of cable companies, which are hardly the paragon of customer service. A wise decision was made to slow growth and fix the software.

The PAR of 2023 is vastly different than the PAR of 2019. Over the past four years, the team has been strengthened, offshore software development resources have been added, the software has been rewritten, and the balance sheet has been fixed through a capital raise. More importantly, the company culture has changed, and the customer value proposition has increased as additional modules have been bought or built, including back office, loyalty, online ordering, drive-through, and payments. Burger King would have been crazy to partner with the PAR of five years ago, but now you could argue they would be crazy not to partner with the PAR of today.

The demands on Burger King’s POS and technology stack have increased notably over the past decade as the operating environment of Tier 1 QSR (quick-service restaurant) chains has gotten significantly more complicated. Multiple software systems must all speak to each other. For example, the POS system needs to exchange data with the mobile app, online ordering site, multiple delivery services such as DoorDash, as well as the loyalty program and the back office/inventory management system. Having the systems working and speaking with each other is critical. An order placed online that does not get transferred to the POS or to the kitchen becomes lost revenue and an angry customer. Burger King invested enormous resources to navigate their technical challenges, bringing in the former CIO of McDonalds, employing over 100 software engineers, and spending more than $60M to reinvigorate their technology. In the end, senior management did not think this was enough and decided to pivot. The top three technology executives departed, and the company issued the RFP that PAR eventually won.

It’s worth going through the minutia about PAR’s history and the rise in complexity of the POS and the fast-food restaurant technology stack because I want to hammer home two critical points:

- PAR has evolved and is ready to win more very large customers.

- Burger King is likely not unique. More is being asked of the POS and restaurant technology, and large chains that try to do it themselves are at a greater risk of falling behind. There are several QSR “whales” out there including Wendy’s, McDonalds, Taco Bell, and Subway, to name a few.

What does signing Burger King mean for PAR? With the stroke of a pen, they added more than 7,000 restaurant locations to their existing base of roughly 22,000, so it is meaningful customer win. Burger King should provide approximately $25M a year in annual recurring revenue on a base of approximately $130M, so PAR’s ARR should grow almost 20% just from Burger King locations in North America. It will take approximately two years to complete the Burger King installations, during which time PAR’s ARR growth rate should climb from >25% to close to >35% per year.

Being selected as the exclusive POS for Burger King North America is an outstanding outcome, and there are likely several additional waves of growth from this single announcement. Why? Burger King is owned by Restaurant Brands International (RBI), which also controls Tim Hortons and Popeyes. RBI has put their crown jewel, Burger King USA, exclusively on PAR’s platform for POS and online ordering, stepping back from internal development and towards standardized data from a single platform. If the Burger King implementation proceeds well, Tim Hortons and Popeyes are the next logical steps, as the same industrial logic that went into selecting PAR for Burger King North America applies to these other chains as well. Popeyes has 2,700 locations and Tim Hortons has more than 5,300 locations. In other words, 8,000+ locations are likely to convert to PAR in the next two to five years, which would represent another $25M+ in ARR. PAR needs to execute.

But wait, there’s more. There are also 10,000+ Burger King locations outside of North America that Restaurant Brands should logically want on the PAR platform. International locations are harder because of language, tax, and support challenges, so these rollouts would likely be the third phase of implementations (after Burger King North America and Popeyes/Tim Hortons). Pricing is likely lower for international, but in round numbers, it will likely add another $20M in ARR on top of the +$25M from Burger King North American (signed) and +25M from Tim Hortons/Popeyes (logical next step).

But wait, there’s still more. The Burger King transition to PAR is part of their “Reclaim the Flame” program, which is committing $400M to finance franchise updates and upgrades, likely involving significant hardware sales to PAR. Those hardware sales should be profitable and include PAR drive-thru and kiosks, on which PAR gets additional software fees. Burger King franchisees already use PAR products Punchh (loyalty) and Data Central, so additional sales of those software offerings seem highly likely as well. At the Burger King franchisee trade show in Miami, the Burger King restaurant of the future booth looked like a PAR showroom. Everywhere an attendee looked, they saw PAR hardware and PAR software.

The Burger King win is enormous for PAR. Perhaps even more importantly, the win also opens the door for other Tier 1 customers. It’s also a massive way to launch their MENU online ordering offering in the United States since Burger King is a great reference account. Will Burger King, Popeyes, or Tim Hortons show up in this quarter’s numbers? No, they will not. In fact, in the short term, there will likely be some elevated expenses for onboarding and support, but this is a massive win and benefits could exceed the $25M, $50M, or $70M in ARR. The Burger King signing marked a new chapter for PAR, validating their unified commerce strategy and showing that they can win RFPs over the largest legacy POS software companies for Super Tier 1 accounts. Theoretically nine years in the making, the Burger King win should roll through PAR’s financial statements for years to come.

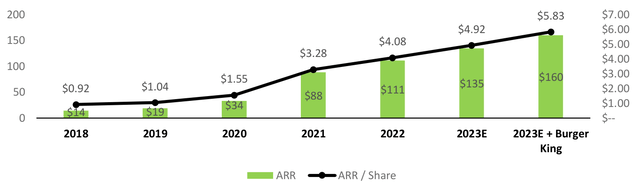

I am spending a lot of time on PAR because it is our largest position. The share price has gone down since the Burger King announcement and greatly lagged the business progress over the last five years. Fortunately, the business has gotten significantly better along just about every metric I can think of. PAR has gone from a single POS offering with significant technical debt and several distracting legacy businesses to a company with six primary offerings (POS, loyalty, online ordering, back office, payments, table service) capable of landing Burger King. This growth was assisted by a capital raise and acquisitions funded with stock, so the most appropriate way to view the business progress, in my opinion, is on a per share basis. The chart below shows the annual recurring revenue (ARR) on a per share basis.

ARR/Share Growth

PAR has grown from less than $1 per share in ARR in 2018 to more than $4.50 today and should end the year at just under $5; if you want to give them credit for just Burger King North America, which is signed, you get to almost $6 per share in ARR. Tim Horton/Popeyes would add another ~$1 per share in ARR, and Burger King International would get you another $1 on top of that. PAR has also made substantial investments that are not yet showing up in revenue, but will begin contributing in 2024, including MENU, the online ordering platform, and table service to name two.

PAR has single-digit market share, a strong product offering, a favorable competitive landscape, and a history of successful acquisitions and product development. PAR should have multiple shots on goal at other large Tier 1s. None of these waves of growth require massive R&D or massive marketing spend: the products are built and the customers already exist.

PAR should inflect to profitability in 2024 and never look back. Given the foundation that has been built, there is reason to believe that the next five years of operating progress will be even better than the last five years and today’s sub-billion dollar valuation will seem quaint. With the October 5 announcement of Burger King, we got one day closer, but in my opinion, we are far, far from the final destination.

Disclaimer:This document, which is being provided on a confidential basis, shall not constitute an offer to sell or the solicitation of any offer to buy which may only be made at the time a qualified offeree receives a confidential private placement memorandum (“PPM”), which contains important information (including investment objective, policies, risk factors, fees, tax implications, and relevant qualifications), and only in those jurisdictions where permitted by law. In the case of any inconsistency between the descriptions or terms in this document and the PPM, the PPM shall control. These securities shall not be offered or sold in any jurisdiction in which such offer, solicitation or sale would be unlawful until the requirements of the laws of such jurisdiction have been satisfied. This document is not intended for public use or distribution. While all the information prepared in this document is believed to be accurate, MVM Funds LLC (“MVM”), Greenhaven Road Capital Partners Fund GP LLC (“Partners GP”), and Greenhaven Road Special Opportunities GP LLC (“Opportunities GP”) (each a “relevant GP” and together, the “GPs”) make no express warranty as to the completeness or accuracy, nor can it accept responsibility for errors, appearing in the document. An investment in the Fund/Partnership is speculative and involves a high degree of risk. Opportunities for withdrawal/redemption and transferability of interests are restricted, so investors may not have access to capital when it is needed. There is no secondary market for the interests, and none is expected to develop. The portfolio is under the sole investment authority of the general partner/investment manager. A portion of the underlying trades executed may take place on non-U.S. exchanges. Leverage may be employed in the portfolio, which can make investment performance volatile. An investor should not make an investment unless they are prepared to lose all or a substantial portion of their investment. The fees and expenses charged in connection with this investment may be higher than the fees and expenses of other investment alternatives and may offset profits. There is no guarantee that the investment objective will be achieved. Moreover, the past performance of the investment team should not be construed as an indicator of future performance. Any projections, market outlooks or estimates in this document are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of the Fund/Partnership. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of the relevant GP. The information in this material is only current as of the date indicated, and may be superseded by subsequent market events or for other reasons. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Any statements of opinion constitute only current opinions of the GPs, which are subject to change and which the GPs do not undertake to update. Due to, among other things, the volatile nature of the markets, and an investment in the Fund/Partnership may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal, and tax professionals before making any investment. The Fund/Partnership are not registered under the Investment Company Act of 1940, as amended, in reliance on exemption(s) thereunder. Interests in each Fund/Partnership have not been registered under the U.S. Securities Act of 1933, as amended, or the securities laws of any state, and are being offered and sold in reliance on exemptions from the registration requirements of said Act and laws. The references to our largest positions and any positions listed in the Appendix are not based on performance. All of our positions will be available upon a reasonable request. All hyperlinks contained herein are not endorsements and we are not responsible for such links or the content therein. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here