Author’s Note: All amounts are in Canadian dollars unless explicitly stated otherwise.

Dear readers/followers,

Fortis (NYSE:FTS) (TSX:FTS:CA) is a company I’ve been covering for some time, and do maintain a small stake in. As you may have noticed in my other utility articles and investments, utilities have not made the greatest investments or potentials for the past few months and about a year. The rise in interest rates have punished many utilities – as have increased costs, and increased costs of debt, as many renewable-oriented business have had to recalculate rates of return for some key project – not a good market.

Fortis has the scale to really keep costs lower though, and it’s hardly exposed to any one worrying sector like some renewables are.

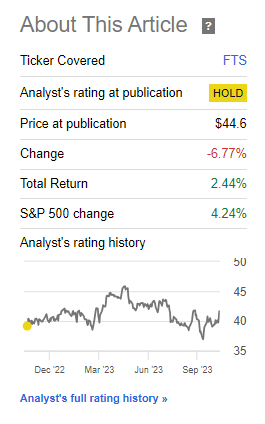

This is an updated article on Fortis, with one of my latest found here. It’s been some time since I offered an update here, and since the time of the linked article, the company has delivered a negative TSR of around 5%, which cements my “HOLD” thesis at that valuation. Over the past 2 months, Fortis has gone up and down, currently after the last two days of extreme upward trajectory settling at just above $56 Canadian dollars. Not that long ago you could have bought the company at $50/share, but this still didn’t make an impression for me in a market where Fortis is still trading at a yield of less than 4.5% where 5%+ is easy to get.

So, in this article, I’ll provide you with an update and see where we could go from here.

Fortis – Very solid fundamentals, less solid long-term upside at 5% risk-free

Several authors and I’m not the only one, have for a long time pointed to the relative risk factor of investing at 4% yield or thereabouts, while pref shares and other investments yield far higher with a similar or improved risk profile.

The problem with Fortis’ common shares has always been one thing – the valuation. The company is very, very rarely cheap. And because it’s a regulated utility that does not control its own pricing and in its nature does not deliver outsized earnings or revenue growth (at least not easily), that begs the question of why we should invest in something that yields so little, even A-rated.

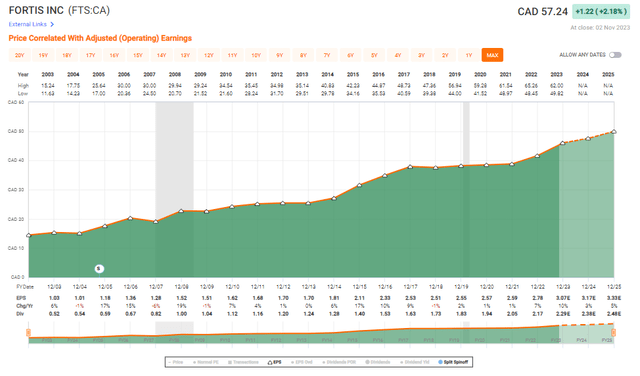

Fortis has averaged 20-year EPS growth of just above 5%. That is not bad in any way, but with the exception of recessions, Fortis has always commanded a significant premium. That premium has, at times, been as high as 24x P/E, which is absolutely ridiculous for an electric utility, even one with over $27B market cap and A-rating.

In fact, since my very first article on Fortis, the company has clearly underperformed the market, if only slightly – at least making clear that this has not been a market-outperforming investment over the past 2 years.

Seeking Alpha Fortis (Seeking Alpha)

The good thing about utility investments is that they are extremely boring – usually in a good way. They don’t see much decline – or growth. Surprises in this sector are very rare. It can be illustrated using this earnings graph that shows the past 2 years.

Fortis EPS (F.A.S.T graphs)

And the company’s share price typically tracks somewhere very close to the earnings trend you see here, with the aforementioned premium added to it. This company won’t see 10-20% EPS growth in a single year. It’s not in its operations, with the possible exceptions of single years like 2015.

Fortis owns a portfolio of regulated utilities across North America, with Newfoundland Power being the original subsidiary of the company, but otherwise also consisting of a number of subsidiaries across the Caribbean and North America.

The company also turned into a dividend king, showing 50 years of consecutive dividend increases, with a 4-6% average annual dividend growth guidance all the way to 2028E. I do not doubt the company’s ability to do this for a second – the problem is that does not equate it to being an attractive investment.

The current asset//geographical mix is as follows.

Fortis Mix (Fortis IR)

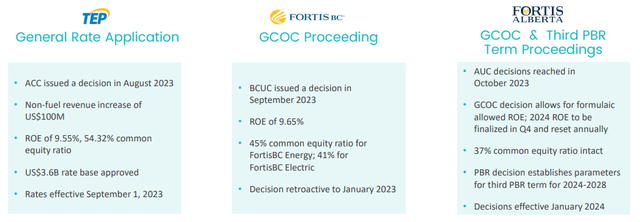

Fortis has also been able to keep consumer price increases at a relatively low overall level compared to others. It has a good working relationship with regulators, as evidenced by recent regulatory decisions, which have been above 9.5% RoE at 40-55% equity ratio range.

Fortis IR (Fortis IR)

The company is a very active manager of its own portfolio. It recently sold Aitken Creek to Enbridge (ENB) for $400M, further strengthening its balance sheet and giving flexibility to the regulated operations of the company across NA. The company is also moving quickly to exit coal – between 2017-2023, over 508MW of coal assets have been retired, and in 2024-2032 the around ~900MW that remain will be retired, with the last retired in 2032. The net-zero target for Fortis is 2050.

Much like other utilities, it has an ambitious CapEx plan involving $25B of investments, much of it going into clean energy, while 57% goes into sustaining capital, meaning payments to ensure safety, performance, and reliability over the next few years.

A quick glance at housekeeping shows us that the company is very well capitalized. The company is A or Baa3 rated by all rating agencies and is effectively 100% regulated which means stable and predictable long-term cash flows. The company’s premiumization can be understood here within this context.

3Q23 was absolutely no different here. (Source: FTS 3Q23) Adjusted EPS is up due to good regulatory outcomes and continued investments in the base as well as very good results in Western Canadian Electric & gas. YTD, the company is seeing good results from virtually all of its segments, which is leading to impressive growth for the company.

As of the end of 3Q, the company has $4B+ in remaining liquidity and has recently raised over $2B in long-term debt at contextually attractive interest rates. (Source: FTS 3Q23)

The math is clear. If you are, at some point, able to buy this company at anything approaching a fair value, then you buy and you don’t look back. The historical performance is proof here. Even during the GFC, Fortis barely touched 15x P/E for the briefest time before going back up. During COVID-19, it didn’t even come close to it.

Currently, the valuation is what I would consider prohibitive for a profitable investment. I can see my way to buying it at a cheaper price, and this is also not a valuation where I would necessarily be selling my stake, but it’s not a great price.

Let’s look at specifics.

Fortis valuation – quality does not make up for an expensive price for a utility

The company isn’t as expensive as it once was, or as it historically has been. That’s of course a positive. At the same time, it’s not anywhere close to what I consider buyable. Over the course of the next 3 years, the company is expected to average around 4.6% growth and is currently trading at an 18.9x P/E. That’s very high for any utility. The fact that it hits its estimates 100% of the time both with a 10-20% margin of error is only a small saving grace here (Source: FactSet).

4% yield and a forecast to an 18-19x P/E range, up to 20x, if we go by the 5-year average, implies an annualized upside of 5.8% on the low end and around 9.8% on the high end, averaging out at around 6-7% per year.

That’s less than the current conservative yield on an IG-rated pref stock or a competitive debt instrument like a well-researched baby bond. And if your conservative and realistic midpoint is less than that, why on earth are you investing?

The simple fact is that this isn’t good enough to “go for” here. There are also some “warnings” on the horizons that are worth at least mentioning here. Like most utilities, the company is currently under margin pressure due to rising costs, rising CapEx, and more green energy. In fact, both Gross and Operating margins are declining for the company. The company’s dividend payout ratio is also above the peer median at above 70% here (Source: GuruFocus), which is not the best. Not worrying to me, but not the best. The company’s ROIC is also less than its WACC. None of these factors are enough to make me not invest at a good valuation – but since the valuation isn’t good, this only adds to my argument.

Fortis has all the makings of a solid investment at the right price. At the right price I would be willing to overlook some margin softness because, despite the decline, it’s still good due to scale and company specifics. I like the business model, the exposure, and the company’s future.

Fortis comes in, if we look at other analysts, at price targets ranging from $40 to $64, with an average of $56. That means that even the analysts following the company currently believe the business to be overvalued. Indeed, only one analyst is currently at a “BUY”, with most at “HOLD” or less than stellar ratings for the business.

I added my voice to their chorus and gave my Fortis stance for November with the following thesis.

Thesis

My thesis for Fortis is:

- An absolutely solid, A-grade utility with safety that can’t be beaten by really any business on the NA market in the same sector. A definite “BUY” at the right valuation, with an excellent potential yield.

- However, 18-22X P/E is the historical high. The P/E to “BUY” FTS is no higher than 18-19X and preferably lower than 17X P/E. That’s when you stand to gain that double-digit RoR that we so want to have.

- FTS is still a “HOLD” here, but one that’s moving very, very close to a fair-value “BUY”. I would set that price at around $50/share, lowering my share price target marginally to account for the increase in risk-free rates. I would always consult with a finance professional before making investment decisions such as this.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized)

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

There’s only an upside here if you give the company a premium – and in this market environment, I am unwilling to legitimize this premium, even with this company’s overall appeal in terms of quality.

Read the full article here