Thesis

enVVeno Medical Corporation (NASDAQ:NVNO) is an undercovered microcap company focusing on treatments for vascular disease Chronic Venous Insufficiency.

enVVeno has just released positive topline data of its pivotal trial in 75 patients with chronic venous insufficiency, treated with the VenoValve. Well beyond expectations, 97% of the patients showed clinical improvement at six months, and 74% of them showed a clinically meaningful benefit at that time on the relevant rating scale. The average improvement on that same scale was more than 2.5 times the amount necessary to show clinical benefit.

The company is awaiting full twelve-month safety data, and should then be on track to file for FDA Approval in Q4 2024.

I believe an investment in enVVeno is substantially de-risked since the topline data readout. The VenoValve has received Breakthrough Device Designation and an Investigational Device Exemption, and there does not appear to be direct competition in case of approval. The total addressable market for the VenoValve consists of about 2.5 million patients in total, with about 600,000 new patients per year in the US alone, which would be the company’s primary territory for commercialization. Expected product pricing would be in between $20,000 and $25,000.

The company has sufficient cash to last through 2025.

The topline readout brings the company a good step closer to accelerated approval.

Given its low market cap, I believe there is significant room for upside for enVVeno’s stock.

Company

Introduction

enVVeno Medical Corporation, previously Hancock Jaffe Laboratories, has two treatment devices in its pipeline, the VenoValve and EnVVe. Both are destined to treat chronic venous insufficiency in the deep veins of the leg. Chronic venous insufficiency is an indication in which, due to damaged valves in veins, the blood is no longer sufficiently returned to the heart and lungs. The venal valves split the vein into chambers, and are supposed to prevent the blood from returning to the lower chamber, creating a one-directional flow. When these valves are dysfunctional, they become leaky or do not close at all, compromising the return of blood to the higher part of the body becomes compromised, creating a two-directional flow. The gravity then causes reflux, with blood pooling in the lower leg and ankle area. The end result is venous hypertension, collapsed veins, discoloration of the leg and ankle area, and ultimately sores and venous ulcers which can take several months or up to a year to heal, particularly when the patient has bumped into something.

Chronic venous insufficiency is historically hard to treat.

The current standard of care for patients suffering from chronic venous insufficiency is the use of compression garments. Surgical treatments exist for veins that are superficial, but not for veins that are located deeper in the leg. Further standard procedures are vascular surgery closing the problematic vein and rerouting the blood to other veins, such as phlebectomy, laser therapy and radiofrequency ablation, sclerotherapy, vein stripping or bypass surgery. None of these procedures solves the problem of valves that are no longer working, and some cannot address veins that are lying deeper in the leg. Surgical treatments have had questionable efficacy in the past, and only few positive outcomes have been reported, without any large clinical trials having been able to confirm efficacy. Apparently, valves in the venous system must function under conditions of low flow with varying vein diameters, different from cardiac valves. There is, therefore, a high unmet medical need for better solutions for these patients.

The yearly average spent on wound care per patient per year is higher (figures vary, $7,000 reported here, $30,000 by enVVeno). Total healthcare costs for chronic venous insufficiency in the US are estimated to exceed $4.9 billion annually. The one-year recurrence rate of ulcers is in between 20 and 40%.

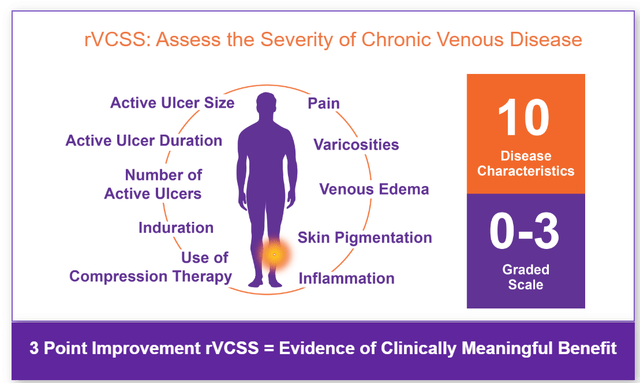

The typical score by which one measures disease severity in the case of chronic venous insufficiency is the Venous Clinical Severity Score or rVCSS. That scale costs of ten outcomes which are graded from 0 to 3 by patient and physician. A clinically meaningful benefit is seen in the case of a three-point change on that scale.

rVCSS rating scale (Corporate Presentation)

The VenoValve

Introduction

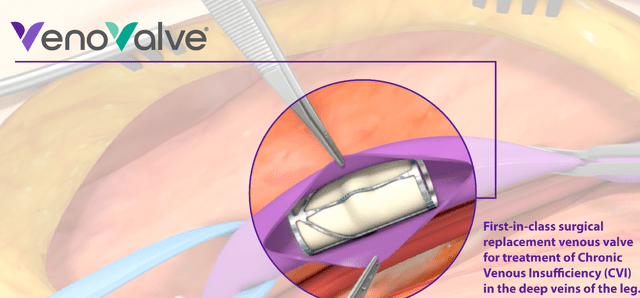

The VenoValve is an artificial valve which functions similar to actual valves in veins.

VenoValve (Corporate Presentation)

It requires surgery to open the concerned vein in the location where the VenoValve will be placed. This is a short company-made video showing how that works.

Previous results

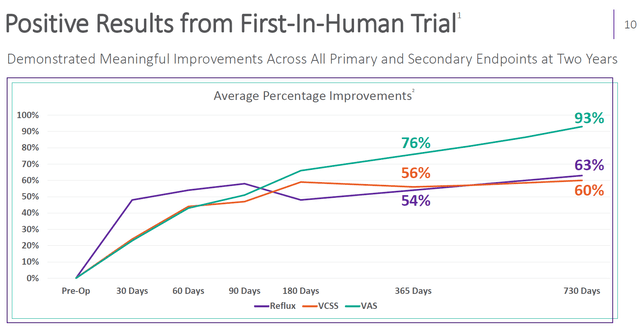

The first-in-human trial already yielded several positive results, with a significant reduction of deep venous reflux, and meaningful improvements on all primary and secondary endpoints at two years.

First-In-Human Trial data (enVVeno)

At two years, venous reflux decreased by 63%, disease manifestations decreased by 60%, and pain decreased by 93%.

There is even three-year data from that trial, showing sustained benefit, with similar numbers as the ones reported at year two, namely 63% decrease in venous reflux, 52% disease manifestations and 84% decrease in pain.

The SAVVE trial: safety

The SAVVE trial, or Surgical Antireflux Venous Valve Endoprosthesis trial in full, enrolled 75 patients with chronic venous insufficiency for surgery to implant the VenoValve. The VenoValve is apparently well received among professionals, Yale School of Medicine was an early supporter, and also ran the trial site where most patients enrolled. A speaker on the webcast discussing the topline readout was also an M.D. from Yale School of Medicine.

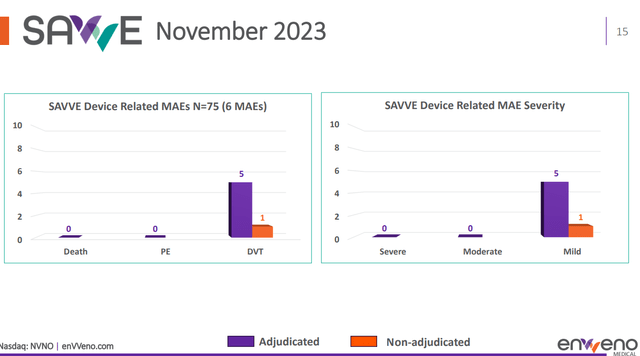

enVVeno had already reported on safety in November 2023. There had not been deaths or pulmonary embolisms during the 30-day major adverse event period, the overall major adverse event rate for the fully enrolled study to be 8%, and that there were six device-related major adverse events. That data is interesting because of the high recurrence rate of device-related material adverse events, particularly immediately or soon after valve implantation. Interestingly, also, from the six patients who reported MAE’s, three patients had shown significant clinical improvement on the rVCSS scale, two patients had not yet passed the ninety-day period for evaluation, and one patient had voluntarily withdrawn from the study after thirty days.

SAVVE trial data on safety (enVVeno)

The SAVVE trial: topline efficacy data

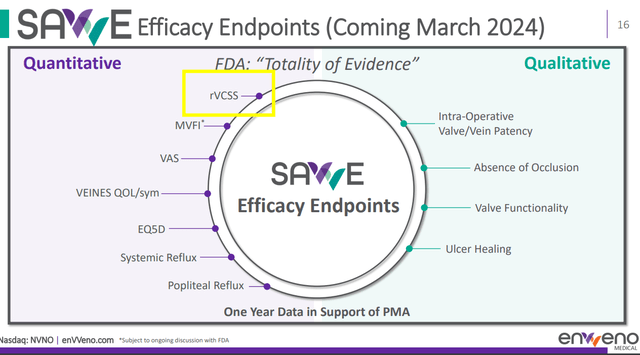

The SAVVE trial measured baseline rVCSS scores in all patients prior to surgery, at 90 days, at 180 days at one year, and at each subsequent yearly visit. Its primary and secondary endpoints are:

– the composite of major adverse events death, major bleeding, deep wound infection, ipsilateral deep vein thrombosis, and pulmonary embolism, with a rate of >9% being expected;

– major adverse event rates over 3, 6 and 12 months and annually thereafter through 5 years.

Efficacy endpoints (enVVeno)

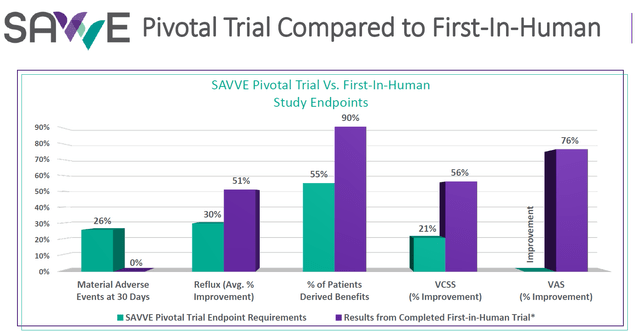

enVVeno planned to include three key points: the overall response rate representing the number of patients that demonstrated improvement which the company hoped to be 30-40%, the number of patients showing clinically meaningful benefit on the rVCSS scale, and the average rVCSS improvement for patients improving three or more points. The comparison between the first-in-human data and the pivotal trial’s study endpoints looked favorable for BioVie, as shown below.

SAVVE trial vs first in human endpoints (enVVeno)

Taking into account that the trial was not blinded, there had already been some interesting anecdotal stories, explaining how much some patients were feeling better and able to walk and do other activities again, without being hindered like they used to beforehand.

The data that enVVeno released on March 6, 2024, were the following.

– 97% of the patients showed clinical improvement at six months on the rVCSS rating scale;

– 74% of the patients showing a clinically meaningful benefit at six months;

– the average improvement on that rating scale was 8 points, which is more than 2.5 times the required 3-point threshold.

Undoubtedly, this is a big win, in a field where all competitors have failed so far, which makes it an even bigger win. On a scale with a maximum of 30 points, an 8 point improvement marks about a 26% improvement, but more relevant would be to find out what the baseline score was for these patients to calculate the percentage improvement. Given the severity of disease symptoms, I assume that that percentage improvement may be much higher than 26%.

Low competition, huge addressable market, and interesting prospective pricing

With enVVeno profiting from Breakthrough Device Designation and an Investigational Device Exemption, the fast-track way to approval is set. The FDA requires an additional six-month follow-up for the patients in the trial, which would probably be for September 2024. enVVeno can file for approval afterward, some time in the fourth quarter of 2024.

I do not have much worries regarding that follow-up period as the company already has three-year safety data showing sustained benefit. During the March 6, 2024, webcast on topline data, enVVeno’s CEO also stated that he considered the VenoValve to be functional for about as long as seen in cardiac surgery, e.g., 15-20 years.

It appears there is little to no direct competition for the VenoValve, as many other treatment candidates to repair a vein with chronic venous insufficiency have failed. One competitor that may have come close to a solution similar to the VenoValve was Intervene with its BlueLeaf catheter-based technology to create venous neovalves. That trial was suspended by the sponsor in October 2023.

That could leave the market wide open for enVVeno.

According to enVVeno, the total addressable market for the VenoValve consists of about 2.5 million patients in total (slide 3). There are about 600,000 new patients per year in the US alone, which would be the company’s primary territory for commercialization.

Expected product pricing would be in between $20,000 and $25,000. I assume Medicare will be able to intervene for such pricing.

It is difficult to assess at this time just how successful the device can become over time, but Yale School of Medicine’s support and the FDA’s position may be first indications in that respect.

The numbers quickly get out of control when one tries to model revenues. For just 2,489 devices sold, one reaches a revenue of $56,000,000. I find it reasonable to assume that VenoValve becomes the standard of care for chronic venous insufficiency, and may be able to reach a target patient population of 50,000 patients per year in the US alone. Numbers could be lower, but could also be higher given the huge total addressable market, in the US alone. Translated into revenue, 50,000 patients per annum would mean about $1.125 billion at an average sales prices of $22,500. Surely bigger market players with a better commercialization organization may be looking at enVVeno at that stage, or earlier. I actually believe that at this time, enVVeno has delivered on the promise that patient investors had been waiting for.

enVVeno’s current market cap of about $90 million largely undervalues that potential, also taking into account that about half of that market cap is cash value.

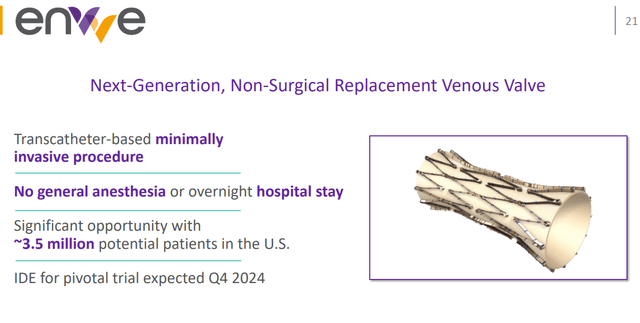

EnVVE

EnVVE is a non-surgical catheter which has a similar mechanism of action, but requires minimal invasive action similar to the placement of a stent.

enVVe (Corporate Presentation)

This is a video showing how enVVe is supposed to be administered.

enVVeno hopes that EnVVE may be able an upgrade compared to the VenoValve. This device is less far advanced, as the company should still perform a pre-clinical GLP study. enVVeno planned to start this trial in the first quarter of 2024, then expects to file an investigational device exemption in the last quarter of 2024, to have the pivotal trial approved by the FDA in early 2025.

enVVE potentially expands the TAM to include people living with less severe disease and people with co-morbidities or for whom an open surgical procedure may pose too much risk. EnVVe may also open up the product to non-surgeons, which may significantly improve the number of treatments.

enVVeno therefore considers the total addressable market for enVVE to be larger than that of the SAVVE trial, consisting of 3.5 million patients.

Financials

At the end of 2023, enVVeno had $46.4 million in cash and investments, which should be sufficient to fund operations through 2025. The company had repeatedly stated that it had sufficient cash to last it through 2024. The recent private placement of $28 million, which was led by several institutions, among which Perceptive Advisors and Nantahala Capital, may therefore have come as a surprise to some.

The major difference between the situation prior to this private placement and the current situation is that the company should now not just be funded for operations beyond the pivotal topline readout for the VenoValve, but also for the start of commercialization and accelerated plans for the pivotal trial for enVVe. The private placement at a time when there is no absolute need for it can be seen as bullish, particularly when it is backed by several hedge funds. Perceptive Advisors had been a larger institutional owner for a longer period. Nantahala Capital’s large stake of about 10% is new. I believe the recent private placement does indicate that institutions at this time are looking at the company as ready for further gains.

enVVeno’s cash burn for the last quarter of 2023 was $5 million. The company expects that cash burn rate to go up slightly to $5 million to $6 million per quarter in 2025.

enVVeno currently has a common stock of about 13.3 million shares. According to the latest annual report, enVVeno has options to purchase 4,771,043 shares of common stock with a weighted average exercise price of $7.86 outstanding, 400,000 restricted stock units, and warrants to purchase 17,129,415 shares of common stock with a weighted average exercise price of $6.49.

The way some warrants have been set up recently indicates to me that enVVeno was planning for success. Some of these warrants are milestone-driven. The first tranche expires within 30 days of the release of positive topline data or by October 11, 2024, has an exercise price of $6.945 and may lead to proceeds of up to $34 million. The second tranche, which may generate an additional $40 million, is tied to the premarket approval of the VenoValve or will expire by October 12, 2026, and has an exercise price of $8.334. At the end of the day, it’s just a way for enVVeno to move forward in case of success; others may do different types of financings upon a positive readout. I actually do not expect enVVeno to do an additional financing following the positive pivotal readout.

Risks

enVVeno’s timelines have in the past been rather optimistic, so it is not impossible that some delays occur with regard to the timeline as currently suggested.

An example is the 6-month delay in filing for FDA approval, which as such is a minor issue, I believe. It is unlikely that the FDA take regulatory action at this stage of the trial, but approval will finally depend on the FDA.

An additional factor to take into account is whether VenoValve would be eligible for reimbursement, which would enormously facilitate sales. In light of the FDA’s stances on the product, with Breakthrough Therapy Designation and Investigational Device Exemption, I am giving the possibility for reimbursement reasonable hope.

The above-mentioned financing construction may lead to dilution around several stock prices, and that dilution may have an effect on the market cap and total float.

Apart from that, investing in biotech stocks is risky. Although enVVeno is well-funded, additional financing may create an overhang, and at any given day, the stock may see unexpected volatility.

Conclusion

enVVeno is a small cap company focused on treating chronic venous insufficiency. The company has just reported positive topline data from their pivotal trial with the VenoValve in 75 patients. The results surpassed expectations, with 97% of patients showing clinical improvement at six months, 74% of the patients showing a clinically meaningful benefit at six months, and more than 2.5 times the required 3-point threshold for improvement on the relevant rating scale. Taking together with all the information that was already available, including long-term data, it appears that the VenoValve is consistently safe and efficacious, making an investment in enVVeno at this time substantially more de-risked than before.

The VenoValve appears to be very well received by healthcare professionals. With the device also benefiting from the FDA’s Breakthrough Device Designation and Investigational Device Exemption, the company appears well-positioned for FDA approval, the application for which could be filed as soon as Q4 2024. The VenoValve targets a significant market of 2.5 million patients in the US alone, about 600,000 patients per annum, with prospective pricing between $20,000 and $25,000 per device. As there is not much direct competition, if any, revenues would be more than $1 billion at that pricing if 50,000 patients per year could be treated. From the perspective of enVVeno’s current market cap of about 90 million with about a little less than half of that cap in cash, I believe the company’s stock may be poised for growth.

In conclusion, enVVeno presents a compelling investment opportunity with promising clinical results, a sizable addressable market, and strong financial backing. Risks are moderate, and I believe the company’s innovative treatments for chronic venous insufficiency position it for significant upside potential. An additional device in the company’s pipeline could add further value at a given point.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here