The E.W. Scripps Company (NASDAQ:SSP) was originally founded in 1878 as a chain of daily newspapers. The company grew into a media conglomerate until splitting into two companies in 2008. As a result of the split, SSP retained the newspaper and TV station part of the business.

In 2015, SSP completed a complex transaction with Journal Communications which resulted in SSP becoming a leading local TV broadcast company.

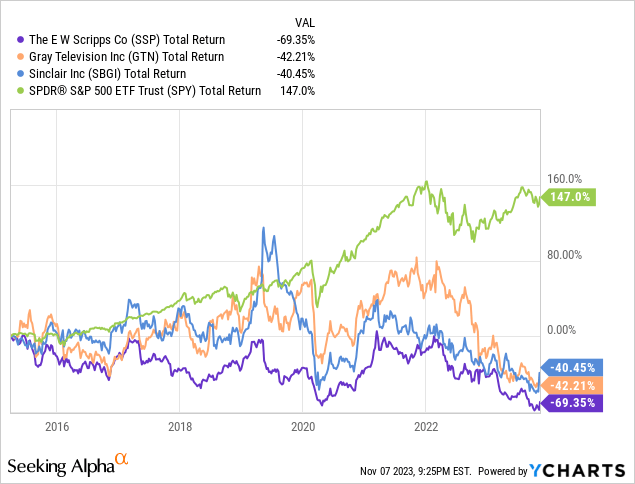

Since the transaction completed, SSP shares have not proved a very good investment. SSP shares have delivered a total return of -69% compared to a total return of 147% delivered by the S&P 500 during the same time period. SSP has also underperformed its peer Gray Television Inc (GTN) and Sinclair Inc (SBGI).

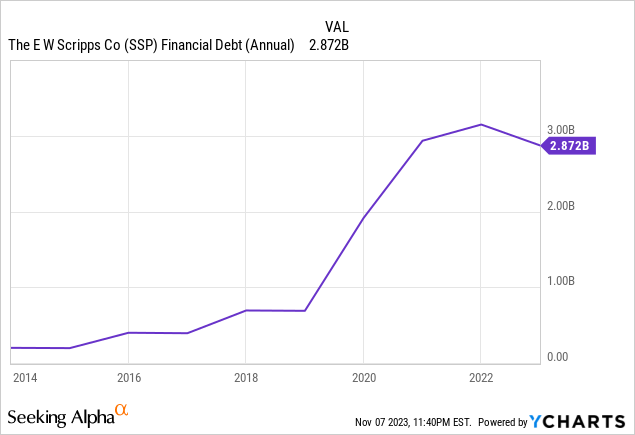

SSP shares have struggled due to a decline in the TV business as streaming players such as Netflix (NFLX) have disrupted the industry. In addition to business challenges, SSP also has a relatively high level of leverage due to a significant increase in debt to fund the 2020 acquisition of ION. The current level of leverage has become a significant concern for investors given the high interest rate environment.

In my view, these challenges are not likely to go away anytime soon and thus SSP is an unattractive investment at current levels.

Company Overview

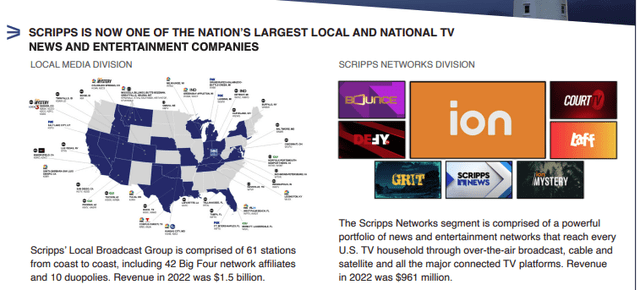

SSP operates a mix of local and national TV networks. The company is split into two segments: Local Media and Scripps Networks.

The Local Media division which accounts for ~61% of revenue includes a portfolio of 61 local TV stations in 41 markets. This group of stations reaches ~25% of U.S. television households and includes 18 ABC affiliates, 11 NBC affiliates, 9 CBS affiliates, and 4 FOX affiliates. The division also has 12 CW affiliates, 5 independent stations, and 10 low power stations. Core advertising accounts for ~42% of Local Media segment revenue while distribution revenues (revenue from cable operators, satellite carriers, and other distributors) accounts for ~44% of Local Media revenue. The remaining ~13% of segment revenue comes from political advertising which tends to fluctuate significantly with election cycles.

The Scripps Networks segment, which accounts for ~39% of revenue, is comprised of a powerful portfolio of news and entertainment networks that reach every U.S. TV household through over-the-air broadcast, cable and satellite, and all the major connected TV platforms. The Scripps Networks segment generates revenue primarily from the sale of advertising time on national TV networks.

SSP Investor Highlights

Secular Business Challenges

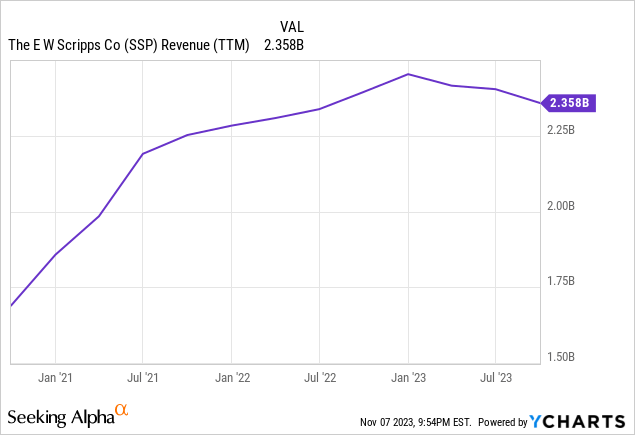

In September 2020, SSP completed a major transaction with Berkshire Hathaway under which SSP acquired ION Media for $2.65 billion. In the period immediately following this deal revenues increased nicely.

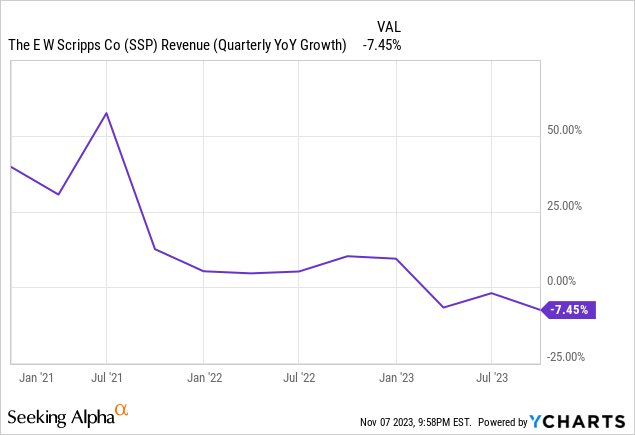

However, more recently revenue has started to decline as the traditional TV business has been disrupted by streaming. Moreover, advertisers have continued to favor digital media over traditional media. Excluding the boost due to the 2024 election, national TV and local TV advertising are expected to decline by 3% and 5% respectively in 2024.

For Q3 2023, SSP reported a 7.4% decline in revenue vs the same period a year ago. This follows a 2% revenue decline on a year-over-year basis in Q2 2023 and a 6.7% revenue decline on a year-over-year basis for Q1 2023.

For Q3 2023, Local Media segment Scripps Network segment revenue dropped 7.6% and 8.5% respectively compared to the same period a year ago.

SSP also projected significant revenue drops for Q4 2023 vs the same period in 2022 with Local Media revenue forecast to drop low to mid-double digits and scripps Network revenue to drop by ~10%

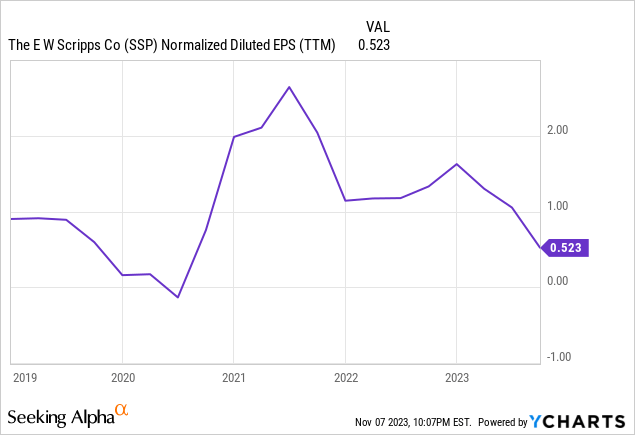

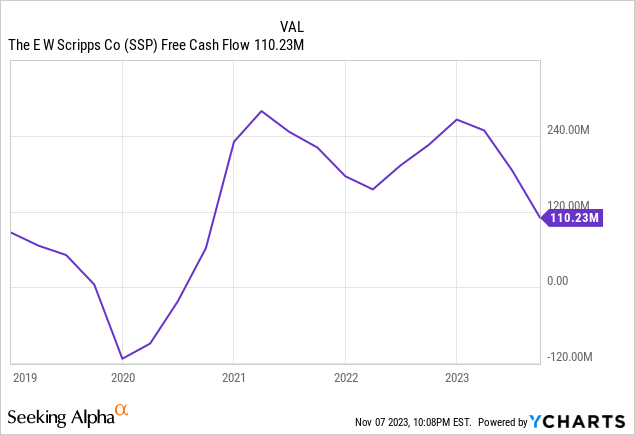

In addition to the recent revenue drop, earnings and free cash flow have also started to decline.

Recently Completed Cable and Satellite Carriage Agreements

On October 11, 2023, SSP announced that it had completed cable and satellite carriage agreements that account for about 75% of the company’s subscriber households. The agreement also expanded the number of stations on which SSP is paid a distribution fee.

For FY 2023, SSP expects Local Media distribution revenue to grow by nearly 15% compared to FY 2022.

While increasing distribution fees are a positive for SSP, they represent a minority of SSPs total revenue which is primarily driven by advertising spend.

Highly Levered Balance Sheet

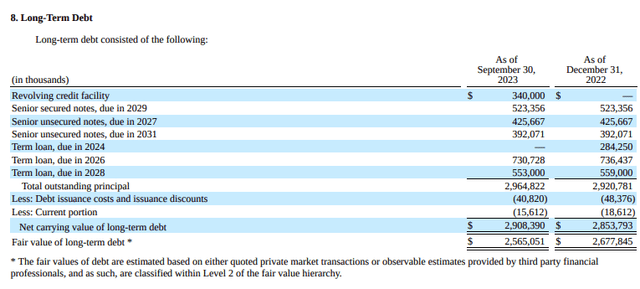

As shown by the table below, SSP has ~$2.96 billion in debt outstanding as of September 30, 2023. Much of this debt was accumulated when SSP acquired ION from Berkshire Hathaway.

SSP has just $15.8 million in cash and thus net debt is ~$2.8 billion.

At the end of the quarter SSP’s leverage was 5.4x per calculations in the company’s credit agreement. SSP believes it can bring leverage down to under 5x by the end of the year.

However, even 5x is a very high leverage level. SSP recently drew down the revolver to pay of the term loan maturing in 2024 which should buy the company additional time to improve its balance sheet prior to refinancing the term loan due 2026.

SSP has said that its highest capital allocation priority is on paying down debt.

SSP Q3 2023 10Q

Valuation

SSP trades at 7.5x LTM normalized earnings (using normalized as the company reported a large goodwill impairment in Q2 2023) and 5.3x consensus 2024 earnings. Comparably, the S&P trades at ~18x consensus 2024 earnings.

While SSP appears cheap on a relative basis, it should be noted that 2024 represents a presidential election year which means SSP earnings will be significantly higher than would be the case in a normal year.

As shown by the table below, SSP has experienced very high earnings volatility historically (even on a normalized basis) thus it is very difficult to project forward earnings for the company. For this reason, it is difficult to be bullish on the stock given the uncertain nature of future earnings.

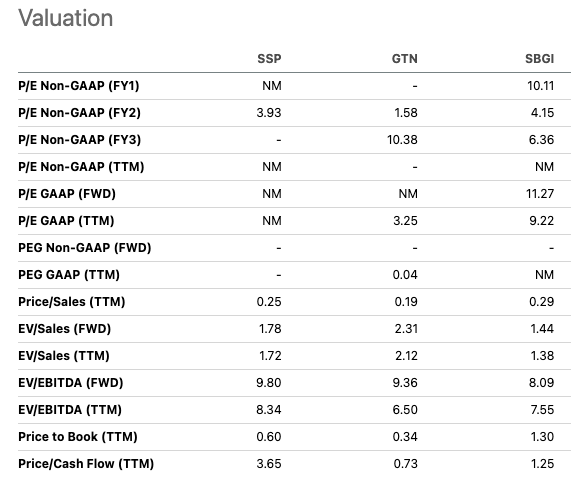

SSP appears to be trading roughly in-line with its closest peers Gray Television Inc and Sinclair, Inc based on key metrics such as EV / EBITDA.

Seeking Alpha Seeking Alpha

Potential Upside Drivers

While secular drivers and a highly levered balance sheet represent clear challenges for SSP, the company does have some potential positive investment catalysts.

Cost Savings

In January 2023, SSP launched a restructuring intended to transform the company and improve margins. On the Q3 2023 earnings call, the company noted that it expects to realized more than $40 million in annual savings with 80% of that coming from eliminating positions and the rest from external spending such as vendor contracts.

Scripps Sports

One of the more resilient parts of the traditional TV business has been live sports. SSP was late to focus on the sports business but recently launched Scripps Sports in December 2022. The group recently announced a new agreements with the NHL’s Arizona Coyotes to distribute games beginning this season with the first broadcast on Oct 13. The company also recently began broadcasting Vegas Golden Knights games. Potential growth in the sports space has potential to create a more resilient advertising revenue business which may be able to better withstand secular headwinds.

M&A Transaction Potential

Another potential upside catalyst for SSP would be a potential M&A transaction with another leading TV player. SSP could be an attractive merger for target for other players such as Gray Television, Sinclair, or Nexstar Media. While regulatory headwinds may prove a challenge, it is not unthinkable that SSP would be able to engage in a transaction with one of its peers which would help the company achieve better scale.

Conclusion

SSP has failed to generate strong returns for shareholders following its transformation in 2015 to focus on the TV business.

In 2020, SSP entered into a significant deal with Berkshire Hathaway to acquire ION. As a result of this transaction, SSP’s debt and leverage levels have risen to very high levels.

SSP’s core TV business faces secular challenges due to increased competition from streaming players and an advertising shift away from traditional media to digital media. These headwinds are especially challenging for SSP has the company has little room for error due to its significant debt load.

2024 is expected to be a very strong earnings year for SSP due to the election. While SSP appears to trading at an attractive valuation of 5.3x consensus 2024 earnings, future earnings are much less predictable.

I believe the structural headwinds currently facing SSP are only likely to accelerate over the next few years and thus I am concerned about the company’s ability to generate profits in 2025 and beyond. Moreover, the company has relatively limited room for error given the very high debt load.

For this reason I am initiating coverage with a sell rating but would consider upgrading the stock if the long-term earnings outlook improves and the company is able to de-lever its balance sheet.

Read the full article here