DLocal Limited (NASDAQ:DLO) operates a payment processing platform that helps businesses in online payments globally. The company has achieved a remarkable amount of growth, as in Q2 the company’s revenues grew by 59 percent. I believe that DLocal’s revenues still have significant room for growth. Although the stock seems expensive on a price-to-earnings basis, I believe that the company’s rapid growth more than compensates for the high ratio. For the time being, I have a buy-rating for the stock.

The Company & Stock

DLocal operates a payment processing platform in emerging markets. The company currently has a large geographical focus on Latin America, as in Q2 the region generated 79% of DLocal’s total revenues with the rest coming from Africa and Asia. The company has a good number of large customers, including names such as HBO, Uber, Amazon, Shopify, and Microsoft:

DLocal’s Selected Clients (DLocal 2023 Investor Day Presentation)

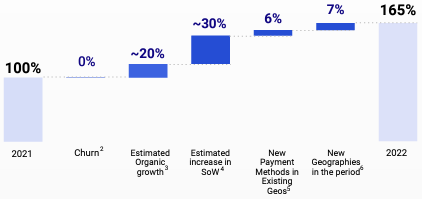

The company also has a top-notch retention rate – from 2021 to 2022, DLocal managed to achieve a net retention rate of 165% as a result of multiple factors:

DLocal’s NRR (DLocal 2023 Investor Day Presentation)

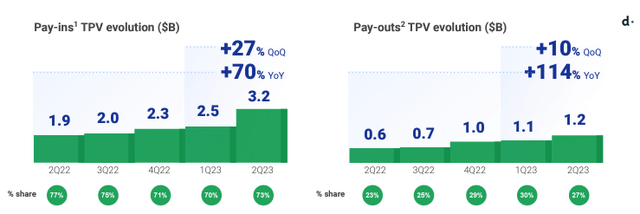

DLocal’s platform can be divided into pay-ins and pay-outs depending on the direction of the transaction. Most of the company’s processing value comes from pay-ins where customers pay the business that uses DLocal.

DLocal Q2 Investor Presentation

The stock hasn’t performed as well as the company’s revenues – from DLocal’s IPO in 2021, the stock has nearly halved in price:

Stock Chart From IPO (Seeking Alpha)

Financials

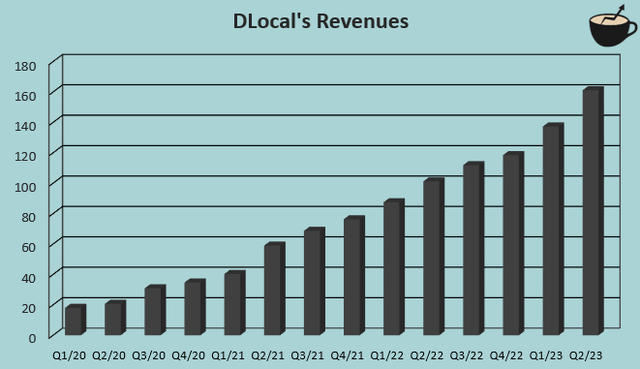

DLocal’s growth has been remarkable. The company’s revenues have grown at a compounded annual rate of 96.4% from 2019 to 2022. The growth has also been very stable and consistent on a quarterly basis:

DLocal’s Quarterly Revenue Growth (Author’s Calculation Using Seeking Alpha Data)

I believe that DLocal still has a good amount of room for growth. The company has room for additional geographical expansion. In addition, emerging markets are expected to have good growth in the market size compared to developed markets – DLocal estimates that emerging markets’ consumer spending will grow at a pace of 7% from 2024 to 2027.

While growing rapidly, DLocal has maintained very good margins. Currently, the company’s trailing EBIT margin stands at 28.5%, and has stayed at a similar level from 2019 with an average annual margin of 31.4% from 2019 to 2022. DLocal has surprisingly low R&D expenses at a trailing level of $8 million, providing room for the impressive margin. Often companies that operate digital platforms have a significant amount of operating leverage as the operations scale, but I don’t necessarily think that’s the case for DLocal, though. The company’s gross margin has been falling slowly into a current level of 45.7% – an operating margin that’s significantly over the current level of 28.5% should be difficult to achieve.

DLocal has a strong balance sheet. The company surprisingly doesn’t pay a dividend, although it holds $549 million in cash and equivalents. Even stronger, DLocal doesn’t have any long-term debt as a form of financing. I believe that drawing debt could provide healthy leverage for DLocal in the future, though. As DLocal doesn’t have cash acquisitions in the company’s history, I wouldn’t expect DLocal to use the strong balance sheet in an acquisition.

Valuation

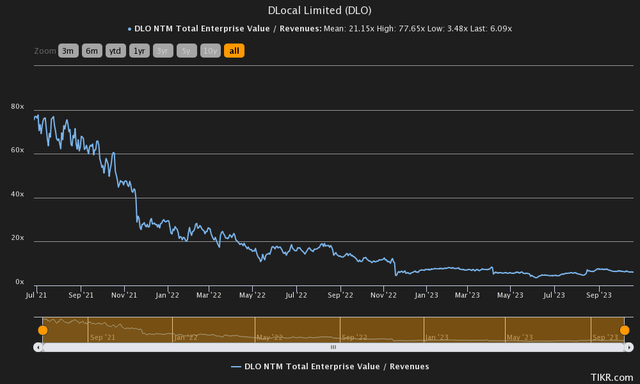

After a wild valuation of a forward EV/S of 77.7 in 2021, DLocal’s revenue growth and stock price fall has compressed the ratio into a figure of 6.1:

Historical Forward EV/S (TIKR)

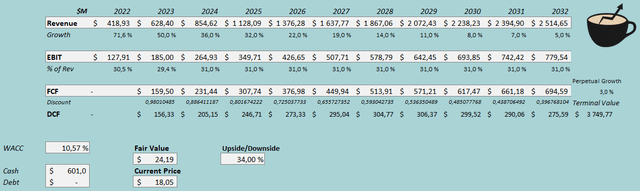

The current ratio seems quite interesting as DLocal is still growing fast with good profitability. To further conceptualize the valuation and to estimate a fair value for the stock, I constructed a discounted cash flow model as usual.

In the model, I estimate DLocal to hit its revenue guidance for 2023 with a growth of 50%. After 2023, I estimate the growth to slow down in slow steps. In 2024, the estimated growth is 36%, that eventually drops into a perpetual growth rate of 3% in 2033 and beyond. The estimated growth represents a CAGR of 19.6% from 2022 to 2032, which I see as appropriate for DLocal. For DLocal’s margins, I estimate the performance to stay quite stable. For the current year, I estimate a slightly lower EBIT margin of 29.4% as the first half had slightly decreased margins. After 2023, I estimate the EBIT margin to stay at a level of 31.0%, quite in line with DLocal historical level.

With these assumptions and a weighted average cost of capital of 10.57%, the DCF model estimates a fair value of $24.19 for the stock, 34% above the price at the time of writing:

DCF Model (Author’s Calculation)

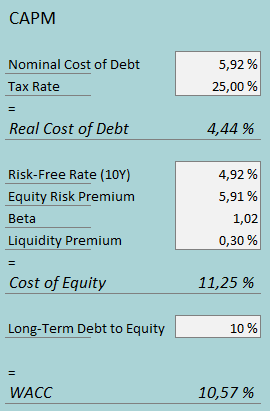

The weighted average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

DLocal doesn’t currently hold any long-term debt. I believe that the company could draw debt in the future as the company matures and stabilizes its operations – I estimate a long-term debt-to-equity ratio of 10%. For the interest rate, I estimate a figure of 5.92%. The figure is calculated using the US’ 10-year bond yield with an addon of one percentage point to provide a margin of safety.

On the cost of equity side, I use the United States’ 10-year bond yield of 4.92% as the risk-free rate. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate made in July. Yahoo Finance estimates DLocal’s beta at 1.02. Finally, I add a small liquidity premium of 0.3%, crafting a cost of equity of 11.25% and a WACC of 10.57%.

Takeaway

At the current price, DLocal seems like an interesting investment. The company has achieved hypergrowth while generating strong cash flows, and continues to expand into further geographical regions while growing the amount of client merchants. The stock price has fallen into a more appetizing level as the forward EV/S ratio only stands at 6.1. My DCF model also estimates the stock to be quite significantly undervalued – at the moment, I see a buy-rating as reasonable.

Read the full article here