Introduction

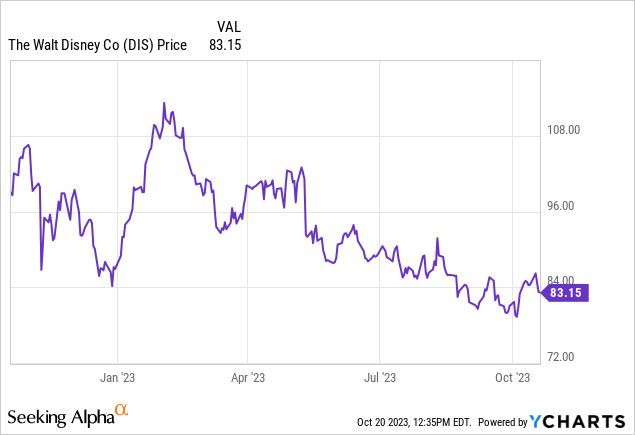

Having published a Buy call on The Walt Disney Company (NYSE:DIS) in early June, with the stock then trading at around $88, a first read-through of the DIS 3Q23 result (released 09 August 2023) left me feeling comfortable with my rating and stock holding. The market initially liked the result too, pushing DIS above $90 (albeit briefly) on good trading volume. Since then, there has been a steady flow of news to further amplify the bear story on DIS, and relatively little to provide comfort for bulls. When DIS dipped below $80 in early October, I concluded that too much bad news had been priced in, and I added modestly to my position. In this note, I will assess a number of issues that have arisen over recent weeks – notably regarding Disney Parks, Experiences and Products (‘DPEP’) – and provide an update on my investment case for DIS. Hopefully my recent purchase wasn’t too hasty.

Not Much Good News Lately

Reviewing recent news flow for DIS can be a disheartening experience for holders of the stock. It’s not all bad news however, and I think that some of the negatives are being overblown in terms of their impact on long term value.

I was not overly concerned about the squabble with Charter Communications. Tough contract negotiations are a feature of the media industry, but I would concede that this one went a bit too far. The open aggression coming from both sides was beyond the norm, and yet I think that this is actually quite understandable given ‘cord-cutting’ and the inevitable shrinking to irrelevance of the traditional linear networks model. With the writing clearly on the wall that these income streams will rapidly diminish, it made sense for both DIS and Charter Communications to play hardball in order to maximise their NPV and in doing so, to not be overly concerned about maintaining a healthy, sustainable partnership. The dispute lasted almost two weeks. Charter Communications and DIS eventually found some middle ground; the financial implications of the deal for both parties remains unclear. Whilst DIS has sent a clear message to other distributors, I doubt that we will have another situation where viewers turn on to a blank screen. It’s worth noting that in arriving at the deal, Charter Communications agreed to continue to take action on password sharing.

Strikes across many industries have caused plenty of disruption and annoyance over the last year or so. Unlike doctors and nurses pushing for more pay, striking actors and writers aren’t putting lives at risk, but I’m sure everyone will be much happier once the situation is resolved. Hollywood writers have already squeezed enough out of studios to agree to new terms and return to work. Studios are having a tougher time getting actors to come to the party. George Clooney seems motivated to end the stand-off, but I guess he’s not really an average member of SAG-AFTRA, and so probably doesn’t speak for the interests of many in the union. The net impact of the strikes for DIS and other media companies is impossible to quantify, but the combination of lost income during the strikes and improved terms and conditions for writers and actors is clearly not an insignificant issue.

There seems to be a great deal of negative commentary regarding the prospect of DIS taking on additional debt to buy out the remaining Hulu stake from Comcast. I’m not a huge fan of companies operating in cyclical industries taking on lots of debt, but it is important to remember that there will be additional Hulu income for DIS post the buy-out. This fact is often overlooked, and indeed I’ve seen valuation analysis on this platform that only allows for the debt increase and ignores the additional income associated with the transaction. I see Hulu as an important part of the DIS DTC strategy; moving to 100% control of Hulu, at what hopefully isn’t an outrageously high price tag, seems a sensible move to make. That said, from a balance sheet perspective, I would feel more comfortable if DIS was able to fund at least part of the Hulu buy out cost via disposal of assets that might be deemed non-core. Recent announcements regarding the potential sale of Indian assets are a modest step in the right direction in that regard.

For me, the biggest news item for DIS by far since the 3Q23 result was the 19 September 2023 update from the company regarding a doubling of capital expenditure in DPEP. I will look at this item in detail further below. Suffice to say that this news caught me off guard; the market was also not impressed. The more recent DPEP news regarding higher ticket prices for Disneyland (California) and Walt Disney World (Florida) had something for both the bulls and bears to seize upon. Inflationary pressures (and perhaps also the need to fund higher capital expenditure), can be argued to warrant the ticket price increases, and I think that a large negative impact on visitation due to the move is rather unlikely, although I’m sure others will disagree. In any case, taking a wider perspective, I struggle to see the ticket price hike as being material to the overall DIS investment case.

The recent release of historical data for the new DIS segment reporting structure should have no real consequence for the underlying value of the company; the new segmentation changes nothing from a fundamental perspective. However, from a strategic standpoint, I think it is a smart move to separate Sports and Entertainment within DMED. ESPN strikes me as a solid business, but one that is very different to the rest of the DIS operations. Providing investors with financial data that can more easily allow a stand-alone valuation to be determined for ESPN increases the probability that DIS may be able to attract a bid for the group’s main Sports asset. A sale of ESPN at a fair price or above would simplify the group’s operation materially and provide capacity to reduce balance sheet debt and fund future investments.

DPEP – Doubling Capital Expenditure

My initial Seeking Alpha note on DIS back in June 2022 highlighted the extreme level of uncertainty regarding the value that can be placed upon the Disney Media and Entertainment Distribution (‘DMED’) segment due to the transition from the legacy Linear Networks world to a DTC future. The exact profile of this transition is impossible to forecast with accuracy, which implies that any valuation of the DMED segment has a fair amount of guesswork embedded within it. My way around this issue was to identify the components of DIS that can be expected to be relatively stable, to calculate a valuation for these more stable cash flow buckets, and to then determine what value the market is implying for DMED. Using this framework, the primary source of stable earnings from a valuation perspective was DPEP. As shown in Exhibit 1, DPEP has delivered 8% CAGR operating income from FY17 through to the twelve months ending 30 June 2023. Given the disruption to the DPEP business during the Covid era, this is an impressive outcome, and I think it supports the logic of the valuation framework that I adopted for DIS.

Exhibit 1:

Source: Disney Parks, Experiences and Products Highlights and Updates presentation, 19 September 2023.

One of the valuation adjustments that I made for DPEP in June 2022 was to allow for capital expenditure to be incurred at levels above the accounting depreciation charge. In doing so, I implicitly assumed that the higher capital expenditure (relative to depreciation) would not lead to higher income. In other words, I was adjusting for the fact that historical accounting depreciation was probably understating the true maintenance capital expenditure required for the DPEP segment. Typically, if an analyst puts that type of reasoning to a company in a Q&A setting, management will push back and say that some of the capital expenditure is actually ‘growth capital expenditure’ and can be expected to generate additional income – bulls will believe management, bears will not. However, the gap between depreciation and capital expenditure is often not all that material in the scheme of things, and so the difference between the bull and bear interpretation may not be overly important.

Fast forward to 19 September 2023, and DIS provides an update to the market on DPEP, advising that it will be massively ramping up DPEP capital expenditure. Overnight, my DPEP valuation assessment moves from being what I considered to be relatively stable, to being much more uncertain. I assume that even the most bearish DIS analyst would agree that the huge step-up in DPEP capital expenditure can be expected to drive an increase in DIS earnings, but there is obviously a lot of uncertainty as to whether the additional earnings are enough to be value accretive after taking account of the extra investment being made.

So what is the likely split of the extra $3bn pa spend between increased maintenance costs and genuine growth investments? DIS would no doubt like the market to believe that the $3bn pa step-up is entirely relating to growth investments, but history suggests that it would be imprudent for investors to swallow that line. It’s easy to find visitor reviews for DIS parks that point to an underinvestment in maintenance spend, but I would also say that this holds true for most, if not all, theme parks.

To determine the value implications of the additional $3bn pa capital expenditure, analysts first need to form a view on the proportion of the uplift that relates to growth investment – this requires making an assumption – which in this specific case (given the lack of information provided by DIS) amounts to a guess. That’s not the end of the guesswork either. Analysts also need to consider what level of ROI DIS will generate on the growth capital expenditure. Given the huge dollars involved, I would have expected DIS to have provided much more detail regarding the expected ROI for the additional growth capital expenditure. There are references in the presentation to a double digit ROI for Disney Cruise Line and Disney Vacation Club (based on historical results through 3Q23), but the overall picture is very unclear. For valuation purposes, we are left needing to making another highly uncertain guess regarding the likely ROI. I’m also unclear as to whether DIS is majority funding the growth capital expenditure in the Asia theme parks despite owning less than 50% of these assets – yet another important detail that was glossed over in the DPEP presentation pack.

Summary & Conclusion

I have previously relied upon DPEP being a high-quality, sustainable and relatively stable (albeit cyclical) source of income for DIS. I also thought that the DPEP segment was quite easy to understand. These attributes gave me a lot of comfort to use DPEP as the foundation on which to build an investment case. In fact, if DIS comprised of only the DMED segment, given that it is impossible to have confidence regarding how the transition from Linear Networks to DTC will play out from a financial perspective, I would place DIS in the ‘too hard basket’ and consider the stock uninvestable. I continue to regard DPEP as a high-quality business, but the announcement regarding the doubling of capital expenditure has made my previous investment case foundation rather wobbly. When it comes to valuation, too much guesswork leads to a lack of confidence and conviction, and that is where I now find myself with DPEP.

Whilst I can still come up with a valuation assessment, building from the foundation of DPEP, that points to DIS being good value at current levels of around $83 per share, my conviction regarding the accuracy of my valuation has diminished greatly. With $3bn pa of additional capital expenditure soon to be pumped into the DPEP division, I require a lot more information from DIS regarding exactly how this money will be spent and the expected return that management is targeting on that capital in order to restore my conviction level back to a comfortable level.

DIS is making solid progress on its ambition to get DTC to profitability; the target to reach profitability by late 2024 appears to be achievable and I think that management deserve some credit for what has been achieved so far. I’m also pleased to see that DIS are looking at actions to simplify the business, such as a divestment of the group’s Indian operations. However, looking across the company as a whole, for me there is now simply too much guesswork involved in my fundamental valuation of DIS to justify a Buy call. I therefore downgrade my rating on DIS to Hold, based on a lack of conviction regarding the value upside on offer.

Read the full article here