We maintain our hold-rating on Disney (NYSE:DIS). We’re constructive on management’s cost-cutting efforts and increased focus on profitability. We see a more balanced risk-reward for the stock, but still, we don’t see enough support for near-term outperformance. We now expect the stock to be an in-line performer in the near-term. The stock has underperformed the S&P 500 by 22% over the past 6-months and was an in-line performer in the last 3-months. We see a more balanced risk-reward profile for Disney after the price hikes in the Parks unit and a rebound in growth this quarter, as well as management’s improved free cash flow. Still, we don’t see enough near-term catalysts to drive material financial outperformance. We recommend investors stay on the sidelines for the near-term.

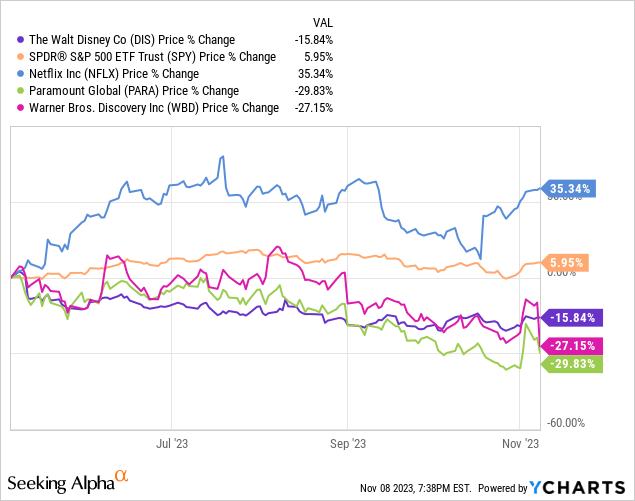

The following graph outlines Disney’s stock against the S&P 500, Netflix (NFLX), Paramount (PARA), and Warner Bros. Discovery (WBD).

YCharts

We’re constructive on management’s goals to turn the streaming business into sustainable, profitable growth; this quarter, Disney reported 150.2M Disney+ subscribers, adding a net of 7M new core Disney+ subscribers. The following outlines total Disney+ subscriber growth up until 4Q23.

Seeking Alpha

We think 4Q23 results were largely driven by better-than-expected growth in the Parks unit. We continue to believe the streaming business has not recovered yet. Revenue missed slightly at $21.24B, up ~6% Y/Y, falling lower than consensus by $170M; the company’s second consecutive miss. We think macro challenges regarding the weaker ad spend and macro uncertainty weighing on net subscriber growth will continue to limit the upside for the company into 2024. While management noted signs of improved ad spend, we think it’ll be 1-2 quarters before we see true ad spend recovery for the sector; WBD management emphasized forecasts of sluggish ad spend continuing into next quarter.

Longer-term positives

We think management’s new financial reporting structure into three segments of Entertainment, Sports, and Experiences will help improve profitability and position the streaming business uniquely across Disney+ and ESPN. The company also announced its intentions to “aggressively manage” its cost base, increasing its cost-cutting measures by an additional $2B to a $7.5B target. We expect losses to continue narrowing into 1HFY24; operating income by segment improved this quarter, with Entertainment at $236, up from -$608M a year ago, Sports up 14% Y/Y, and Experiences up 31% Y/Y. We see a more balanced risk-reward profile for Disney into 1HFY24, but don’t see any drivers for material financial outperformance in the near-term. Hence, we recommend investors wait on the sidelines for better entry points into the stock.

Valuation

The stock is trading well below the peer group average. On a P/E basis, Disney is trading at 17.3x C2024 EPS $4.89 compared to the peer group average of 35.7x. The stock is trading at 2.2x EV/C2024 Sales, versus the peer group average of 3.1x. We don’t see favorable entry points at current levels.

The following chart outlines Disney’s valuation against the peer group.

TSP

Word on Wall Street

Wall Street is bullish on the stock. Of the 33 analysts covering the stock, 25 are buy-rated, six are hold-rated, and the remaining are sell-rated. The stock is currently priced at $85 per share. The median sell-side price target is $109, while the mean is $104, with a potential 23-29%. The following charts outline Disney’s sell-side ratings and price-targets.

TSP

What to do with the stock

We remain hold-rated on Disney and expect the stock to continue to be an in-line performer in the near-term. We don’t see more downside in the near-term, but we are holding off on upgrading to a buy as we don’t see enough near-term catalysts driving outperformance. We think industry headwinds from weaker ad spend and increased competition will weigh on growth into 2024. We recommend investors stay on the sidelines for evidence of a rebound in the demand environment.

Read the full article here