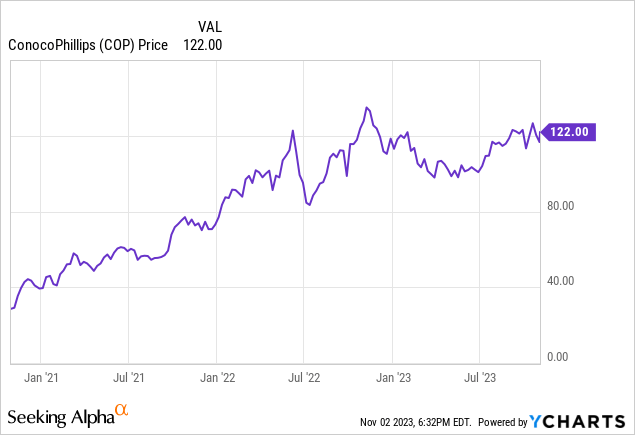

ConocoPhillips (NYSE:COP) experienced a 4.6% daily price jump on November 2, 2023, after announcing good 3Q23 results. Despite its investor-friendly programs along with excellent plans and operations, the company appears fully valued. I am downranking it from buy to hold. Long investors will want to wait for a lower entry point.

Those looking for cash returns will appreciate that the company increased its fixed quarterly dividend by 14% to $0.58/share/quarter for a 1.9% annualized yield. It will announce its variable return of cash (VROC) soon – last quarter’s was $0.60/share which, if annualized, is an additional $2.40/year for a total 3.9% yield. The company also repurchases shares: it repurchased $1.3 billion of shares in 3Q23.

Third Quarter 2023 Results

In the third quarter of 2023, ConocoPhillips earned net income of $2.8 billion or $2.32/share. This compared to 3Q22 net income of $4.5 billion or $3.55/share.

The US (Lower 48 plus Alaska) accounted for 71% of segment earnings before corporate costs. Other key regions are Canada, Europe-Middle East, and Asia-Pacific.

The company’s average realized price in 3Q23 was $60.05/BOE, versus $83.07/BOE for 3Q22.

A few 3Q23 highlights:

*raised fixed dividend 14% to $0.58/share/quarter

*bought the other half of the Surmont facility for $2.7 billion

*ahead of schedule on Norwegian and Chinese offshore projects

*signed a new 15-year LNG supply contract for the Port Arthur LNG facility

*produced 1.81 million BOE/D total, including 1.08 million BOE/D from the lower 48

*cash from operations was $5.5 billion. Of this $1.3 billion was used for share repurchases and $1.3 billion was used for dividends and variable return of cash (VROC).

COP and others are partnering in the Mexico Pacific Saguaro LNG export facility on Mexico’s west coast. As explained at a recent conference this facility can access semi-stranded west Texas natural gas, avoid Panama Canal shipping constraints, and supply interested Asian markets.

A Modest Acquisition

Given the consolidation news of Exxon Mobil’s (XOM) proposed $64.5 billion acquisition of Pioneer Natural Resources (PXD) and Chevron’s (CVX) proposed $53 billion acquisition of Hess (HES), the natural question is whether ConocoPhillips might also make a similarly large acquisition.

While Devon and ConocoPhillips have been rumored to be interested in Midland basin private company CrownRock LP and as a possible suitor for other Permian companies, investors should be aware a) ConocoPhillips has already proven itself by acquiring Concho, b) it has just acquired the remainder of Surmont in Canada, and c) per the 3Q23 earnings call “we have a high bar for M&A.”

Macro

Chris Birdsall, Director of Economics and Energy for ExxonMobil recently provided his group’s forecast of energy demand through 2050. A few points from his summary of this complex model and the subsequent Q&A:

*Energy demand, including for hydrocarbons, will continue to increase as non-OECD countries improve their standard of living

*Growth in transportation is more than cars: key factors are commercial transportation-shipping and heavy-duty trucking-the tons of freight that need to be moved correlate with economic growth and optimized supply chains

*The industrial sector is the biggest growth driver for oil and gas moving forward

*The level of US debt is worrisome.

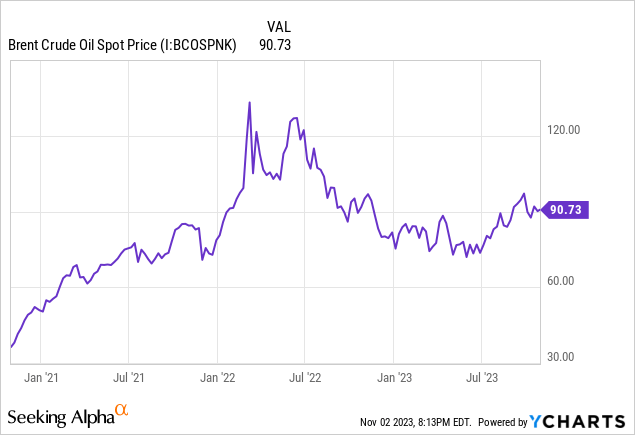

Oil and Gas Prices

The November 2, 2023, Brent oil price was $86.85/barrel for January 2024 delivery. The West Texas Intermediate (WTI) crude oil price was $82.53/barrel for December 2023 delivery. Henry Hub natural gas for December 2023 delivery was $3.50/MMBTU. Dutch Title Transfer LNG for December 2023 delivery was $15.09/MMBTU.

ConocoPhillips reports annualized sensitivities for both net income and cash flow, with the only exception being Canadian crude. The crude oil and NGL sensitivities are per $1/barrel change in price; the natural gas sensitivity is per $0.25/MCF change in price.

*WTI $115-$125 million

*Brent $45-$50 million

*ANS (Alaska) $30-$35 million

*WCS (Canadian) $30-$40 million for net income (larger $40-$50 million for cash flow)

*Natural gas liquids $50-$55 million

*Equity affiliates $25-$30 million

*Henry Hub natural gas $70-$80 million

*International natural gas $4-$6 million

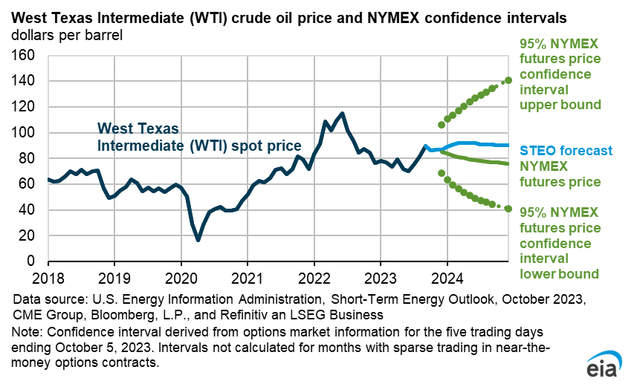

The US Energy Information Agency (EIA) shows a 5-95 confidence interval of about $40/barrel to $140/barrel for WTI prices at year-end 2024.

EIA

Competitors

Close observers of the just-released movie, “Killers of the Flower Moon,” which takes place in Osage County, Oklahoma, may have noticed one scene in which a railroad greeter holds a sign for Phillips. Both original companies – Conoco and Phillips 66 – are indeed over a century old and both were brought to life or expanded by their exploration in northern Oklahoma oil basins.

Now headquartered in Houston, Texas, ConocoPhillips produces significant volumes of oil and gas from major Lower 48 oil and gas basins as well as Alaska and offshore Gulf of Mexico. It thus competes with virtually every other public and private US producer.

ConocoPhillips also competes with/partners with companies operating in Canada, the North Sea, Qatar, Libya, and China.

Reserves and PV-10 Value

At year-end 2022, ConocoPhillips’ proved developed and undeveloped reserves for consolidated operations and equity affiliates were 6.6 billion BOEs, 8% higher than at year-end 2021. Of this, 1.45 billion BOEs were in Alaska (22%), 3.05 billion BOEs (46%) were in the US Lower 48, 1.1 billion BOEs (17%) were in equity affiliates, and the rest elsewhere.

By product, the total is divided as 46.5% oil, 3.0% bitumen, 13.6% natural gas liquids, and the remainder (36.9%) natural gas.

The PV-10 value of reserves at that time was $99.0 billion: $85.7 billion for consolidated operations and $13.3 billion for equity affiliates. This compares to $57.7 billion for year-end 2021. The bulk of the difference is due to higher prices in 2022 than in 2021.

Due to lower prices this year, especially for natural gas, COP’s year-end 2023 reserve value may be lower.

Governance

On October 28, 2023, Institutional Shareholder Services ranked ConocoPhillips’ overall governance as a weak 9, with sub-scores of audit (3), board (4), shareholder rights (8), and compensation (10). In this ranking, a 1 indicates lower governance risk and a 10 indicates higher governance risk.

Insiders own a negligible 0.15% of the stock. Effective October 13, 2023, stock shorted as a percent of float was just over 1.0%.

ConocoPhillips’ beta is 1.29. This is more volatile than the market for a large company but reflects big uncertainties in the energy market from the potential Middle East complications of the Hamas-Israel war to the Russia-Ukraine war to the anywhere-but-the-US hydrocarbon supply policy of the current administration to questions about the level of Chinese demand.

On June 29, 2023, the five largest institutional stockholders, some of which represent index fund investments that match the overall market, were Vanguard (9.3%), BlackRock (8.25%), State Street (4.8%), JP Morgan Chase (4.6%), and Wellington Management Group (3.9%).

Four of the five – all but Vanguard – are signatories to the Net Zero Asset Managers initiative, a group that, as of September 30, 2023, manages $64 trillion in assets worldwide and which limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

COP Financial and Stock Highlights

ConocoPhillips’ market capitalization is $146.1 billion at a November 2, 2023, stock closing price of $122.02/share, 88% of the 52-week high of $138.49/share. The current market capitalization is barely above the $145.6 billion market cap of September 2022, the time of my last review.

However, the share price is up 6.7% from $114.39 due to repurchases.

The current one-year target price is $129.91/share, putting the closing price at 94% of that level.

Trailing twelve-months’ EPS (through September 30, 2023) attributable to ConocoPhillips per share of common stock is $9.15 for a current price-earnings ratio of 13.3.

Annualizing the dividend increase, ConocoPhillips’ (new) fixed dividend of $2.32/share represents a 1.9% annual yield at the closing price. This ordinary dividend does not include the company’s VROC payment, which, if extended from 2Q23 would be an additional $2.40/share annually for a total cash return to shareholders of 3.9%.

The company also has a large share repurchase program underway.

Per the company’s program, as explained in the 3Q23 earnings call,

based on our mid-cycle price call, you can expect us to deliver at least 30% of our cash flow back to our shareholders. And then we’ve said, when the prices are in excess of our mid-cycle price call, which is where the prices are today and where they’ve been over the last few years, you should expect us to be delivering more of our cash back. And that’s, in fact, what we’ve done over the last 5 to 6 years, delivered mid-40%, 45% or so of our cash, has gone back to our shareholders. And it’s done that in a form of both the cash and buying our shares back.”

Starting in 2024, instead of splitting the announcement of fixed dividends and VROC, ConocoPhillips will announce its fixed dividend and any VROC simultaneously on the same date. In the future, it will also pay its fixed dividend and VROC together on the same date.

On September 30, 2023, ConocoPhillips had $45.9 billion in liabilities, including $18.2 billion of long-term debt (and $880 million of short-term debt), and $93.7 billion in assets giving a liability-to-asset ratio of 49%.

The company’s ratio of long-term debt to market capitalization is a small 12.5% but its goal is to reduce the debt level within three years from $18.2 billion to $15 billion.

The mean analyst rating is 2.0, or “buy” from 21 analysts. At least one analyst measures it as near fair value.

Notes on Valuation

ConocoPhillips’ market capitalization is $80,900/flowing BOE and $157,600/flowing barrel of oil.

Comparing overall totals: PV-10 reserve value is $99.0 billion, asset value is $93.7 billion (liabilities of $45.9 billion) and market capitalization is $146.1 billion.

Positive and Negative Risks

Abroad, ConocoPhillips is active in Qatar and Libya. Given the war in the Middle East, there is political risk in these OPEC countries.

COP’s operations offshore China, offshore Norway, Australia, and even Canada present different country-specific risks.

Political risk in its largest areas of operations, the Lower 48 and Alaska are also significant given the current administration’s (and some states’) anti-US-hydrocarbon policies. Some US oil demand risk has abated as auto companies scale back electric vehicle plans due to lower-than-expected consumer interest.

ConocoPhillips’ results are sensitive to global oil and natural gas prices. On the supply side, OPEC could pump more oil.

Despite the sanctions against Russian oil, many countries like China and India buy it. Per the destruction of the Nordstream pipeline and actions taken by Russia, it no longer provides northern Europe with pipelined natural gas; however, Russia-like COP and the US generally–does sell LNG to Europe.

Recommendations for ConocoPhillips

I am reducing my recommendation for ConocoPhillips from buy to hold, particularly for dividend investors. Growth in Norway, the Permian, and through LNG projects is diverse and steady, so growth investors may yet be interested. Still, oil prices are already high, the stock appears fully valued, and 2023 reserve values will be reduced, given lower gas prices.

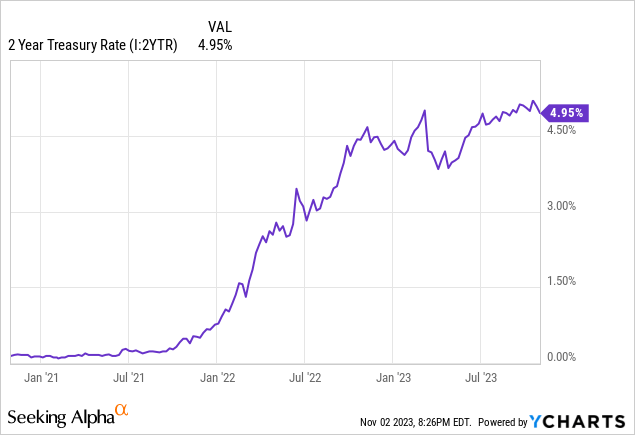

The company has an investor-friendly capital return program and relatively little debt for its size. In addition to its small regular dividend, COP makes variable cash payouts and repurchases shares. However, as the graph of 2-year Treasury bills above makes clear, the equities of all companies are now challenged to compete with relatively higher and less risky Treasury rates.

www.conocophillips.com

Read the full article here