Summary

Readers may find my previous coverage from last December via this link. My previous rating was a buy, as I believed Cohu, Inc. (NASDAQ:COHU) would see a recovery soon despite the weakness seen in the auto and industrial segments. I am revising my rating to hold (neutral) as I am no longer confident that COHU will see a strong recovery in FY24 after reviewing the 4Q23 performance, where weakness continues to be seen in the auto and industrial segment (utilization rate fell again) and management 1Q24 guidance was really weak (implying another 20+% growth decline for FY24). From an equity investor perspective, I think it makes more sense to wait for more clarity on the timing of recovery before investing.

Financials/Valuation

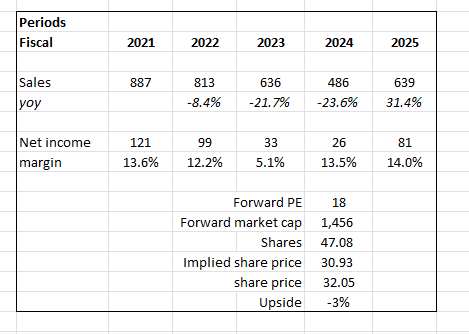

COHU reported 4Q23 revenue on February 16th of $137 million, down 9% sequentially and 28% annually. This does not come as a surprise, as I expected, weakness to persist. Breaking revenue down, systems revenue was down $63 million, or 14% sequentially and 40% annually, while recurring revenue saw $74 million, down 4% sequentially and 14% annually. Weak results were seen in other aspects of the P&L as well. Gross margin declined by 30bps and EBITDA margin declined by almost 10pts, which resulted in EPS falling by more than 60% to $11.1.

Based on author’s own math

Based on my view of the business, COHU’s upside is no longer attractive. With the incremental weakness seen in the auto and industrial segments, I am no longer confident that COHU will see a strong recovery in FY24, especially with management guiding for just $104 million in revenue for FY24 (at the midpoint). Also, the inventory surplus (particularly for industrial) situation appears not to be anywhere near the end yet. As such, to be more conservative, I am now aligning my expectations with consensus: -24% growth for FY24 and 32% growth in FY25 (recovery pushed out to FY25), and 13.5%/14% margin for FY24/25. Suppose consensus estimates come true, and the stock trades at a premium multiple to its historical average, at +1 standard deviation (18x forward PE), which I argue to be justified given it is in a recovery growth phase. The stock is only worth ~$31, which is roughly the same price as where it is trading today versus my previous $41.92 valuation.

Comments

I will split my comments on COHU into two parts: my positive outlook for the medium term and my negative outlook for the near term. I still think that COHU can do well over the medium term. While demand remains subdued in the smartphone market, there continue to be positive signs of recovery in the mobile segment. For one, the test cell utilization rate remains stable at 76% vs. 3Q23, suggesting no deterioration. Inventory levels are also reaching normal levels, with customer feedback (as per the 4Q23 transcript) suggesting a strong recovery is possible in 2H24. Note that the utilization rate needs to be more than 80% for capacity buys to kick in, so the upside from the improvement to a 76% utilization rate does not show up in the P&L for now.

As we always say, utilization of about 80% is when you see capacity buys. And we have to see, across markets, not only 80%, but more of a trend up towards that 80%. So, climbing from 71% to 80% mark. And the rate of climb also will determine how fast we get to that turning point, right. Source: 4Q23 earnings

Another positive sign of recovery is that COHU’s semiconductor test has finally bottomed. After six consecutive quarters of sequential declines, segment revenue grew 6% sequentially in 4Q23 and is expected to grow by 25% sequentially in 1Q24, as per management commentary. Lastly, touching back on one of the points that I monitor for COHU, gross margin. I think 4Q23 performance reinforces the viewpoint that COHU’s gross margin is a lot more resilient than expected. While revenue fell by 28%, gross margin only fell by 30bps to 48.5%. This further confirms my point that the COHU gross margin is now structurally higher.

Up to this point, my view on COHU has stayed relatively the same. However, the weakness seen in 4Q23 forced me to take a more conservative view in the near term. Firstly, while mobility utilization test rates showed signs of stabilization, outside of it, test cell utilization continued to decline, with test cell utilization falling 2% sequentially to 71%. Secondly, it seems like the weakness in the industrial segment will last longer than I expected. Results and commentary from one of COHU’s major customers, Texas Instruments Incorporated (TXN), suggest that COHU is going to continue facing weakness in this end market. For TXN, 4Q23 revenue continues to fall by the low teens level, similar to the previous 2 quarters, showing no major signs of recovery yet. Furthermore, the inventory surplus situation is not going to end anytime soon, as per TXN comments. As such, even if the mobility segment test cell utilization rates appear stable, I now believe that the market will not attach any upside value to that narrative as utilization rates in the industrial segment continue to decline.

Yeah. No, thanks, Chris. So, broadly speaking, our inventory targets have not changed over the last six, nine months through this cycle, so we still have some ways to go, clearly less than we did six months ago, but we still have some ways to go on that front.

So that’s the data that we can see. We actually can’t see their inventory levels. We can anecdotally, as we see a market like personal electronics is down 30%, 40%, we know handsets and PCs, that market hasn’t gone down as much as that. So we know anecdotally that we’re shipping below demand. So we believe that that’s what’s going on in industrial. We have customers who have told us that they have built inventory and plan to correct that. So having a real clear picture of what their demand looks like and their channel inventories look like isn’t something that we can see directly overall. Source: TXN 4Q23 earnings

Readers that have followed my previous update know that I took a very aggressive position in assuming growth recovery in FY24 (20% growth in FY24 and 17% growth in FY25). That was a strong contrarian view relative to the consensus that expected flattish growth back then. Now that management has explicitly guided for 1Q24 revenue of $107 million at the midpoint, which suggests that FY24 is likely going to be another negative growth year ($107 run rate implies $428 million, down 33% vs. FY23), I think the right portfolio management strategy is to turn neutral on the stock until we see solid signs of recovery in the auto and industrial segments.

Conclusion

I am adjusting my rating on COHU from a buy to a hold as I am no longer confident in a strong FY24 recovery. The 4Q23 performance indicates persistent weakness in the auto and industrial segments, with utilization rates declining and management providing a weak 1Q24 guidance. While the medium-term outlook holds promise with positive signs in the mobile and semiconductor test segments, the near-term challenges, including declining test cell utilization and prolonged weakness in the industrial segment, have led me to adopt a more conservative stance. COHU’s FY24 revenue guidance of $107 million at the midpoint suggests another year of negative growth. To exercise prudence, I recommend a neutral position until clearer signals of recovery emerge in the auto and industrial sectors.

Read the full article here