The Calamos Convertible Opportunities and Income Fund (NASDAQ:CHI) is a closed-end fund that aims to provide investors with a very high level of current income. This is hardly unusual, as many closed-end funds have the same basic goal. As is the case with many Calamos funds, though, this one has a rather unique method of achieving its goals. The fund invests heavily in convertible securities, which frequently perform more like common equities than bonds. It is not a perfect correlation, of course, but these securities have outperformed investment-grade bonds year-to-date:

Seeking Alpha

As we can see, the iShares Convertible Bond ETF (ICVT) outperformed the Bloomberg U.S. Aggregate Bond Index (AGG) year-to-date, despite the bond index having a higher yield. This is due to the convertible feature possessed by these bonds, which becomes more valuable as the stock price of the issuing company rises. Obviously, though, we cannot expect these securities to match the performance of a common stock index during a bull market. They do tend to have higher yields, though, and the Calamos Convertible Opportunities and Income Fund is able to pass this through to its shareholders. As of the time of writing, the fund boasts a 9.61% yield. This is very reasonable compared to the yields of either equities or bonds:

|

Index/Index ETF |

Current Yield |

|

Calamos Convertible Opportunities and Income Fund |

9.61% |

|

S&P 500 Index (SP500) |

1.30% |

|

Bloomberg U.S. Aggregate Bond Index |

3.44% |

|

Bloomberg High Yield Very Liquid Index (JNK) |

6.57% |

(all figures based on the trailing twelve-month period)

However, the Calamos Convertible Opportunities and Income Fund’s current yield is not particularly impressive compared to its peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Calamos Convertible Opportunities and Income Fund |

Fixed Income-Taxable-Convertibles |

9.61% |

|

Advent Convertible & Income Fund (AVK) |

Fixed Income-Taxable-Convertibles |

11.58% |

|

Bancroft Fund (BCV) |

Fixed Income-Taxable-Convertibles |

8.04% |

|

Ellsworth Growth and Income Fund (ECF) |

Fixed Income-Taxable-Convertibles |

6.15% |

|

High Income Securities Fund (PCF) |

Fixed Income-Taxable-Convertibles |

11.29% |

|

Virtus Convertible & Income Fund (NCV) |

Fixed Income-Taxable-Convertibles |

12.11% |

As we can see here, the yield of the Calamos Convertible Opportunities and Income Fund is only average compared to its peers. This might reduce the fund’s appeal to those investors who are seeking to maximize the income that they earn from their assets. However, it could also be a positive thing, as it does suggest that the market believes that its current distribution is sustainable. We will want to have a look at the fund’s finances over the remainder of this article to determine whether or not this is the case.

As regular readers can likely remember, we previously discussed the Calamos Convertible Opportunities and Income Fund towards the end of April 2024. The equity markets have been fairly strong since that time, although bonds have struggled somewhat. This fund frequently trades more in line with equities, though, so we can probably expect that its performance has been pretty reasonable over the past few months. This is indeed the case, as shares of the fund have risen by 6.76% since the date of our previous discussion:

Seeking Alpha

A 6.76% gain is certainly a reasonable performance over a roughly three-month period, although the fund did still underperform the S&P 500 Index. That is not unexpected, though, since we would ordinarily expect a fund focused on convertibles to underperform common stocks. The fund did manage to substantially outperform convertible bonds over the same period:

Seeking Alpha

This performance is probably solid enough to satisfy most income-focused investors. After all, many investors in that category are willing to sacrifice a certain amount of capital gains in exchange for income. However, as I pointed out in a previous article:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

The distributions paid by the fund constitute a real return to the fund’s shareholders that is not reflected in its share price performance. When we take this into account, we get the following alternative chart:

Seeking Alpha

As we can see, when the distributions are included, shareholders of the Calamos Convertible Opportunities and Income Fund realized a total return of 9.41% over the period. This is still not as good as common stocks, but it is a very good return considering that only about two-and-a-half months have passed since we last discussed this fund. Overall, it is unlikely that anyone will be too disappointed here.

There have been a few significant changes since the last time that we discussed this fund. Perhaps most importantly, the fund has released an updated financial report that details its performance for the first half of the current fiscal year. We will want to pay special attention to this report, as it will give us a great deal of insight into how sustainable the fund’s distribution is likely to be.

About The Fund

According to the fund’s website, the Calamos Convertible Opportunities and Income Fund has the primary objective of providing its investors with a high level of total return. This makes a certain amount of sense given the strategy that the fund aims to achieve its objective. The website, unfortunately, is not too descriptive with respect to the fund’s strategy:

Calamos Investments

We can see here that the second bullet point states that the fund invests at least 80% of its assets into convertible and non-convertible income securities. At first glance, that figure seems low, as technically everything in the market is either a convertible or a non-convertible security of some sort. An income security can be anything from a bond to a preferred stock to a dividend-paying common stock or a real estate investment trust. However, for the purposes of the 80% mandate, this fund specifically means that its assets will be invested in a combination of convertible securities and non-convertible bonds. The remainder can be in anything that the fund managers want. It would be nice if the website was a bit clearer on this fact.

The fund’s website does not provide any rule as to how the fund’s assets need to be divided between convertible and non-convertible bonds. This is both a positive and a negative thing. The positive aspect comes from the fact that the fund’s managers are free to overweight convertibles or non-convertibles based on bond market trends. For example, back in 2022, junk bonds and investment-grade bonds both substantially outperformed convertibles:

Seeking Alpha

The fund’s flexibility allows it to overweight non-convertible bonds, or even ignore convertible bonds entirely, in order to reduce its losses. If the fund had to have a certain percentage invested in convertible bonds, then investors would have lost a lot more money than with an all-non-convertible portfolio. Of course, the Calamos Convertible Opportunities and Income Fund delivered a negative 23.05% total return in 2022, so investors in this fund still lost a lot of money when compared to any of the indices.

The downside to the lack of a stated mandate between convertible and non-convertible bonds, of course, is that investors are not necessarily certain what they are buying at any given time. This is something that could very easily annoy some potential investors.

The fund’s semi-annual report (linked in the introduction) states that the Calamos Convertible Opportunities and Income Fund had the following positions as of April 30, 2024:

|

Asset Type |

% of Net Assets |

|

Asset-Backed Securities |

0.1% |

|

Corporate Bonds |

40.9% |

|

Convertible Bonds |

102.1% |

|

Bank Loans |

7.7% |

|

Convertible Preferred Stocks |

3.6% |

|

Warrants |

0.0% |

|

Common Stocks |

0.4% |

|

Preferred Stocks |

0.4% |

|

Purchased Options |

0.1% |

Curiously, the fund’s Schedule of Investments does not list any money market or cash holdings as of April 30, 2024. That is a bit strange, since we would assume that the fund would want to have some cash on hand in order to finance its distributions or buy a security when an opportunity presents itself. Without cash, the only way to afford these things is to sell something, and that could force the fund to sell a security at a bad price. It is possible that the fund did not list its cash in its Schedule of Investments for some reason, or that it temporarily emptied it on April 30, 2024. The fund pays its distributions in the middle of the month, so it definitely did not empty its cash to pay the distribution.

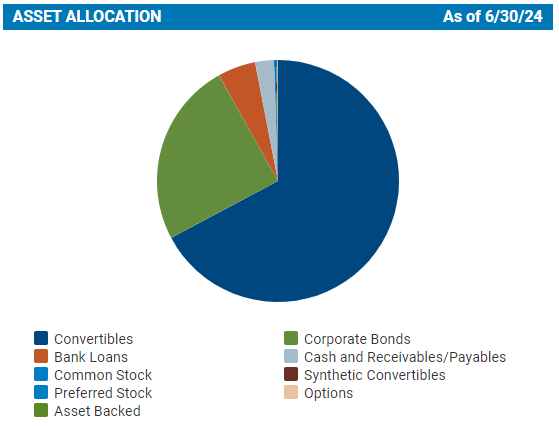

The website states that the fund had the following weightings as of June 30, 2024:

Calamos Investments

In table form:

|

Asset Type |

% of Total Assets |

|

Convertibles |

67.24% |

|

Corporate Bonds |

24.67% |

|

Bank Loans |

5.05% |

|

Cash and Receivables/Payables |

2.54% |

|

Common Stock |

0.21% |

|

Preferred Stock |

0.08% |

|

Synthetic Convertibles |

0.08% |

|

Options |

0.07% |

|

Asset-Backed |

N/A |

The chart on the website does not actually have a weighting listed for asset-backed securities, but that does not mean that there are none in the portfolio. The semi-annual report only lists a single asset-backed security as of April 30, 2024:

Fund Semi-Annual Report

It is possible that this security is still in the portfolio today, but its value simply accounts for too small of a percentage to be included in the website’s chart due to rounding.

We see that the Calamos Convertible Opportunities and Income Fund includes a small position in so-called “synthetic convertible bonds.” These are likely to be a new concept to some investors, as they are very rarely covered in the financial media. A synthetic convertible bond is simply an options strategy in which the fund buys a non-convertible bond and a call option or warrant against the common stock of the same company. The price of the call option or warrant should increase in price when the company’s stock price goes up, just like a convertible bond. At the same time, the non-convertible bond provides the fund with a stream of income from the company. Thus, the position’s total return overall should resemble a convertible bond, despite not actually being one. This is a good way to get a convertible bond-like payoff from a company that does not actually issue these bonds.

We do note some changes to the fund’s portfolio in the chart above compared to what it had the last time that we discussed it. In particular, the fund’s weighting to both convertible bonds and bank loans increased:

|

Asset Type |

Weighting on March 31, 2024 |

Weighting on June 30, 2024 |

% Change |

|

Convertible Bonds |

66.89% |

67.24% |

+0.35% |

|

Bank Loans |

4.38% |

5.05% |

+0.67% |

This is actually rather surprising. Convertible bonds underperformed investment-grade and junk bonds by quite a lot over the period in question:

Seeking Alpha

However, we can see that bank loans generally outperformed both types of fixed-rate bonds. This suggests that the fund sold some of the corporate bonds that it was holding in order to purchase convertible securities. It may have left the bank loans alone, since those can be expected to see their weighting increase due to their relative outperformance. This fund has a 39.00% annual turnover, so it does certainly engage in a certain amount of asset trading and active management, such as what would be necessary to produce the weighting changes that we see here.

There have also been a few changes to the largest positions in the fund since the last time that we discussed it. Here are the largest positions as of June 30, 2024:

Calamos Investments

There were two major changes to this list since the time of our previous discussion. These changes are that Super Micro Computer (SMCI) and Integer Holdings (ITGR) were removed from the largest positions list. In their place, we have Snap (SNAP) and Palo Alto Networks (PANW). Palo Alto Networks is a very common holding among convertible funds. Indeed, regular readers likely know that we have mentioned this company numerous times in articles about other convertible bond funds. Snap, Inc. is a somewhat less common company to see among the largest positions in a convertible bond fund, but it is certainly well known for its popular social media network SnapChat. Many analysts seem to believe that the common stock is worth buying today, and Seeking Alpha’s proprietary Quant rating system has a strong buy rating on the common stock:

Seeking Alpha

For the most part, if a company’s common stock is worth buying, then its convertible bonds are as well. Thus, there does not appear to be any reason for us to complain about the changes that this fund has made over the past few months.

Leverage

As is the case with most closed-end funds, the Calamos Convertible Opportunities and Income Fund employs leverage as a method of boosting the effective yield and total return that it earns from its portfolio. I explained how this works in my previous article on this fund:

Basically, the fund borrows money and then uses that borrowed money to purchase convertible securities and high-yield junk bonds. As long as the purchased securities deliver a higher total return than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will usually be the case.

However, it is important to note that leverage is not as effective at boosting returns today as it was two years ago. This is because rates are significantly higher today and the difference between the rate at which the fund can borrow and the yield that it can receive on the purchased securities is narrower than it was three years ago.

Unfortunately, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because this would expose us to an undesirable amount of risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the Calamos Convertible Opportunities and Income Fund has leveraged assets comprising 37.39% of its portfolio. This is a bit higher than the 36.85% leverage that the fund had the last time that we discussed it, which is rather surprising. After all, the fund’s share price has increased over the period. Its net asset value has increased too, although not to the same extent as the fund’s share price:

Barchart

As we can see, the fund’s net asset value has increased by 3.28% since the publication of my previous article on this fund. That is much less than the 6.76% gain that the share price delivered, which suggests that the fund has become even more expensive over the past few months. This fund was arguably overpriced back in April, so it is likely worse now. We will discuss this later in this article.

As I have pointed out a few times in the past, the only way in which a fund’s leverage will increase along with its net asset value is if the fund increases its borrowings. That must have been the case here, which I will admit is a bit disappointing. The fund’s leverage was already a bit high, as it has exceeded the one-third of assets maximum level that I would prefer for quite some time. This fund’s leverage is also higher than that of its peers:

|

Fund Name |

Leverage Ratio |

|

Calamos Convertible Opportunities and Income Fund |

37.39% |

|

Advent Convertible & Income Fund |

42.60% |

|

Bancroft Fund |

22.00% |

|

Ellsworth Growth and Income Fund |

22.00% |

|

High Income Securities Fund |

0.00% |

|

Virtus Convertible & Income Fund |

37.66% |

(all figures from CEF Data)

We can see that there are three peer funds whose leverage is well below that of the Calamos Convertible Opportunities and Income Fund. The fourth fund, the Virtus Convertible & Income Fund, has a level of leverage that is barely above it. That fund does not have the greatest reputation among investors, due partly to problems that its leverage caused it back when the convertible bubble burst in 2022. The fact that the Calamos Convertible Opportunities and Income Fund has a similar level of leverage therefore might be concerning for some.

Historically, Calamos funds have generally proven themselves able to carry a significant amount of leverage. However, I will admit that I would prefer this one to have less than it currently does.

Distribution Analysis

As mentioned earlier, the primary objective of the Calamos Convertible Opportunities and Income Fund is to provide its investors with a high level of total return. It primarily aims to deliver this via distributions paid to the shareholders. To this end, the fund pays a monthly distribution of $0.0950 per share ($1.14 per share annually). This gives the fund a 9.61% yield at the current price, which is roughly average when compared to its peer group.

The fund has, fortunately, been generally consistent with respect to its distributions over the years:

CEF Connect

As I stated in the previous article:

We do see that the fund cut its distribution back in 2018 but then raised it back to the previous level in early 2021. Thus, except for a short period from 2018 to 2021, the fund has paid a stable $0.0950 per share monthly over the past decade. This is likely to be reasonably attractive to any investor who is seeking to earn a safe and consistent level of income from the assets in their portfolio. The temporary distribution cut is certainly a turn-off, but this fund did much better than peers such as the Virtus Convertible & Income Fund, which has steadily decreased its distribution over time.

We should certainly make sure that the fund is able to sustain its distribution, though. After all, as we saw in the previous article, the fund failed to cover its distributions for the full-year period that ended on October 31, 2023. It is now a new fiscal year though, and the fund has released its semi-annual report for the six-month period that ended on April 30, 2024. Let us take a look at this document to determine its distribution sustainability for the new year.

For the six-month period that ended on April 30, 2024, the Calamos Convertible Opportunities and Income Fund received $17,441,970 in interest and $1,106,324 in dividends from the assets in its portfolio. However, some of the received interest was considered to be a return of principal so it is not considered to be investment income and needs to be subtracted from the total. This gives the fund a total investment income of $6,618,715 for the six-month period. This was not sufficient to cover the fund’s expenses, and it ended up reporting a $10,152,335 net investment loss. Obviously, this is not sufficient to cover any distribution.

However, the fund had sufficient capital gains to come out in good shape. For the six-month period, it reported net realized gains of $6,689,566 and $102,144,366 net unrealized gains. That was more than sufficient to cover both the net investment loss and the $42,751,460 that the fund paid out in distributions. Overall, the fund’s net assets increased by $60,222,468 after accounting for all inflows and outflows during the period. This was much better than the fund had during the previous period and gives us some confidence that it will not have difficulty covering its distribution for a while.

Valuation

Shares of the Calamos Convertible Opportunities and Income Fund are trading at a whopping 17.21% premium on net asset value. That is in line with the 17.10% premium that the shares have had on average.

This is an incredibly high price to pay for any fund. While this is one of the better convertible funds available in the market, it is very hard to justify paying such a premium for it.

Conclusion

In conclusion, the Calamos Convertible Opportunities and Income Fund appears to have improved significantly since the time of our last discussion. In particular, the strength of the capital markets over the past several months has easily allowed this fund to cover its distribution with a great deal of money left over that can be carried forward. However, investors have to pay a very high price for this, and that premium is one of the highest possessed by any fund.

I want to recommend this fund, but not at the current price. It would be a great deal if it traded at a price that is close to net asset value, though.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here