Not so long ago, Celsius Holdings (NASDAQ:CELH) had one of the cleanest hyper-growth stories in the market, with analysts piling up estimates for a multi-year trajectory of 30% or above growth.

I, too, had high expectations for the company, as it was firing on all cylinders in 2023. Then, came 2024, and the warning signs started mounting. While some investors adjusted accordingly, others chose to ignore them.

Following the second-quarter results, it is no longer a question, but rather a fact, Celsius will not deliver on those initial high expectations.

However, it’s still a good company which could turn out to be an attractive investment, at the right price.

Let’s dive in.

Briefing Through The Rise And Fall

Celsius Holdings came on my radar a little over a year ago. At the time, the company was in the early innings of its PepsiCo partnership, which provided Celsius the distribution and scale it needed to take the industry by storm.

Pretty quickly, the push from Pepsi became apparent, driving four consecutive quarters of nearly 100% growth, as well as doubling the company’s market share, and introducing new channels, primarily food service.

Not only that, but PepsiCo enabled Celsius to grow fast while generating significant operating leverage. Celsius ended 2023 with operating margins north of 20%, compared to the prior year’s 5.9%.

Entering 2024, worries about tough comps were overshadowed by enthusiasm about a strong spring reset season, international expansion, and the first year of full planning with PepsiCo.

As we progressed through the year, it turned out that the enthusiasm was exaggerated, and I warned about it. International was too small and early to offset the tougher comps, and the full planning with PepsiCo turned out to be a headwind, as PepsiCo optimized its inventory management and pushed for better terms.

In addition, more and more competitors entered the field, and while supply grew, demand subsided, amid energy-drink fatigue, health questions, and an overall decline in discretionary spending.

I wrote about it extensively in a June article, titled: ‘Don’t Ignore The Warning Signs (Rating Downgrade)’.

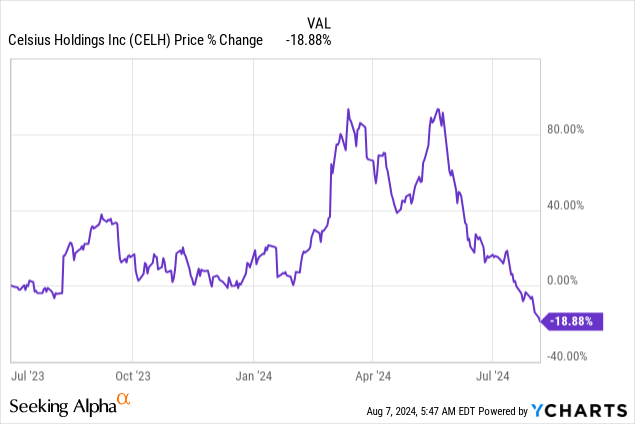

Well, I guess a graph is better than a thousand words. Celsius shares are down nearly 20% since my first article, but there were plenty of opportunities to sell or trim during this period where investors could have made good profits.

All that belongs to the past, but it’s important to set the foundation for our future-looking discussion.

Second-Quarter Highlights

Another clearing assignment before we provide our outlook, let’s briefly go over second-quarter results.

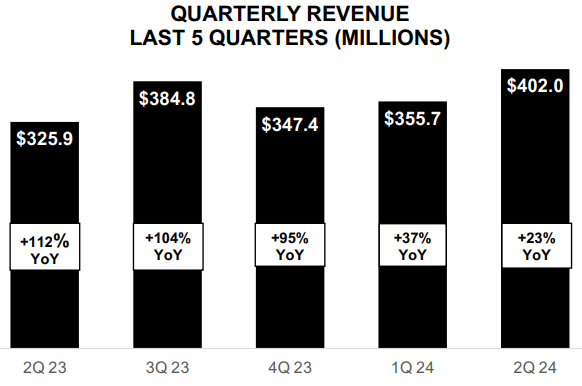

In the quarter, revenue was $402 million, up 23.4% Y/Y. Growth was driven by international sales, which grew over 30%, and sales to Amazon, which increased 41%. Growth was significantly offset by a deceleration in sales to PepsiCo, as it continues to optimize the inventory buildout.

As I said in the past, PepsiCo’s inventory optimization is not a one-off. It’s a new reality. True, it might be less of a headwind next year, but inventory optimization in supplier-distributor relationships is an integral part of doing business.

Celsius Holdings Q2’24 Presentation

In an attempt to foresee possible comments, I have to acknowledge that 23% growth is objectively high. However, this is not an objective game. When Celsius shares were trading in the $90s, consensus estimates had Celsius generating nearly $1.9 billion in revenues in 2024. Today, it’s at $1.5 billion, reflecting 18% growth. That’s a pretty bearish 18% growth.

Celsius Holdings Q2’24 Presentation

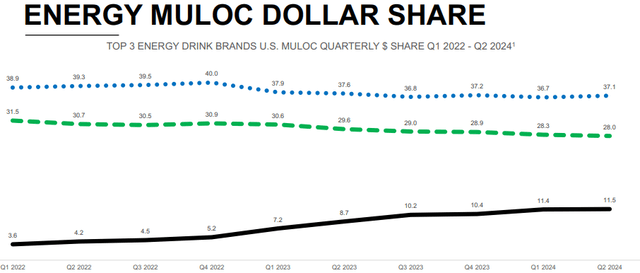

Something that would be tougher to defend is Celsius losing market share. Not yet shown in the graph, Celsius’ market share dropped to 11% in July, reflecting a 50 bps decline.

Celsius Holdings Q2’24 Presentation

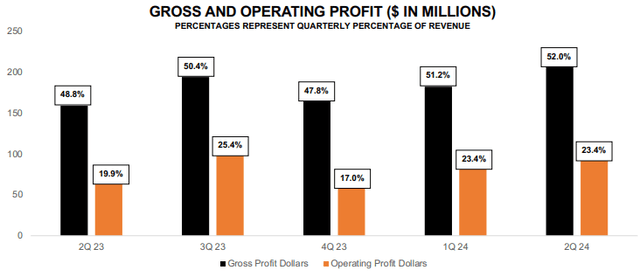

On a more positive note, Celsius continues to demonstrate significant operational leverage, with gross margins reaching all-time highs, and operating margins sustained at 23.4%. Looking ahead, management expects a decline in margins, as they accelerate marketing spend.

Overall, this wasn’t a good quarter considering initial expectations for the year, but it was a decent quarter based on the updated subdued expectations, with EPS beating by 20%.

Monster Beverage Comps & Hyper Growth Out, Double-Digit Growth In

With Celsius growth slowing down materially, Monster Beverage (MNST) comps are becoming more relevant than ever.

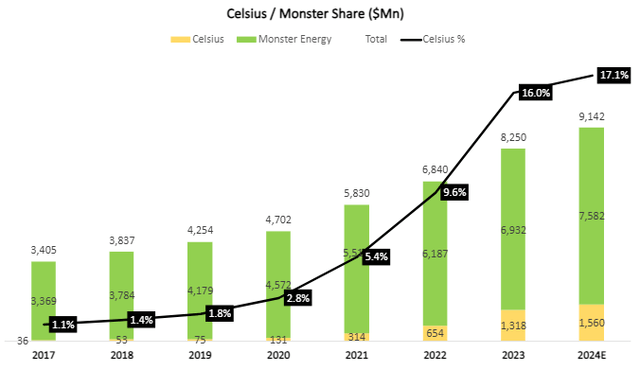

Created and calculated by the author using data from the company’s financial reports and consensus estimates; Monster Energy numbers don’t include revenues derived from Monster Beverage’s non-energy businesses.

Monster is yet to report its second-quarter numbers. However, based on consensus estimates, it is expected to report $1.95 billion in energy-drink revenue. That would reflect 8.5% growth, much slower than Celsius, bringing the latter to 17.1% of combined revenues, up from 16.5% in Q1.

However, looking ahead, both companies are expected to generate similar growth in Q3 and beyond, which means Celsius’ share will remain flat.

If the industry disruptor is growing at a similar rate as the incumbent, this means that the hyper-growth era is behind us. However, Celsius does still have a reasonable path for double-digit growth. In fact, consensus estimates still see Celsius growth accelerating to 31% next year (which is very optimistic in my view).

Valuation

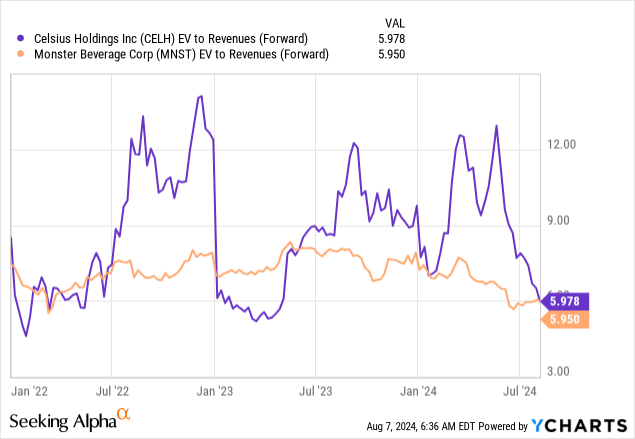

Following the recent selloff, Celsius is no longer trading at the astounding multiples we saw just a few months ago. However, this doesn’t necessarily mean it’s cheaper, considering its growth outlook.

Looking at EV to Sales, we can see that for the first time since mid-2023, Celsius is trading in line with Monster. Although it might seem attractive, I’d argue that with Monster having a longer track record of maintaining double-digit growth at 28% market share, it might be reasonable to say Celsius doesn’t deserve a premium. This also reflects the market being suspicious about consensus estimates for next year.

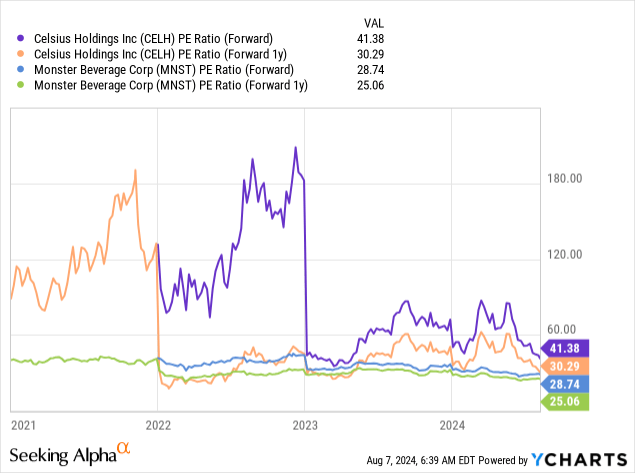

Looking at their PE ratios for 2024 and 2025, we can see that Celsius does get a premium, which narrows significantly in FY1.

Again, this is predicated on the expectation Celsius’ growth will accelerate from 18% this year to 32% next year, something that I view as unlikely. Even then, Celsius would be trading at a little over 1.25x PEG, not particularly cheap considering the amount of uncertainty.

Conclusion

Celsius hyper-growth days are over. However, there’s still a path to an attractive growth story here, which could generate good returns at the right price.

However, as Celsius is still searching for a normalized growth rate, and with questions about long-term industry growth remaining, I find that the current valuation is still too high.

Therefore, I reiterate Celsius as a Hold.

Read the full article here