Investment Thesis

Company Overview

Celestica Inc. (NYSE:CLS), incorporated in 1994 as a subsidiary of IBM and sold off to Onex Corporation in 1996 with its headquarters in Toronto, Ontario, Canada, is a global provider of designing and manufacturing hardware platforms and supply chain solutions for enterprise customers in networking, storage, and computing capacity. The company has two reportable segments. Its Advanced Technology Solution (ATS) segment consists of Aerospace & Defense (A&D), Industrial, Health Tech, and Capital Equipment businesses, while its Connectivity and Cloud Solution (CCS) segment consists of Communications and Enterprise end markets.

Strength & Weakness/Risks

As a supply chain solution provider specialized in end-to-end capabilities tailored to meet specific market and customer product lifecycles, Celestica has been riding the demand for supply chain optimization brought on by the pandemic and the war in Russia-Ukraine. The company has major clients in its CCS segment from original equipment manufacturers (OEMs), cloud-based and other service providers and hyperscalers, and also companies in a wide range of industries. In the latest quarter, the company generated 50% more revenue from its clients than in 2021. Although its revenue and earnings still have a way to go before reaching the highs it reached pre-08, notice that back then, it had quite some net losses while it has had positive net income consistently in recent history. In other words, with its top line pulling ahead and lifting both net income and earnings, its financials are in better shape than before in its history.

Celestica: Revenue vs EBITDA, Net Income (Calculated and Charted by Waterside Insight with data from company)

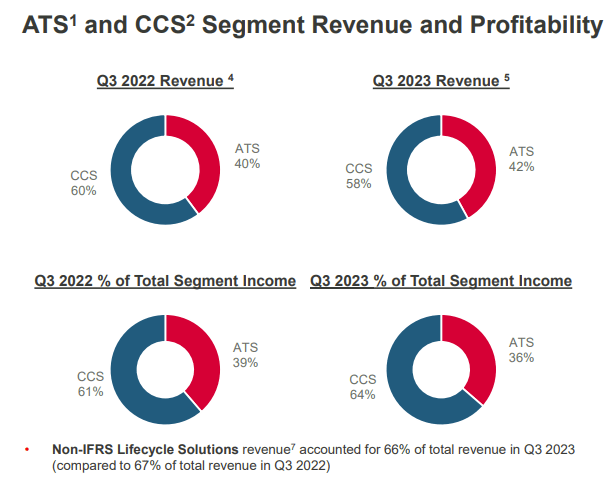

Celestica’s traditional revenue has been from its CCS segment, which has a lower margin, and lower working capital requirement compared to the ATS segment and relies more on volume. This segment has experienced lower pricing pressure as noted in its Q3 MDA in recent quarters. However, this segment has a Hardware Platform Solutions unit that has a higher margin than the typical CCS business. HPS combines firmware/software enablement across all primary IT infrastructure data center technologies, including using open-source software, to serve its hardware platforms and aftermarket services including ITAD ( IT Asset Disposition). The added value through research required by this unit highlights the nature of the services. It helps the CCS segment to have higher income comparably although with a lower revenue by a few percentage points YoY. Also helping the higher margin for the CCS segment this quarter were the higher volumes with its hyperscaler customers and production efficiencies. On the other hand, the ATS segment benefited from the volume leverage and program ramps in its Industrial business, which serves the A&D and HealthTech industries. This has helped offset the softness in the Capital Equipment business within this segment.

Celestica: Segment Revenue and Profitability (Company presentation)

If counting inventory, Celestica has more cash in the conversion cycle than its current revenue. But the rise of cash in conversion is not only from its inventory, which has been mostly flat since the end of last year but mostly from the strong conversion from credit to cash from lower accounts payables and higher accounts receivables.

Celestica: Revenue vs Cash Conversion (Calculated and Charted by Waterside Insight with data from company)

Celestica gave detailed information on the current state of its cash cycle in Q3. The company’s days in accounts receivable (A/R) and days of accounts payable (A/P) basically canceled out each other, leaving the bulk of the cash cycle hinging on the days in inventory. To mitigate the impact of high inventory levels, it receives cash deposits from some of its customers. Cash deposits consist of A/R sales and Supplier Finance Programs, which are the A/R sales sold to third-party banks. It has increased such cash deposits by almost 45% YoY in order to help shorten the cash cycle. This cash deposit program actually increased its financing costs by about $9 million YTD compared to 2022. Its financing costs, which primarily consisted of the cash deposit program, currently are only about 1.1% of the revenue.

Celestica: Cash Conversion Cycle (Company Q3 2023 MDA)

The financing cost has impacted its financing cash flow in the past year or so but is compensated by the rising operating cash flow, which in turn, was benefited from increased net income. Simply put, it has the capacity to use the financing program to reduce inventory overhang and help the cash flow conversion cycle.

Celestica: Net Cash Flow Breakdown (Calculated and Charted by Waterside Insight with data from company)

Celestica has a high concentration of revenue in the top 10 customers. They collectively accounted for 66% of the total revenue. How fast it can drain the inventory will depend on these top customers’ purchase pace in the next year.

To support its recent growth, Celestica has grown its liabilities at a similar speed.

Celestica: Debt Effectiveness (Calculated and Charted by Waterside Insight with data from company)

However, the accumulation was largely from long-term debt, with the short-term debt being paid down in 2020-2021. It is mostly long-term debt outstanding, which helps alleviate short-term pressure on its cash flow when it needs the flexibility to work off the inventory.

Celestica: Debt Accumulation (Calculated and Charted by Waterside Insight with data from company)

The biggest news recently coming from Celestica is the release of its next-generation 800G switch. This new switch focuses on speed and agility for data center and enterprise-class access deployments. This launch is within the HPS unit in the CSS segment, which as we alluded to earlier, is the higher-margin unit within this traditional lower-margin segment. Celestica has long been a member of the Open Computer Project (OCP) and the company is seeking approval to release it into the open-source domain as the first OCP-inspired commercial 800G Ethernet switch. It has collaborated with Meta (META) in the past to develop designs using some of OCP’s earliest platforms. This newest launch is similarly adopting some OCP features.

Overall, Celestica has a good mix of business that both benefits from volume and higher margin. One helps offset weakness in another, while its product adaptation continues winning the audience both in the open-source space and the large industrial customers, including the hyperscalers.

Financial Overview & Valuation

Celestica: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

Based on our analysis above, we use our proprietary models to assess Celestica’s fair value by projecting its growth ten years ahead. We used a cost of equity of 9.8% and a WACC of 10.33%. In the base case, the company’s strong momentum in 2023 will continue into next year with 20-30% YoY growth, and within two years’ time, it could revisit its past highs achieved pre-08. In the longer term, there are product revamps and some growth bumps ahead due to the natural fierce competition and product migration in the tech space but it was able to manage to stay strong, it was priced at $26.39. In the bullish case, the near-term projections are similar but long-term growth is more stable; it was priced at $47.22. In the bearish case, the top 10 customers could experience some slowdown in the next two year’s growth, and it took the long term to work off the inventory overhang while maintaining a similar long-term outlook as in the base case; it was priced at $23.81. The current market price is bullish on the stock but not overpriced in our view.

Celestica: Fair Value (Calculated and Charted by Waterside Insight with data from company)

Conclusion

Celestica has strong base products, wide connection with users in the open-source community and large corporate customers, along with its specialties in A&D and the Healthtech industry, it has a well-balanced product mix that is key to its current success to take advantage of the demand for supply chain optimization induced by the recent bottlenecks. The company’s inventory overhang is significant but the sales pace has kept up, and its cash deposit program will help maintain a stable cash conversion cycle until it works off the loads. We are optimistic about its growth in the medium term and look to revisit the thesis from time to time. It is a hold for us currently.

Read the full article here