Written by Nick Ackerman, co-produced by Stanford Chemist.

It seems that Calamos Investments is once again busy launching a new exchange-traded fund, or ETF. This time, it is the Calamos CEF Income & Arbitrage ETF (NYSEARCA:CCEF). We previously covered their foray into the ETF space with their Calamos Convertible Equity Alternative ETF (CVRT).

This manager is known more for the convertible investment niche that they invest in. In fact, they are probably better known by some for their closed-end fund, or CEF, products and not their ETFs. CCEF is now the third ETF they launched, which started with Calamos Antetokounmpo Global Sustainable Equities ETF (SROI) in early 2023.

Even more recently, shortly after originally writing up this CCEF piece, they also now have launched the Calamos Alternative Nasdaq & Bond ETF (CANQ) on February 13.

With CCEF, we are getting a bit of a different approach outside their convertible category. Here, we are getting an “income & arbitrage” approach with a fund-of-funds approach. That is, they are investing this ETF’s assets into closed-end fund investments.

There are a number of these funds to choose from on the market today. Invesco CEF Income Composite ETF (PCEF) and Saba Closed-End Funds ETF (CEFS) are just a couple of others in the ETF wrapper. In the CEF structure, we have the Cohen & Steers Closed-end Opportunity Fund (FOF) as well.

Having another option in the space isn’t a bad thing, but I believe it could take Calamos some time to get established with this ETF if they do at all. Currently, based on the February 7, 2024 data, the fund is sitting with about $1.256 million in assets under management, or AUM. CVRT, when we covered it previously, was sitting around $5 million in AUM. That’s now climbed to around $18.7 million, so it’s definitely heading in the right direction. That said, that’s a strategy right in their wheelhouse.

Calamos certainly has an attractive record in the convertible and equity space on a number of their CEFs, but whether that applies to successfully managing a fund of CEFs is yet to be determined.

The Strategy

CCEF’s investment objective is to deliver high monthly income and capital appreciation by investing in income-producing closed-end funds trading at attractive discounts.” More specifically mentioned in the prospectus, the fund will invest “at least 80% of its net assets (plus borrowings for investment purposes, if any) in U.S. and non-U.S. closed-end funds.”

In this sense, it isn’t arbitrage in the traditional sense as defined by most financial sources. Instead, it’s more the ‘arbitrage’ opportunity to potentially realize the relatively large discounts that can open up in the CEF space. Reinforcing that, they state one of the key features specifically is “invests in closed-end funds trading at steep discounts to unlock the potential for capital appreciation.”

In the prospectus, they provide a bit more detail:

The Fund’s strategy seeks to identify closed-end funds trading at attractive discounts and sell such funds when the arbitrage opportunity has either been achieved by capturing the benefit of discount narrowing or when the Adviser determines the discount level no longer represents an unusual divergence from the fund’s underlying asset value

Of course, we already know that most CEFs pay out some hefty distribution yields. So, another key feature highlighted by the fund is that “CCEF is actively managed and seeks to pay high current income monthly.”

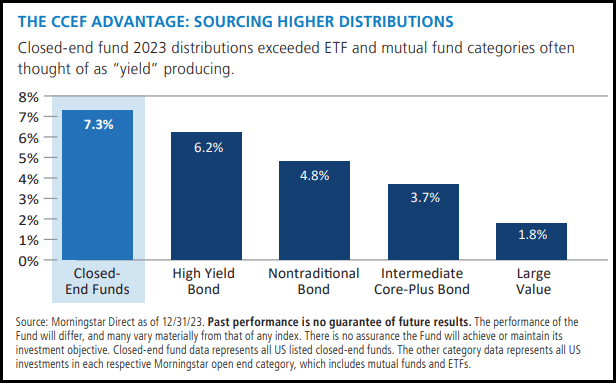

CEF Distribution Comparison (Calamos)

Income here is a bit of a stretch, as we know most CEFs, particularly those in the equity space, are going to derive a substantial amount of their payouts from potential capital gains. Alternatively, the return on capital may be a source of their hefty distributions as well.

Perhaps that’s me being too pedantic, but we are here for a review of this new ETF product. In my opinion, it’s worth highlighting these technicalities for potential investors.

One of the benefits of a fund-of-funds approach is that you get vast diversification immediately. In the case of a CEF, you can get massive discounts to net asset value per share on top of massive discounted underlying investments.

In the ETF wrapper, you lose out on that advantage, meaning premiums/discounts are not generally available due to the redemption/creation mechanism in ETFs. This process keeps the share price relatively close to the NAV at almost all times.

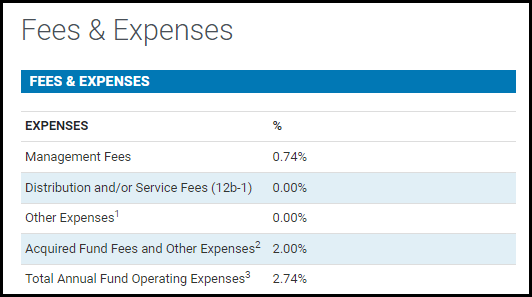

One of the biggest downsides that is notable is the fees-on-fees that you also get when you are a fund buying other funds. CCEF is not immune from this, as they currently look at a total annual fund operating expense of 2.74%. 2% alone of this is from the underlying CEFs, which are often leveraged and come with relatively higher expenses than ETFs.

CCEF Expenses (Calamos)

They don’t mention anything about applying leverage at the fund level, but most CEFs are leveraged. That means indirectly; they are going to be getting that added volatility and higher expenses that come with employing borrowings.

The management fee is also a bit hefty here in the ETF space, but it is an actively managed fund, which carries generally higher expense ratios. If the fund grows in a meaningful way in the future, this is something they could potentially reduce to become more competitive.

Expense Comparison

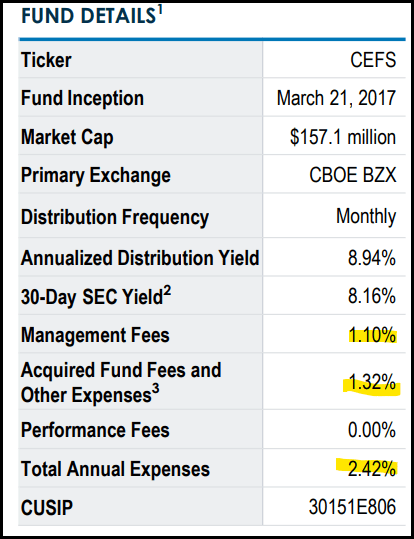

This isn’t too out of line with other competitors, though, either. In fact, CEFS carries a 1.1% management fee, but makes up for that in the acquired fund fees and other expenses side for a total annual expense ratio of 2.42%. Bearing in mind, CEFS is also running with around $157 million in AUM right now.

CEFS ETF Information (CEFS (highlight from author))

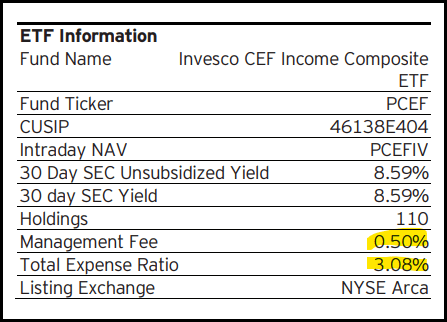

For PCEF, we actually have a higher total expense ratio listed at 3.08%. Interestingly, the management fee here is only 0.50%. That’s more competitive in terms of management fees. That said, they are also a passively managed fund. Both CCEF and CEFS take an active approach. PCEF has amassed an AUM of $739.62 million.

PCEF ETF Information (PCEF (highlights from author))

Any expense potential return that does not go to investors goes instead to the operating of the fund and to management.

Distribution

As we can see in the above information panels, both PCEF and CEFS offer an attractive distribution yield in the upper 8% range. As of writing this, I have not seen anything listed just yet for CCEF’s distribution. However, they do plan to pay a monthly distribution, with capital gains paid annually.

CCEF Distribution Schedule (Calamos)

CCEF’s Portfolio

Despite a fairly small amount of AUM so far, they went to work right away, providing plenty of diversification for the fund. As of February 7, 2024, they have holdings across 35 different closed-end funds.

| Holdings | Calamos CEF Income & Arbitrage ETF |

As of Date: 2024-02-07 |

|||

| Ticker | Security Description | CUSIP | Weight % | Shares | Market Value Base |

| THQ | ABRDN HEALTHCARE OPPORTUNITIES | 879105104 | 4.05 | 2,702.00 | 50,878.66 |

| PDT | JOHN HAN PREMIUM DIVIDEND FD | 41013T105 | 3.96 | 4,548.00 | 49,755.12 |

| BXSY | BEXIL INVESTMENT TRUST | 25538A204 | 3.92 | 4,066.00 | 49,279.92 |

| NFJ | VIRTUS DVD INTRST & PRM STR | 92840R101 | 3.91 | 4,006.00 | 49,113.56 |

| EMO | CLEARBRIDGE ENERGY MIDSTREAM | 18469P209 | 3.8 | 1,362.00 | 47,670.00 |

| RIV | RIVERNORTH OPPORTUNITIES | 76881Y109 | 3.63 | 3,860.00 | 45,548.00 |

| NMCO | NUVEEN MUNICIPAL CREDIT OPP | 670663103 | 3.53 | 4,340.00 | 44,268.00 |

| ASGI | ABRDN GLOBAL INFRASTRUCTURE | 00326W106 | 3.52 | 2,514.00 | 44,196.12 |

| NMZ | NUVEEN MUNI HI INC OPPORT | 670682103 | 3.49 | 4,372.00 | 43,763.72 |

| EVV | EATON VANCE LTD DURAT INC | 27828H105 | 3.41 | 4,324.00 | 42,850.84 |

| NTG | TORTOISE MIDSTREAM ENERGY | 89148B200 | 3.08 | 1,140.00 | 38,634.60 |

| BBN | BLACKROCK TAXABLE MUNICIPAL | 09248X100 | 3.05 | 2,266.00 | 38,340.72 |

| IGD | VOYA GLBL EQTY DVD & PRM OPP | 92912T100 | 3.02 | 7,464.00 | 37,917.12 |

| AOD | ABRDN TOTAL DYNAMIC DIVIDEND | 00326L100 | 3 | 4,684.00 | 37,612.52 |

| ASG | LIBERTY ALL-STAR GROWTH FD | 529900102 | 2.98 | 6,994.00 | 37,417.90 |

| PML | PIMCO MUNICIPAL INCOME FD II | 72200W106 | 2.97 | 4,340.00 | 37,324.00 |

| BME | BLACKROCK HEALTH SCIENCES | 09250W107 | 2.97 | 876 | 37,230.00 |

| HTD | JOHN HANCOCK T/A DVD INCOME | 41013V100 | 2.95 | 1,952.00 | 37,048.96 |

| ETW | EATON VANCE T/M GLBL BUY-WR | 27829C105 | 2.93 | 4,638.00 | 36,732.96 |

| KYN | KAYNE ANDERSON ENERGY INFRAS | 486606106 | 2.87 | 4,184.00 | 36,024.24 |

| IIF | MORGAN STANLEY INDIA INVEST | 61745C105 | 2.81 | 1,542.00 | 35,265.54 |

| RQI | COHEN & STEERS QUAL INC RLTY | 19247L106 | 2.79 | 2,984.00 | 35,091.84 |

| BDJ | BLACKROCK ENHANCED EQTY DVD | 09251A104 | 2.67 | 4,218.00 | 33,533.10 |

| EMF | TEMPLETON EMERGING MKTS FND | 880191101 | 2.51 | 2,752.00 | 31,565.44 |

| RSF | RIVERNORTH CAPITAL & INCOME | 76882B108 | 2.39 | 1,866.00 | 30,042.60 |

| PEO | ADAMS NATURAL RESOURCES FUND | 00548F105 | 2.28 | 1,398.00 | 28,686.96 |

| EOS | EATON VANCE ENH EQT INC II | 278277108 | 2.23 | 1,414.00 | 28,025.48 |

| USA | LIBERTY ALL STAR EQUITY FUND | 530158104 | 2.02 | 3,840.00 | 25,420.80 |

| RA | BROOKFIELD REAL ASSETS INCOM | 112830104 | 1.97 | 1,910.00 | 24,734.50 |

| BLE | BLACKROCK MUN INC TRUST II | 09249N101 | 1.97 | 2,306.00 | 24,697.26 |

| IGR | CBRE GLOBAL REAL ESTATE INCO | 12504G100 | 1.96 | 4,842.00 | 24,597.36 |

| BCX | BLACKROCK RESOURCES & COMMOD | 09257A108 | 1.95 | 2,898.00 | 24,546.06 |

| IGA | VOYA GLOBAL ADVANTAGE AND PR | 92912R104 | 1.86 | 2,710.00 | 23,333.10 |

| PTA | COHEN & STEERS TAX-ADVANTAGE | 19249X108 | 1.48 | 980 | 18,531.80 |

| NML | NEUBERGER BERMAN ENERGY INFR | 64129H104 | 1.34 | 2,634.00 | 16,883.94 |

| US DOLLAR | 0.57 | 7,100.91 | 7,100.91 | ||

| NET OTHER ASSETS | 0.15 | 0 | 1,908.43 | ||

Thirty-five holdings might be a relatively narrow portfolio for some funds or investors. Still, when you are looking at investing in 35 closed-end funds, you are getting exposure to hundreds or thousands of underlying investments. That includes fixed income, equities, and commodities exposure.

Several of these positions I own are also in my personal portfolio, so they have to be good… A couple of examples include abrdn Healthcare Opportunities Fund (THQ) and John Hancock Premium Dividend Fund (PDT), two of the fund’s largest holdings currently.

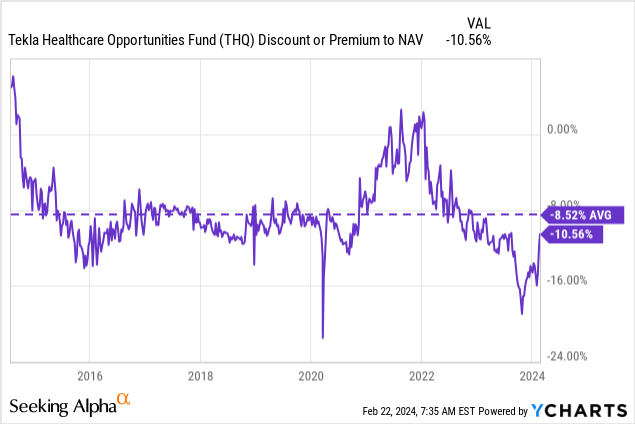

THQ is a leveraged healthcare-focused fund. They focus on a diversified healthcare approach and aren’t necessarily overweight to a particular subsector. The fund is also trading at a substantial discount on an absolute and relative basis. This is one of the reasons I found it quite appealing myself recently, though it is of some of the deepest discount levels that it touched a short while ago. More recently, THQ announced a massive distribution increase that saw the discount narrow materially. However, it is still trading at an attractive level.

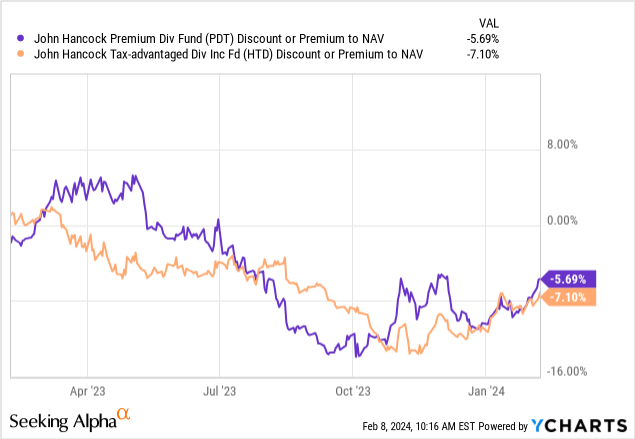

PDT is another fund that looks quite attractive, but its discount has been quite volatile. It was actually trading at a premium a year ago, but a distribution cut last year spurred investors to dump this name. That’s actually around when I went and scooped up some shares myself after the distribution cut. I had previously been holding its sister fund, which is invested similarly to the John Hancock Tax-Advantaged Dividend Income Fund (HTD). Coincidentally, HTD is also a position in CCEF as of the above listing.

Today, PDT’s discount isn’t necessarily the most attractive. So it is a bit surprising seeing it CCEF today. That said, it can still be a solid long-term performer, but perhaps it’s a hint that Calamos isn’t going to be too overly active.

YCharts

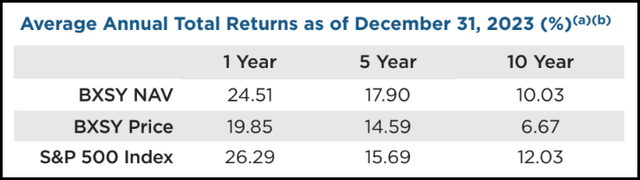

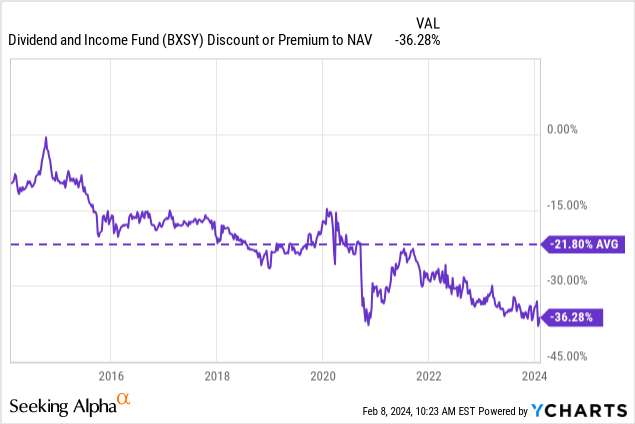

The third-largest holding is another interesting fund. The Bexil Investment Trust (OTCPK:BXSY) is a name we’ve covered, but it was formerly the Dividend and Income Fund (DNIF). They switched their name and ticker on January 2, 2024. During this switch, the fund did not change its investment policy or objective.

This fund trades over-the-counter and carries a massive discount. Trading OTC with seemingly no catalyst for the discount to contract currently means there might not be too much change in the short term. Still, the fund’s portfolio doesn’t seem particularly bad. It has at least delivered respectable historical annualized results on a total NAV return basis.

BXSY Annualized Performance (Bexil Investment)

Further, the discount is deep on both an absolute and relative basis. So, potentially, over the longer term, the Calamos management team for CCEF is finding these aspects appealing.

YCharts

We are approaching pandemic-wide discount levels for BXSY. For me, it just seems like it is hard to find where the floor is in terms of the discount. It just keeps trending wider and wider; presumably, at some point, the discount is just so absurd that it would be hard to ignore. The fund is overwhelmingly invested in level 1 securities with no private exposure, meaning the NAV here is going to be pretty much spot on. What the NAV says is what the fund should be able to raise if they sold it today.

Conclusion

CCEF is a new exchange-traded fund that invests in other closed-end funds. This is to generate substantial distribution yields for investors paid monthly and also allow for some potential capital appreciation. The capital appreciation could come through their “arbitrage” strategy in looking for CEFs trading at substantial discounts.

The Calamos CEF Income & Arbitrage ETF is incredibly small at this point, and Calamos is mostly known for its convertible niche. That could make it more difficult to grow AUM, but only time will tell whether it is successful or not.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here