Investment action

Based on my current outlook and analysis of Campbell Soup Company (NYSE:CPB), I recommend a sell rating. CPB is currently traversing a complex environment marked by poor quarter results, evolving consumer preferences, and strategic moves that present a blend of potential benefits and uncertainties. While select brands under CPB’s umbrella have demonstrated adaptability and growth, overarching market dynamics and macroeconomic challenges, notably inflation, pose significant concerns for the company’s future trajectory. The anticipated acquisition of Sovos Brands, although presenting potential growth avenues, is viewed with a degree of scepticism. Furthermore, when benchmarked against industry counterparts, CPB lags in key financial metrics, further underscoring the recommendation.

Basic Information

CPB is an iconic American producer of canned soups and related products. The company has over the years expanded its portfolio beyond soups to include a diverse range of food products, such as broths, sauces, snacks, and beverages. CPB’s is recognized globally for its red and white canned soup products, but its reach extends through various brands that cater to different consumer needs and preferences. The company’s commitment to quality, innovation, and consumer trust has solidified its position as a household name, not just in the U.S. but in several international markets. As CPB’s continues its journey, it strives to adapt to changing consumer tastes while maintaining its rich legacy and commitment to nourishing people’s lives.

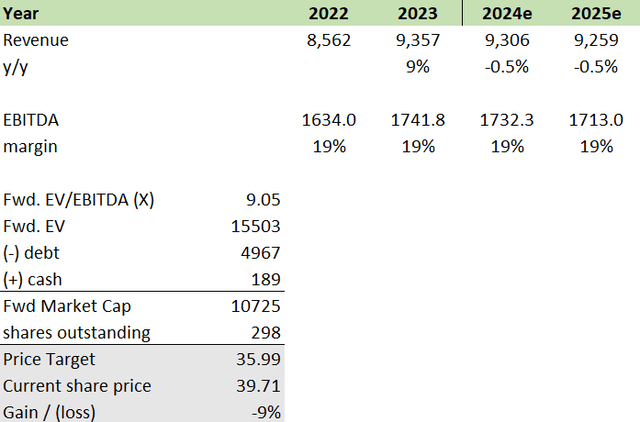

From 2019 to 2023, CPB has witnessed a concerning decline in its revenue growth rate. While it stood at 23% in 2019, it plummeted to 9% by 2023. Even more worrisome is the management’s projection for FY24, anticipating a growth rate between a decline of 0.5% and an increase of just 1.5%. This is particularly unsettling when considering that CPB’s revenue CAGR was 6%, and before the COVID-19 pandemic, it was in the double digits. As the effects of COVID wane, one would expect revenue growth to revert to pre-pandemic levels. However, CPB’s trajectory seems to be diverging, already veering into negative territory.

Review

Campbell Soup’s fourth quarter showcased a mixed bag of results. While there was a 4% decline in end-market consumption, brands like Prego, Pace, and Pacific exhibited impressive growth, registering increases of 5%, 7%, and 11%, respectively. The period also marked a 5% rise in organic net sales, reaching $2.1 billion. A standout performance came from the Snacks division, a pivotal segment for Campbell Soup, which recorded a 9% growth in organic net sales. It’s worth noting that this growth was influenced by the residual demand induced by COVID, which is now nearing its end. As the pandemic recedes and economies rebound, this impact is anticipated to wane.

Upon examining consumer behaviour, Campbell Soup pinpointed three critical elements shaping the market landscape. First, the lingering effects of COVID, which may not have been a focal point in the previous year’s fourth quarter, have left a mark on specific categories, notably those not typically favoured during the summer, such as soup. This influence correlates with the spikes observed at the close of fiscal 2022 and the onset of 2023, though they’re projected to wane. Second, there’s been a pronounced move towards value-centric, stretchable meals. This shift has bolstered sales in segments like pasta sauce and condensed cooking soups but has also strained the ready-to-eat soup category. Given the persistently high inflation, it’s anticipated that this value-driven behaviour will persist, further challenging the ready-to-eat soup segment. Collectively, these factors are generating multiple challenges for CPB.

Campbell Soup is strategically positioning itself for expansion by aiming to diversify into the ultra-distinctive sauces segment despite declining revenue due to inflation. The completion of the Sovos acquisition is projected for December 2023. Interestingly, this acquisition hasn’t been factored into their FY24 projections by the management. As highlighted, inflation is taking a toll on CPB’s revenue, and the boost from COVID-induced demand is fading. There are reservations about this acquisition, given that Sovos operates in a similar market space as CPB. It’s plausible to deduce that the challenges CPB currently grapples with might soon be Sovos’s challenges too. This scepticism is further fuelled by the management’s decision to exclude Sovos from their FY24 outlook. If the acquisition was truly a strategic move to bolster their position, wouldn’t it have been more reassuring to stakeholders if it was included in the FY24 forecast, rather than casting a shadow with a negative outlook? Regarding future projections, the management anticipates a reported net sales growth between a decrease of 0.5% and an increase of 1.5%, a stark contrast to the current year’s 9%. They also project organic net sales growth of 0% to 2% for the upcoming year, a decline from the current year’s impressive 10% growth.

Valuation

I anticipate that CPB will experience a negative growth rate over the next two fiscal years. This prediction aligns with the management’s guidance, as previously discussed. Additionally, with ongoing inflation and the Federal Reserve’s inclination to maintain the federal funds rate, consumers will likely have reduced disposable income. This prompts a shift towards more value-focused food categories and private brands, further pressuring CPB’s revenue. The company’s historical trend of declining revenue, combined with the waning boost from COVID-related demand, doesn’t bode well for its future. Moreover, the management doesn’t view the COVID-induced surge as a long-term benefit and doesn’t expect it to carry into 2024.

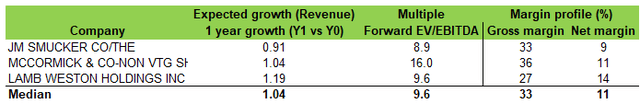

Author’s work

CPB is presently trading at 9.05x forward EV/EBITDA, while its peers have a median of 9.6x. Considering CPB’s gross margin of 31% falls short of the peer’s median of 33% and its net margin of 10% is below the peers’ 11%, coupled with a projected next 12-month revenue growth rate of 1% against the peer’s median of 4%, its current forward EV/EBITDA seems justified.

Based on my DCF, my target price for CPB is around $36, indicating a potential decline of 9%. Given the challenges CPB is grappling with, as outlined earlier, I recommend a sell rating for the stock. If the company’s performance deteriorates further than anticipated, I expect an even steeper drop in its share price. Additionally, the unpredictability surrounding the duration and trajectory of inflation adds another layer of uncertainty. Should inflation escalate, it could exert additional downward pressure on CPB.

Author’s work

Risk and final thoughts

A potential upside risk for CPB would be if inflation not only stabilizes but also drops below the Federal Reserve’s target rate of 2%. In such a case, the Fed might consider lowering interest rates to ward off deflation. This move would likely increase disposable income, giving consumers more purchasing power. With enhanced spending capacity, consumers might pivot away from value-focused products, opting instead for higher-quality food items. This shift could provide a boost to CPB’s revenue and keep it on track to reach its pre-COVID levels.

In conclusion, CPB’s recent performance presents a complex picture. While certain brands have shown resilience and growth, overall market consumption and revenue trends raise concerns. The company’s strategic decision to acquire Sovos Brands, despite its potential synergies, is met with scepticism, especially given the exclusion of this acquisition from their FY24 outlook. The prevailing economic environment, marked by persistent inflation and the fading boost from COVID-induced demand, further complicates the outlook for CPB. The company’s current valuation, when compared with its peers and considering its financial metrics, appears reasonable. However, my DCF analysis suggests a downside for the stock. Given the myriad challenges and uncertainties, including those posed by inflation, I recommend a sell position for CPB.

Read the full article here