Co-authored with “Hidden Opportunities.”

In his 80+ year investing career, the financial services industry has been Warren Buffett’s favorite. Through depressions, recessions, and wars, Mr. Buffett has extracted deals on sweet terms with leading banking and insurance firms, including American Express (AXP), Bank of America (BAC), and Goldman Sachs (GS). Despite the negative outlook and sentiment of the broader market, The Oracle of Omaha built massive positions in the then-struggling firms and held on patiently while collecting big dividends.

“Banks are a great place to put money when they are well-managed, have a strong competitive position, and are available at the right price.” – Warren Buffett.

Let us look at Mr. Buffett’s AXP purchase in 1963, which is highly regarded as one of his best investments ever. The company was supposed to have $150 million in vegetable oil as collateral, but the actual value was under $6 million due to falsifying inventories. After this became public, AXP stock dropped by more than 50%, and while Mr. Market was busy panicking, Warren Buffett saw profitability, value, and opportunity. He swooped in and bought 5% of the bank for $20 million. He didn’t catch the absolute bottom, but still collected growing dividends for the next few years. By 1973, his investment had become a ten-bagger.

And who says Warren Buffett doesn’t use leverage in his investing strategy? Berkshire Hathaway (BRK.A, BRK.B) is the biggest North American insurance company, and Mr. Buffett has been a long-term admirer and beneficiary of the insurance business, as it provided cheap leverage that he could use to boost his returns.

“I’ve been in love with the insurance business ever since I was a teenager. It’s a fascinating industry that allows us to turn float into a real source of financial strength.” – Warren Buffett.

We will now discuss two picks from Mr. Buffett’s favorite industry that fit our income needs nicely.

Pick #1: BTO – Yield 10.2%

The banking sector experienced another pronounced sell-off recently, and the Federal Reserve’s expressed monetary stance did not help. In light of the regional bank failures earlier this year, banks are facing increasing regulatory pressure, creating the need for higher capital requirements.

“The investor psychology on banks is about as poor as one could possibly imagine it. But this isn’t the first set of challenges the sector has faced, and each time, banks typically figure out how to realign their businesses to remain profitable – and enticing – for investors.” – Chris Kotowski, Analyst, Oppenheimer.

Notably, insiders at First Citizens Bancshares, Summit Financial Group, Commerce Bancshares, Berkshire Hills Bancorp, and Bank of South Carolina had recently bought up stock on the open market. In Q2, we saw significant insider buying in US Bancorp, East West Bancorp, and Zions Bancorp.

In general, bank insiders would have a good sense of the liquidity, deposit base, and operating fundamentals, and it’s unlikely for leaders across multiple institutions to make significant purchases if things were falling apart behind the scenes. Several companies in this critical sector operate conservatively and have minimized risky investments. In recent weeks, we discussed several banking common and preferred stocks, explaining how these firms are well-capitalized, maintain adequate liquidity levels, and grow their deposit base while maintaining healthy spreads between collected and paid interest.

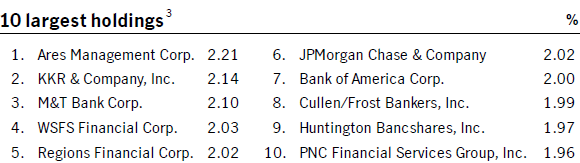

John Hancock Financial Opportunities Fund (BTO) is a closed-end fund (“CEF”) with diversified assets across 164 holdings. About 93% of the fund is built with banking and capital market companies. Notably, the fund’s top holdings are leading alternate asset managers or banking institutions with highly conservative lending and banking strategies. Source.

Investor Fact Sheet Investor Fact Sheet

BTO has been around for about 30 years and has an excellent track record of solid performance and NAV (Net Asset Value) growth over the long term. The CEF is known for its active portfolio management, taking advantage of mismatched pricing and discounts in the financial services sector. Such a strategy proves very lucrative when there are deep bargains all over the industry.

BTO pays a quarterly distribution of $0.65/share. This calculates to a healthy 10.5% annual yield. In the three quarters for FY 2023, BTO’s distributions have been 17% NII (Net Investment Income), 41% ROC (Return of Capital), and 42% capital gains, making it quite efficient from a taxation standpoint.

Author’s Calculations

At the end of Q2, BTO reported $105 million in unrealized gains, which can cover the current annual distribution for ~2 years. BTO currently presents an excellent way to invest in the heavily sold-off yet critical banking sector while drawing large income from your invested capital.

Pick #2: ATH Preferreds – Up to 8% Yields

Athene Holding Ltd. is a leading retirement services company and a wholly-owned subsidiary of Apollo Global Management, Inc. (APO). The firm maintains a separate capital structure from APO and issues senior debt and preferred stock on its own merits. As of June 2023, Athene managed $257 billion in gross invested assets, more than double since 2018, demonstrating a solid 21% CAGR. Source.

Fixed Income Investor Presentation

During FY 2022, Athene stood out as one of the largest annuity sellers in the United States, achieving the #1 position in fixed annuity and fixed-index annuity sales. Source.

LIMRA

Athene ended Q2 with a debt-to-capital ratio of 14.4%, well below the peer average, and $78 billion in available liquidity. With capital well above regulatory requirements, the company’s balance sheet was rated A+ by leading credit agencies. The company is taking advantage of elevated interest rates by maintaining a low-risk investment portfolio. 94% of Athene’s investment portfolio is in cash or fixed-income, invested across mostly investment-grade securities.

During 1H 2023, Athene spent $247 million on interest expenses and $92 million on preferred dividends. After these expenses, the company generated $1.1 billion in net income, indicating adequate profitability to keep preferred investors happy.

Athene preferreds pay qualified dividends and are attractively discounted at this time.

-

6.35% Fixed-to-Float, Non-Cumulative, Series A Redeemable Perpetual Preferred (ATH.PR.A)

-

5.625% Fixed Rate, Non-Cumulative, Series B Redeemable Perpetual Preferred (ATH.PR.B)

-

6.375% Non-Cumulative Rate Reset, Series C Redeemable Perpetual Preferred (ATH.PR.C)

-

4.875% Fixed Rate, Non-Cumulative, Series D Redeemable Perpetual Preferred (ATH.PR.D)

-

7.75% Non-Cumulative, Rate Reset, Series E Redeemable Perpetual Preferred (ATH.PR.E).

Each Athene preferred offers unique benefits to shareholders. Some offer a high current yield that you can lock into, while others offer slightly lower yields but come at steep discounts to par value. A few offer a hybrid of attractive current income and upside potential.

Fixed-rate preferreds ATH-B and ATH-D present excellent income opportunities at this time.

- ATH-B offers a 44% YTC (Yield-To-Call) if it were to be called next year. This security provides a 7.8% yield and 34% upside to par.

- ATH-D is further discounted due to its low base coupon. It provides a fixed-rate yield of 7.9% and offers 62% upside to par.

- ATH-A lets you lock a high 7.8% yield up to June 2029. After this date, if uncalled, the security floats to 3-month LIBOR + 4.253%.

With large qualified dividends, these significantly discounted Athene preferreds make excellent investments amidst rate uncertainties and recession fears.

Conclusion

Warren Buffett doesn’t buy his picks and count on immediate price upside. In fact, several of his purchases have seen substantial drawdowns since the initiation, but the iconic investor continued to load up. Most of Berkshire’s more prominent positions pay healthy (and often growing) dividends, which he has collected for decades.

We replicate his principles in ways that cater to our requirements. Our Investing Group buys businesses at favorable prices, intending to collect dividends for our retirement needs. We don’t fear when they experience further price drops, as we use it as an opportunity to grow our position. As income investors, we always have cash coming in to redeploy into the markets.

Higher rates have weighted down dividend stocks, but we do not intend to sell because our income stream is stronger than ever and well-positioned to tackle what Mr. Market throws at us tomorrow. We are in a buyer’s market, and I am shopping for income. You can do the same, and here are two excellent dividends with up to 10% yields for a merry and energetic retirement.

Read the full article here