Money raining down on a young person.

Anybody who is even remotely acquainted with financial markets knows that in the short run, they are often wildly wrong about individual stocks. Sometimes, a stock is massively overvalued. Other times, a stock is dirt cheap.

The Chairman and CEO of Berkshire Hathaway (BRK.A)(BRK.B) and the world’s greatest investor, Warren Buffett, has shared plenty of valuable investing nuggets over the years. The one that stands out to me above all of the rest is as follows:

Be fearful when others are greedy and greedy when others are fearful. The Oracle of Omaha, Warren Buffett

In investing, what hurts people the most is their human emotions. It’s what causes even the most brilliant people to make the dumbest mistakes. Investing in its purest form focuses entirely on facts (e.g., fundamentals and valuation) and supports those facts with reasoning.

Upon assessing the fundamentals of Bristol-Myers Squibb (NYSE:BMY), I have concluded that the stock is a convincing buy right now. Revenue concentration and eventual patent expirations have put the stock on a bumpy road to nowhere, up just 13% in the past five years (not counting dividends). But after years of underperforming the markets, the pain of past investors could be your gain if you buy at the current valuation. Here’s why.

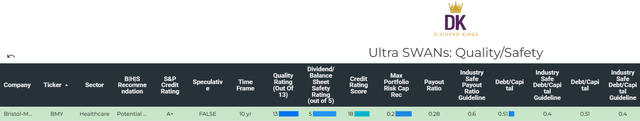

DK Research Terminal

Bristol-Myers’ 4% dividend yield is much greater than the 1.6% yield of the S&P 500. This decent starting yield also doesn’t come with the sacrifice of dividend safety. That is because Bristol-Myers’ EPS payout ratio is just 28%, which is less than half of the 60% that rating agencies like to see from its industry.

DK Research Terminal

The company also has a reasonably healthy balance sheet, boasting an A+ credit rating. This puts the company at just a 0.6% risk of going bankrupt over the next 30 years, making it a good pick for capital preservation.

Compared to its fair value of $88 a share, Bristol-Myers is obscenely undervalued at the current $57 share price. The stock is priced 35% below its fair value of $88 and could have a 54% capital appreciation from the current share price when it returns to fair value. Thus, Bristol-Myers could be a coiled spring waiting to soar.

- 4% yield + 2.4% FactSet Research annual earnings growth consensus + 4.4% annual valuation multiple expansion = 10.8% annual total return potential > 10% annual total return prospects of S&P 500

Bristol-Myers Can Navigate Looming Headwinds

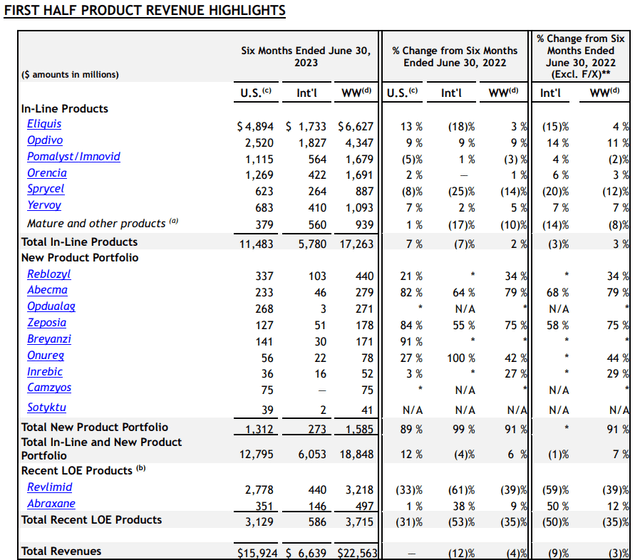

Bristol-Myers Q2 2023 Earnings Press Release

Bristol-Myers is a pharmaceutical with an exceptionally deep product portfolio. At first glance, this may seem to be a contradictory statement. After all, the blood thinner co-owned with Pfizer (PFE) named Eliquis and the cancer drugs Opdivo and Revlimid contributed to $14.2 billion or 62.9% of revenue during the first half of 2023. This is especially important to note with the former two likely to face competition in the next five- to 10 years and the latter already being pressured.

Significant competition to Revlimid from generics led its revenue to plunge 39% year-over-year in the first half to $3.2 billion. Growth from the company’s other two mega-blockbusters and newer products wasn’t quite enough to offset Revlimid’s topline decline. That is why Bristol-Myers’ total revenue fell 4% over the year-ago period to $22.6 billion for the first half. Adjusting for unfavorable foreign currency translation, the topline shrank by 3%.

Bristol-Myers’ non-GAAP diluted EPS decreased by 2.3% year-over-year to $3.80 during the first half. A lower share count wasn’t enough to offset the reduced revenue base and slightly diminished profitability.

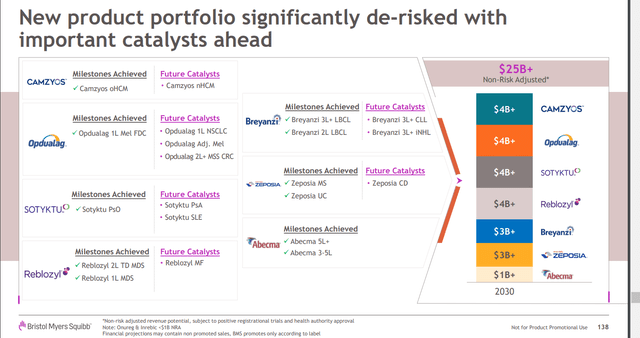

Bristol-Myers 2023 R&D Day Investor Presentation

Despite these seemingly uninspiring financial results, the company’s products launched within the last few years provide reasons to be hopeful. Based on the exceptional efficacy profiles, large addressable markets, and strong growth rates of its newer drugs, Bristol-Myers expects these nine drugs to generate over $25 billion in non-risk adjusted annual revenue by 2030. For context, revenue from the company’s three top-selling drugs could completely dry up and this would be enough to at least grow the revenue base a bit.

Aside from its promising new drugs and the 45+ compounds it currently has in development, Bristol-Myers can also grow through strategic acquisitions. The company recently announced that it would be acquiring Mirati Therapeutics in a $5.8 billion deal to strengthen its oncology portfolio. While Edmund Ingham notes this acquisition won’t provide immediate results for Bristol-Myers, it could pay major dividends for the company based on its potential. That’s only possible because of Bristol-Myers’ A+ credit rating from S&P, which allowed this acquisition to happen.

Considering all these factors, FactSet Research anticipates that the company’s earnings will grow by 2.4% annually in the long term. That is inclusive of the inevitable lumpiness that will occur when Bristol-Myers’ other two top-selling drugs face patent cliffs.

Slow And Steady Dividend Growth Can Be Maintained

Bristol-Myers has delivered 7.4% annual dividend growth to shareholders in the past five years (calculation sourced from data on Bristol-Myers’ dividend page). I wouldn’t expect this type of growth to continue moving forward, but with a higher starting yield, moderated growth would still be attractive.

Fortunately, Bristol-Myers should have the ability to deliver mid- single-digit annual dividend growth for the foreseeable future. This is because the company’s dividend is also comfortably covered by free cash flow. Bristol-Myers posted $4.3 billion in FCF through the first half of 2023. Against the $2.4 billion in dividends paid during that time, this equates to a 55.4% FCF payout ratio (details per page 5 of 57 of Bristol-Myers’ 10-Q filing).

Risks To Consider

Bristol-Myers is a great business. It still stands to reason, however, that the company has its share of risks.

Bristol-Myers’ adjusted profit margins are over 30% for one. This is a double-edged sword for shareholders. On one hand, this is what funds the generous dividend, share repurchases, and acquisitions. On the other hand, it also draws negative attention from regulators. This could result in increasing price pressure on its products, which could weigh on profit margins.

If Bristol-Myers overestimated the sales potential of its new products, its growth prospects could be somewhat reduced. The good news is that the market has expectations that are so low, that the company has a manageable bar to clear.

Summary: Bristol-Myers Is Undeniably Cheap

Zen Research Terminal

As demonstrated by its product portfolio, pipeline, and balance sheet, Bristol-Myers is an all-around wonderful company. That’s precisely why it earns a 13/13 ultra SWAN quality rating, which makes it a lower-risk investment overall relative to other stocks.

The current valuation also has Bristol-Myers trading 35% under its fair value estimate. Due to such a steep discount, the stock’s 12-month total return potential could be 60% if the market were to suddenly come to its senses and restore it to fair value.

In a more likely scenario where Mr. Market warms up to Bristol-Myers over time, the total return outlook is equally as encouraging. The stock has a 10.8% annual total return potential for the next 10 years. That’s enough to deliver 179% cumulative total returns to shareholders, which is more than the roughly 160% total returns expected from the S&P 500 index during that time. Since I believe Bristol-Myers is a higher quality business than the S&P 500 index, the risk/reward ratio is much better than the S&P 500. That is why I rate shares of Bristol-Myers a strong buy.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here