Overview

I’ve found great success with a hybrid portfolio that has a blend between income focused asset classes such as business development companies, alongside traditional dividend growth stocks. Through my experience, I noticed that I naturally tend to favor the internally managed BDCs because it always feels like a lot more of the excess earnings gets passed along to shareholders. However, there are some externally managed BDCs that I have incorporated as a part of my portfolio. The Blackstone Secured Lending Fund (NYSE:BXSL) is one of those externally managed BDCs that I make an exception for because of its diversity, performance, and underwriting strategy.

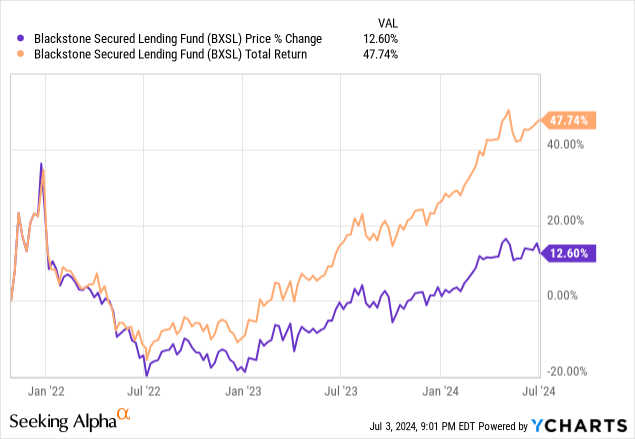

For context, BXSL operates as a business development company that generates earnings through its portfolio of debt investments. The BDC focuses on investing in primarily first lien senior secured debt of US-based companies. BXSL is externally managed by Blackstone Credit BDC Advisors. BXSL has a market cap of about $6B and a recent inception dating back to 2021. We can see that the price of BXSL has moved up over 12% since inception, but the total return is much larger and sits at approximately 48%. This total return has been supported by the large distribution yield of 9.9%. This large yield makes BXSL an attractive choice for investors looking to add some splashes of income to their portfolio.

Since the public trading history for BXSL is so limited, we do not have a large set of historical data to base a valuation on. However, I do believe that the portfolio growth and strategies implemented make for a good recipe for continued growth. The fund currently trades at a premium to its net asset value, but this is something that we see quite frequently with higher quality BDCs. Therefore, I believe BXSL to remain a buy at these levels want to start buying a bull case by first reviewing this business development company’s portfolio exposure and focus on making high quality investments.

Interest Rates & Strategy

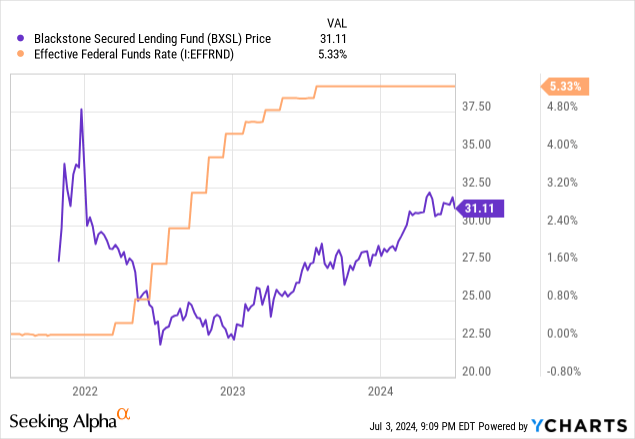

One of the primary focuses of BXSL’s portfolio is to maintain exposure to debt investments that operate on a floating rate basis. BXSL’s portfolio is comprised of about 98.8% of floating rate debt. This means that BXSL has the ability to better capitalize on the current higher interest rate environment that we sit in. As interest rates currently sit at their decade high, BXSL is able to collect higher levels of income through higher interest payments required on the debt investments in their portfolio.

Although the history here is short, we can see that BXSL’s price did initially react negatively to the rise of interest rates starting in 2022. However, we can see that the price started to stabilize and grow after a few quarters as the fund management started to adapt to the current macro environment. The Fed has decided to leave rates unchanged as of their latest meeting and await more economic data to roll in around inflation and the labor market. This means that we can probably expect another quarter or two of higher interest rates and potentially higher earnings for BXSL.

The same concept will likely play out in the opposite direction; if interest rates start to get cut, there’s a good chance that net investment income would come down, and we’ll see lower earnings from BXSL as the rates on their debt is also lower. However, I do believe that this can be offset by a higher volume of potential borrowers looking to get their hands on some capital as the environment becomes more attractive and affordable. While it’s too early to confidently say that this is how it’ll play out, I do think it’s a very likely scenario because of how much more attractive the borrowing environment will be. As the unemployment rate creeps up to the 4% mark and inflation continues to slowly tick downward, we may be approaching more ideal circumstances to induce an interest rate cut.

Not to mention, BXSL has really only operated in an environment of rising interest rates. If management was able to thrive and adapt in an environment that doesn’t incentivize high levels of borrowing, I believe they will have more wiggle room for efficient growth in an environment that better caters to borrowers. Even in an environment where interest rates are lower and NII is lower, this can be efficiently offset by a higher volume of growth and new investment commitments.

Portfolio & Risk Profile

A part of BXSL’s portfolio is to maintain a majority exposure to first lien senior secured investments. About 98.5% of their investments are on a first lien senior secured basis. This helps mitigate the risk that all invested capital is lost when a company’s performance doesn’t meet initial expectations. This is because senior secured debt sits at the top of the corporate capital structure, which means that this form of debt has the utmost highest priority for repayment. In situations where a portfolio company may be going through a bankruptcy and liquidating assets, this structure helps ensure that BXSL doesn’t lose 100% of their investment and can recoup some of their invested principal.

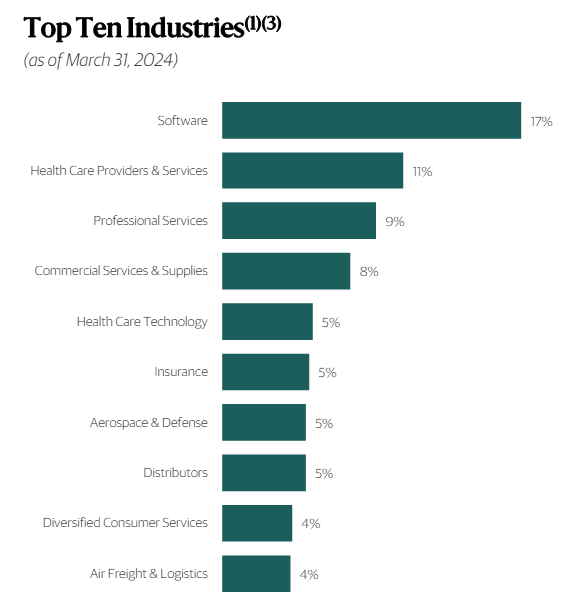

Additionally, their investments span across 210 different portfolio companies that sit at a fair value of about $10.4B. The diversity is spread across many different industries, but there is a majority focus on the software industry, which accounts for 17% of their overall portfolio. This is followed by exposure to health care providers and services, which account for 11%. This diversity helps mitigate any sort of concentration risk and limits vulnerability to sector-specific volatility.

BXSL Q1 Presentation

They’ve done a great job at assessing what investments to make, and this is reinforced by the average loan to value ratio of rate of 47.8%. This ratio compares the size of loan to the underlying asset or borrower. Therefore, A lower loan to value rate indicates a lower level of risk versus a higher loan to value rate.

Their strategy has been successful so far if you consider that the non-accrual rate remains extremely low. This metric alone reassures me of BXSL’s quality and efficiency with underwriting. If anything, I believe that operating and having to find profitable deals in this higher interest rate environment while still maintaining low accruals helps contribute to BXSL’s overall experience and knowledge.

Non-accruals are a crucial metric to be aware of for BDCs because it indicates the rate of portfolio companies within that are significantly underperforming and can no longer maintain the payments required on the debt owed. As a result, companies that are put in non-accrual status are no longer contributing to BXSL’s earnings potential. Non-accruals as of the last quarter sits at 0.1% at cost, which is extremely healthy. For reference, here are some of the non-accruals of peer BDCs.

- Oaktree Specialty Lending (OCSL): 4.3% non-accrual rate at cost.

- FS KKR Capital (FSK): 6.5% non-accrual rate at cost.

- Ares Capital (ARCC): 1.7% non-accrual rate at cost.

Financials

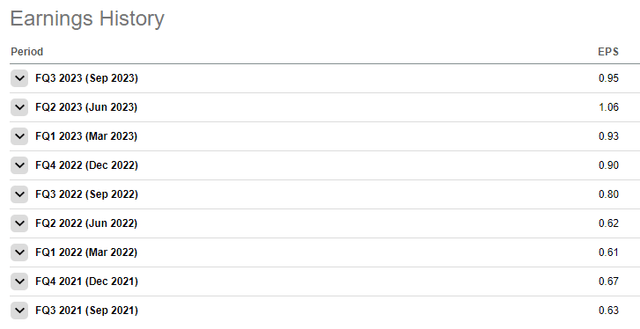

As of their latest quarterly earnings, net investment income landed at $0.96 per share and beat expectations by $0.02. As previously mentioned, we can see how the higher interest rates have had an effect on the earnings power here, and it tells a story when looking at the history. For instance, NII per share during Q3 of 2021 came in at $0.63. For context, interest rates remained near zero levels at that point in 2021 as a way to stimulate the economy during the pandemic era.

Seeking Alpha

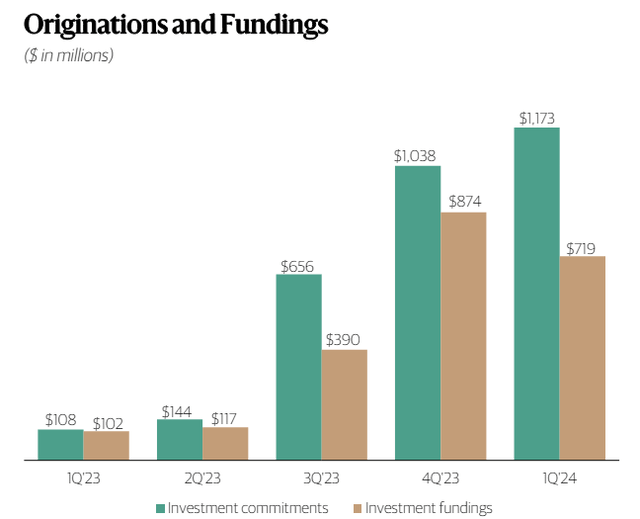

BXSL has really been able to capitalize on these higher rates by not only growing NII per share, but also growing their total portfolio value through increases in net assets and a growing amount of originations and funding. Originations continued to grow quarter over quarter, with investment commitments now totaling $1.1B as of the latest quarter.

This is more than a 10x increase from Q1 of the prior year, which totaled only $108M. This level of growth will likely continue to help grow their overall portfolio value, while simultaneously providing the opportunity to expand reach in underserved industries.

Similarly, I am impressed with the level of investment funding that BXSL has maintained, which now sits at $719M. This helps ensure that BXSL continues to have the access to new investments as it maintains a level of liquidity that helps the BDC navigate any unexpected headwinds.

BXSL Q1 Presentation

Management has committed about $532M in funded investment activity for the quarter. This includes investments in 18 new portfolio companies that have a weighted average yield of 11.4%. Additionally, the new investment commitments have an average position size of $35M. Lastly, BXSL’s liquidity remains quite solid with $148M in available cash and equivalents, which is accompanied by $1.3B in undrawn borrowing capacity.

Dividend Coverage

As of the latest declared quarterly dividend of $0.77 per share, the current dividend yield sits at 9.9%. Although the dividend yield is already nearing that double-digit rate, BXSL does have a history of raising their dividend rate. When the fund went public, the quarterly dividend rate was $0.53 per share. This is supported by the growing NII that we’ve seen. As previously mentioned, NII per share for the quarter landed at $0.96. Since the distribution is typically covered by NII, this means that net investment income covers the distribution at a rate by 124.68%.

This sort of coverage leaves me very confident that the distribution remains well-supported and there is very little threat of a dividend cut. Even if interest rates come down and NII comes in a bit lower, I believe that the strong growth and underwriting abilities of the fund can offset any hits to earnings with new investments. As mentioned, originations and funding has consistently grown during a time where the environment is a bit challenging and discourages growth. Therefore, in the opposite environment where interest rates are falling, I believe that BXSL will be able to offset any weaknesses through added growth and additional originations.

Therefore, BXSL may be a great choice for the investor that is looking for exposure to the BDC sector and wishes to have a ‘set it and forget it’ investing experience. The distribution coverage is very healthy and if NII continues to grow despite the interest rate environment, we could see future distribution increases or supplementals when performance is strong.

Valuation

Since BXSL operates as a business development company, the price can trade at a different level than the value of the underlying assets within the fund. Since the price history is very limited, we don’t have much price to NAV (net asset value) data to reference here. However, the price currently trades at a premium to NAV of about 19.3%. For reference, BXSL traded at an approximate discount to NAV of about 11% at the very beginning of the year in January. The continued growth of the NAV per share and NII has contributed to BXSL’s upside and shrinkage of this discount.

CEF Data

Trading at a premium to NAV doesn’t necessarily mean that a BDC is overvalued, however. There are plenty of high quality BDCs that have frequently traded at a very high premium to NAV due to their consistent performance and high quality management or portfolio. Here are some of the BDCs that I favor and have consistently traded at a high premium to NAV frequently.

- Hercules Capital (HTGC): Average 3-year premium to NAV of 44.5%.

- Capital Southwest (CSWC): Average 3-year premium to NAV of 35%.

- Main Street Capital (MAIN): Average 3-year premium to NAV of 57.2%.

Wall St. seems to agree with my consensus that there is an upside potential. The average price target currently sits at $32.38 per share. This represents a potential upside of about 4% from the current level. While I cannot provide a specific price target, I do believe that as the portfolio grows, we will see appreciation in share price as the NAV grows due to new investments.

Takeaway

In conclusion, BXSL stands as a high quality business development company that has a very strategic approach to its debt investments that maintains a specific risk profile and structure to mitigate risk. The dividend yield of 9.9% remains well supported by the net investment income and eliminates any worries of potential cuts happening. Even if interest rates start to get cut, I believe that BXSL should be able to offset any hits in NII through their increased investment activity and growing originations and funding profile. Despite the price trading at a premium to NAV, I believe this premium it justified by the fund’s performance and may grow. Therefore, I am rating BXSL as a buy.

Read the full article here