A few days ago, we discussed the BlackRock Resources & Commodities Strategy Trust (BCX), which is a closed-end fund that invests in a combination of energy stocks, mining stocks, and other stocks that are poised to benefit from rising commodity prices. While it does pretty well at its stated task, it is probably not the best fund for investors seeking profits today due to the fundamentals of most commodities being somewhat poor. The exception to this, of course, is energy, which has seen a very impressive performance over the past two or three months and appears to be quite likely to continue to deliver strong performance going forward. Fortunately, BlackRock has another closed-end fund that is designed specifically for those investors who want to invest in companies that will benefit from rising oil and gas prices. This fund is the BlackRock Energy & Resources Trust (NYSE:BGR), which will be the topic of this article.

We last discussed this fund in our service back in September. The fund’s share price is down slightly since that time, as its share price declined from $13.14 to $12.95 per share. However, the distribution received offsets about half of that decline. The fund’s performance over a longer period of time has been much more promising. We last discussed this fund on the public site on May 22, 2023. Since that time, the fund has significantly beaten the S&P 500 Index (SP500):

Seeking Alpha

This is partly due to the change in market conditions since that time. During the first half of this year, the headline inflation rate was falling rapidly and many market participants (and politicians) were inclined to call the Federal Reserve’s fight against inflation a “victory.” As such, there was a great deal of optimism that interest rates would eventually be reduced, and we would get back to the bubble market environment in no time. However, as I pointed out, that improvement in inflation was almost entirely caused by the Federal Government flooding the economy with crude oil from the Strategic Petroleum Reserve. Now that the Reserve is in tank-bottom condition, that is no longer an option. In the absence of this extra oil, the balance between supply and demand for crude oil is extremely tight and energy prices have been trending up since July. That reversed the optimism about the progress that has been made against inflation, causing the S&P 500 Index to start declining as it now looks likely that high rates will be with us for a very long time. As energy prices have been slowly trending upward, this fund has outperformed the broader market index.

As we will discuss in this article, the fundamentals for energy prices continue to remain strong, which should benefit this fund over the next few years. As such, it may be a good idea to obtain some energy sector exposure in your portfolio, and this fund offers an easy way to do it.

About The Fund

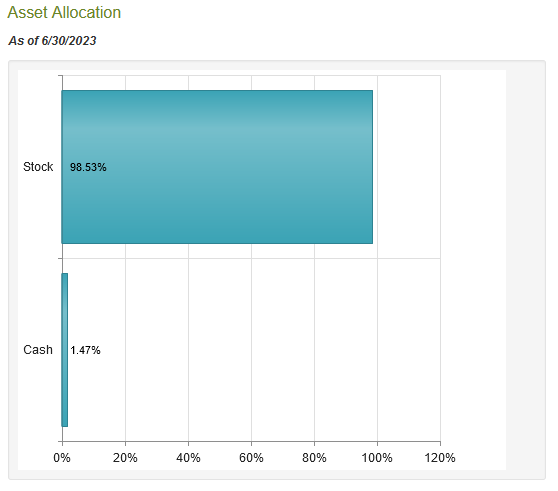

According to the fund’s website, the BlackRock Energy & Resources Trust has the primary objective of providing its investors with a high level of total return. This objective makes a great deal of sense considering that the fund invests primarily in common equities. As we can see here, fully 98.53% of the fund’s total assets are invested in common stocks. Its only other asset is a rather small cash position:

CEF Connect

This is in line with the website’s description of the fund’s objectives and strategy:

BlackRock Energy & Resources Trust’s investment objective is to provide total return through a combination of current income, current gains and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of energy and natural resources companies and equity derivatives with exposure to the energy and natural resources industry. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust utilizes an option writing (selling) strategy to enhance dividend yield.

As I have explained in numerous previous articles, total return makes sense as a primary objective for any fund that invests primarily in equity securities. After all, common stocks are by their very nature total return vehicles. This is why investors purchase them with the intention of receiving an income from the dividends that they pay out as well as benefiting from the capital gains that should accompany the growth and prosperity of the issuing company. This differs from a fixed-income fund, which will generally have limited capital gains potential and deliver most of its total return in the form of direct payments to the investors.

The energy industry as a whole is well known for paying out much higher yields than other sectors. After all, as of the time of writing, the Alerian MLP Index (AMLP) yields 6.91%, which is actually one of the lowest yields that this index has had in many years. The iShares U.S. Energy ETF (IYE) currently yields 2.91% and the iShares Global Energy ETF (IXC) yields 4.39% as of the time of writing. Admittedly, all of these yields are less than we have seen for quite some time, but they are still better than most other sectors. For example, the iShares U.S. Healthcare ETF (IYH) only yields 1.21% and the iShares U.S. Technology ETF (IYW) yields 0.37% at the current price. Thus, dividend income is likely to make up a greater proportion of the total returns for an energy fund like this one than it would for a fund that invests in a different sector.

There is a very big reason for this. The energy sector in general came under a lot of fire from investors for the subpar returns that it delivered over the decade prior to the coronavirus pandemic. From January 1, 2010, until January 1, 2020, the iShares U.S. Energy ETF underperformed the S&P 500 Index by a lot:

Seeking Alpha

This is despite the massive increase in production that U.S. shale producers delivered over the period. We can see that the big problem is that the energy sector in general never recovered from the crash in 2015 when Saudi Arabia was attempting to destroy the shale industry. This is partly due to the fact that energy prices never really recovered from that incident. This chart shows the spot price of West Texas Intermediate crude oil over that period:

Barchart.com

Investors were naturally upset by this poor performance compared to everything else, so the energy industry came up with a solution. Basically, many companies decided to simply pay out the majority of their free cash flows to the investors as share buybacks and dividends. They generally eschewed investing in production growth, even when energy prices skyrocketed in 2021 and 2022. This did result in some of these companies having dividend yields in excess of 10% though, so investors in these companies did fine over the years since the pandemic, even as every other sector was crashing in 2022.

Unfortunately, the BlackRock Energy & Resources Trust’s largest positions are not in those companies that sported abnormally high dividend yields during 2022’s energy price boom. Here are the largest positions in the fund:

BlackRock

Here are the dividend yields for each of these companies:

|

Company |

Dividend Yield |

|

Exxon Mobil Corp. (XOM) |

3.31% |

|

Shell plc (SHEL) |

3.43% |

|

TotalEnergies SE (TTE) |

4.62% |

|

ConocoPhillips (COP) |

1.63% |

|

BP p.l.c. (BP) |

4.36% |

|

Chevron Corp. (CVX) |

3.68% |

|

Canadian Natural Resources (CNQ) |

3.93% |

|

EOG Resources (EOG) |

2.47% |

|

Cheniere Energy (LNG) |

0.89% |

|

Schlumberger (SLB) |

1.70% |

Admittedly, none of these companies have the jaw-dropping yields that we occasionally see in U.S. shale plays or midstream companies, but TotalEnergies and BP are not really too bad in terms of yield. All of them boast significantly higher yields than we see in many other sectors, however. For example, all of these companies except for Cheniere Energy have a higher yield than the S&P 500 Index. By themselves though, none of these companies has a high enough yield to justify investing in the fund in the absence of capital gains. After all, if the yield was all we got, we would be better off just sitting in a 5%-yielding money market fund.

Fortunately, all of these companies are positioned to see their net incomes and cash flow surge over the coming years. One of the big reasons for this can be found in the discussion that we just had about the poor performance of the energy sector since the oil price crash in 2014.

As a result of that price crash, energy companies around the world tightened their belts considerably. Long-time readers may recall that I published a few articles around that time specifically pointing out that cuts to exploration and development activities would hinder growth prospects across the industry. That proved to be correct, and unfortunately, prices never recovered enough for investment to return to its previous levels. As a result, we now have a situation where the industry has underinvested in production capacity for almost a decade. However, the global demand for crude oil has not declined. The pandemic did result in a temporary blip, but total global oil consumption has been steadily increasing:

Statista

This is expected to increase going forward, with most independent energy analytics firms projecting that total consumption will be somewhere between 105 to 110 million barrels per day in 2030. Due to the underinvestment in energy production over the past several years, it is unlikely that global crude oil production will actually be at that level. One of the characteristics of oil fields is that their production output declines over time. Thus, without sufficient new capacity coming online, production will go down. That is the scenario that is currently being projected to occur. Analysts at JPMorgan Commodities recently predicted that the world will have a 1.1 million barrel shortage of crude oil by 2025 and a 7.1 million barrel shortage by 2030:

Zero Hedge/Data from JPMorgan Commodities

I do not have to explain what that will do to energy prices, as the basic economic law of supply and demand makes that case for me. As we have seen over the past few months, the stocks held by this fund tend to appreciate when energy prices rise, as does the fund itself.

Thus, the BlackRock Energy & Resources Trust appears to be very well-positioned to deliver both a very attractive yield and share price gains to its investors going forward.

Distribution Analysis

As mentioned earlier, the BlackRock Energy & Resources Trust has the primary objective of providing its investors with a high level of total return. However, as is the case with most closed-end funds, the fund’s basic business model is to maintain a relatively stable level of net assets and pay out most to all of its investment returns to investors. When we consider the total returns that are available both through capital gains and dividends, we can probably expect that this fund would have a reasonably high distribution yield.

That is indeed the case, as the BlackRock Energy & Resources Trust pays a monthly distribution of $0.0657 per share ($.7884 per share annually), which gives it a 6.09% yield at the current price. This is not nearly as high as the yield that we can obtain from a fixed-income fund or similar, but the current yield is a direct result of the share price appreciation that the fund has benefited from over the past few months pushing down its yield. Unfortunately, the fund has not been particularly consistent with respect to the distribution that it pays out:

CEF Connect

As we can clearly see, the fund’s distribution has varied quite a bit over the years. This seems likely to reduce the fund’s appeal in the eyes of those investors who are seeking a safe and secure source of income to use to pay their bills or finance their lifestyles. This is not really the best use of this fund though, as our overall thesis here is that the fund works as a play on rising energy prices. As we can see above, the distribution cuts have generally occurred during periods in which energy prices were declining. The fund has been steadily increasing its payout over the past two years as energy prices have gone up and companies in the sector have started to give higher returns. For example, we can see here that it raised its distribution earlier this year:

CEF Connect

It seems logical that the fund will continue to increase its distribution as our thesis plays out and higher energy prices allow the companies held in the fund’s portfolio to enjoy higher valuations.

As is always the case, we want to investigate how well the fund is covering its distribution. After all, we do not want the fund to be overdistributing and drawing down its asset base unnecessarily. This will not work very well in the long term, for obvious reasons.

Fortunately, we do have a fairly recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on June 30, 2023. This is nice as it covers the first half of this year. As mentioned earlier in the article, this is a period in which the Federal Government was artificially suppressing the price of crude oil by draining the Strategic Petroleum Reserve. As such, the price of crude oil during this period was lower than we saw over much of 2022, which naturally had an adverse impact on the performance of the companies that are held by the fund. The fund’s ability to handle this situation and deliver solid returns will speak well of its overall quality of management, and of course, the better management’s ability to generate returns during that environment, the better it should perform during a period of rising energy prices as we are likely to see going forward.

During the six-month period, the BlackRock Energy & Resources Trust received $8,126,851 in dividends from the assets in its portfolio. The fund had to pay foreign withholding taxes on some of this, which reduced its total investment income to $7,731,316 over the period. The fund paid its expenses out of this amount, which left it with $5,682,231 available for shareholders. This was, unfortunately, not nearly enough to cover the $10,606,571 that the fund actually paid out in distributions over the period. That is likely to be concerning at first glance, as the fund clearly failed to fully cover its distribution out of net investment income.

However, the fund has other methods through which it can obtain money to use to cover the distribution. For example, it might have had some capital gains that could be paid out. In addition, this fund occasionally writes options in an attempt to generate premium income that acts like a synthetic dividend for the stocks that it owns. Neither one of these things is included in the net investment income, but they obviously represent money coming into the fund. Fortunately, the fund did enjoy some success here as it reported net realized gains of $18,132,696 but these were offset by $28,865,010 net unrealized losses. Overall, the fund’s net assets declined by $18,450,086 during the period after accounting for all inflows and outflows.

Despite the fact that net assets went down during the period, the fund’s distribution does appear to be quite reasonably covered. One reason for this is that the fund’s distribution was less than its net investment income plus net realized gains. The only reason for the decline in net assets was the net unrealized losses, but these can very easily be reversed the second the market becomes stronger. When we consider that the energy sector in general did start trending up around mid-July, it is quite possible that some of these losses are not losses anymore.

Secondly, the fund’s net assets are still up over the training eighteen-month period. Over the full-year 2022 period, the BlackRock Energy & Resources Trust saw its net assets increase by $84,989,114 after accounting for all inflows and outflows that it experienced over the period. Thus, the decline in net assets that the fund saw during the most recent period only partially offset that. Overall, the fund’s finances seem to be in good shape, and we should not have to worry about too much here.

Valuation

As of October 12, 2023 (the most recent date for which data is currently available), the BlackRock Energy & Resources Trust has a net asset value of $14.65 per share but the fund’s shares only trade for $12.95 each. This gives the fund’s shares a whopping 11.60% discount on net asset value at the current price. This is a very attractive discount that is relatively in line with the 11.72% discount that the shares have averaged over the past month. As I have pointed out numerous times before, anytime that a closed-end fund obtains a double-digit discount, it generally represents a good entry point unless the fund’s finances are distressed. That is clearly not the case here, so the current price is more than acceptable to buy the fund’s shares.

Conclusion

In conclusion, the BlackRock Energy & Resources Trust is a very solid closed-end fund that is well-positioned to profit from any increase in crude oil prices. That is quite likely to happen considering that it looks highly likely that the world will suffer from a shortage of this necessary commodity over the next several years. As such, the fund may make a lot of sense right now as a way to obtain a 6.09% yield that is likely to increase going forward. The fund is having no trouble covering its distribution and it is currently trading at an incredibly attractive valuation, so there is no reason not to pick up some shares here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here