Dear readers/followers,

BASF (OTCQX:BFFAF) hasn’t unfortunately been the greatest investment thus far. As with other investments where the immediate upside hasn’t been as immediate or as quick as I expected, I do provide and work with ongoing coverage of these investments. In BASF’s case, I have positions in both my private and my corporate portfolio, both are actually flat or in the green, but in no case am I looking to rotate or invest elsewhere.

Why is this?

That is something I will both remind you of in this article, but also update my thesis on here. Because a global giant like BASF, that question is a complex issue to look at.

However, my overall expectations for the company remain positive. I won’t call the yield “safe” here – because it isn’t – but the upside, to me, is dependent on the macro to a degree where any major recovery in the next 4-5 years is likely to send this company’s valuation to a level I expected and clarified in articles 1-2 years ago.

Let me show you what I mean.

I have covered BASF previously – so this is an update on the company with my latest article to be found here.

BASF is a good company with yield and upside – here is why

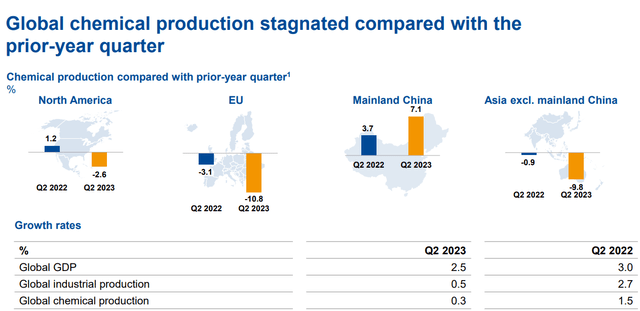

The ominous red sky in the picture of this article gives you, I believe, a very good idea of where the company is because things for the last 12 months have not been going in BASF’s favor. The war in Ukraine with the Russian invasion has pulverized the plans for Nordstream and the company’s otherwise profitable listing/monetization of Wintershall DEA, and the global chemical trends do not look good. The only part of the company’s operations that looks in any way positive is mainland China. (Source: BASF 2Q23)

BASF IR (BASF IR)

This is really all a product of macro trends, which is why it really does not worry me in any major way. I know the global trends for chemicals go up and down, and BASF being a major upstream producer of core chemicals and commodities – the largest in the world in some, is on the clear receiving end of that stick.

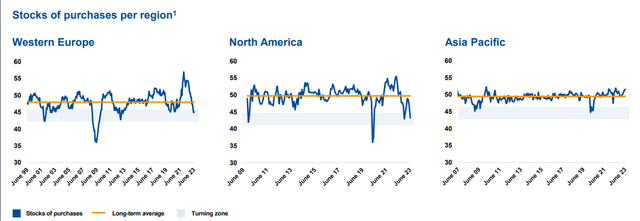

Current stock levels are below the average in manufacturing, and within the range of past inflection points if we look back 20-25 years. What I mean by this is that we’re now approaching levels where things are implied to go for a rebound, especially in NA and Europe.

BASF IR (BASF IR)

Does approaching this inflection mean that we’re actually going to see a reversal now? Should we be buying BASF with both hands?

Well, no. As you can see in 2009 especially, and in NA in 2020, the levels can continue to drop even lower for some time before reversing. But when they reverse, they do so with a vengeance.

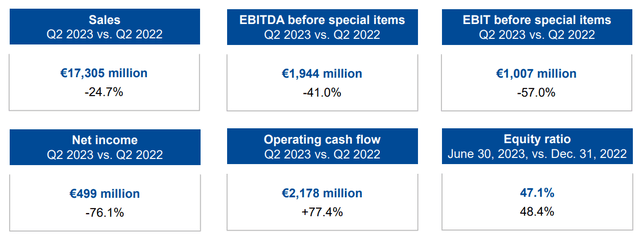

A part of the problem for BASF is also extremely strong comps. It colors every single YoY comparison we have here. The company’s 2022 trends saw over €2.3B worth of EBIT in 2Q22, and now we’re at half that. This decline was mostly driven by the cyclical-impacted upstream segment. If we want to view this with more granularity, it can be said that the automotive and industrial segments were the primary antagonists for this decline, and none of that is outside of what I came to expect from BASF here.

Does it worry me?

No, it does not. The company is doing everything it can to prepare for the next upcycle of demand. Its new Verbund site, set to be one of the largest on the planet, is progressing well. It’s China, and Zhanjiang, with the new engineering plastics plant started up a year ago, with the first “Made in Zhanjiang” products delivered at the onset of this year or the end of last. The next asset, the TPU plant, is starting next quarter.

2025, the startup phase is really happening, with its steam cracker going online, and in 2028E, the company is looking at expansion and diversification, including a 500 MW offshore wind park. But this Chinese Verbund site is far from the only thing BASF is doing.

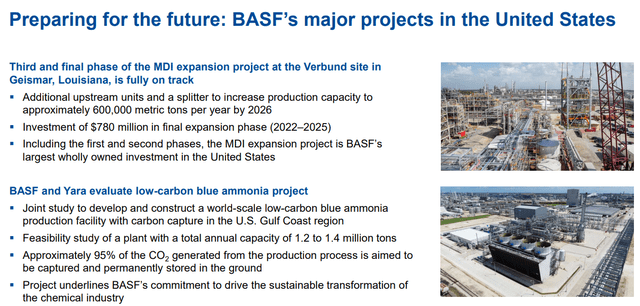

BASF IR (BASF IR)

As you can see, its US projects are also progressing quite well. You’ll note that none of these projects are actually in Europe or Germany, so what exactly is happening here?

I believe the BASF of the future is going to have less of a German-centric footprint, and this is something I view as a positive. The company already has the assets it needs in Germany, perhaps even “too much” given the current environment. The current German focus is less on the commoditized chemical segments, and more on more premium materials, such as high-performance CAM. The company is planning the first fully automated large-scale CAM facility in all of Europe.

And the best part of that?

The plant’s capacity is already sold out for the next few years, given the demand from cell manufacturers.

BASF, dear readers, is nothing less than a sleeping dragon.

Despite numbers like this.

BASF IR (BASF IR)

That obviously does not look good, does it?

Nor is the dividend “safe” as such. With the variety of impacts here, the company’s adjusted EPS is set to decline to €3.62/share for the 2023E period, marking a decline of 48%, in line with the EBITDA and EBIT declines we’re seeing on a quarterly basis here.

As a reminder, the company has a dividend of €3.4. Current estimates from S&P Global and FactSet both expect this dividend to remain. They do not expect the company to cut it.

There are many arguments for this stance. First off, the trough is really expected to be temporary. We’re expecting 20%+ EPS growth in 2024 already, another 20%+ in 2025E.

Secondly, despite volatility, BASF has not cut its dividend for over 10 years at this point. Not since the GFC. And that cut was from €1.95 to €1.7, so it wasn’t a massive cut, despite a 2-year EPS decline of 50% in that particular cyclicality.

Third, BASF remains A-rated. Despite everything that’s happened, BASF is one of the best-rated, largest chemical players on earth. That’s the key reason I’m so comfortable being invested in the business here.

Everyone who invests in BASF knows or should know, that the company is incredibly cyclical. If you do not know or understand this, you shouldn’t invest in the business. Its current P/E of 9-10x P/E is not even close to the trough we saw in GFC.

The company could, and I emphasize, could, move lower.

But I still wouldn’t call a 90% payout dividend “safe”, and the company may decide to temporarily reduce it, if needed.

The reason we invest in BASF however, is the upside and normalization we see here.

BASF – The upside is at least 50-70% in the longer term

BASF is a sleeping dragon, that’s something I want to be very clear about here. We’re going into a year when the company is going to see a significant EPS decline, but going out of this environment, I believe we’ll see 15%+ EPS reversals in both 2023 and 2024E, provided that macro forecasts hold.

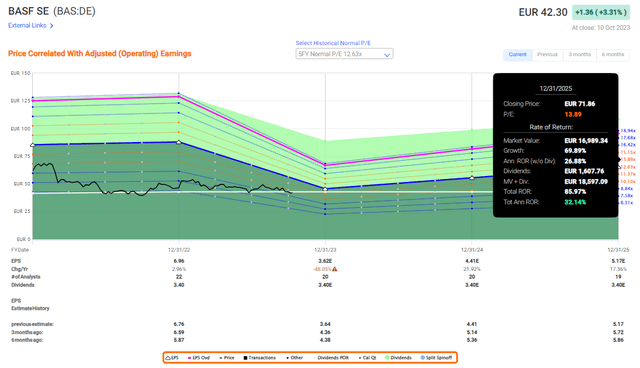

If this turns out to be the case, then we’re looking at a company typically valued at 12-14x P/E trading at a current P/E of 9.68x, with an upside of what I consider to be at least 30%+ per year, to a total RoR of 85%.

BASF Upside (F.A.S.T Graphs)

As you can see, BASF has been stagnant for years at this point. But the catalyst for a reversal here, is as I believe, coming in the next 2-3 years. When this comes, I believe a €60-€70/share price is a given, and €80/share or higher is entirely possible. As with my thesis on HeidelbergCement, I am very clear when I am rotating or saying “This is good enough”.

For BASF, I would say at this time this is at €75/share or above. If the company reaches this, then I would likely start taking home profits and investing elsewhere.

Like other companies I am writing about today, BASF yields 8%+ at this time. That 8% is what you can currently get from IG-rated bonds and good debt, so that 8% is important to me when I do investments like this – either 7-8% yield and a situation like this, or a high likelihood of a total 15%+ annualized upside.

In BASF’s case, this is something we have.

All we need is a turnaround in macro. The company is certainly not going anywhere, and it’s a given to me that the dividend for the next year is going to be at the very least attractive here.

Because of that, I see BASF as being a “BUY” here, and the following is my current thesis on the company.

Thesis

- BASF is one of the most qualitative and attractive chemical commodity players in the world, but it’s also incredibly cyclical and currently impacted by a very unfavorable macro.

- However, I view the company as being more of a “sleeping dragon”, and once the order stocks inventories and industrial production starts normalizing, this company will be climbing back up again.

-

At any conservative multiple, DCF still shows us a target of above €60/share. On a growth/NAV-specific basis, BASF’s previous targets have been significantly cut into due to the valuation uncertainty from the Oil/Gas business, as well as Wintershall DEA. This has impacted the company’s short and medium-term results heavily.

-

I still view BASF as a “BUY”, and I maintain my 2022-given share price of €71 here, based on a 2025E target of 13.9x P/E with the current forecasts.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversions.

This means that the company fulfills every single one of my criteria, making it relatively clear why I view it as a “BUY” here.

Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here