Introduction

The Income-Related Monthly Adjustment Amount, referred to as IRMAA, was first enacted in 2003 as part of the Medicare Modernization Act, and then first applied four years later. It originally applied only to high-income enrollees of Medicare Part B, but in 2011, IRMAA was expanded under the Affordable Care Act to include high-income enrollees in Medicare Part D. While it applies to Advantage policy premiums, I couldn’t confirm if it applies to Part B Gap policies also.

Since most of us value our time, the answer to the title questions appears to be that investors should worry about other parts of their finances as the potential savings for a couple appears to top out at $3000 for any year. I do suggest reading on as there are useful strategies discussed that might justify the time and effort to execute them. Look at avoiding some IRMAA costs as a bonus. Unless you are just over one of the IRMAA income thresholds, odds are you will not drop down a bracket anyway.

That disclaimer aside, the Life Events section could apply to your situation if you retired within two years of enrolling into Medicare.

IRMAA bracket changes

A great change started in 2020 when the income thresholds for IRMAA surcharges became inflation adjusted (finally). With the two-year look back for income, this benefits those who might be caught by the calculation, especially if inflation is running high. The brackets and surcharges are adjusted based on the Consumer Price Index for Urban Consumers (CPI-U). In 2018, the Bi-Partisan Budget Act created a 5th IRMAA bracket, with the stipulation that this new bracket would not be increased for inflation until at least 2028.

To give readers an idea of how things have changed over time, I built this table using data pulled from IRMAA Solutions.

| Year | Lowest IRMAA | MC “B” cost | IRMAA cost | IRMAA “D” cost | Highest IRMAA B | Highest IRMAA D |

| 2007 | $160-200k | $93.50 | $12.30 | NA | $67.90 | NA |

| 2011 | $170-214 | $115.60 | $45.90 | $12.00 | $253.50 | $69.10 |

| 2015 | $170-214 | $104.90 | $42.00 | $12.30 | $230.80 | $70.80 |

| 2019 | $170-214 | $104.90 | $84.70 | $12.34 | $323.70 | $77.40 |

| 2022 | $182-228 | $170.10 | $68.00 | $12.40 | $408.20 | $77.90 |

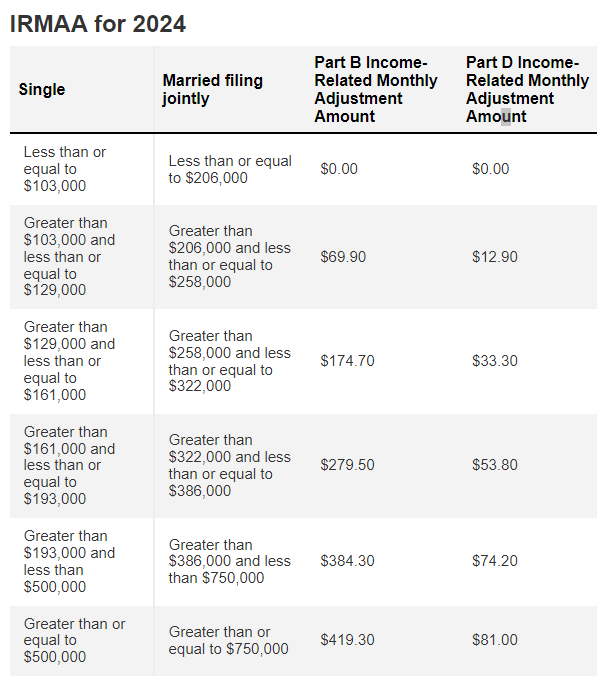

IRMAA brackets for 2024 premiums

The Medicare Part B premiums, the IRMAA brackets and add-on were just announced. That full table is presented next. Remember the income listed is for 2022. The Part B premium went from $164.90 in 2023 to the new 2024 rate of $174.70.

kiplinger.com/retirement/medicare/medicare-premiums-2024-irmaa

So, if a married couple stayed below $206,000 for their 2022 IRMAA MAGI, they would have saved almost $2000 in additional Medicare premiums for one year. For those wanting to avoid IRMAA in 2025, I suggest a target MAGI below $212,000 for a couple. They still have time to see if they can pull that off while not losing more than $2000 in income or opportunity cost of paying extra taxes early.

Understanding the IRMAA MAGI calculation

Before you want to take action to reduce your income that counts toward the IRMAA limits, you need to understand what goes into that calculation. A single dollar over a limit, and you have to pay IRMAA surcharges for an entire year. That last part is the good part; each year is treated independently of all prior years. So, if you have a large, unexpected income boost (bonus payment, capital gains, etc.), the extra premium only applies for one year. If you file a joint return and both spouses are on Medicare, both sets of premiums are effected. Calculating your taxes both as joint or married-separate should be done and should be easy for any tax software to do. The tax difference would then be compared to the single boost in Medicare premiums.

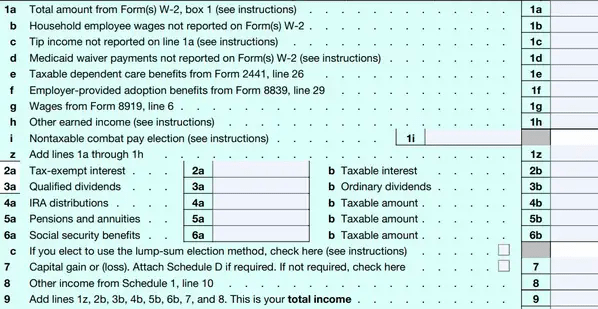

The first very important point is IRMAA calculations have a two-year lag time. Whether you must pay an IRMAA in 2023 depended on your 2021 tax returns. Thus, starting with the 1040 form makes sense.

fiphysician.com 1040

Your Modified Adjusted Gross Income (MAGI) calculation starts with form 1040. Above is the top portion of Form 1040 which shows what counts as Total Income (Line 9).

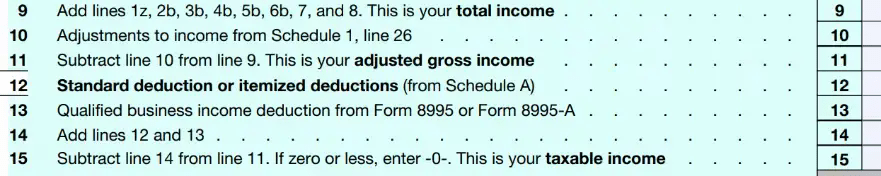

Line #11 is the AGI starting point for getting to the IRMAA MAGI amount. Before I begin, please note that whether you use the Standard or Itemized deduction does not matter since that is entered after the AGI line #11 on the 1040 form.

fiphysician.com 1040

To get to your IRMAA MAGI, you must add back the following:

- tax-exempt interest from municipal bonds, earned or accrued.

- interest from US savings bonds used to pay for higher education.

- foreign-earned income from wages, but not investment income, including income earned in US possessions like Guam or Puerto Rico.

Unlike the ACA Premium Tax Credits calculation, the non-taxed part of your Social Security benefit is not part of the IRMAA MAGI total.

Hold Harmless rule does not apply

The Hold Harmless rule states your Social Security benefit cannot drop if the Medicare increase is larger than your SS increase. That protection does not apply to folks who are subject to the IRMAA premium surcharges. Sorry!

Actions to possibly avoid IRMAA costs

Before I start listing actions one can take to alter one’s income that counts toward the IRMAA calculation, a very important reminder: do not let the cure cost more than the disease. Translation: the idea is to shift income sources more than eliminating them. It doesn’t make sense to reduce income by more than the extra Medicare premiums are.

Funding an IRA

Moving assets from a taxable account into a tax-deferred account should reduce future income from RMDs as that percent starts at levels below what hopefully your account is generating.

Funding a Roth instead

Switching contributions from an IRA to a Roth IRA or from pre-tax 401(k) to a Roth 401(k) while you’re still working means you’ll pay more in income taxes now but reduce your RMDs later, which count toward MAGI. If you do the 401(k) conversion, be sure the income boost doesn’t push you over a limit! This strategy is best executed at least three years prior to starting Medicare.

Maximize your Pre-Tax 401k contributions

The biggest bang here is starting the year you turn 62 or three years before you enroll in Medicare B or D, or an Advantage plan. While starting sooner might be done for other reasons, the point here is to reduce payroll income during the lead up years used in the calculation.

Delay enrolling in Medicare Parts B and D

If you (and spouse) are 65, you do not need to sign up for Medicare if those over 65 are covered by acceptable medical and drug plans. Medicare Part A is outside IRMAA so there are limited reasons not to enroll in that part. One reason is you are funding a HSA account, which has to stop before enrolling in any part of Medicare. Funding an HSA also helps lowering what flows onto your 1040 form.

Conversions

Make Roth IRA conversions while your income is low, like between the year you retire and when RMDs from traditional IRAs and 401(k)s must begin. That should minimize the tax cost of executing this strategy. If offered, converting Pre-tax 401(k) assets to a Roth 401(k) does the same thing. Funds converted into a Roth IRA or Roth 401k count toward your MAGI so time these accordingly. One strategy is to do it all in one year if Medicare enrollment is coming or already happened.

Investing decisions

How you invest can be altered to reduce income but remember the caveat mentioned above. Ideas include:

- Invest in funds that do not generate taxable income from dividends or capital gain distributions. One way to accomplish this is placing your high-yield and non-ETF funds in tax-sheltered accounts.

- Do enough tax loss harvesting to claim the maximum $3000 loss.

- Consider using tax-free investments, since you are most likely in a tax bracket that makes the after-tax yield close. As noted, tax-free income does count toward IRMAA, though your income should be lower.

Medicare IRMAA: What Is It and When Does It Apply?

Give to charity

If you have appreciated assets and have a desire to support nonprofits, either directly or by setting up a Donor Advised Fund, should be considered. This helps if you have winning assets you want to liquidate and regularly support charities, religious organizations or other nonprofits.

Use RMD alternatives

While you cannot avoid taking RMDs once required, there are ways to keep them off your tax return. A popular one is using Qualified Chartable Distributions, or QCDs. This strategy can only be used after you are passed the age of 70.5. As the name applies, you want to support eligible non-profits. Here is an article that explains this strategy.

Reduce future RMDs

Another strategy for charity supporting is the use of a Legacy IRA QCD which’s allows you to setup a Charitable Reminder Trust and receive annual income that should be less than what the RMD would have been. This article covers this strategy. Future RMDs can also be reduced by taking withdraws before you are required as long as that doesn’t push you over an IRMAA limit.

Life events can avoid IRMAA for a year (maybe more)

If Social Security says you owe an IRMAA surcharge, you can appeal via form SSA-44 by proving you’ve had one of eight “life-changing events” that lowered your current income. Those events are:

- Marriage

- Divorce or annulment

- Death of your spouse

- Work stoppage

- Work reduction

- Involuntary loss of income-producing property

- Loss of pension income

- Employer settlement payment due to its closure or bankruptcy

That link also provides an 800# if you can show that your modified adjusted gross income was wrong that SSA listed in your notice letter.

Portfolio strategy

Medicare trustees say the Part A program will begin running deficits again in 2025, drawing down the Trust fund until it depletes in 2031. The Supplementary Medical Insurance SMI Trust always has sufficient financing to cover Part B and Part D costs because the beneficiary premiums and general revenue contributions are specifically set at levels to ensure this is the case. Premiums are set to cover roughly 25% of all Part B and Part D costs. That explains how the premiums are set and why IRMAA rates were instituted (i.e., make the “wealthy” pay more so others don’t have too.)

Back at the implementation of IRMAA in 2007 there were roughly 1.7 million people in IRMAA which equated to about 5.70% of all eligible Medicare beneficiaries. By the end of 2023 there will be close to 6.8 million people in IRMAA for the year or roughly 16% of all eligible Medicare beneficiaries. Going forward the numbers will not be getting smaller as the Trustees are expecting a gradual increase annually until 13.5 million people will be in IRMAA. This is an expected 25% of all Medicare beneficiaries being in IRMAA which is the exact percentage that the government projected in 2014 through the Presidential Budget for that year.

Source: irmaacertifiedplanner.com/irmaa-2024

IRMAA is coming after more of us! As mentioned in various places above, trying to avoid the IRMAA surcharges might be accomplished by adjusting how you invest. As mentioned, the point is “hiding” income from IRMAA more than reducing your income, with the possible exception of switching from taxable bonds to tax-free bonds. While avoiding taxes and the surcharges is great, but only if the net result is more money in your pocket at the end of the day.

Final thoughts

After now having spent time reading over 1800 words and reviewing multiple tables, now that I am wrapping up the analysis that went into this article, my final thought boils down to this: Worry about something else! The people in the middle brackets can save the most and for them it is just over $3000, or 1% of their reportable income. Spending the same time on what should be seven figure portfolios will provide a higher return for the time spent.

That said, some of the avoidance strategies might make sense for other reasons, especially of the current income tax rates are allowed to expire come 2026.

Read the full article here