PeopleImages/iStock via Getty Images

Summary

Asana Inc (NYSE:ASAN) reported mixed performance for its second quarter 2024 result. Sales growth decelerated compared to the previous quarter. Strategic initiatives like reducing global headcount and making cautious investment decisions allow the company to achieve a better-than-expected operating margin. A significant highlight was ASAN reporting a positive FCF for the first time. However, there was a decline in the dollar-based net retention rate across all segments. On the brighter side, ASAN is actively exploring avenues for business expansion, targeting sectors like healthcare, life sciences, financial services, and government. The introduction of the Enterprise+ plan and a renewed focus on compliance highlight their growth commitment. Their revamped pricing strategy, set to be introduced soon, aims to ensure continuous revenue growth. Yet, given the current net loss situation and a relatively high valuation driven by the market’s optimism for ASAN, I recommend a sell rating.

Financials / Valuation

ASAN provides a task management platform used by individuals and companies across the globe. This platform aids organizations in coordinating various tasks, ranging from daily activities to significant cross-departmental projects. It’s instrumental in overseeing product rollouts, promotional campaigns, and setting overarching objectives. The firm caters to a diverse clientele, spanning sectors like tech, commerce, academia, public service, healthcare, media, manufacturing, specialized services, and finance.

Over the last five years, there’s been a clear deceleration in ASAN’s revenue growth. In 2020, the company reported impressive 86% growth, but by 2023, this had dropped to 45%. For 2024, the management’s guidance suggests a further slowdown, with a midpoint estimate of around 18%. Despite this significant deceleration, the market continues to assign ASAN a notably high EV/revenue ratio. Regarding net income, while there’s been some improvement, it remains deeply negative. In 2023, ASAN reported a net income of approximately negative 38%, an improvement from 2019’s negative 55%.

Valuation

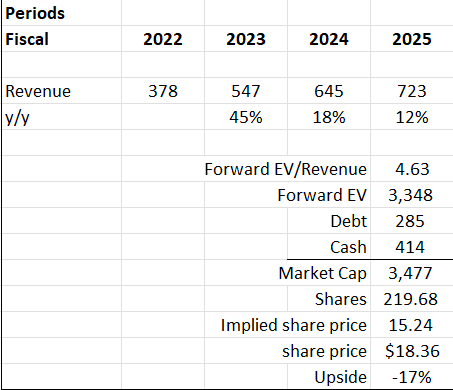

Based on my view of the business, I forecast 18% growth in ASAN’s revenue for 2024, followed by a 12% growth in 2025. The anticipated 18% revenue growth rate for 2024 is based on the management’s guidance from their earnings results, where I’ve used the midpoint of the guidance range. Management guided to a lower growth rate as they expect the dollar-based net retention rate to continue its downward trend for the rest of the fiscal year.

The forecast of 12% revenue growth for 2025 derives from market consensus. This 12% forecast is influenced by the company’s weak results in the second quarter, which showed a deceleration in revenue growth. Additionally, the dollar-based net retention rate declined by approximately 5% across all segments, attributed to macroeconomic challenges leading to fewer seat expansions and customer downgrades. In examining ASAN’s five-year historical performance, there’s a noticeable deceleration in revenue growth. From an impressive 86% in 2020, it has tapered off to 45% by 2023. Lastly, management has set a guidance of 18% growth for 2024. This suggests that management is pessimistic on ASAN’s future growth outlook. For potential investors, this is worrisome, especially considering that ASAN has yet to report a positive net income and is already encountering significant growth challenges.

Based on author’s own math

Peers overview:

- Smartsheet: (SMAR) EV/Revenue = 4.63, 1 year expected rev growth rate = 26%, 2 year expected rev growth rate = 21%

- monday.com: (MNDY) EV/Revenue = 6.14, 1 year expected rev growth rate = 40%, 2 year expected rev growth rate = 28%

- Peers Median: EV/Revenue = 5.39, 1 year expected rev growth rate = 33%, 2 year expected rev growth rate = 24%

Currently, ASAN is trading at 5.32x forward revenue, which aligns closely with the median of its peers. However, when compared to its peers, ASAN projects a lower revenue growth rate for both the next 12 months and the subsequent 12 months. Its expected revenue growth rate for the upcoming 12 months is 17%, and for the following 12 months, it’s 18%. Given its comparatively weaker growth outlook, ASAN’s EV/Revenue ratio should be closer to the lower end of its peer group. I believe that its current 5.32x forward revenue is overly optimistic, possibly fueled by the market’s heightened enthusiasm and expectations for ASAN. By applying a more conservative 4.63x forward revenue multiple, my target price for ASAN is approximately $15.24, suggesting a potential decline of 17%. Based on my analysis, I recommend a sell rating for ASAN.

Comments

During the second quarter of 2024, ASAN reported mixed performance. Sales increased 20% year over year, slowing from the 26% growth seen in the previous quarter. A decrease in global headcount earlier in the year and more cost-conscious investment decisions led to a better-than-expected operating margin of negative 6.4%. ASAN’s positive FCF of $14.6 million in the second quarter was a notable accomplishment, marking the first time the company has posted positive FCF since going public. In terms of the dollar-based net retention rate, it has fallen across the board by 5%. For customers over $5K in annualized spend, it fell to over 110% vs. the previous 115%. $100K annualized spend fell to over 125% vs. the previous 130%. Overall dollar-based net retention fell to 105 vs. the previous 110%.

On the flip side, ASAN is proactively looking at ways to grow their business. Healthcare, life sciences, financial services, and government are all mentioned by ASAN’s management as possible verticals for expansion in the company’s investor day transcript. He goes on to say that the new Enterprise+ plan is aimed at industries where compliance, regulations, security, and scalability are paramount. He also said that while the sales team will be verticalized, the process will be slow and that ASAN will not focus all of its resources on it. Executives have stated that they are dedicated to enhancing their healthcare vertical go-to-market motion and that the introduction of HIPAA compliance last year is a prime example of this commitment. When asked about plans for growth with partners, ASAN said it was concentrating on forging connections with global GSIs so as to broaden the scope of its ecosystem within corporate settings. A channel partner that is interested in expanding ASAN into underserved markets like Latin America is crucial to taking advantage of the growth opportunity that these regions present, as was mentioned by ASAN.

In a bid to ensure continued revenue growth, ASAN introduced its new pricing and packaging strategy. This strategy involves the rebranding of three existing product options and the addition of two new ones, all set to be available in the fourth quarter. Furthermore, ASAN is implementing limits across portfolios, automation, and reporting features. Current subscribers will transition to these updated plans upon renewal, while newcomers will be introduced to them from the fourth quarter onward. The redefined plans include the Personal tier, taking over from the Basic tier and designed for up to 10 free users, a reduction from the earlier 15. The Starter tier follows in the footsteps of the previous Premium, serving up to 500 users. The Advanced tier mirrors the old Business tier but is limited to 500 users. The Enterprise tier remains untouched, and a new addition is the Enterprise+ tier. It’s worth noting that every paid tier now incorporates ASAN intelligence, with enhanced AI functionalities becoming available as users climb the tiers.

Risk & conclusion

A potential upside to my sell recommendation for ASAN could arise from a better-than-anticipated outcome of its revamped pricing and packaging strategy and the introduction of new products. Presently, ASAN is operating at a net loss. However, it’s noteworthy that their second quarter 2024 result reported positive FCF. A closer look at their current cash flow statement reveals that stock-based compensation, a non-cash expense, is the primary contributor to this net loss. This suggests that their actual net income might be trending positively. If the new initiatives successfully boost both revenue and margins, there’s a high chance that ASAN will post a positive net income. In such a scenario, the stock price could surge, especially considering the market currently assigns them a higher EV/revenue ratio despite a growth outlook that lags behind peers. This valuation is likely influenced by the market’s high expectations for ASAN, particularly given their second quarter positive FCF report.

In conclusion, while ASAN showcased a weak performance in the second quarter, with a deceleration in sales growth, it achieved a significant milestone by reporting positive FCF for the first time. The company’s proactive approach towards exploring new verticals for expansion, combined with its revamped pricing strategy, indicates a forward-thinking approach to growth. However, the current valuation seems to be influenced by the market’s optimistic expectations, especially in light of their second quarter positive FCF. While there’s potential upside with successful implementation of new strategies, the present continuing net loss and weaker growth outlook suggest caution. Given these factors, the market’s high EV/revenue ratio for ASAN appears to be a premium. When I applied a more conservative ratio, my model implied a downside of 17%. Therefore, I recommend a sell rating.

Read the full article here