Apellis Pharmaceuticals (NASDAQ:APLS), a standout player in the biotech sector, distinguishes itself with its novel C3 inhibitor technology, including their flagship compound, pegcetacoplan which has been branded into EMPAVELI (systemic) and SYVOVRE (intravitreal). Apellis has aimed pegcetacoplan to take on treating Paroxysmal Nocturnal Hemoglobinuria (PNH) and Geographic Atrophy (GA), with impressive data. In fact, SYVOVRE, exhibited its efficacy in impeding GA disease progression, while EMPAVELI was effective at stopping PNH at the core issue of the disease.

I have avoided APLS due to the ticker’s premium valuation and limited commercial track record. Furthermore, the ticker has experienced elevated volatility following a short report concerning SYFOVRE’s safety. However, I can no longer ignore the company’s clinical data supporting the safety and efficacy of SYVOVRE as well as the company’s commercial success thus far. As a result, I have decided to put APLS on the Portfolio watch list ahead of the company’s Q3 earnings slated for November 1st.

I intend to provide a brief background on Apellis Pharmaceuticals and their recent updates. Then, I will take a look at the company’s expectations for Q3 and the Street’s projections moving forward. In addition, I will point out some downside risks that investors should consider when managing their APLS position. Finally, I present my game plan for attempting to initiate a position in APLS around their Q3 earnings.

Background on Apellis Pharmaceuticals

Apellis Pharmaceuticals is a commercial-stage biopharma focusing on therapeutic compounds that inhibit the complement system, particularly for autoimmune and inflammatory disorders. Among its offerings, EMPAVELI (systemic pegcetacoplan) stands out as a treatment for PNH, as well as C3 glomerulopathy (C3g), cold agglutinin disease (CAD), immune complex membranoproliferative glomerulonephritis (IC-MPGN), amyotrophic lateral sclerosis (ALS), and thrombotic microangiopathy associated with hematopoietic stem cell transplantation (HSCT-TMA).

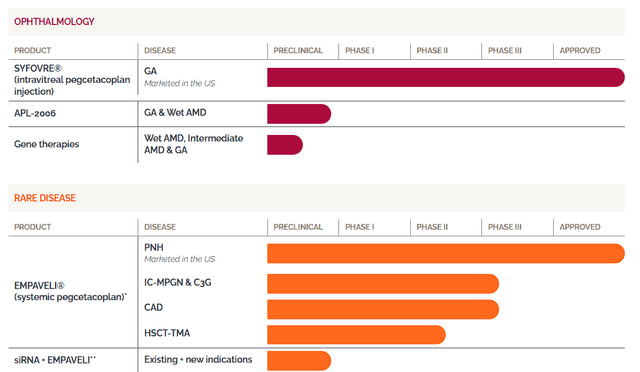

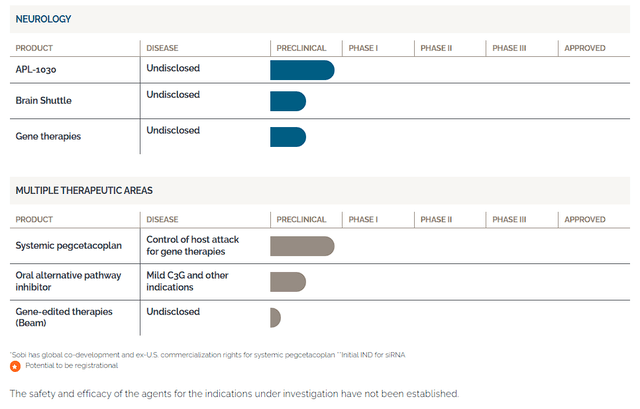

Apellis Pharmaceuticals Pipeline 1 (Apellis Pharmaceuticals) Apellis Pharmaceuticals Pipeline 2 (Apellis Pharmaceuticals)

Additionally, the company provides their intravitreal form of pegcetacoplan, called SYFOVRE, for addressing GA. Apellis also has several other compounds in their pipeline including APL-2006, APL-1030, and a combination treatment of EMPAVELI matched with a small interfering RNA (siRNA) aimed at reducing the production of C3 proteins by the liver.

The company’s lead compound, pegcetacoplan, a derivative of a compstatin analog, zeros in on C3, a pivotal protein in the complement cascade. Its unique feature lies in selectively targeting C3, ensuring precision in immune response modulation and potentially reducing side effects. Notably, pegcetacoplan boasts a lengthier half-life, potentially leading to less frequent dosing.

In terms of cash, Apellis finished Q2 with a robust cash balance of $625.68M, assuring operational sustainability until Q1 of 2025.

Q3 Earnings Expectations

The company’s Q3 earnings will be a must-see to confirm the impact of a number of updates that occurred throughout the quarter. One of these events includes the company’s decision to reduce their workforce by about 25% in a corporate restructuring initiative that is projected to yield up to $300M in cost savings through 2024. The restructuring is intended to help the company prioritize their R&D for retinal and central nervous system candidates. Consequently, the company intends to put siRNA with systemic pegcetacoplan, APL-1030, along with APL-2006 on the back burner. However, the Apellis-Beam Therapeutics (BEAM) partnership for base editing will carry on. For the Q3 earnings, Apellis aims to report $9M to $11M in one-time expenses before year-end. So, we should see some impact on Q3 earnings. Moreover, the company plans to deliver an update on how this move has already impacted the cash runway.

Earlier this month, Apellis shared early financial figures, announcing approximately $74M in U.S. net revenue from SYFOVRE in their Q3 earnings. The company was confident in announcing these preliminary numbers thanks to a surge in weekly demand starting in August of this year. In fact, the company is reporting they are seeing sustained strong demand, with over 100K vials of SYFOVRE being distributed to healthcare providers since launch. What is more, SYFOVRE now has a permanent J-code to improve billing with more than 95% of Medicare insurers who now cover SYFOVRE.

Risks To Consider

First and foremost, investors should be concerned with the ticker’s valuation. Currently, Seeking Alpha Quant has assigned APLS a valuation grade of ‘D’, indicating APLS is trading at a rich valuation compared to its counterparts in the Healthcare sector. A closer look reveals that APLS lags the sector median in various key metrics including enterprise value-to-sales, price-to-sales, and price-to-book. APLS has an EV/Sales ratio of 28.45x representing a significant deviation of 764.35% from the sector median. Price Ratios paint a similar picture, with APLS having a price-to-sales of 30.04x, reflecting an 803.82% deviation from the sector median. The price-to-book ratios are particularly noteworthy at 16.67x representing an astonishing 874.65% deviance. In addition, APLS boasts a Market Cap of $5.76B, with a manageable Total Debt of $110.80M. The company maintains a healthy cash reserve of $625.68M, contributing to a hefty EV of $5.25B.

In addition, there was a short report from Favus research about alleged safety concerns regarding SYFOVRE. This followed the mid-July commotion associated with an ophthalmology body issuing a warning about Syfovre, which led to several analyst downgrades. However, Apellis continues to report encouraging data, including the GALE extension study data, which revealed SYFOVRE’s ability to elicit a 45% reduction in nonsubfoveal GA lesion growth, from Months 24 to 30. Moreover, in terms of safety, the incidence of retinal vasculitis remains exceedingly rare, at just 0.01% per injection. Although the company has the data to support their position, the market can be apprehensive about these events as short seller campaigns are well thought out. According to Seeking Alpha data, APLS’s short percentage is over 22%, so it looks like they haven’t reached their target yet.

There are also potential setbacks in the commercial performance of SYVOVRE, which is dependent on pricing and reimbursement challenges, IP, and ex-U.S. regulatory approvals. Multiple setbacks could hurt commercial performance, thus, forcing the company to chew through their cash position quicker than projected. This would most likely weigh on the share price as investors begin to forecast potential dilution and possibly steep financing terms to keep the company’s commercial operations alive.

Considering these risks, I assigned APLS a conviction level of 2 out of 5 at this point in time.

Our Takeaway

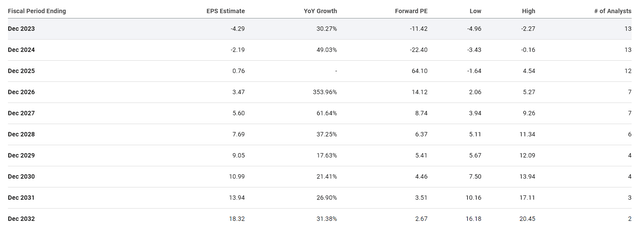

For me, Apellis Pharmaceuticals is showing signs of being on a promising trajectory thanks to the updated Syfovre numbers, as well as their substantial cash reserves, and the potential to expand pegcetacoplan’s uses. If all goes well, Street analysts believe Apellis could report a positive EPS in 2025 and will report strong double-digit growth into the next decade.

Apellis Pharmaceuticals EPS Estimates (Seeking Alpha)

Indeed, those estimates can be hard to imagine considering the company’s current earnings. However, those numbers are obtainable considering the global PNH market is estimated to hit $8.9B in 2030 and the global GH market is anticipated to be ~$35B in 2030.

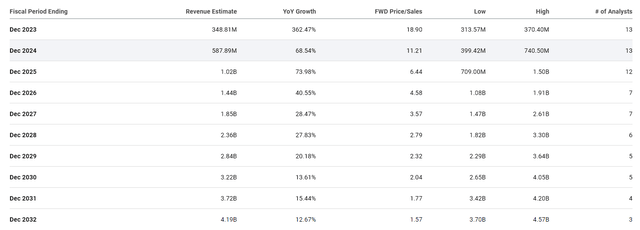

Apellis Pharmaceuticals Revenue Estimates (Seeking Alpha)

Therefore, I don’t see the Street’s estimate of clearing over $4B in 2032 to be unreasonable, especially considering the other potential pipeline programs. This suggests a significant upside over the long term.

What Are We Looking At?

Well, using the Street’s 2032 estimate of $4B and the industry’s average price-to-sales of roughly 4x, we get a fair valuation of $135 per share. Indeed, the ticker is already trading around $50 per share, but keep in mind that the $135 per share valuation is a fair value, and is not a price target considering the ticker’s tendency to trade at a premium. Considering the company could still be in a state of significant growth in 2032, I would expect APLS to be trading at a hefty premium into the next decade.

Overall, despite recent stock volatility, Apellis remains a formidable contender in the biotech landscape, with the potential for significant future growth, and is a prime acquisition target.

My Plan

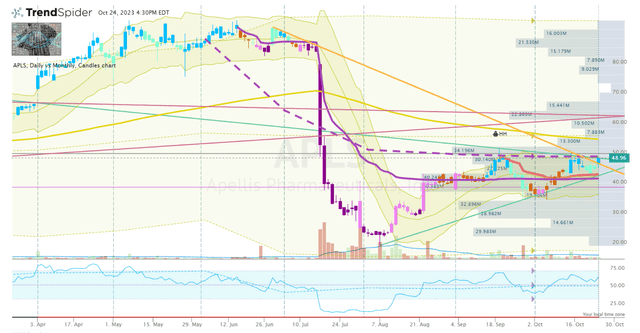

I have APLS near the top of the watch list heading into the company’s Q3 earnings report slated for November 1st. Typically, I would wait for calmer waters well before or after an earnings report to initiate a position in order to find a reliable technical setup. However, Apellis is essentially providing me with some general highlights from their earnings thanks to their recent update. In addition, the ticker was able to break out of their descending wedge formation, so there is a nice setup forming to break above the high of the formation.

APLS Daily Chart (TrendSpider)

Therefore, I will consider starting a minuscule position in the immediate term if the share price is able to break and hold above the formation high. Then, I will look to make another addition following the earnings report if the share price fades and tests the support of the high of the formation.

Admittedly, I am not looking to amass a large APLS position due to its rich valuation at the moment. However, I am willing to reassess my strategy if the Q3 and Q4 earnings verify strong growth that tracks along the Street’s estimates.

Read the full article here