Fat shaming is out of style everywhere but the stock market. Investors should ignore it there, as well.

We’re talking, of course, about the seven large companies collectively known as Big Tech that make up 29% of the S&P 500 index. As their share prices have increased this year, the consternation about their strength has only grown. It’s almost as if their weighting might be the biggest risk to the stock market—to the point that entire strategies are being designed to help investors avoid the pitfalls that come with having so much invested in so few stocks.

Never mind that many of the other risks were on display this past week. War has broken out between Israel and Hamas and threatens to spread across the Middle East. Investors were disinclined to buy long-dated Treasuries at an auction on Thursday, causing yields to surge, at least for a day. Inflation remains sticky, according to the latest consumer-price-index reading. None of those were able to keep the stock market down this past week, however. The

S&P 500

gained 0.45% to push its October gain to 0.9%.

This is all right on schedule, mind you. Seasonality suggests that stocks should be starting to rally right about now. The S&P 500’s strongest period begins on the 197th trading day of the year—Oct. 13 in 2023—and extends through year end, notes Jay Kaeppel, senior research analyst at SentimenTrader. Over that period, the S&P 500 has risen 70% of the time going back to October 1953, with an average gain of 6.8% when it has risen.

None of this is to say that the market can’t go down—30% of the time stocks fall, after all—but the odds are in investors’ favor. What’s more, there have been 12 periods that saw gains of 10% or more and just two that experienced double-digit declines. Together, that means investors should “give the bullish case the benefit of the doubt as long as the market is acting reasonably well,” Kaeppel writes.

One of the two, of course, was Black Monday in 1987, in another bull market led by a handful of stocks, and one that ended with the Dow Jones Industrial Average’s worst one-day loss on record. Comparisons between then and now have started making the rounds, thanks to the rapid rise in bond yields and real interest rates.

Strategas Research Partners’ Chris Verrone, for instance, wrote about seeing “shades of 1987,” while permabear Albert Edwards of Société Générale added his voice to the choir. “Just like in 1987, any hint of recession now would surely be a devastating blow to equities,” he wrote on Oct. 3. “But it could be worse: thankfully, we are not in the seasonally most risky month of the year,” he added archly.

Such comparisons were enough to prompt Ed Clissold, chief U.S. strategist at Ned Davis Research, to rebut them in a note on Friday. While acknowledging the similarities—a strong start to the year, a summer peak, a nearly identical third-quarter pullback, and weakening breadth—he noted the differences, as well. The market’s rally this year was much broader, with plenty of stocks finding themselves in short-term uptrends based on 50-day moving averages. Growth was stronger and accelerating faster in 1987. And even the magnitude of the rate increases isn’t as fast now as it was before Black Monday.

“We conclude that while there are several high-level similarities, not enough line up to conclude that a crash-like event is likely,” Clissold writes.

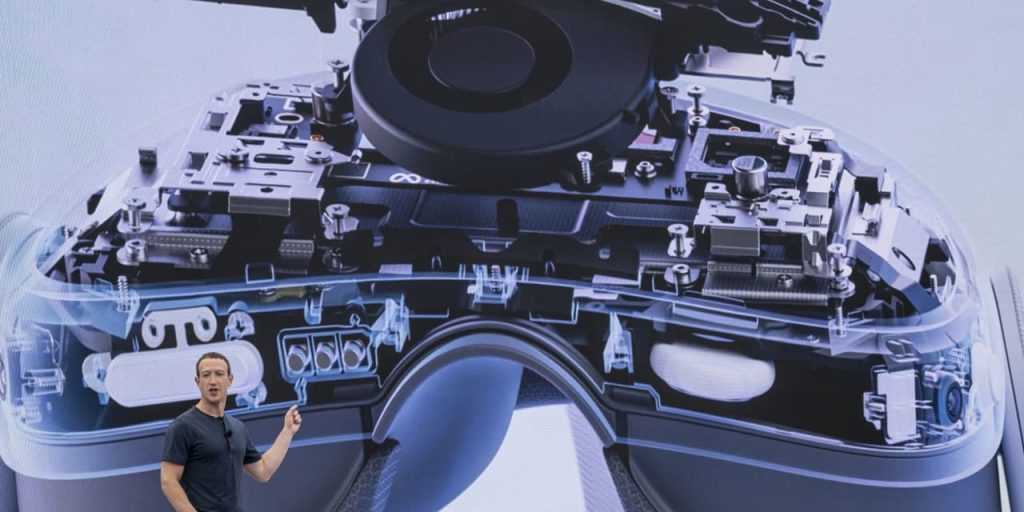

But if we’re going to give the bullish case for the market the benefit of the doubt, as Kaeppel urged, we also have to give the seven Big Tech companies the benefit of the doubt, as well. As a group,

Apple

(ticker: AAPL),

Microsoft

(MSFT),

Alphabet

(GOOGL),

Amazon.com

(AMZN),

Nvidia

(NVDA),

Meta Platforms

(META), and

Tesla

(TSLA) have averaged a 95% gain this year. Even the laggards—Microsoft and Apple, up 38% and 37%, respectively—have nearly tripled the S&P 500’s 13% rise. Given their weightings in the index, they’ll have to keep working for the market to head higher.

That’s not as daunting as it seems. For one, the group is far cheaper than it was at the end of 2021, just before 2022’s big decline. The seven stocks trade for an average of 32.9 times 12-month forward earnings, down from 51.1 at the end of 2021. What’s more, the group is expected to grow earnings this year, as opposed to the beginning of 2022, when earnings were forecast to drop. If anything, investors should be thankful that Big Tech will go a long way toward guaranteeing that S&P 500 earnings will break their slump and grow in the third quarter of 2023.

“Our view is that 3Q earnings over the coming weeks will be an eye opener for the Street as the transformational AI growth and stabilizing IT spending environment will create a massive tech rally heading into year end in which we expect tech stocks to be up another 12%-15% in 4Q,” writes Wedbush analyst Dan Ives.

The ever-bullish Ives may be the flip side of SocGen’s Edwards, but you don’t have to be a tech superfan to believe that the Big Seven will continue to lead the market higher. Andrew Slimmon, head of the applied equity advisors team at Morgan Stanley Investment Management, sees the stocks leading the market into the end of the year, thanks to their strong earnings and reasonable valuations. For an active manager, the hardest thing to do is overweight them, although it needs to be done collectively if not individually. “You have to be overweight,” says Slimmon. “If they lead and we’re not overweight, that will be a problem.”

Individual investors don’t have that problem. They just need to own the S&P 500. In other words, it’s time to fatten up.

Write to Ben Levisohn at Ben.Levisohn@barrons.com

Read the full article here