Stocks declined Tuesday and bond yields rose after a report on U.S. retail sales in September was stronger than expected. Meanwhile, President Joe Biden is scheduled to visit Israel Wednesday amid rising concerns of an escalation of the Israel-Hamas war, and third-quarter earnings season has picked up momentum.

These stocks are making moves Tuesday:

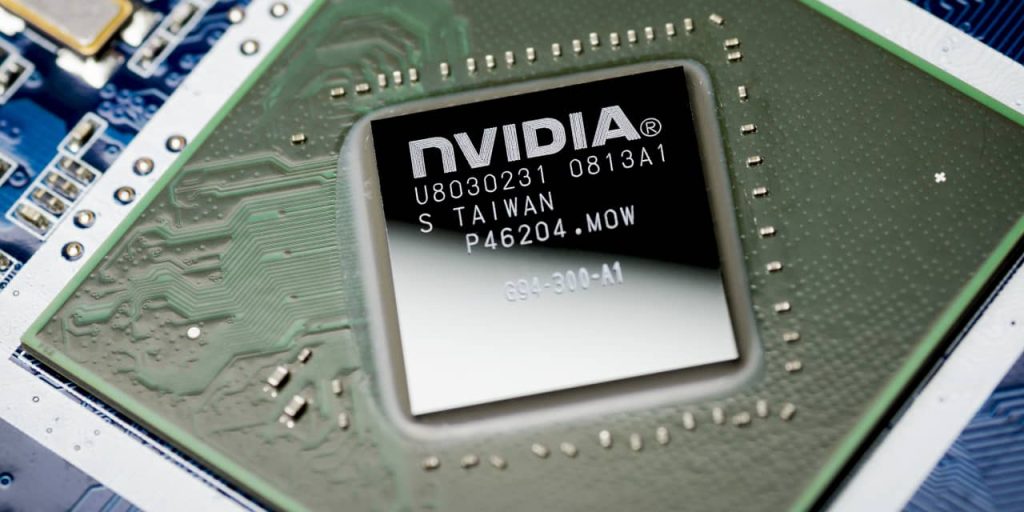

Nvidia

(NVDA) was down 6.6% after the Biden administration said it would be tightening its restriction on exports of artificial intelligence chips to China.

Johnson & Johnson

(JNJ) reported third-quarter adjusted earnings of $2.66 a share, beating analysts’ estimates of $2.52. Sales of $21.4 billion also topped estimates of $21 billion and the healthcare giant lifted full-year guidance. The report marked the company’s first that doesn’t include the results of its consumer health division that separated from J&J over the summer. The stock was up 0.5%.

Bank of America

(BAC) reported third-quarter earnings of 90 cents a share, topping Wall Street forecasts of 83 cents. Net interest income rose 4% to $14.4 billion because of higher interest rates and loan growth. The stock was rising slightly.

Third-quarter profit of $5.47 a share at investment bank

Goldman Sachs

(GS) beat expectations of $5.42. Third-quarter revenue of $11.82 billion declined from almost $12 billion a year earlier. The stock fell 0.3%.

Lockheed Martin

(LMT), the defense contractor, reported third-quarter earnings of $6.73 a share on sales of $16.9 billion. Wall Street was looking for profit of $6.67 a share on sales of $16.7 billion.

Lockheed

was up 1.4%.

Lucid

(LCID) was down 2.9% after the electric-vehicle maker produced 1,550 vehicles in the third quarter, down 32.1% from a year earlier.

U.S.-listed shares of

Ericsson

(ERIC) fell 4.7% after the Sweden-based maker of telecommunications equipment withdrew margin guidance for 2024, saying it expects current macroeconomic uncertainty to “prevail” into next year.

Choice Hotels International

(CHH) launched a hostile bid for

Wyndham Hotels & Resorts

(WH) of $90 a share in cash and stock. Wyndham shares jumped 11% to $76.61. Choice shares fell 6.3%.

NetScout Systems

(NTCT) was falling 22% after the cybersecurity company said it was reducing guidance for fiscal 2024 “to reflect a recent slowing in order conversion.”

SunPower

(SPWR) declined 4% to $5.56 after shares of the residential solar technology company were downgraded to Underweight from Equal Weight at

Morgan Stanley

and the price target was reduced to $5 from $8. Citi also cut its recommendation on SunPower to Sell from Neutral.

Dollar Tree

(DLTR) was upgraded to Buy from Neutral at

Goldman Sachs

and the stock rose 2.7%.

Write to Joe Woelfel at joseph.woelfel@barrons.com

Read the full article here