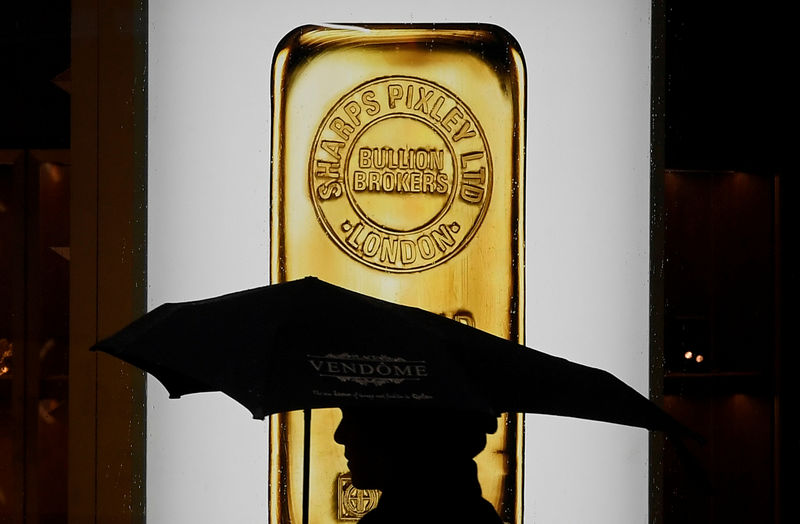

Investing.com– Gold prices swelled to settle at an all-time high on Monday, underpinned by ongoing geopolitical tensions and bets on a Fed rate cuts ahead of testimony from Federal Reserve chairman Jerome Powell later this week.

rose 1.5% to settled at a record of $2,126.30, while expiring in April 1.4% to $2,125.65 an ounce.

Gold’s gains were driven by some soft U.S. economic data spurring bets that the Fed will cut interest rates by June. But anticipation of more cues from the central bank saw traders once again step back from big bets on the yellow metal.

Other precious metals also retreated on Monday. rose 1.9% to $904.75 an ounce, while rose 3.3% to $24.14 an ounce.

Powell testimony, nonfarm payrolls awaited

Markets were now focused squarely on a two-day testimony by this week, for any more cues on the path of interest rates.

Analysts expect Powell to reiterate his stance that the Fed will need more convincing that inflation is moving back towards the bank’s 2% annual target, with the Fed chair widely expected to maintain a hawkish tilt.

But traders were still pricing in a greater chance for a 25 basis point cut in June, according to the .

After Powell’s testimony, focus is also on key data for February, due on Friday. A cooling labor market is also one the Fed’s main considerations for altering interest rates.

Copper prices creep lower before more China cues, ANZ says watch India

Among industrial metals, expiring in May fell 0.4% to $3.8443 a pound, with markets turning cautious towards the red metal ahead of key signals from top importer China.

China is set to hold its 2024 National People’s Congress on Tuesday, and will likely roll out more stimulus measures while also providing economic forecasts for 2024.

Fears of slowing Chinese demand rattled copper prices over the past two years, as a post-COVID economic recovery in the country failed to materialize.

But ANZ analysts said that surging growth in India could help offset a demand slowdown in China. Recent data showed India remaining as the world’s fastest growing economy in 2023, with sustained infrastructure spending in the country likely to drive up copper demand.

Read the full article here