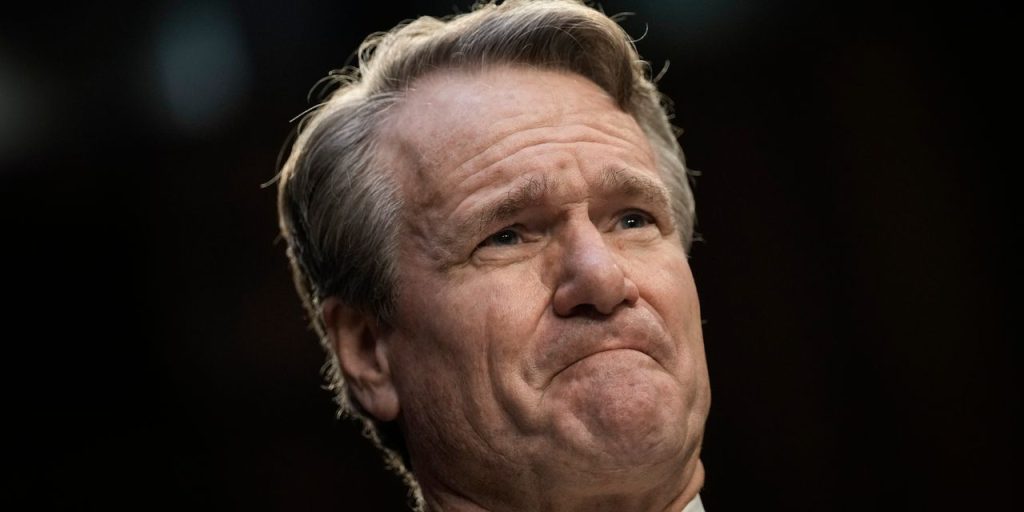

Bank of America Corp. Chief Executive Brian Moynihan doubled down on the bank’s net-zero-emissions efforts despite pushback in the political arena.

Moynihan said that the bank is doing what’s right for its company and its customers, and that the effort by banks to address climate change has been drawing strong support from clients.

“The private sector is deep into this and driving it,” Moynihan said during an interview on stage at the Reuters Next conference on Wednesday.

Bank of America

BAC,

-0.96%

and the financial industry in general have also drawn criticism from the political left for financing oil and gas development, he noted.

Moynihan joked that he must be doing something right if both sides are upset with him.

The bank remains committed to its part in the Net Zero Banking Alliance, a United Nations-backed effort to finance development of renewable energy, Moynihan said.

Meanwhile, Kentucky State Treasurer Allison Ball was elected state auditor of public accounts on Tuesday. Early in 2023, she authored a letter to BlackRock Inc.

BLK,

+0.98%,

JPMorgan Chase & Co.

JPM,

+0.49%

and Citigroup Inc.

C,

-0.33%,

saying those companies would face divestment of state investments for their “boycott” of energy companies.

In Texas, the office of Attorney General Ken Paxton gave notice last month that it was investigating whether major banks including JPMorgan Chase and Wells Fargo & Co.

WFC,

-0.15%

potentially violated 2021 state laws that ban municipalities from investing in companies that discriminate against energy companies and gun makers.

Moynihan said the bank would have to comply with the law in Texas but that it’s not walking away from its climate-change efforts.

Moynihan’s comments came the same week that JPMorgan Chief Executive Jamie Dimon said while visiting Texas that the bank doesn’t discriminate against anybody, but that its makes decisions based on running its business.

“We do make risk, legal, credit and reputational decisions, which is our legal right — and my obligation as chairman,” Dimon said, according to a report by NBC Dallas Fort Worth.

Soft landing on track

Turning to the economy, Moynihan said Bank of America’s economic forecasters continue to project a soft landing for the economy in 2024, with two quarters of anemic 0.5% growth and then picking up from there.

The Federal Reserve will likely raise interest rates one more time in the coming months and then potentially start cutting rates in late 2024, Moynihan said.

At last check, Bank of America’s network of consumers is increasing its spending by about 4% to 5%, which is a “precipitous slowdown” from the double-digit growth of about a year ago, he said.

Across the industry, loans are more expensive, employment levels are coming down and commercial lending is cooling off, he said, while credit-card delinquencies are rising to normal levels comparable with 2019, which was an economically strong year.

“You won’t see massive delinquencies” based on current economic projections, he said.

Read the full article here