With a market capitalization of $226.4 billion, Shell plc (NYSE:SHEL) is one of the largest publicly traded energy companies on the planet and it’s also one of the largest publicly traded companies on the planet period. Leading up to the third quarter earnings release for the firm’s 2023 fiscal year, shares hit a fresh new high. This comes at a time when revenue, profits, and cash flows are all declining. This may cause some investors to worry about whether or not now is the time to invest in the enterprise. But when you consider just how healthy the company is and its long-term objectives, it does seem to me as though upside for shareholders could still be had from this point on.

The picture is worsening and that’s okay

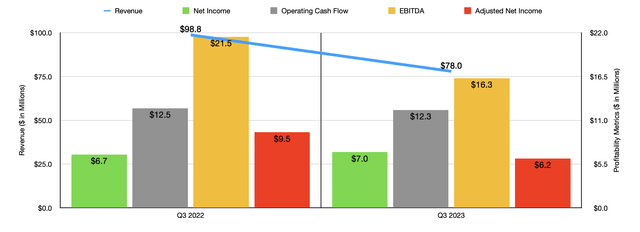

One of the complicated things about investing in the energy market, particularly when it comes to firms involved in oil, natural gas, and NGLs, is that financial performance can be extremely volatile from one year to the next. The important lesson to take away from this is that, so long as shares are still cheap and the enterprise as a whole is healthy, it can be okay for financial results to come in worse year over year than they did the year prior. As an example, we need only look at data covering the third quarter of Shell’s 2023 fiscal year. Revenue for the third quarter came in at $78.01 billion. Although this is a fantastic amount of money, it actually represents a massive decline compared to the $98.76 billion in revenue generated one year earlier. Even with this decline, however, management exceeded analyst’s expectations by $11.29 billion.

Author – SEC EDGAR Data

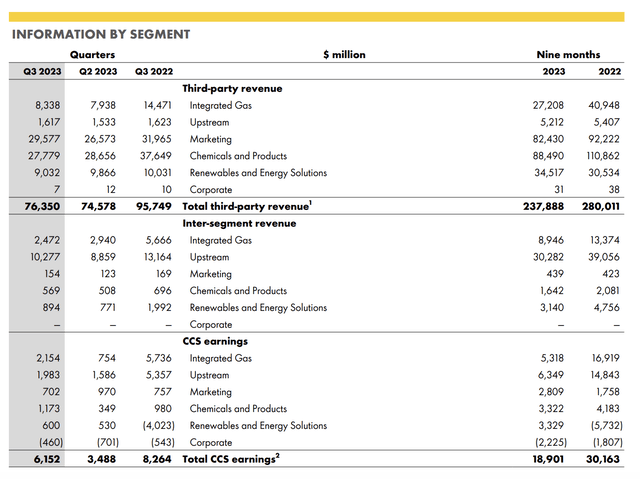

Truth be told, all of the main operating segments of the company showed a weakening on the top line relative to the same time last year. The Integrated Gas segment, for instance, saw revenue plummet from $20.14 billion to $10.81 billion. For those who don’t know, the Integrated Gas segment of the company manages the LNG activities of the firm, as well as the conversion of natural gas into gas-to-liquids fuels and other similar products. Its activities even extend to natural gas and liquids exploration and extraction activities, as well as the operation of any upstream and midstream assets that are needed in order to deliver these products to the market.

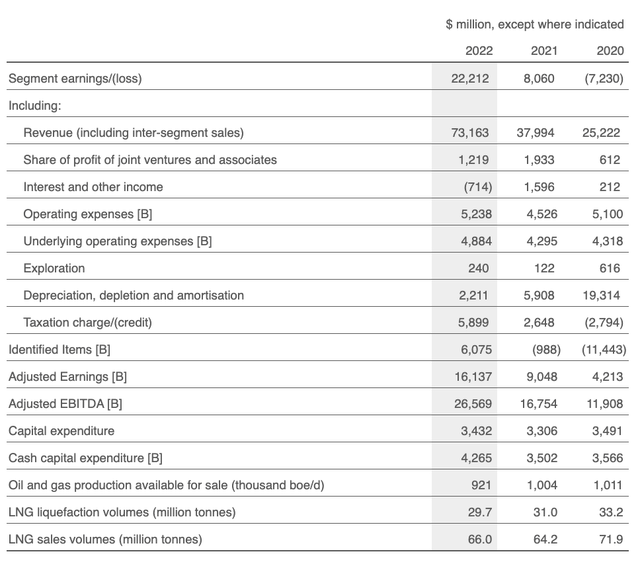

Shell

This is a part of the company that has done incredibly well over the past few years. From 2020 to 2022, revenue skyrocketed from $25.22 billion to $73.16 billion. There are multiple profitability metrics that we should be paying attention to here. The first of these would be the segment earnings generated by the unit. The company went from a loss of $7.23 billion in 2020 to a gain of $22.21 billion last year. But there are other metrics as well. Adjusted earnings, for instance, grew from $4.21 billion to $16.14 billion, while EBITDA increased from $11.91 billion to $26.57 billion.

You would think that, given this rapid expansion, the company has benefited from tremendous operational growth. But that’s not actually the case. Oil and gas production made available for sale through this segment actually declined from 1.01 million boe (barrels of oil equivalent) per day to 921,000 over this three-year window. Liquefaction volumes of LNG fell from 33.2 million tons to 29.7 million tons, while LNG sales volumes dropped from 71.9 million tons to 66 million tons. It is worth noting that some of this pain was driven by massive declines involving Russia given all that’s going on there between it and Ukraine. Back in 2020, Shell reported 3.1 million tons of LNG being dedicated to Russia. That number dropped to only 0.9 million tons of last year. The increase in revenue and profits, then, which driven mostly by higher realized prices, as well as benefits from trading and optimization activities that fall under this segment. Gains related to fair value accounting for commodity derivatives also contributed to some of this upside. But at the end of the day, it does seem as though pricing was the heavy lifter in this formula.

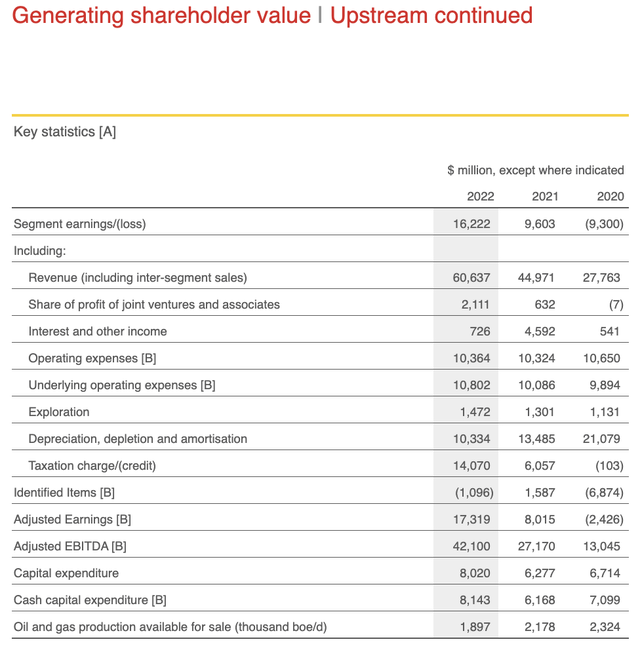

Shell

There is another part of the company that has proven to be a key growth driver in recent years. This is the Upstream segment, which explores for and extracts crude oil, natural gas, and NGLs. It also involves other similar activities such as marketing and transporting oil and gas, and more. This allowed revenue for the segment to grow from $27.76 billion to $60.64 billion. Profits moved nicely higher as well. For the sake of brevity, I won’t detail each of them out. But for context, adjusted earnings for the company went from negative $2.43 billion to $17.32 billion. This, and the other profitability metrics, can be seen in the image above. But just as was the case with the Integrated Gas segment, Upstream did not report any real organic growth. In fact, oil and gas production available for sale as a result of the segment declined from 2.32 million boe per day to only 1.90 million boe per day. This drop in production can be attributed to certain asset sales that the company made and to scheduled maintenance that created downtime. These issues were more than offset by higher pricing that significantly benefited the company and, in turn, its shareholders.

Author – SEC EDGAR Data

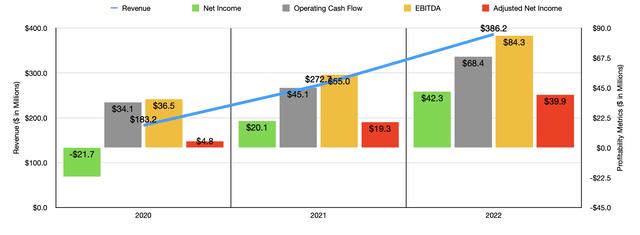

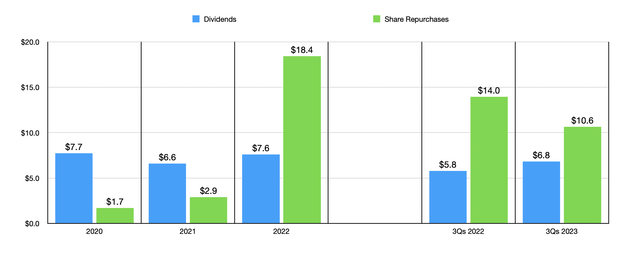

It’s the growth from these two primary segments that has proven instrumental in overall expansion for the company in recent years. Revenue went from $183.20 billion in 2020 to $386.20 billion in 2022. Net profits went from negative $21.68 billion to positive $42.31 billion. As you can see in the chart above, cash flow metrics for the company also improved drastically during this time period but there is also what that improvement does for the business. During that three-year window, management completed $21.95 billion worth of dividend payments. It also repurchased $23.03 billion worth of stock, $18.44 billion of which was completed in 2022.

Author – SEC EDGAR Data

As I showed at the start of this article, however, this year is looking to be quite a bit different. As I pointed out already, revenue associated with the Integrated Gas segment of the company declined materially. But literally all of the other segments saw drops also. The biggest drop, excluding the one seen by Integrated Gas, came from the Chemicals and Products segment, with revenue plunging from $37.65 billion to $27.78 billion. As its name suggests, this segment focuses on the company’s chemical manufacturing plants, as well as all related assets.

Shell

Unfortunately, the declines in revenue that these segments reported brought with them significant declines in profitability as well. Earnings for the Integrated Gas segment, for instance, plunged from $5.74 billion to $2.15 billion while for the Upstream segment profits fell from $5.36 billion to only $1.98 billion. But there was one meaningful bright spot during this time. And that was the Renewables and Energy Solutions segment. Including inter segment revenues generated during the quarter, sales fell from $12.02 billion last year to $9.93 billion this year. But the company went from generating a segment loss of $4.02 billion to generating a profit of $600 million. In fact, this was very instrumental in helping the company earn $1.05 per share for the quarter, which is up from the $0.92 per share generated one-year earlier. It is worth noting that each ADS (American Depositary Share) that somebody owns is actually worth 2 common shares. So that would translate to $2.10 in profit, which was $0.23 per unit higher than what analysts expected.

This is a particularly interesting segment to me because it is a space that management has been investing in heavily. In July of 2022, for instance, the company took the final investment decision to build Holland Hydrogen I, which will ultimately be the largest renewable hydrogen plant in Europe once it goes live in 2025. Of course, the company’s initiatives involve more than just hydrogen. They include biofuels, carbon capture initiatives, electric vehicle charging technologies, and more. For instance, as of the end of last year, the company had over 50 hydrogen fueling retail sites spread throughout Europe and parts of North America. $4.3 billion of the $25 billion that management allocated toward capital expenditures last year ended up going toward carbon capture and other green oriented initiatives. This year, management is planning to spend $23 billion to $25 billion on projects, and with management having dedicated between $10 billion and $15 billion into low carbon and other related initiatives in the near term, it wouldn’t be a surprise to see even more spent this year. This has not stopped the company from directly rewarding shareholders.

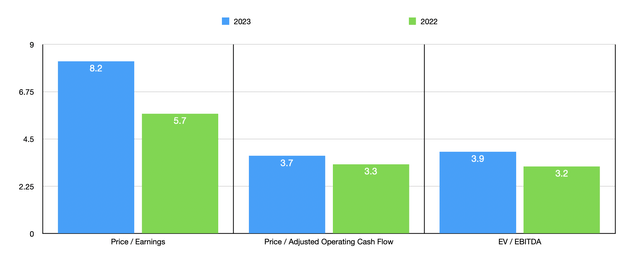

During the most recent quarter, the company allocated $2.23 billion toward dividends and about $2.73 billion toward share buybacks. For the year as a whole, management is targeting $23 billion in shareholder distributions and it announced a new $3.5 billion share buyback initiative just over the next three months. So clearly, the company is using its capital to pay shareholders a tremendous amount without sacrificing growth initiatives. As for valuation, based on my own estimates, the company should generate around $27.7 billion worth of adjusted earnings this year. That’s likely down from the $39.9 billion generated one year earlier. Operating cash flow should fall from $68.4 billion to $61.9 billion, while EBITDA can be expected to drop from $84.3 billion to $69.1 billion.

Author – SEC EDGAR Data

Using these figures, I was able to value the company as shown in the chart above. Even though the stock is more expensive on a forward basis than if we looked at it through the lens of 2022, shares do still look very cheap on an absolute basis. They also are perhaps tilted slightly toward the cheap end of the spectrum relative to similar firms. In the table below, you can see how I priced the company against five similar firms. Using the price to earnings approach, two of the five companies were cheaper than Shell. This number drops to one of the five using the price to operating cash flow approach before rising to three of the five when we involve the EV to EBITDA approach.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Shell | 8.2 | 3.7 | 3.9 |

| TotalEnergies SE (TTE) | 8.8 | 5.7 | 3.7 |

| Chevron (CVX) | 11.0 | 22.5 | 5.6 |

| BP plc (BP) | 4.4 | 3.0 | 2.3 |

| Equinor ASA (EQNR) | 6.1 | 4.0 | 1.6 |

| Exxon Mobil (XOM) | 10.8 | 7.6 | 5.5 |

Takeaway

Operationally speaking, Shell is doing quite well for itself. Yes, this year is looking weaker than last year did. But that doesn’t change the fact that shares look cheap. Personally, I am not a huge fan of share buybacks or distributions. I would prefer capital to be allocated toward more growth initiatives. But considering how cheap the stock is, I would make an exception when it comes to the share buybacks. When looking at the picture as a whole, the company looks to be on solid footing and management is making some interesting investments for the future. Adding all of this together, I would make the case that a ‘buy’ rating on the company is logical right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here