Ahead of its quarterly earnings report, scheduled for next week, Affirm (NASDAQ:AFRM) jumped by an impressive 15.42%. Swept from the market anticipating the Federal Reserve will stop raising interest rates, its alliance with Amazon (AMZN) is a positive catalyst.

Will the upcoming quarterly earnings report undo today’s rally? The stock market is merciless against firms that posted weak results. For example, Cognizant (CTSH) resumed its downtrend after forecasting lower corporate sales. SolarEdge (SEDG) slumped after reporting sharply lower profit margins and trouble ahead. Moderna (MRNA) wrote down COVID vaccine inventory in the last quarter.

Amazon Alliance Expands

Speculators are betting that Amazon Business adding Affirm as the first “buy now, pay later” provider at checkout is a positive catalyst. Regardless of the Q1/2024 results, this rollout should vastly increase Affirm’s revenue outlook.

Affirm timed the Amazon partnership perfectly. Shares jumped on the news. PayPal (PYPL) gained 5.5% after posting higher transaction volumes and an aggressive stock buyback plan. That offsets some of its stock-based compensation.

Affirm Q1 2024 Expectations

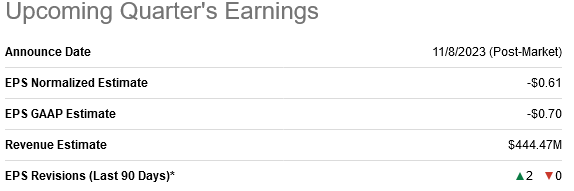

Analysts raised their earnings per share revisions in the last three months. They expect the firm to post a GAAP EPS loss of 70 cents.

Seeking Alpha

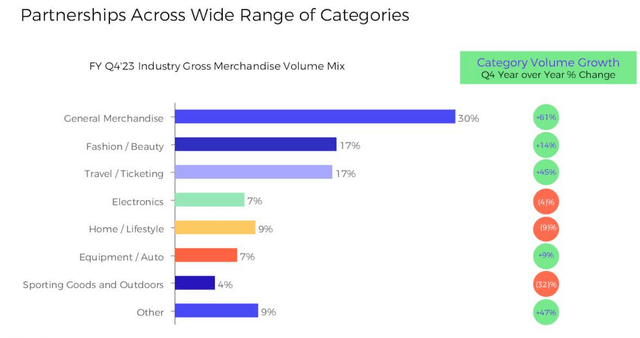

If Affirm posts a normalized EPS loss of -$0.61, it will continue a trend of declining losses through FQ4 2024.

Seeking Alpha

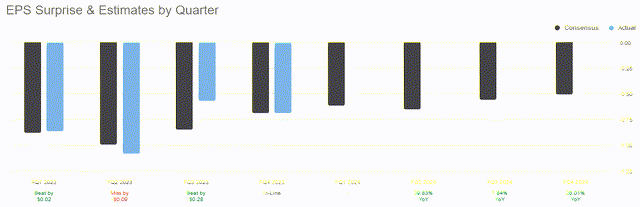

In the last report, Affirm issued a Q1/24 revenue forecast of$430 million to $455 million. This, along with gross merchandise volume (“GMV”) expectations, are above consensus estimates. In Q4, Affirm added around 75,000 active cardholders monthly since late May. It had 300,000 active cardholders as of mid-August. From its Q4/2023 presentation, Affirm posted the highest growth in GMV and in transactions per active customer. It would need to post outsized active customer and revenue growth exceeding expectations.

Affirm Q4/23

Failing to beat expectations may lead to profit-taking, hurting AFRM stock after the report.

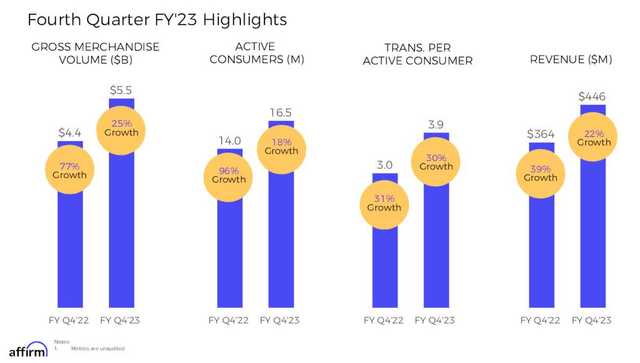

Bullish investors are not concerned about high interest rates hurting demand for “nice to have” items. The Fashion/Beauty and Travel/Ticketing are both big components of the GMV volume mix at 34%.

Affirm Q4/23 Presentation

Fortunately, General Merchandise is 30% of the mix. It grew by 61% Y/Y. Markets already saw a steep sell-off when luxury goods supplier Estee Lauder (EL) cut its full-year outlook. However, the company blamed a slowdown in Asia travel retail and the conflict in Israel for the headwinds.

Affirm’s Fiscal Year 2024 Priorities

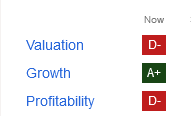

Affirm needs to convince investors that its priorities will lead to profitability. The stock, rated a Hold on the Seeking Alpha quant score, has weak scores in valuation and profitability:

Seeking Alpha

Chief Financial Officer Michael Linford said that Affirm adjusted to the higher rate environment. It prioritized its long-term growth priorities like Affirm Card. It advertised the product as “giving consumers the ability to seamlessly unlock the full power of Affirm in-store or online, providing the flexibility to pay in full or request to pay over time in the Affirm app. Swipe, tap and spend with peace of mind, since Affirm never charges any late fees, hidden fees or compound interest.”

The promise of no hidden fees is appealing. SoFi (SOFI) is an example of a fintech that caters to its customers. By doing this, it’s potentially outflanking the bigger banks like Wells Fargo (WFC), Bank of America (BAC), and Citigroup (C).

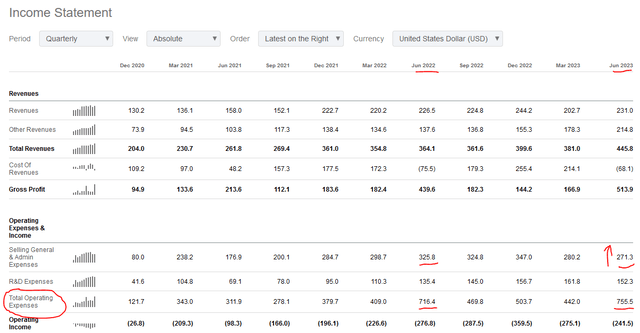

Now at the top of the rate cycle, Affirm expects stability from here. It will prioritize growing and scaling its network aggressively. It will continue engaging with its customers more often and at a deeper reach. Watch for Affirm increasing both its administrative expenses and research and development. To impress investors, revenue will need to grow faster than its costs.

Seeking Alpha

Risks

Affirm posted a weak operating margin in the 2% range. It limits the company’s operating expenditure baseline for the fiscal year. CEO Max Levchin dismissed that concern. He said indirectly that its productive developers should come up with product enhancements efficiently.

The company needs growth in merchant customers. Although it reported new partner signings and expansions, shareholders will need to see GMV growth.

The student loan repayment restart is another risk. However, the CEO said that it modeled for the modest headwind in its forecast and business plan.

Your Takeaway

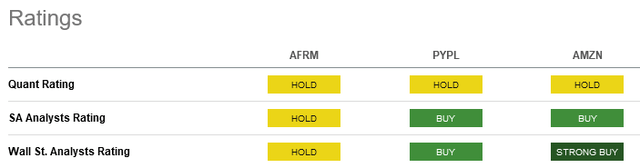

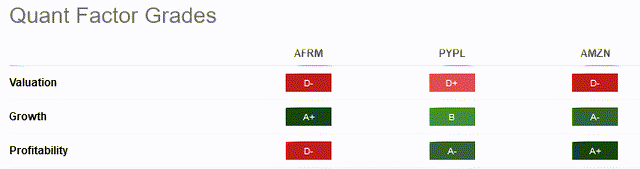

Analysts are most bullish on Amazon, followed by PayPal. They’re potentially overlooking Affirm’s prospects ahead of its quarterly report next week.

Seeking Alpha

Bears need not cite Affirm’s valuations. It scores the same as that of PayPal and Amazon. Short sellers have a 20.06% short float against the stock.

Seeking Alpha

A surprisingly strong quarter would set up a short squeeze. Given the reversal in market sentiment overall and on news of the Amazon partnership today, bears should consider closing the bet before the earnings report.

Read the full article here