Investment Thesis

I wanted to take a look at the financial health of Alpha and Omega Semiconductor (NASDAQ:AOSL) to see if it would be a good time to start a small position before it reports earnings on the 6 November after the market close. The company is suffering from the downturn in consumer electronics, and I wouldn’t be surprised if another quarter comes below estimates and the company’s share price goes further down. Therefore, I initiate my coverage of AOSL with a hold rating until I see financials start to improve significantly and the cyclicality within the industry turns positive.

Briefly on the Company

AOSL designs, supplies, and develops power semiconductor products for computing, consumer electronics, industrial applications, and communications. Products include metal-oxide-semiconductor field-effect transistors or MOSFET, transistors for use in smartphone charges, notebooks, PCs, battery packs, and data centers. Its competitors include Infineon Technologies AG (OTCQX:IFNNY), ON Semiconductor (ON), STMElectronics (STM), Monolithic Power Systems (MPWR), and Texas Instruments (TXN).

The company has two reportable segments: Power Discretes, which include load switching, AC-DC conversion, DC-DC for CPU and GPU, battery protection, and power factor correction. The other segment is Power ICs, which include integrated devices for power management, analog devices for circuit protection and signal switching.

Financials

As of FY23, which ended June 30 ’23, the company had around $195m in cash and equivalents against around $38m in long-term debt. The company seems to be very liquid and such a small amount of debt is not an issue. Its interest coverage ratio stood at around 22x as of FY23, which means EBIT can cover interest expense on debt 22 times over. For reference, many analysts consider 2x to be a healthy ratio, while I consider 5x to be much better as I am on the more conservative side. It also gives some leeway for bad years that eventually occur. So, it is safe to say the company is at no risk of insolvency.

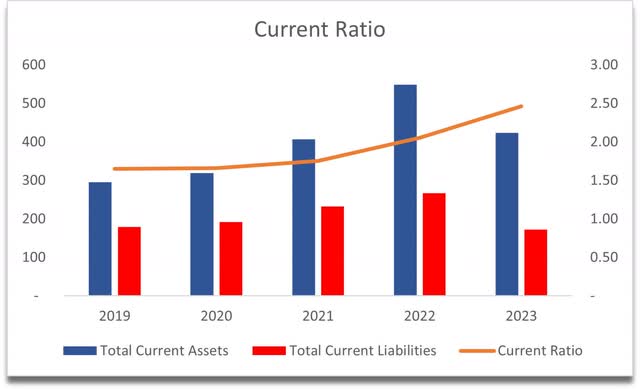

The company’s current ratio has been very strong over the years, which is great. It is right around the range that I think is an efficient range because it has enough liquidity to cover all its short-term obligations and still has enough left for growth initiatives, whatever those may be. Anything too much over 2 I consider a wasted opportunity to deploy capital to further the growth of the company.

Current Ratio (Author)

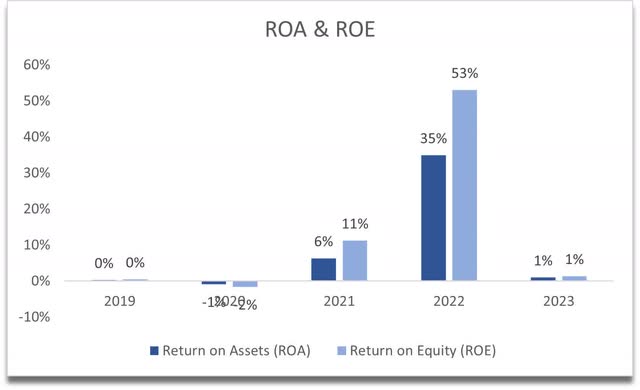

In terms of efficiency and profitability, the company’s historic ROA and ROE have not been particularly appealing over the years except in FY21, and FY22. FY21 seems like a year that saw better profitability and efficiency due to market conditions, while FY22 was due to the deconsolidation gain on JV Company of around $399m. It seems that the company has been particularly hit with the downturn in the industry it is operating, however, I don’t think this is going to continue as this industry is bound to turn back up once again, the question is when? I will cover that in the Comments on the Outlook Section later on but so far, I am not liking what I’m seeing.

ROA and ROE (Author)

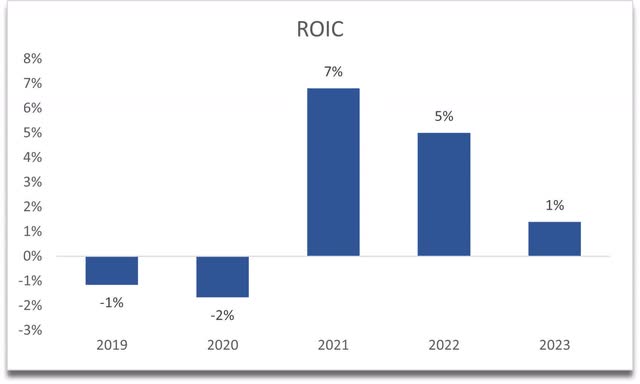

The same story can be seen in the company’s ROIC, which ever since FY21, has trended down and is not very appealing to me. Seems that over the years the company didn’t have much of a competitive advantage or a strong moat.

ROIC (Author)

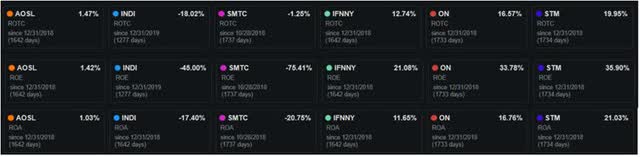

If we compare the company to its competitors, we can see that AOSL is quite the underperformer, especially compared to onsemi, which I recently covered here and opened a small position, and STMElectronics, which I will try to cover in the future. So, there are better companies out there right now that are not being affected by the downturn in the semiconductor industry too much, and that is something to think about when comes to investing.

AOSL vs Competition (Seeking Alpha)

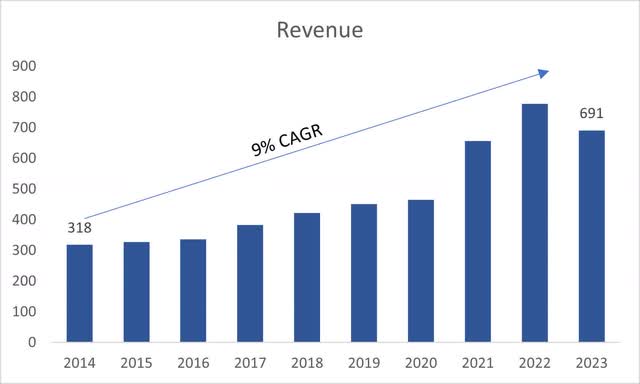

In terms of revenues, the company has been growing a little slowly in my opinion. Other companies like onsemi, managed to achieve low double-digit growth over the last decade, while AOSL had just about 9% CAGR. It’s not to say that it is bad growth, however, from such a small company like AOSL, I would expect something much better.

Past revenue growth (Author)

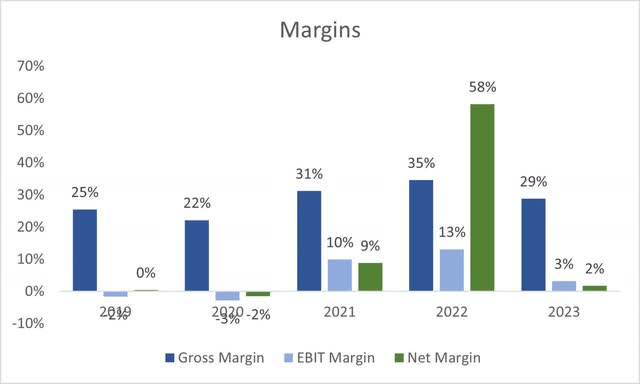

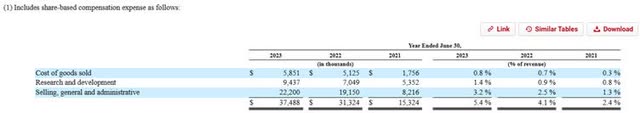

Another area of operations, which is very important, is the margins. These have been quite bad over the years, with the same exception of FY21, and FY22 for the mentioned reason before. Share-based compensation plays a huge role in the company’s results. SBC doubled in the last two years, which makes me think that the company is not going to stop there and will continue to report non-GAAP numbers for a while, which excludes SBC.

Margins (Author) SBC (AOSL 10K)

Overall, there isn’t much to like about the company’s historical performance. Will this improve once the downturn goes away? Only time will tell. I will also be looking for any comments regarding the outlook of the industry from the management but so far, it looks like the company is not prime for a long-term investment right now and will be overvalued.

Comments on Outlook

I’ve covered many semiconductor companies in the past, and the last year or two have not been particularly forgiving for them. There were some glimmers in the industry when it came to EV/automotive industry within the semiconductor sector. This segment performed relatively better than the rest, especially the ones that AOSL gets most of its sales, which are the PC and smartphone markets. Cyclicality has been brutal for companies like AOSL. Revenues saw around 12% dip from FY22 to FY23, and it is not going to be looking too well for the remainder of the year overall.

Many companies that I’ve covered in the past are seeing the bottom set in the semiconductor industry and a slight rebound was already seen in some companies. These companies see a return of demand sometime in the first half of ’24 and that is basically what the experts are seeing too. According to IDC, “PC shipments will go down to 252m units in ’23” and “2023 will be a record negative year for the industry”, there will be a slight rebound going forward in ’24. AOSL’s management is upbeat about the remainder of the year. In the transcript, Stephen Chang said:

“In closing, as we stated last quarter, we believe the worst of the inventory correction in PCs and Smartphones has passed and we look forward to a solid second half of 2023. While we remain cautious beyond our near-term visibility, our fundamentals have never been stronger, driven by our leading technology, more diversified product portfolio, Tier 1 customer base in all our business segments, and expanding manufacturing capability and supply chain. As such, we are confident we will emerge as an even stronger company on the other side of this cycle.”

So, at least that is good news to hear. The bottom is set, and only up from now on, however, there are other matters to think about before investing in the company.

Around 70% of the company’s sales come from 3 customers, which sounds quite risky to me, especially if the company loses one or more of them. This would cut the company’s revenue potential significantly. And why do I think that is a real risk? Well, any of those three customers most likely are either in China or Hong Kong, which with the recent geopolitical uncertainties and bans, is quite a risk for the company. The customers might not be directly affected by these bans; however, a lot of investors may avoid the company because most of their business is done within China and Hong Kong. So, let’s check what I would be willing to pay to take on the risks.

Valuation

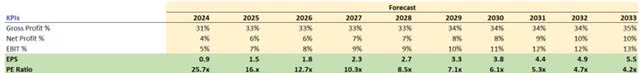

As I mentioned in the outlook section, the PC market is going to rebound slightly in 2024, which means that the cyclicality is about to turn. The company isn’t very widely covered on the Street, so I will have to make some educated guesses as to how the revenue is going to develop over the model period, which is 10 years. I decided to stick with the company’s historical average of 9% for the base case. I don’t think that the past is a good indication of the future, however, it is much better than some completely random figure. Below is the revenue growth of the base, conservative, and optimistic cases.

Revenue Assumptions (Author)

In terms of margins and EPS, I decided to improve these slightly over the next decade. My reason is the demand will pick up and stabilize over the longer period, so the production costs won’t be disproportional to sales, which in the bad times it mostly is. Below are the estimates for margins and EPS.

Margins and EPS assumptions (Author)

So, it looks like the company will be trading at around 26x PE ratio in FY24, which I think is slightly expensive still, however, this seems to improve quite considerably in the later years according to my model.

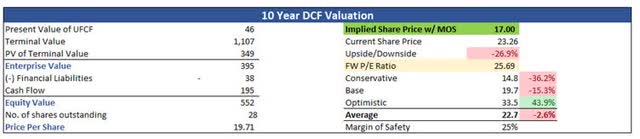

For the DCF valuation, I went with the company’s weighted average cost of capital, which turned out to be 12.24% for my discount rate. It is quite high, and I usually go for around 10% because companies usually have a WACC of around 10%, however, seeing that the company’s financials aren’t the best, I decided to go with 12.24% for an extra margin of safety. The reason its WACC is so high is because of the company’s 3-year Beta, which is around 1.8. The most recent beta many websites have is around 2.4 but I don’t think that is going to stay this elevated for long.

I also went with a 2.5% terminal growth rate for the base case, 2% for the conservative, and 3% for the optimistic case.

On top of these estimates, I also decided to add another 25% margin of safety, so that I get even more cushion on the downside. It’s better to be safe than sorry. With that said, the company’s intrinsic value and what I would be willing to take on the risks is $17 a share, which unsurprisingly means that the company is trading at a premium to its fair value.

Intrinsic Value (Author)

Closing Comments

As I suspected after going through the company’s financials and its growth in sales and seeing that the company is trading at around 55 PE ratio, the company is overpriced for my liking, and the risk/reward if I was to start a position right now is not very enticing, and most likely will underperform in the long run.

I wouldn’t be surprised if the company comes closer to my PT over the next couple of months because of the softness in the industry, which still has not fully recovered from the downturn. On top of that, the macroeconomic environment is not ideal right now, with elevated interest rates and sticky inflation, I could see further risk to the downside over the remainder of the year and probably in early next year. I’ve set a price alert at my PT and will reassess if it comes down.

Cyclicality in this industry is nothing new, it happens all the time, and I know that this too will turn positive once again. One insignificant reason is that I need to upgrade my phone and my laptop already as I haven’t bought these for 3 and 7 years respectively. I don’t think I’m the only one like this.

Read the full article here