I have discussed Enphase Energy Inc. (NASDAQ:ENPH) previously, so investors should view this as an update to my earlier coverage of the company.

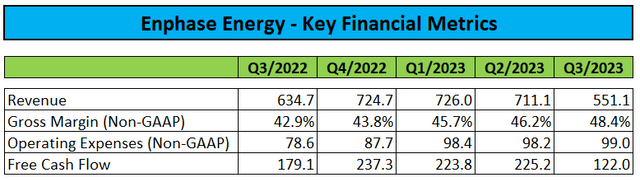

After the close of Thursday’s session, leading microinverter supplier Enphase Energy Inc. or “Enphase” reported third quarter results largely in line with the disappointing guidance provided by the company in late July.

Company Press Releases

Non-GAAP gross margin included a 260 basis point Inflation Reduction Act (“IRA”) benefit as the company continues to ramp up domestic production in the United States.

Enphase generated $122 million in free cash flow for the quarter but this was largely offset by the unfortunate decision to spend $110 million on common stock repurchases at an average price of approximately $130 per share.

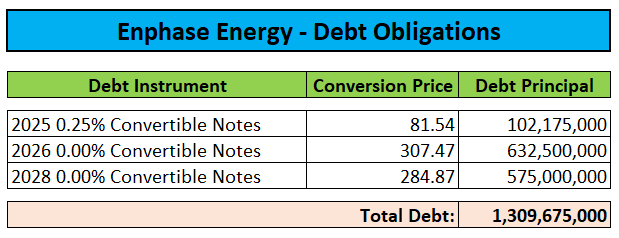

The company finished the quarter with cash, cash equivalents, and marketable securities of $1.78 billion and $1.31 billion in convertible debt:

Regulatory Filings

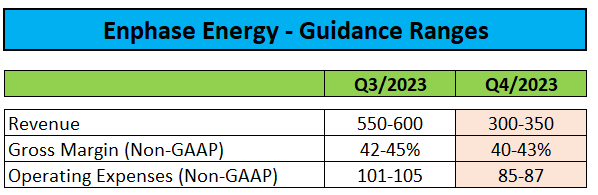

As expected by me after competitor SolarEdge’s (SEDG) ugly warning last week, Enphase’s fourth quarter guidance missed consensus expectations by a mile:

Company Press Releases

Please note that the company’s non-GAAP gross margin guidance for Q4 is net of an anticipated 800 basis point IRA benefit.

At the low end of the provided ranges, income from operations would turn negative.

In the company’s quarterly report on form 10-Q, management blamed the shortfall on a number of factors (emphasis added by author):

The demand environment for our products experienced a broad-based slowdown beginning in the second quarter of 2023 in the United States and in the third quarter of 2023 in Europe.

This resulted in elevated inventory with distributors and installers, and as a result we sold less microinverters to distributors and installers during the third quarter of 2023 as they respond to this slower demand environment.

In the United States, this was primarily the result of higher interest rates and the transition from NEM 2.0 to NEM 3.0 in California increasing the payback period for our customers.

In Europe, this was primarily the result from a slowdown in purchases after the initial surge of sales related to onset of the Russian-Ukraine armed conflict, and more recently lower utility rates.

In addition, there has been increased uncertainty in NEM policy and solar export penalties in a key European market. We expect these trends to continue to have an adverse effect on our revenue in the fourth quarter of 2023.

On the conference call, management warned of additional weakness in Q1/2024 with an expectation for channel inventory to normalize in the second quarter of next year, assuming no near-term improvements in demand.

But even in case the inventory issue being addressed by Q2, revenues would only recover to a range of $450 million to $500 million according to statements made by CEO Badri Kothandaraman during the questions-and-answers session of the call.

While management remained optimistic on demand trends in both Europe and California for the second half of next year, a number of analysts on the call appeared concerned about channel inventory not returning to historical patterns anytime soon.

Quite frankly, I can’t blame them following the company’s second, massive guidance reduction within three months.

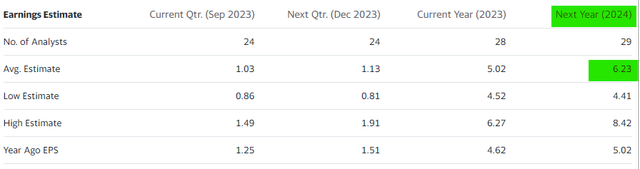

Even when assuming demand to increase in the second half of next year, I would expect Enphase’s 2024 revenues to be down substantially on a year-over-year basis with earnings per share in a range of $2.00 to $3.00 which would be a far cry from the current analyst consensus:

Yahoo Finance

As a result, shares continue to look expensive even when considering the after hours sell-off.

Consequently, I would expect sell-side analysts to slash estimates and price targets across the board over the next couple of days with a meaningful number moving to the sidelines until visibility improves.

Considering the company’s abysmal near-term outlook in combination with general market weakness and potential tax loss selling, I wouldn’t be surprised to see shares trading closer to $60 going into 2024.

Bottom Line

Enphase Energy’s core microinverter products are facing major demand headwinds in both California and Europe which will likely take a couple of quarters to resolve.

However, even assuming the current inventory glut being addressed in due time and demand to improve in the second half of next year, the company’s revenues and earnings are likely to miss current consensus expectations by a mile.

With analysts being required to rework their models, I would expect a host of near-term price target reductions and downgrades.

Given the magnitude of the shortfall projected for the next two quarters and limited visibility into demand trends for the second half of the year, I would advise investors to move to the sidelines for now.

Based on my expectations for 2024 revenues and earnings to take a major hit, I am reiterating my “Sell” rating on the shares with a near-term price target of $60 which might prove generous should demand not pick up in H2/2024.

Risk Factors

Given current market conditions, there appear to be little risks for the near-term bear case on the shares.

However, any signs of residential solar demand picking back up are likely to result in the shares staging a major recovery rally.

Read the full article here