Investment Thesis

We ascribe a Buy rating on Spectrum Brands (NYSE:SPB) primarily driven by its long term positioning within its pet care business with focused portfolio post product rationalization along with easing industry wide headwinds within its Home and Gardens business. The closing of the sale of its HHI business removes an overhang bolstering its balance sheet, we remain skeptical on its Home & Personal care (HPC) business and management’s inability to sell is likely to pose a key overhang on the stock. We believe the company is likely to achieve a mid single digit growth in the longer term (excluding HPC business) and remain positive on the overall story despite the 80%+ rally in the past year.

Company Background

Spectrum Brands is a diversified branded consumers and home essentials company with operations in three segments: 1) Home and Personal Care (HPC) 2) Global Pet Care (GPC) and 3) Home and Garden (H&G). The company manufactures and distributes products globally with North America generating the bulk of sales (63%) along with EMEA (26%) with remaining sales generated from Latin America (8%) and Asia (3%). Products include kitchen appliances and personal care appliances such as hair dryers, body groomers and shaving kits within HPC, animal food and care products for a wide range of animals as well as aquatic tools and kits within Global Pet Care as well as pest control products, cleaning solutions and animal repellents within Home and Garden segment.

Significant Challenges in HPC business

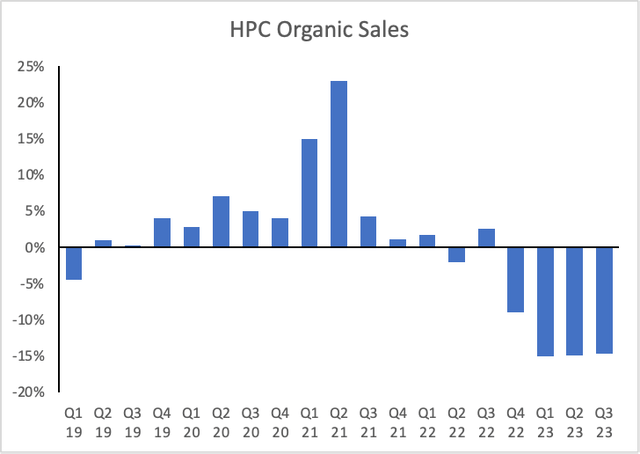

Home appliances formed about 66% of the total revenue with the rest of the revenues contributed by personal care products, as of FY22. In addition, about 35% of the total sales are contributed by Walmart and Amazon with manufacturing primarily outsourced to Asia. From a historical perspective, Spectrum announced in Jan 2018 that it had signed an agreement with Energizer to sell its battery and lighting solutions business and simultaneously announced that the remaining appliance business will be held for sale and be reported as discontinued operations. However, it was only later after a year that the company decided to keep the business which led to the suffering of the organic sales growth. The company witnessed significant growth due to COVID related tailwinds as a larger number of people staying at home led to an exponential growth in its appliance and personal care business. It reported consistently high teens double digit decline in organic sales growth driven by inventory reduction by the retailers as a result of the cautious outlook, particularly within the appliances category.

Company filings

We remain cautious on the demand outlook within the appliance business as several large manufacturers such as Electrolux, maker of popular brand Frigidaire, reported continued decline in shipments, along with adverse product mix and high promotional environment while Whirlpool also guided towards a cautious outlook.

Even though we are starting to see early, but clear signs of a strengthening U.S. housing market, which will benefit us disproportionately, but broader consumer sentiment is still cautious and not yet pointing towards more discretionary purchases.

– Marc Bitzer, Chairman and CEO (Source: Q2 Earnings)

This was echoed by the company’s CEO in its latest investor call.

We continue to see pressure in the home — small home appliance space due to lower consumer demand and continued higher-than-expected retail inventory levels.

– David Maura, Chairman and CEO, Spectrum Brands

The company’s poorly timed acquisition of Tristar in 2021 along with lower demand for kitchen appliances exacerbated the decline. In addition, even currently the company spends about $15 – 20 mn annually (as of 2021 and 2022) in legal and professional fees to evaluate strategic initiatives for the separation of HPC business. Given the lack of management’s focus on the business, weak industry backdrop as well as its inability to sell the business entails a continued overhang for the company’s HPC business.

Green Shoots in Home and Garden

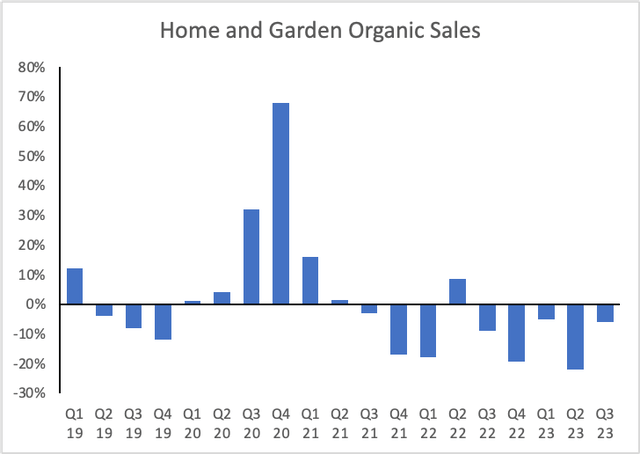

Home and Garden business has a diversified revenue stream with weed control solutions (39%) and household pest solutions (31%) contributing the bulk of revenue while repellents (23%) and cleaning solutions (7%) contributing the rest. It largely derives its revenues from the US (99%) with miniscule revenue generated from Latin America (1%). The company has reported negative organic sales growth in past 8 out of 9 quarters as a result of continued challenges.

Company filings

The sharp decline was as a result of the adverse weather as well as continued lower inventory levels by the retails which came in worse than expected. However, the destocking continues to remain am industry wide headwind but the demand has improved in July / August, still remaining below post-COVID levels which is likely to help them arrest the decline entering into FY24. The company has been able to maintain double digit Adj. EBITDA margins as a result of strict cost control and lower advertising and promotion spends. We believe the Home and garden segment looks better placed with the easing industry wide disruptions heading into FY24, improving demand levels and operational leverage which can lift EBITDA margins.

Pet Care remains a Silver Lining

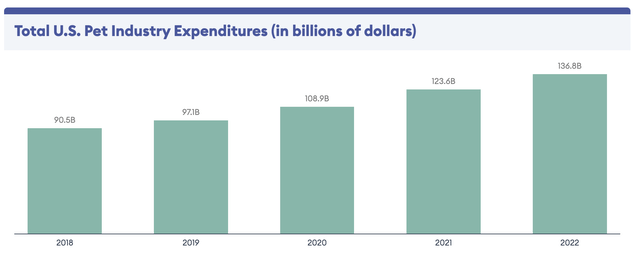

US Pet Industry expenditures has consistently grown at a 11% CAGR during the 2018-2022 as a result of increasing pet adoption and humanization of pets as families increasingly view their pets as a part of their family. This has led to the premiumization of products as pet owners often opt for high quality premium food and care products for their pets. According to American Pet Products Association, US Pet Industry expenditures is set to grow to $143.6 bn in 2023, up 5% YoY.

Forbes, American Pet Products Association

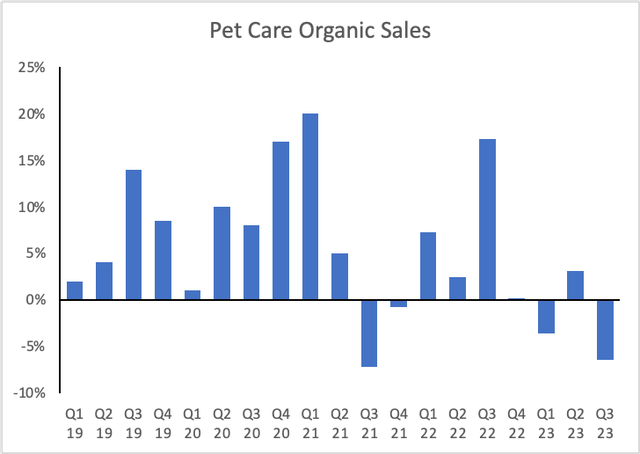

Companion animals forms about 70% of the total sales compared to 30% for Aquatics with North America (65%) and EMEA (30%) contributing the bulk of the sales. Pet care business has consistently reported strong organic growth historically driven by premiumization and increasing pet ownership, however, the weakness in the aquatics business has led to a decline in the organic sales growth in the recent quarters.

Company filings

We believe the aquatics business is likely to be soft but turn positive and report low single digit growth going into FY24 on the back of an improving demand environment and moderation of SKU rationalization. SKU rationalization contributed to a bulk of the decline recently and could pose headwinds entering FY24, however, this would entail a much cleaner and focused portfolio which will be poised for a mid single digit growth going forward.

Valuation

We value SPB on a SOTP basis given the different business models. We compare its Home & Personal care business with Hamilton Beach Brands (HBB), Newell Brands (NWL), SharkNinja (SN), De’Longhi America (OTCPK:DELHF) and Helen of Troy (HELE). Given the relative underperformance of SPB’s HPC business and continued overhang, we apply a 30% discount and ascribe an EV/ Fwd EBITDA of 6.2x for its HPC business.

| EV/ Fwd EBITDA | |

| Hamilton Beach Brands | – |

| Newell Brands | 8.7x |

| SharkNinja | 8.9x |

| De’Longhi America | 8.1x |

| Helen of Troy | 9.7x |

| Average | 8.8x |

We compare its Home and Garden business with similar sized businesses, The Scotts Miracle-Gro Company (SMG), Central Garden & Pet (CENT) and Henkel (OTCPK:HENKY). We ascribe an EV/ Fwd EBITDA of 10.6x in line with the peer average.

| EV/ Fwd EBITDA | |

| Scotts Miracle-Gro | 13.6x |

| Central Garden and Pet | 9.6x |

| Henkel | 8.6x |

| Average | 10.6x |

We compare its Global Pet Care business with other players in pet care and wellness market including Chewy (CHWY), Freshpet (FRPT) J. M. Smucker (SJM), Central Garden & Pet (CENT) and Petco (WOOF). We ascribe a target price of 10x at a slight premium to the mature players, excluding Chewy due to its growth premium.

| EV/ Fwd EBITDA | |

| Chewy | 20.0x |

| Freshpet | NM |

| JM Smuckers | 9.2x |

| Central Garden & Pet | 9.6x |

| Petco | 8.0x |

| Average | 11.7x |

SOTP Value

| ($mn) | Valuation Basis | Enterprise Value |

| HPC | 6.2x Fwd EBITDA | $370 mn |

| Home & Garden | 10.6x Fwd EBITDA | $864 mn |

| Pet Care | 10.0x Fwd EBITDA | $1,320 mn |

| Total EV | ||

| (+) Net Cash | $800 mn | |

| Equity Value | $3,354 | |

| Implied Price | $95 |

As per the SOTP value, the implied share price is $95 which represents a 25% premium to the current market price. We initiate with a Buy.

Risks to Rating

Risks to rating include

1) Prolonged overhang within its Home and Personal care business as a result of management’s inability to restructure or sale could lead to continued sales decline and weak profitability

2) Management can take longer than expected to rationalize its pet care portfolio which can contribute further decline in organic sales

3) Inventory destocking continues across the home and garden and HPC business which can further lead to weakness well into FY24

Final Thoughts

The company’s closing of the sale for its Home and Hardware business is a welcome step which addresses significant steps in bolstering its balance sheet while focusing on its core businesses. We believe while the HPC business continues to be an overhang, we remain positive on its pet care business driven by favorable industry tailwinds and its strong brand positioning along with focused portfolio (post SKU rationalization). In addition, while its Home and Garden business faces industry wide headwinds as a result of inventory destocking, we believe this could further ease up heading into FY24. We ascribe a Buy rating with a target price of $95.

Read the full article here