Shares of Fiserv, Inc. (NYSE:FI) reacted positively to the company’s solid set of Q3 earnings results, rising 4% in response on Tuesday morning. This adds to what has been a solid year for investors, with its stock rising over 17%. Since I recommended shares last October, they have converged to my $113 fair value estimate, making now an opportune time to determine whether these results point to further upside.

Seeking Alpha

In the company’s third quarter, Fiserv earned $1.96 in adjusted EPS, rising 20% from last year and beating consensus by $0.03. FI delivered these strong results on adjusted revenue growth of 8%. Organic growth was 12%. Last year, I argued Fiserv had strong growth engines within its business, and while those investments were weighing on margins, we would begin to see them pay off over the next year. We have.

Not only is the growth continuing, but the margin recovery has been truly impressive, which is why adjusted EPS rose more than twice as quickly as revenue growth. Overall, operating margin expanded 160bp to 38.1%. Most impressively, even as revenue rose by $255 million, its cost of processing and services fell by $132 million during the quarter as businesses build scale, past M&A is fully integrated, and some units appear to be taking pricing. Importantly, I see strength across the board.

Fiserv’s biggest unit is its merchant segment. This unit saw revenue rise 12% to $2.1 billion. Its overall volume growth was 6%, pointing to increased revenue per unit. As a consequence, there was 350bp of margin expansion here. This unit helps businesses accept transactions, and there had been concern that emerging fintech players like Block (SQ) could push out legacy providers like FI. This has not been the case; instead, Fiserv has its own fintech growth engine within the business-Clover. Clover’s revenue rose by 26%. This was driven by the fact that Clover’s gross payment volume is up to $272 billion, up 15%. With revenue rising 11 percentage points faster than volume, Clover is gaining pricing power as it builds scale and entrenches itself into small and medium sized businesses’ payment systems.

Industries always face disruption, but legacy players do not necessarily have to be the losers of the disruption. Instead, they can innovate and adapt, shifting their businesses to take advantage of new technologies. With Clover, Fiserv is doing just that. This component of its merchant business is growing more than twice as quickly as overall volume growth, and it is now building pricing. This has played a role in the margin expansion we have seen. I continue to expect solid double-digit growth out of Clover through next year. It is worth noting that last quarter, Block’s annualized GPV was about $240 billion. Clover is now bigger than that. SQ’s market capitalization is about $27 billion, whereas all of FI is $67 billion. With FI, I have long felt you are able to buy strong growth businesses at a discount valuation.

Elsewhere, its payments and network volume rose 5% to $1.171 billion with 270bp of margin expansion. In particular, FI is seeing strength in debit cards. Notably, its growth opportunity in this segment comes from Zelle, the banks’ peer to peer payments platform. Its Zelle clients rose by 26% while transactions rose by 44%. While Zelle is less than 5% of the business and much earlier in its journey relative to Clover, this is solid growth. I am also encouraged to see volumes grow much more quickly than customers, pointing to customers using the application with increasing frequency. It should be a continued tailwind for the business.

Lastly, Fintech is its smallest unit with about $700 million in revenue, but it also posted a 6% organic revenue growth increase, adjusting for divestitures. Critically, all of this growth and margin expansion is flowing down through cash flow. FI generated $1.25 billion of free cash flow in the quarter and $2.7 billion year to date. It is important to note FI tends to see working capital headwinds in H1 that reverse in H2 given the cadence of its payments. This year, there has been -$700 million of working capital movement, which should shrink during Q4.

Just as FI has reduced operating expenses as it has gained scale, it has been able to slow the pace of investment in its business. So far this year, cap-ex spending has been $1.04 billion from $1.15 billion last year. This has provided a further lift to free cash flow. Importantly, FI is still spending over 5% of revenue on cap-ex, which I view as consistent with investing to grow and innovate. We are seeing cap-ex return to more normal level after an acceleration in spending to grow the business; we are not seeing Fiserv underinvest. This is a critical distinction.

With this strong free cash flow, FI did $1.2 billion in share repurchases during the quarter, taking the 2023 total to $3.7 billion. This has exceeded free cash flow, in part due to the anticipation of working capital movements. Net debt has also increased by about $1.3 billion due to the issuance of 5- and 10-year bonds. Due to this share repurchase funded from free cash flow and incremental debt, its share count is down by 5.4% from last year.

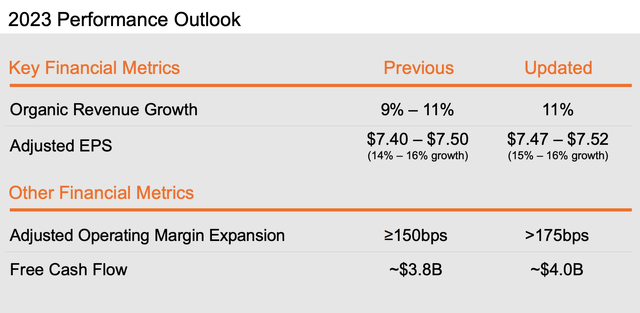

Alongside these strong results, management raised earnings, revenue, and free cash flow guidance, as you can see below. Margin expansion is also forecast to be stronger than previously expected, which is consistent with the solid results the company published today.

Fiserv

Last year, I argued FI had about $7 in go-forward earnings power as Clover continued to grow, and margins began to recover. However on the margin front with better pricing and disciplined cost control, FI has accomplished in one year what I thought might take two to three. As such, FI will be able to earn about $7.50. Over the next twelve months, I expect margin gains to slow, meaning EPS growth will decelerate towards revenue growth. With Clover maintaining strong momentum, revenue should continue to rise 8-11% next year. Combined with the ability to repurchase about 4% of shares per year from free cash flow, I would look for 12-15% EPS growth next year or about $8.50 in 2024 earnings power.

While some concern over its legacy business is likely to leave multiples somewhat compressed versus a pure-play fintech player, with Clover, Zelle, and operating discipline, I continue to believe a 15-16x multiple on forward earnings is justified, pointing to a fair value of $130-135. FI has strong growth platforms within its business; these continue to mature, providing margin and cash flow benefits. Fiserv, Inc. remains a great stock for long-term investors seeking solid growth at a reasonable valuation.

Read the full article here