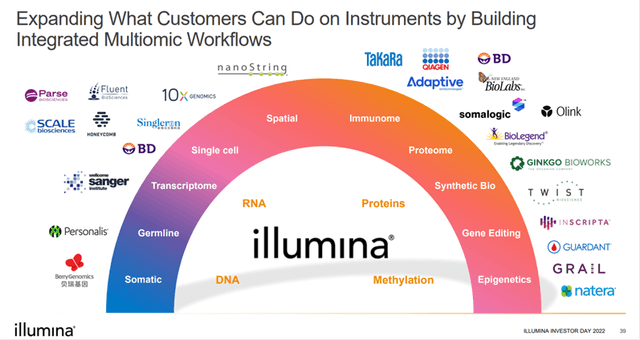

Illumina (NASDAQ:ILMN) is the world leader in gene sequencing with about 75% global market share and 90% domestic share. The sequencing[1] of DNA – the gene’s building-block – is used for a wide range of genetic research and clinical applications today. In the future, DNA sequencing, along with DNA synthesis/replication and encapsulation, can potentially address enormous non-medical applications like data storage, compute, cryptography, agriculture and other industrial applications. Illumina’s genetic research and clinical medical applications include genetic and infectious diseases, drug discovery, reproductive health, oncology, research/applied genomics, and multi-omics[2].

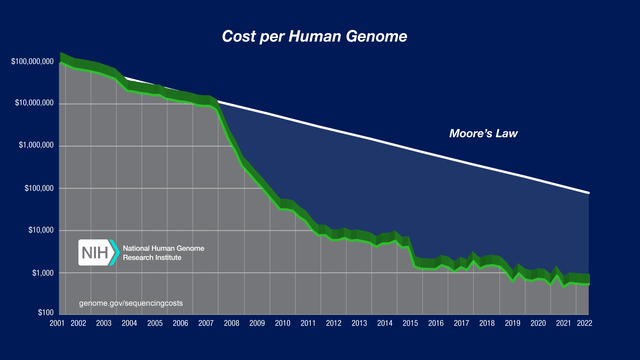

Illumina’s annual revenues stand at $4.5 billion, grew at an 11% CAGR from over the last five fiscal years, with gross margins of 69% to 71% and $4.2 billion in accumulated operating cash flow. Illumina’s next generation sequencing {NGS} market is expected to double over the next five years, growing at a 15.7% CAGR. NGS’ improving throughput and subsequent lower genome sequencing costs are leading to rising demand for the detection of diseases such as cancer as well as national health studies.

The company has two key competitive advantages. The first is the scalability of its DNA sequencing platform. The company’s proprietary sequencing by synthesis {SBS} tracks the addition of labeled nucleotides as the DNA chain is copied in a massively parallel fashion. The scalability of SBS enables the sequencing of more than 20,000 human genomes per year. The recently launched NovaSeq X production-scale sequencing systems can read a human genome for as little as $200, much lower than 2022 levels.

NIH

The second advantage is a highly integrated and scalable system that provides a lower cost of ownership to customers. Illumina provides critical operational support for customers’ sample preparation, instrument control/management, and post-run analysis, providing benefits such as end-to-end workflows, lower data compression losses, lower storage and compute costs, etc. Once customers are integrated into Illumina’s informatics suite, bio-IT platform, and connected analytics, they tend to stay. Furthermore, Illumina is the cornerstone of the broader sequencing / multi-omics ecosystem.

Illumina

Illumina has an attractive business with growing recurring revenues and economies of scale. Instrument sales accounted for 18% of Q2 2023 core sequencing revenues, the remainder comes from higher-margin consumables and services. Each new instrument sold creates a recurring, higher-margin revenue stream of consumables and services. Secondly, as previously mentioned, as sequencing costs fall, demand increases due to the plethora of new applications that can now be feasibly addressed. Illumina has disproportionately benefited from lower genome costs by keeping its clients’ total cost of ownership below that of its competitors.

In some ways, Illumina can be compared to Nvidia (NVDA). Just like Nvidia, Illumina has a dominant market share in a fast-growing market. Nvidia’s CUDA proprietary computing platform locks in developers into its GPU hardware; the same type of competitive moat that Illumina’s informatics, bio-IT and analytics provides to its users. Some startups are claiming to have faster GPUs than Nvidia, just like some upstarts claim to have lower sequencing costs per gigabase than Illumina. But it does not matter, as long as Nvidia and Illumina are in the same ballpark, their support ecosystems provide the competitive moat including lower total cost of ownership that retains customers. I know this firsthand from Illumina customer visits.

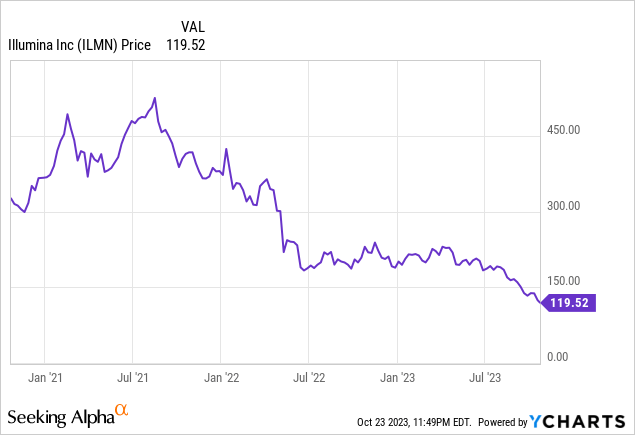

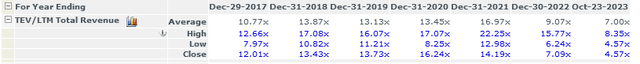

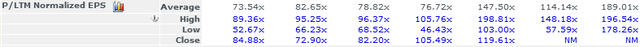

Nvidia’s top-line growth rate is expected to accelerate substantially in 2023 led by generative AI, resulting in a 194% year-to-date jump in the NVDA stock price, with EV/LTM revenues of 32.3x. Currently priced at $119.47, ILMN stock is down 41% year-to-date and 77% from its August 2021 peak, with EV/LTM revenues of 4.6x (well below its last-five-year average of 13.3x).

Illumina’s weak stock market action can be attributed to several factors including 1) product timing transition while NovaSeq X ramps up, 2) dwindling COVID test revenues, 3) China difficulties, 4) possible competitive worries, 5) macro-economic conditions, and last but not least, 6) punitive regulatory steps from Illumina’s re-acquisition of its stake in Grail that it did not already own.

The NovaSeq X product launch started in earnest in Q1 of 2023, with production capacity ramping over the 2023-2024 period. In the interim, several customers are postponing orders from the previous production-sale sequencers – NovaSeq 6000, and waiting for the more-efficient NovaSeq X series. Secondly, COVID surveillance program revenues shrank to $6M in Q2 2023 versus $27M in the year-ago quarter. Third, China is taking various measures to supplant Illumina DNA sequencers with domestic alternatives, notably low-cost sequencers from BGI Genomics (SZSE:300676). This demand slowdown is limited to China, which is about 10% of total revenues. The China slowdown is limited to mid-to-low throughput sequencers, albeit being the majority of the volume.

Fourthly, competition comes from larger longstanding companies like Thermo Fischer Scientific (TMO), Qiagen N.V. (QGEN), and BGI/Complete Genomics, as well as smaller players and startups like Pacific Biosciences (PACB), Oxford Nanopore (LSE:ONT), Singular Genomics (OMIC), Element Biosciences, and Ultima Genomics, some of which are in Illumina’s hometown of San Diego, CA. As some of Illumina’s sequencing patents are expiring, some competitors have tried to incorporate its SBS sequencing methodology, notably in the mid-throughput category. In addition, the EU has even revoked a few key Illumina patents in 2019. Still, Illumina has more than adequate patent protection with 9,178 patents, including the defense of its proprietary support tools.

Side-by-side industry comparisons of NGS mid-throughput sequencers (the majority of Illumina sequencing revenues today) and NGS high-throughput sequencers are shown below. The key is that Illumina is in the ballpark on various metrics, and then wins on lower total cost of ownership through its integrated support tools.

|

NGS Mid-Throughput DNA Sequencers |

|||||

|

Measurement |

Illumina NextSeq 550 |

Illumina NextSeq 1k/2k |

Element Bio Aviti |

Singular G4 F2 Flow-Cell |

Pacific Bio Onso |

|

Run Time (hour) |

30 |

48 |

48 |

19 |

48 |

|

Max Output Run (gb) |

120 |

360 |

600 |

200 |

150 |

|

Max Reads Paired Ends (m) |

400 |

2,400 |

2,000 |

660 |

500 |

|

Max Read Length |

2×150 |

2×150 |

2×150 |

2×150 |

2×150 |

|

Flow Cell/Run |

1 |

1 |

2 |

4 |

NA |

|

Daily Max Output (gb) |

96 |

180 |

300 |

253 |

75 |

|

Accuracy# |

>85% |

>85% |

>90% |

75% – 90% |

>90% |

|

Instrument Price |

$275,000 |

$335,000 |

$289,000 |

$350,000 |

$259,000 |

|

Best price per Gigabit |

$41 |

$17 |

$2 |

$9 |

$15 |

|

# Assumes a Quality Score of Q30 (99.9% accuracy of base call) except Pacific Bio with Q40 (99.99% accuracy) |

|||||

|

Source: Company Data, UBS¸ Biocompare |

|||||

|

NGS High-Throughput DNA Sequencers |

|||||

|

Measurement |

Illumina NovaSeq6000 |

Illumina NovaSeqX |

Illumina NovaSeqX Plus |

BGI DNBSEQ-17 |

Ultima UG100 |

|

Run Time (hour) |

13 |

13 |

13 |

~16-18 |

~20 |

|

Max Output Run (gb) |

~6,000 |

8,000 |

16,000 |

7,000 |

3,000 |

|

Max Reads Paired-Ends (m) |

16,000-20,000* |

52,000§ |

52,000§ |

5,800 |

NA |

|

Max Read Length |

2×250 |

2×150 |

2×150 |

2×150 |

2×150 |

|

Flow Cell/Run |

0^ |

2 |

1 |

2 |

4 |

|

Daily Max Output (gb) |

96 |

180 |

300 |

253 |

75 |

|

Accuracy# |

>90% |

>90% |

>90% |

>85% |

NA |

|

Instrument Price |

~$1,000,000 |

~$1,000,000 |

~$1,250,000 |

~$1,000,000 |

NA |

|

Price per Genome |

~$450 |

~$200 |

~$200 |

~$100 |

~$100 |

|

# Assumes a Quality Score of Q30 (99.9% accuracy of base call) § Assumes 25 billion flow cell, 20,000 if use 10 billion flow cell, 3,200 if use 1.5 billion flow cell * Assumes S4 flow cell, 6,600 – 8,200 if use S2 flow cell, 1,300 – 1,600 if use SP flow cell ^ Uses a low-cost reduction surface |

|||||

|

Source: Company Data, UBS, Biocompare |

|||||

Management has repeatedly stated that it has not lost market share outside of China. Win rates versus competitors remain stable in the mid-throughput category (ex-China), and Illumina is penetrating the high-throughput category with its new sequencers (and related products to be released in the coming months). Some aspiring gene sequencing peers claim to be increasing placements (not orders or purchases) with customers. Placing sequencing boxes with customers alongside purchased DNA sequencers from Illumina should be taken with a grain of salt. Thus, competition displacing Illumina is overblown. The one caveat is the need to monitor if and when BGI tries to export its cheap mid-throughput sequencers outside of China, and what traction they may get, if any.

The long-term industry trend of declining ASPs of mid-throughput DNA sequencers with each succeeding generation of more powerful sequencers does continue. But this is similar to the cost per byte for semiconductor chips declining due to Moore’s Law, as you can pack more transistors on a chip. Likewise, processing more DNA data per gigabase provides similar cost benefits that generally gets passed onto customers. Gross margins have not been impacted by declining ASPs over a full product cycle, at least for Illumina.

The fifth factor impeding Illumina’s results are macroeconomic headwinds. In the August 2023 quarterly earnings call, management sited “more cautious purchasing patterns” and “longer sales cycles”, with an analyst on the call adding “weakening biotech and pharma funding”. Management then lowered its full-year 2023 estimates for revenue from 7.5% growth to roughly flat, and operating margins from 22% to 20%, with the nadir being Q3, and sequential improvement in Q4. The management attributed ~25% of the guidance shortfall to China (both economic weakness and BGI domestic market share gains), ~37.5% to the transition from NovaSeq 6000 to NovaSeq X, and ~37.5% to the longer sales cycle and slow economic recovery (ex-China).

The transition to NovaSeqX has been adversely impacting Illumina’s results since last year, and is probably the largest contributor to Illumina’s softening year-over-year results that started in Q2 of 2022. China, some funding issues for government research organizations and biotech during last year’s stock market downturn, and declining COVID testing revenue also had an impact. A bear rebuttal is that management recently has gone out on a limb, and reiterated its 25% non-GAAP operating margin target accompanied by revenue growth for core Illumina (ex-Grail) for 2024. This projection incorporates cuts in non-core R&D spending, productivity improvements, and notably, acceleration of NovaSeq X revenues.

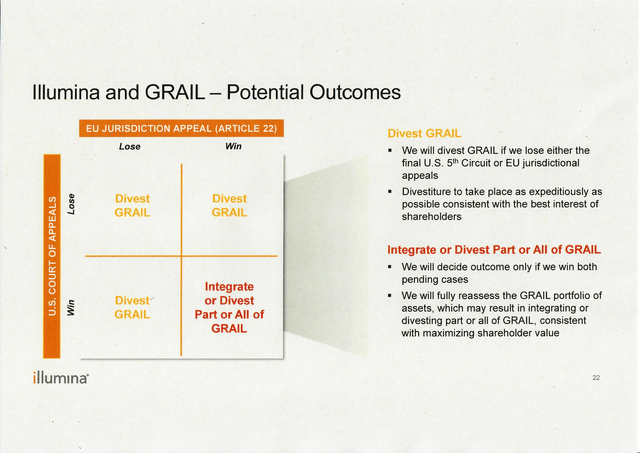

This brings us to the extremely harsh regulatory treatment that Illumina is receiving on its re-acquisition of its Grail cancer detection startup. As a background, Illumina incubated Grail back in 2015 and owned 100% of its startup. Grail’s Galleri test can screen for more than 50 types of cancers from one blood draw, and holds tremendous potential for the early cancer detection. In 2016, Illumina spun off Grail to help finance its development, but retained a 12% stake. Illumina reacquired Grail in 2021 despite opposition principally from European regulators (more recently, an appeal by the FTC to the US Fifth Circuit Court of Appeals has re-opened the previous US legal clearance of the Grail acquisition as well). In an unprecedented move, Illumina was fined €432 million ($461 million) by the EU for illegally making the re-acquisition of the company it founded and still partially owned under Article 22 of EU law, and was told to divest its Grail stake. In the interim, Illumina must ensure that Grail is well-capitalized and can function independently, which translates to funding a current burn rate of ~$700-$800 million annually. The EU took over a year to actually issue the divestiture order, which was recently issued on October 13, 2023, while Grail continued to burn a large hole in Illumina’s wallet. Needless to say, the EU’s treatment of Illumina has not helped its stock price.

Even with the EU divestiture order, there still remains some uncertainty, as the divesture order is only enforceable if Illumina does not win its challenge in court. In the meantime, Illumina also has an appeal in the US courts that overturned the legality of its Grail re-acquisition. Thus, this high cash-burn holding pattern can continue for between one to three years, as the appeals process can be quite slow, especially in Europe. Management may have some leeway, but this how they have laid out the scenario:

Illumina

Grail’s early detection of cancer has tremendous value, despite its high cash burn today. Revenues are expected to roughly double in 2023 to ~$100 million. Grail can be a billion-dollar revenue company by the end of the decade. On the other hand, the regulatory authorities are dead-set on preventing Illumina from realizing Grail’s potential. Management believes that successful appeals will give them greater flexibility to optimize value for shareholders as opposed to a forced sale. Carl Icahn, an active shareholder in Illumina, has another view. Icahn would like to Grail divested as soon as possible.

Jacob Thaysen, previously a senior executive at Agilent, has taken over as CEO of Illumina last month. November 9th is his first quarterly earnings call to investors. I see a lot more upside on this call than downside. He can tow the previous management line of waiting for the appeals process to take its course, as Illumina does have a decent chance to win both appeals, especially in the US. This endless cash burn scenario without a definitive solution is what is spooking investors today.

The goal of the October 13th EU divestiture order is to return Grail to the same competitive position it had prior to the 2021 re-acquisition, not create an endless outflow of Illumina’s cash. Furthermore, the divestiture order only requires Illumina to fund Grail up to the time of divestment, not beyond. However, in the scenario where Illumina funds Grail independently (e.g. a spin-out), they may need to raise additional debt or equity to keep Grail competitive and in good-standing until the close. This may require an additional $1 billion in capital (estimated $600M net annual Grail burn rate x 15 months, plus a cash cushion). Maybe this is what is putting pressure on the stock price? If so, $1B in capital is not that onerous – 5% share dilution at today’s depressed price (or can use debt if it’s cheaper). In any case, it’s a wash for Illumina shareholders that keep the Grail shares. A less burdensome route may be an IPO, but then Illumina shareholders lose the Grail upside for unknown, short-term proceeds.

Rationally, it’s hard to see much more downside. In fact, if the new CEO on November 9th states a clear path to a fast Grail divestiture, then we should see a rebound in Illumina’s stock price.

Some investors worry that the new CEO will throw in the kitchen sink in terms of lowering Q3 financial results and may provide a conservative forecast, in order to set the bar as low as possible. The 2024 and 2025 estimates below, already incorporate some of that conservatism.

We are approaching maximum pessimism, with more upside than downside. ILMN’s stock freefall over the last two years appears to be disproportional to the aforementioned bear arguments discussed above, even with the punitive regulatory actions. This assumption is quantified below.

|

Illumina Financials (GAAP) |

||||||

|

$, millions |

2020 |

2021 |

2022# |

2023e |

2024e |

2025e |

|

Revenues |

3,239.0 |

4,526.0 |

4,584.0 |

4,598.6 |

5,202.6 |

6,108.8 |

|

% change |

-8.6% |

+39.7% |

+1.3% |

+0.3% |

+13.1% |

+17.4% |

|

Gross Profit |

2,231.0 |

3,225.0 |

3,145.0 |

3030.0 |

3,530.0 |

4,190.0 |

|

% of revs |

68.9% |

71.3% |

68.6% |

65.9% |

67.8% |

68.6% |

|

Optg. Income |

580.0 |

652.0 |

179.0 |

-154.9 |

511.0 |

903.3 |

|

% of revs |

17.9% |

14.4% |

3.9% |

-3.4% |

9.8% |

15.3% |

|

Net Income |

656.0 |

762.0 |

-4,404.0 |

-304.7 |

367.3 |

737.1 |

|

EPS |

$4.45 |

$5.04 |

-$28.05 |

-$1.93 |

$2.33 |

$4.64 |

|

# 2022 results include $3.914B Grail goodwill impairment & $0.619B legal cost |

||||||

|

Grail results included in above figures |

||||||

|

$, millions |

2020 |

2021 |

2022# |

2023e |

2024e |

2025e |

|

Revenues |

NA |

12.0 |

55.0 |

100.0 |

200.0 |

400.0 |

|

% change |

– |

– |

+358.3% |

+81.8% |

+100.0% |

+100.0% |

|

Gross Profit |

NA |

-29.0 |

-62.0 |

-50.0 |

25.0 |

150.0 |

|

% of revs |

– |

– |

– |

– |

12.5% |

37.5% |

|

Optg. Loss |

NA |

-919.0 |

-688.0 |

-775.0 |

-650.0 |

-425.0 |

|

# 2022 results include $3.914B Grail goodwill impairment |

||||||

|

Illumina Financials (GAAP) excluding Grail § |

||||||

|

$, millions |

2020 |

2021 |

2022# |

2023e |

2024e |

2025e |

|

Revenues |

3,239.0 |

4,514.0 |

4,529.0 |

4,498.6 |

5,002.6 |

5,708.8 |

|

% change |

-8.6% |

+39.4% |

+0.3% |

-0.7% |

+11.2% |

+14.1% |

|

Gross Profit |

2,231.0 |

3,254.0 |

3,262.0 |

3080.0 |

3,505.0 |

4,040.0 |

|

% of revs |

68.9% |

72.1% |

72.0% |

68.5% |

70.1% |

70.8% |

|

Optg. Income |

580.0 |

1,571.0 |

867.0 |

620.1 |

1,161.0 |

1,328.3 |

|

% of revs |

17.9% |

34.8% |

19.1% |

13.8% |

23.2% |

23.3% |

|

Net Income |

656.0 |

1,335.4 |

210.8 |

527.1 |

986.9 |

1,129.1 |

|

EPS |

$4.45 |

$8.83 |

$1.34 |

$3.34 |

$6.22 |

$7.11 |

|

# 2022 results include $0.619B legal settlement |

||||||

|

§ for 2024-25: assume 15% tax rate, no interest inc./exp., 158.8M shares |

||||||

Illumina 2018-2022 average: EV/Revs: 13.3x, P/E: 100.0x

S&P CaptialIQ S&P Capital IQ

Adjusted to current market conditions, the historical multiples may not be warranted. Still, even if you discount them by 50%, you come up with an Illumina-alone value of $260[4]. This is more than 2x the current stock price of $119.47.

Let’s assume Illumina decides to spin-off Grail to shareholders, and needs to raise $1 billion in capital, and we choose equity because debt may be currently too expensive. This would be 5.3% dilution ($1 billion / $119.47 = 8.37M shares; 8.37M / 158M =5.3%. I would gladly incur this minor dilution to receive shares in Grail, a game-changing company that can potentially be worth billions of dollars down the road. An Illumina fair price adjusted for the dilution required to set-up a Grail spinoff equates to $247 (260 / 1.053), which is still more than double the current depressed Illumina price of $119.47 – and you would get Grail as well. Even if you are extremely risk-averse, and decide to sell Grail right after the spin-off, you will still get a lot more for it than the minor dilution that you incurred. The NPV of a breakthrough company doubling revenues every year in the hundreds of millions of dollars, even with a lot of red ink, would likely have a $1 billion-plus market cap.

And Grail is just the icing on the cake. Investors today can buy a crown jewel of a business – Illumina, at a tremendous discount to its inherent value. I would strongly recommend that investors take advantage of this rare opportunity.

[1] DNA sequencing reads the order of nucleotide bases (A, C, G, or T) in a DNA sample. Illumina can sequence whole genomes, de novo (new) genomes, exomes, RNA, as well as targeted resequencing of specific genes/gene regions.

[2] Muti-omics is the analysis beyond the genome such as the proteome, transcriptome, and epigenome. Integrated multi-omics improves the genotype-to-phenotype connection, enhancing drug target discovery and biomarkers.

[3] At the beginning of a new product cycle, like NovaSeq X, gross margins are adversely impacted due to 1) cost ramp of instrument tool production with low-capacity utilization and yield (including software bugs), 2) adverse product mix with more low-margin instrument sales. Thus, Illumina’s GAAP gross margins were 60.3% in Q1 2023 versus 66.6% in the year-ago quarter, and 62.2% in Q2 2023 versus 66.0% in the year-ago quarter. Gross margins should improve in the second half of 2023 and 2024 as the NovaSeq X volumes ramp. The previous NovaSeq 6000 product ramp in 2017-18 had the same negative gross margin effect.

[4] $311 on a P/E basis (CY 2024 EPS of $6.22 x 50), $209 on a revenue multiple basis (CY 2024 revs of $5,002.6M x 6.65 / 158.8M shares). ($311 +$209) / 2 = $260.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here