Investment thesis

Our current investment thesis is:

- MarineMax is a high-quality business, following a period of investment into its business model, particularly around the services it provides and support given to potential/actual customers. The business has reduced the friction associated with boat purchases, while growing its brand globally in a highly fragmented industry.

- We believe these factors will position the company well for long-term growth, with its heightened margin levels sustainable going forward.

- The issue is that the near-term appears bleak, with demand declining and interest rates making purchases unattractive. We suggest patience until conditions ease.

Company description

MarineMax, Inc. (NYSE:HZO) is the largest recreational boat and yacht retailer in the United States, with operations across the country. The company sells new and used boats, as well as marine accessories and services. With a diverse portfolio of premium boat brands, MarineMax caters to a wide range of customers, from enthusiasts to seasoned yachters.

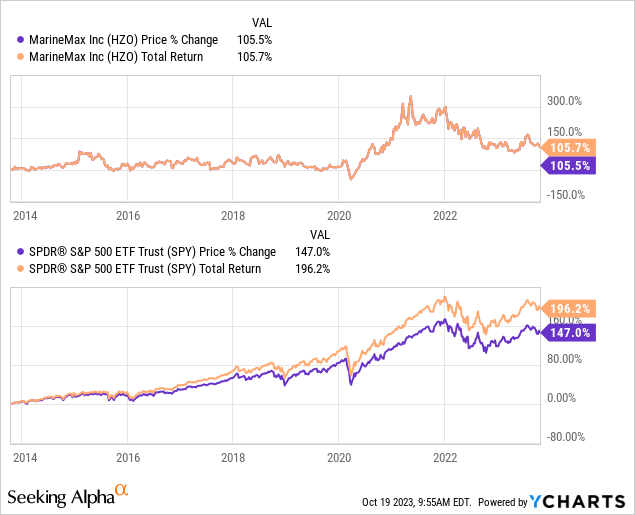

Share price

MarineMax’s share price performance has been reasonable, with over 100% returns. The business has benefited well post-pandemic but the economic slowdown has equally brought the MarineMax back down to earth. The volatility in share price is a reflection of the forward expectations of its financial performance, with periods of strong growth and corresponding offsets.

Financial analysis

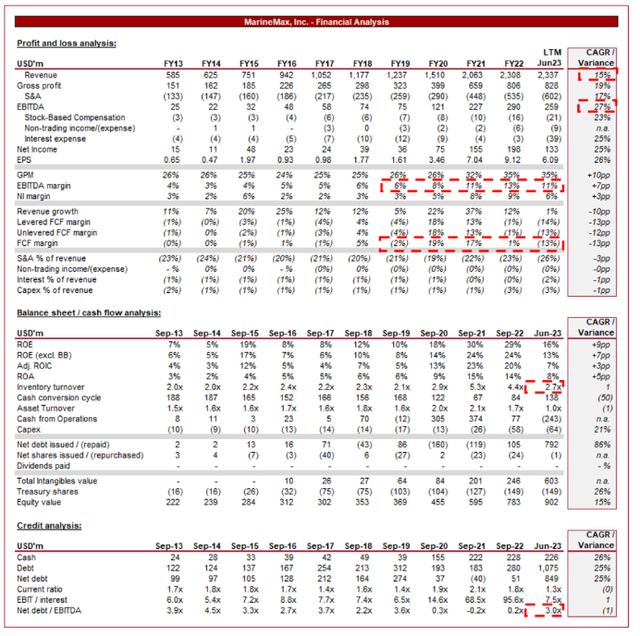

MarineMax financial (Capital IQ)

Presented above are MarineMax’s financial results.

Revenue & Commercial Factors

MarineMax’s revenue has grown at a CAGR of 15% during the last decade, with volatile revenue growth year-on-year that has importantly always remained positive. EBITDA has materially exceeded this growth rate (~27%), owing to consistent margin improvement.

Business Model

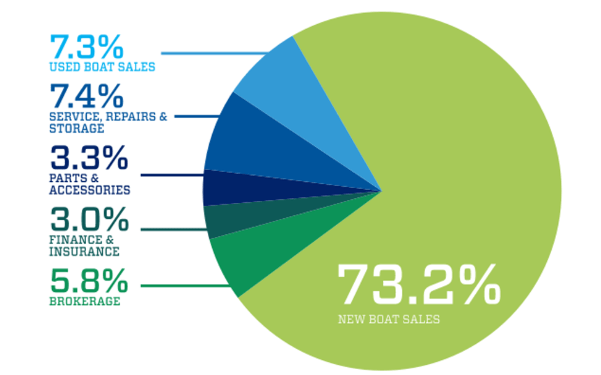

Revenue split (HZO)

MarineMax offers an extensive selection of new and used boats and yachts from various manufacturers, catering to different preferences and budgets. Its range includes motor yachts, sport boats, sailboats, and fishing boats, appealing to a diverse customer base and budgets. The company also provides Brokerage services, allowing it to utilize its brand to drive sales.

Apart from selling boats, the company provides a comprehensive suite of other ancillary services, used to maximize its revenue potential and to remove friction associated with making such large purchases.

- Services / Repairs and Parts – Apart from selling boats, MarineMax provides comprehensive support services including maintenance, repairs, and upgrades. This post-purchase support enhances customer loyalty and confidence, as consumers do not need to fear being left without guidance if there are issues. This has allowed the business to foster long-term relationships. Further, these services are far less volatile compared to boat sales, improving the wider revenue profile of the company.

- Financing and Insurance – MarineMax offers financing options and insurance services to customers, simplifying the buying process. These services are usually high-margin, while also contributing to reduced revenue volatility year-on-year.

- Charter and Vacations – MarineMax offers yacht charter and vacation services, allowing customers to experience yachting without ownership responsibilities. This service diversification attracts both potential boat buyers and individuals seeking unique vacation experiences.

Given the substantial costs associated with these products, reducing friction is critical. Beyond the services it provides, MarineMax has enhanced its broader offering to make acquisitions as easy and attractive as possible to potential consumers. Factors include:

- Education and Training – MarineMax conducts training programs and educational events for boat owners. These initiatives seek to enhance customer knowledge about boat operation, safety, and maintenance, ensuring a positive ownership experience.

- Online Presence – MarineMax has a strong online presence, showcasing its inventory and services. The company has relied heavily on its website and social media platforms to serve as effective marketing tools, particularly due to the fragmented nature of the industry. MarineMax is the largest boat, yacht, and superyacht company, and it is critical to maximize its exposure to potential customers.

- Experienced Staff – MarineMax employs knowledgeable and experienced staff, with strong recurring investment in training.

- Marinas – MarineMax has invested in a number of valuable real estate locations globally, with 59 owned or operated marinas. This has allowed the business to expand its global presence and market its services, while further enhancing the quality of the service provided to customers.

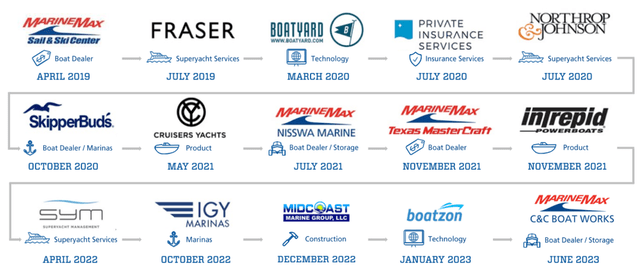

- M&A – Management has increased its M&A activity in recent years, acquiring a range of product and service businesses to expand its expertise and deepen its exposure to specific segments. We consider this a critical component of its broader strategy, as it has allowed the company to be a one-stop shop for all things boats.

Acquisitions (HZO)

We believe MarineMax has a fantastic business model. The company has two key factors to navigate, the fragmented nature of its industry and the friction associated with purchasing boats, which are the definition of discretionary. Its response to fragmentation has been a focus on developing its brand and services, making it a compelling proposition for consumers who want a convenient service provider. Friction has been reduced through a significant investment in related services outside of the purchase of boats, most of which also come with the benefit of providing revenue.

Margins

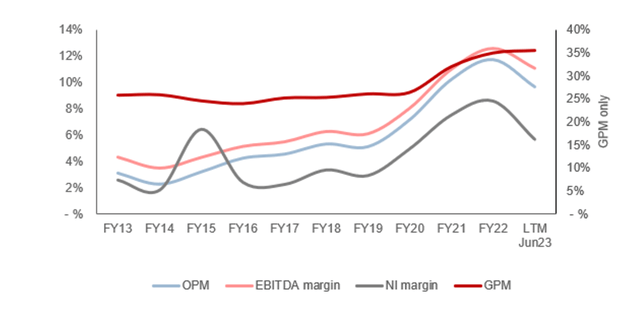

Margins (Capital IQ)

MarineMax’s margins have developed well during the last decade, with EBITDA-M increasing from 4% in FY13 to 11% in the LTM period. This margin improvement is attributable to a number of factors that could with growth. The business has benefited from economies of scale, with revenue 4x higher. Further, the company’s product mix has shifted toward higher-margin goods and services (such as financing and parts). Finally, MarineMax has exploited the increased demand from the post-pandemic period to improve its unit economics.

The sustainability of its current levels is uncertain in our view. We are seeing margins trend down, with the risk that falling demand will contribute to a reversion of its historical unit economics. This is a trend we are seeing in the automotive industry following a period of demand/supply misalignment.

Quarterly results

MarineMax’s recent financial performance has slowed, with top-line revenue growth of +16.1%, +7.5%, (6.5)%, and +4.8% in its last four quarters. In conjunction with this, margins have stepped down noticeably since FY22, with no evidence to suggest a bottom has been reached.

The decline in trajectory is a reflection of the macroeconomic environment in our view. With elevated interest rates and inflation, we are seeing a change in consumer spending, with greater defensive actions and care with capital purchases. MarineMax’s target customers are more resilient to the current conditions but that does not mean they are immune. With financing costs significantly up, and the ongoing risk of a recession, we suspect conditions will remain difficult until expansionary policy returns.

Key takeaways from MarineMax’s most recent quarter are:

- Management believes they are seeing robust consumer demand, evidenced by a small increase in same-store sales. The ability to achieve sale-store growth is impressive, although we would hesitant to suggest demand is resilient given the consistent step-down.

- Management is executing on its strategy to enhance margins through a mix shift toward premium products and services. Although this appears to be succeeding, the current environment is materially offsetting gains.

- Management is seeing more aggressive retail pricing currently. We suspect this will continue in the coming quarters as businesses seek to protect their top line.

- Prior acquisition, IGY Marinas, has begun contributing to revenue growth. Further, the company has completed on the acquisition of C&C Boat Works.

Balance sheet & Cash Flows

MarineMax has recently raised debt to fund its acquisition, contributing to an ND/EBITDA ratio of 3x. We do not consider this level concerning, although we would be hesitant to see further growth in this balance without growth. Once the acquisitions provide a full-year earnings, this ratio will decline, positioning the business for further investments in the coming years.

The slowdown in demand is illustrated in its working capital profile, with inventory turnover materially declining, contributing to a negative FCF. This is not overly concerning given the nature of the products it provides, as underlying demand should ensure this stock is unwound in the coming quarters. This said, investors should consider if they are interested in a business that has such volatility in FCF.

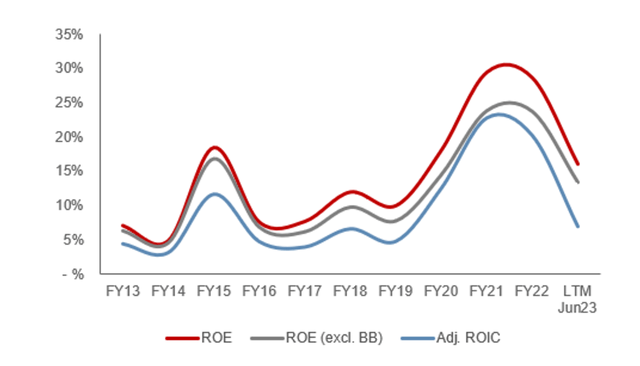

MarineMax’s shift toward higher-margin services, as well as numerous successful acquisitions are illustrated in the below graph, with ROE trending upward.

Return on equity (Capital IQ)

Outlook

Outlook (Capital IQ)

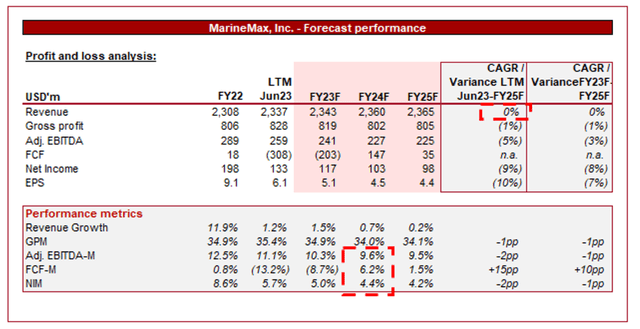

Presented above is Wall Street’s consensus view on the coming 3 years.

Analysts are forecasting a stagnation in revenue, with flat growth into FY25F. In conjunction with this, margins are expected to step down, although will remain in excess of their pre-pandemic levels.

We broadly concur with this assessment. Revenue growth will likely continue to decline in the coming 3-6 quarters, offset well by MarineMax’s recent acquisitions. Beyond this point, we should see some improvement, which to us implies little growth is possible.

Margins are a reflection of the positive development achieved, offset by the current macroeconomic conditions. We suspect the business could see a normalized EBITDA-M level of ~11% when demand is healthy but based on the outlook in the coming 1-2 years, 9-10% appears reasonable.

Industry analysis

Specialty Stores Stocks (Seeking Alpha)

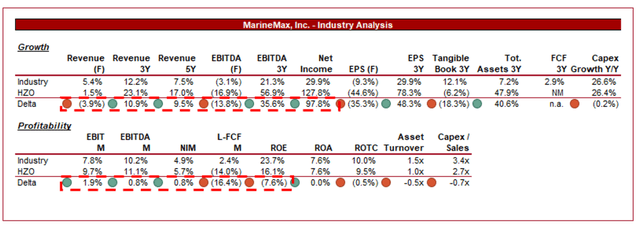

Presented above is a comparison of MarineMax’s growth and profitability to the average of its industry, as defined by Seeking Alpha (21 companies).

MarineMax performs well relative to its peers. The company has achieved superior revenue growth across both a 3Y and 5Y period, with better profitability growth, also. This is a reflection of strong demand for its specific products, as well as its M&A strategy.

Further, despite the recent margin contraction, MarineMax continues to boast an above-average EBITDA-M and NIM, although is lacking in LFCF and ROE. The layered business model of MarineMax (services and products) allows for greater scope for margin improvement and resilience.

These factors aside, the issue with MarineMax is that it is highly cyclical. As the forward estimates illustrate, the company is forecast to significantly underperform its peers, with greater scope for margin erosion.

Valuation

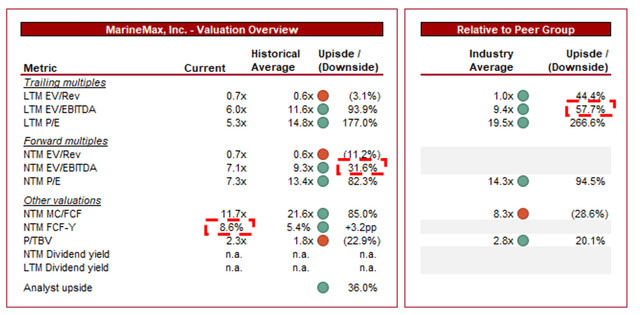

Valuation (Capital IQ)

MarineMax is currently trading at 6x LTM EBITDA and 7x NTM EBITDA. This is a discount to its historical average.

Despite the strong financial and commercial development, in today’s climate, a discount to its historical average is warranted in our view. The company is facing headwinds that will inevitably contribute to stagnation, if not a decline, with uncertainty as to where it will normalize.

Further, MarineMax is currently trading at a discount to its peers, with a ~58% delta at an LTM EBITDA basis and ~95% on a NTM P/E basis. We believe a discount is reasonable, again due to the risks associated with downside movements in the face of macroeconomic conditions.

We see good upside with MarineMax at its current valuation, even with the outlook appearing bleak. The business has fundamentally improved relative to the past yet is trading at a substantial discount. Further, it outperforms its peers on a financial basis but is being punished heavily for its cyclicality. It appears investors are expecting an extended period of difficulty and so sentiment remains low.

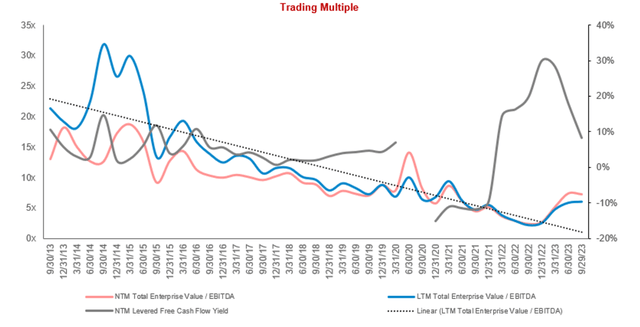

Valuation evolution (Capital IQ)

Key risks with our thesis

The risks to our current thesis are:

- [Upside] Expansion into new markets.

- [Upside] Successful integration of digital technologies to reduce the friction of purchases.

- [Downside] Economic recession affecting high-value discretionary spending.

- [Downside] Intensifying price competition eroding profit margins.

Final thoughts

MarineMax is a quality business and illustrative of the value that can be achieved through enhancing a business model. The company’s current performance is significantly better than pre-FY17, owing to the wider investment in the company’s offering. The company is a leader in the industry and has a strongly defensible position.

The current economic conditions are a major issue with investing today. The share price is attractive despite the near-term outlook but we see little reason for positive share price action. We suggest investors remain patient, focusing on monitoring margin development and early signs of growth improvement.

Read the full article here