AT&T Inc. (NYSE:T) stock rose sharply in pre-market trading after the company reported better-than-expected Q3 earnings, beating consensus on both the top line and earnings. During the September quarter, AT&T’s revenues increased 1% year-over-year, while earnings grew 8% year-over-year. Moreover, AT&T also boosted free cash flow (“FCF”) guidance by $500 million, to $16.5 billion for FY 2023.

I have long been bearish on T stock arguing that I am concerned about AT&T being a value trap back in August 2022, when the stock was trading at $18.3/ share. Since then, AT&T shares have lost close to 18% in value, while the S&P 500 (SP500) remained roughly flat. Although I still remain somewhat concerned about AT&T’s debt position, I feel it is time for me to let go of the bearish sentiment skew and upgrade AT&T stock to an investable “Hold.”

AT&T Beats Q3 Expectations

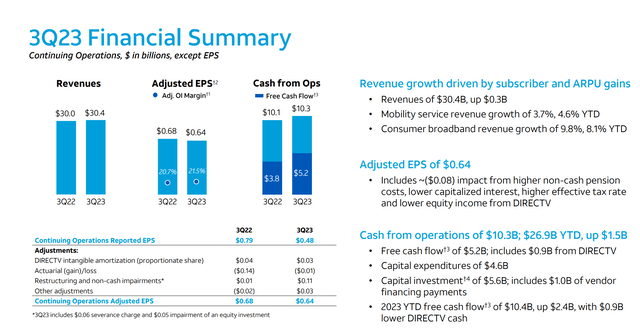

AT&T opened its books for the Q3 2023 earnings period, reporting a solid set of results and beating analyst consensus expectations on both revenue and earnings forecasts. For the period spanning from the end of June to the end of September, the largest telecommunications conglomerate in the United States reported approximately $30.4 billion in revenues. This figure represented a year-over-year growth of about 1% versus the same period one year earlier. Now, although 1% growth is not much, AT&T is effectively ending a streak of two consecutive quarterly top-line contractions, and beating consensus estimates by approximately $160 million, according to consensus estimates gathered by Refinitiv.

Regarding profitability, AT&T’s adjusted operating income came in at $6.5 billion, and EPS was reported at 64 cents, up 9% year-over-year. Cash generated from operating activities amounted to $10.3 billion, marking a $0.2 billion increase versus Q3 2022. Additionally, free cash flow, which has for a long time been the most important metric when judging AT&T, was reported at $5.2 billion for the September quarter, representing a $1.3 billion jump versus the same period one year prior. On an annualized basis, AT&T is now running on a >$20 billion annual FCF run-rate, if Q3 results can be reasonably extrapolated into the future.

AT&T earnings

Outlook Is Strengthening

In addition to the solid Q3 results, AT&T positively surprised investors with an improved outlook for FY 2023: Management now forecasts full-year free cash flow of approximately $16.5 billion or better, up from its previous guidance of $16 billion. This positive outlook suggests that AT&T is making encouraging progress in the face of challenges within the broader telecom industry, where new mobile customer demand has been slowing down, and the competition for customers between AT&T, Verizon Communications Inc. (VZ), and T-Mobile US Inc. (TMUS) had intensified. In the third quarter, the company added 468,000 net new mobile subscribers, reversing four consecutive quarters of declining subscription growth and exceeding estimates. While competition is expected to remain fierce in the telecommunication industry, the AT&T outlook suggests early signs of a potential turnaround for AT&T.

I see AT&T’s upward revision in free cash flow as very important for investor confidence. This is because AT&T is in the midst of a challenging restructuring effort while carrying a substantial debt load of about $159 billion in net debt. The company also faces more costs associated with the remediation of lead in its old copper phone network. Furthermore, AT&T has lagged behind its competitors in building a nationwide 5G network. But with $16 billion of free cash flow, AT&T’s debt repayment and CAPEX outlay should be manageable, while safeguarding the dividend yield of about 7.8% (suggesting $8-9 billion of dividend payouts).

Update Valuation: Raise Target Price

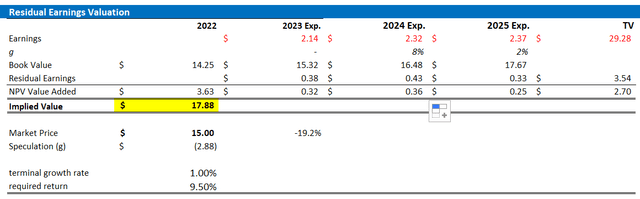

Following a stronger-than-expected Q3 reporting, I adjust my valuation framework for AT&T to account for updated EPS expectations through 2025: I now model that AT&T’s EPS in 2023 will likely fall somewhere between $2.0 to $2.2, slightly below analyst consensus. I also update my EPS expectations for 2024 and 2025 to $2.32 and $2.37, respectively.

With regard to my terminal growth expectation, I extrapolate AT&T’s top-line growth equal to 1%, which I think is reasonable. On the implied cost of equity, I estimate a 9.5% rate in line with the CAPM framework.

Given EPS and other variables plugged in as highlighted below, I now calculate a fair implied share price of $17.9/ share, suggesting almost 20% upside for AT&T stock compared to the currently quoted price of about $15.

Company Financials; Author’s EPS Estimates; Author’s Calculation

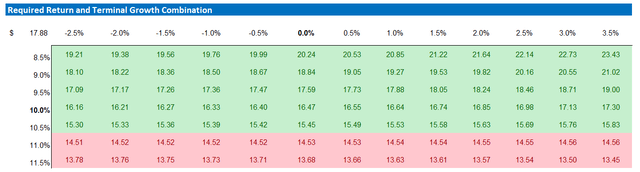

I understand that investors might have different assumptions with regard to AT&T’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red cells imply an overvaluation as compared to the current market price, and green cells imply an undervaluation. Basically, the valuation question is a story largely influenced by the cost of equity assumption.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Investor Takeaway

AT&T pleasantly surprised investors with its Q3 2023 earnings report, topping expectations on both revenue and earnings. The telecommunications giant recorded a notable turnaround from two consecutive quarters of revenue contraction, while increasing cash generated from operating activities by about $200 million, up to $10.3 billion. In another positive signal, AT&T strengthened its outlook for FY 2023, with management forecasting full-year free cash flow of approximately $16.5 billion or better, up from their previous guidance of $16 billion. This improved outlook indicates that AT&T is making progress amidst the competitive challenges within the telecom industry, including slowing mobile customer demand and intense competition among major carriers. The strengthened outlook should help manage investor confidence about debt repayment and capital expenditure, while preserving a dividend yield of approximately 7.8%.

In light of the stronger-than-expected Q3 results, I adjust my valuation framework for AT&T Inc., now calculating a $17.9 per share implied target price. While AT&T’s fundamentals continue to be pressured by headwinds, I think AT&T may finally be “investable” again; and accordingly, I update my recommendation to “Hold.”

Read the full article here