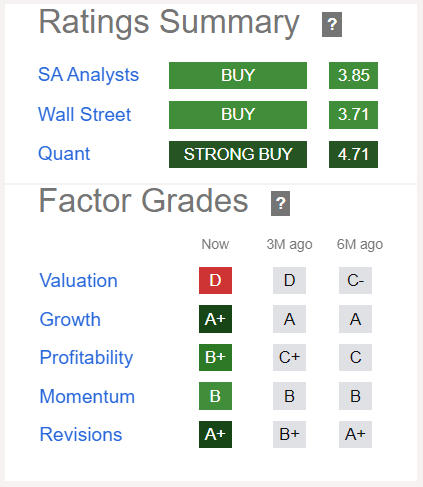

Trading at around $15.4 with a market cap of $8.7 billion, UiPath (NYSE:PATH) is rated as Buy to Strong Buy by analysts as pictured below. This is based on strong grades for Growth, Profitability, Momentum, and EPS revision which during the last three months has been revised upwards by 19 times. However, with a valuation grade of “D”, this stock apparently does not rhythm with value.

Ratings and Grades (seekingalpha.com)

This thesis thinks otherwise, and in order to make my point, I will perform a more targeted peer comparison, and provide insights as to how it has added Generative AI (Gen AI) features to its product, but start by providing insights into the business and the evolution of its sales in order to assess whether these are sustainable, especially after analysts downgraded the stock in June based on top-line growth.

Looking for Sustainable Growth

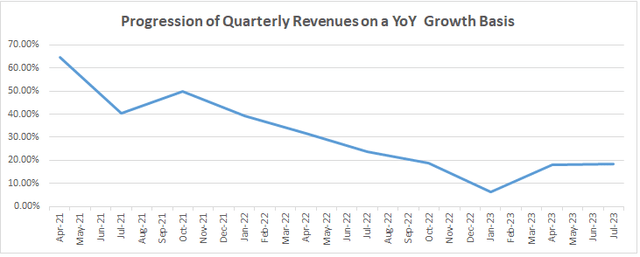

Valued at $1.34 billion during its April 2023 IPO, UiPath is a leading provider of process automation and orchestration, which is basically about providing a platform hosting applications to automate repetitive office tasks. Interestingly, well before the advent of Gen AI and ChatGPT which have gained popularity since the start of this year, its approach centered around using RPA or robotic process automation and AI-powered document processing. Looking at the modus operandi, this involves the use of software codes that have a degree of autonomy, analogous to software robots. These help automate processes, in such a way that the organization is not burdened with completely changing the way it operates. This can be viewed as a different approach to digital transformation and was an instant success with revenue growth surging to above 60% at the beginning of 2021 as charted below. Subsequently, there was a net deceleration with sales growing at a low of 4.72% in the January 2023 quarter.

Chart built using data from (www.seekingalpha.com)

Looking for an explanation, after such a rapid growth rate which saw revenues increasing from $336.2 million in fiscal 2020 to $607.6 in fiscal 2021, or by nearly 81%, within one year, it would seem logical for subsequent growth percentages to be lower as comparisons were made relative to high numbers. Second, the year 2022 saw the Fed aggressively tightening monetary conditions which did not augur well for the economy. As a result, the management lowered guidance prompting analysts to downgrade the stock in 2022. This also explains the last year’s significant downside with the stock bottoming to the $11-$12 range.

Breaking with the downward trend, as evidenced by the above chart, YoY growth has accelerated to above 18% in both of the two quarters ending in April and July respectively, with the uptrend mainly explained by customer retention and squeezing more sales from them in addition to winning new contracts. For this purpose, UiPath’s dollar-based net retention rate, or NRR for the second quarter of fiscal 2024 (Q2) which ended in July was 121%. Now, this is an excellent metric when compared with other SaaS companies like Zendesk (private) and New Relic (NEWR) which both score 116% and a value of 100% signifies that UiPath is not suffering from churn (customers leaving its platform) and that the topline will grow even if no new customers are added.

However, RPA is basically about using software meaning the barrier to entry is low, which in turn implies that UiPath faces competition. In this respect, in addition to large IT service providers that are adding RPA and AI features to their product offerings, it faces more direct competitors like ServiceNow (NOW) and Automation Anywhere.

Addressing Competitive Threats by Using Gen AI

In response to this competitive threat, UiPath’s strategy has been to leverage Gen AI for differentiation purposes. This new flavor of AI could engender productivity improvements of 37% to 70% across most industries like sales, marketing, R&D, and customer operations, with software engineering benefiting the most as per a report by McKinsey. Now, one of UiPath’s advantages is that as a developer of automation software platforms and software robots, it was already exploiting artificial intelligence before. Thus, stepping into Gen AI has been relatively easy.

Thus, there was an initial announcement at the end of June on using Gen AI in its Document Understanding and Communications Mining solutions. This involves using LLMs (large language models) to improve the classification, and labeling of documents, as well as accelerate the training process through certain automation features. UiPath also launched the “Wingman” project to use natural language prompts, thanks to the integration of GPT (Generative Pre-trained Transformer) technology which is also used by OpenAI’s ChatGPT.

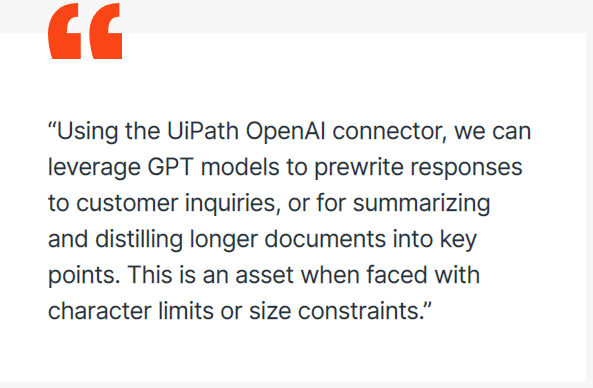

Additionally, to facilitate its customers’ interaction with LLMs, the firm also proposes connectors for major models on the market, like OpenAI’s GPT-4, Falcon for Amazon (AMZN) SageMaker as well as for previewing the Google (GOOG) Vertex with support for PaLM 2.

Gen AI announcements (www.uipath.com)

More recently, there was the announcement of Autopilot which uses natural language (in contrast to complex computer codes) to allow any user to automate more of their everyday work via the Business Automation Platform.

Assessing how these developments could positively impact the topline, as per the CEO during Q2’s earnings call:

Looking ahead, we expect this next evolution of GenAI to be a tailwind to the business, helping customers create better, more resilient automation more quickly and opening up novel use cases that facilitate the automation of even more processes”.

Discussing this further, the company opportunistically adding some ChatGPT-style features to its product will certainly help as OpenAI’s star application has acted as an eye-opener to millions as to the potential of AI, but, to be realistic, some may prefer to watch out from the sidelines whether these translate into a better NRR.

Still, I believe that in addition to upselling prospects based on product reengineering (to be ChatGPT-like), UiPath software robots could be more attractive to companies embarking on Gen AI projects. The reason is simply that this innovative technology needs context and to build it, there is a need for data for the LLM to learn from, before being operational. For this purpose, UiPath’s technology is useful as it excels at finding and integrating the data from across the enterprise, whether it lies as information in documents or database records in corporate CRMs (customer relationship management) or ERPs (Enterprise Resource Planning).

As a result, the company should continue incrementing revenues, a possibility which is also supported by analysts, who have more recently (or on September 28) raised topline consensus estimates from $1.27 million to $1.28 million thereby supporting a valuation upgrade.

Valuations and Risks

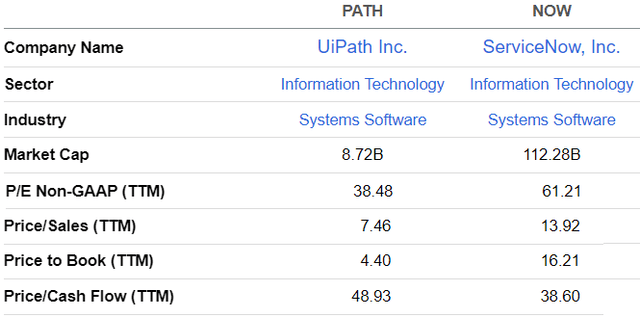

For valuation purposes, instead of comparing with the wider IT sector, a more targeted comparison with ServiceNow which, from an ITSM (IT service management) provider has reengineered its business into more of a process automation company helps. Moreover, in the same way as UiPath, the company’s platform now also leverages Gen AI.

As tabled below, UiPath remains undervalued on most metrics. I single out its trailing Price-to-Sales multiple which is the current share price divided by the last 4 quarterly sales per share and the lower this ratio, the better the investment

Now, since its P/S of 7.46x is lower than ServiceNow’s 13.92x, I adjust for a 25% rise to obtain a value of 9.325x, which, by the way, remains on the lower side. This in turn translates into a target stock price of $19.24 (15.39 x 1.25) based on the current share price of $15.39, which is slightly lower than Wall Street’s average of $19.59.

Comparison between ServiceNow and UiPath (seekingalpha.com)

One of the reasons for my moderated instance is that, unlike ServiceNow, UiPath is currently not profitable on a GAAP basis which means that it is not well-suited for value-oriented investors who emphasize fundamentals. One of the risks here is wage inflation reaccelerating while growth suffers in a sort of stagflation scenario exacerbating losses.

In this respect, contrarily to last year when the basket of unprofitable tech stocks tracked by Goldman Sachs (GS) got hammered, this year it has been faring well, instilling concern among some analysts at John Hancock Investments that there may be a bubble forming. Now, the bursting of such a bubble in case the optimism around the resilience of the U.S. economy falters or the Fed continues to tighten monetary policy as the inflation issue lingers on can result in volatility for the stock in case investors sell indiscriminately as during a selloff.

Justifying the Buy Position

Still, looking ahead, with high gross margins of 84%, which heftily exceeds the median for the IT sector of only 49% by 70%, and the restructuring initiative announced during fiscal 2023, there is room to continue scaling (or growing revenues) in such a way as not to sacrifice margins. For this matter, after accounting for capital expenses, Q2’s free cash flow (both levered and unlevered) was $97.9 million. This represents an FCF margin of 25.27%, which is above the median for the IT sector by more than 238%. On top, after accounting for debt, UiPath is net cash positive by $1.77 billion.

By comparison, Automation Anywhere, UiPath’s main competitor (as a pureplay RPA play) which was valued at around $7.3 billion in November 2019 had to raise $200 million in debt financing in October last year.

Therefore, with its healthy balance sheet, UiPath is a buy and could potentially rise by 25% as the company delivers on revenues and earnings, but this will be along a volatile path as the Middle East conflict creates additional uncertainty in the investment community, but some of the effects of adverse market conditions could be offset by the $500 million stock repurchase program.

Furthermore, to justify my optimism, UiPath seems to have a good moat around the pricing when it comes to weather economic uncertainty. This is seen by gross margins increasing by above 20% while sales progressed only by over 18%, or around 2% less, implying that it has been able to offset higher costs of sales through an increase in prices. Along the same lines, it can also rely on recurring revenues, as the ARR of $1.308 billion in Q2 represented a 25% YoY increase thanks to a 10,890-strong customer base, with those spending more than $1 million and $100K increasing by 30% and 19% respectively.

Finally, the more targeted peer comparison helps as the wider IT sector consists of both hardware suppliers and software service providers or companies that do not necessarily propose the same products and are not subject to the same macros.

Read the full article here