I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful. — Warren Buffett

International investing has been brutal for over a decade. Why bother at all when the US has been arguably the only place to be? Because the US has been the only place to be. I believe cycles still exist, and that the cycle for international investing and non-US outperformance will come. The question becomes how to play it if you’re a forward-looking long-term investor.

The SPDR Portfolio Developed World ex-US ETF (NYSEARCA:SPDW) is designed to provide investment results that correspond to the total return performance of the S&P Developed Ex-U.S. BMI Index. This index is a market capitalization-weighted index that measures the investable universe of publicly traded companies domiciled in developed countries outside the United States.

Run by State Street Global Advisors, the fund has a robust asset base and is part of the low-cost core SPDR Portfolio ETFs. It offers a diversified and low-cost way to gain exposure to international equities, thereby potentially mitigating country-specific risks.

Key Features of SPDW

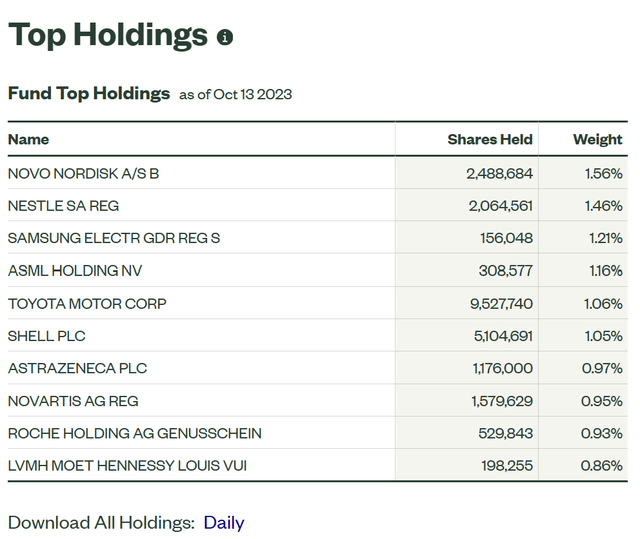

SPDW is a low-cost fund with a gross expense ratio of 0.03%, making it a cost-effective choice for investors. It also boasts a low turnover ratio of 3%, suggesting a low level of trading activity, which can further reduce transaction costs for investors. The fund offers a dividend yield of 3.07%, providing an income stream for investors in addition to potential capital gains. The fund’s portfolio is deeply diversified, with its largest holding, Novo Nordisk, accounting for just 1.56% of its total assets. This diversification can help to mitigate risk and provide steadier returns.

ssga.com

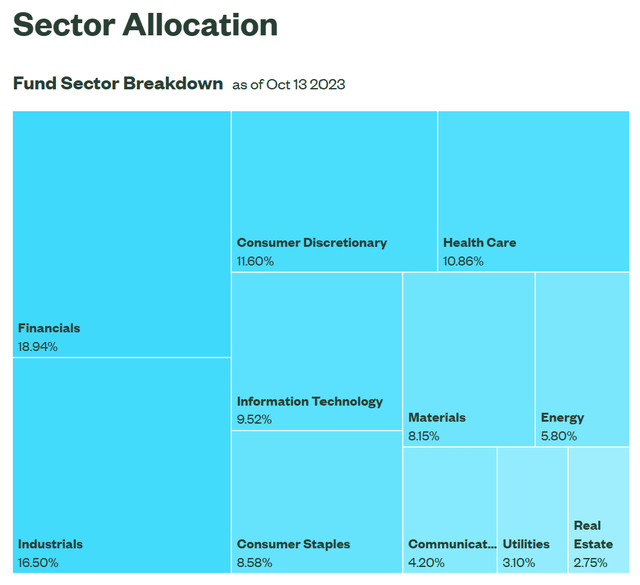

The fund’s portfolio is diversified across various sectors and countries. The top sectors represented in the fund’s portfolio are Financials, Industrials, and Consumer Discretionary, which together account for over 47% of the fund’s total portfolio.

ssga.com

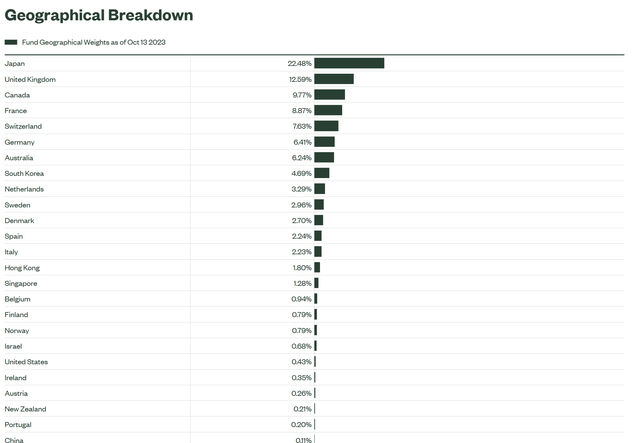

SPDW has a significant presence in several developed countries. Its top country allocations include Japan, the United Kingdom, Canada, France, and Switzerland. These countries, all of which have strong economies and stable political climates. The comparatively large allocation to Japan is interesting here, especially given some of the economic growth and inflation numbers the country is producing.

ssga.com

Peer Comparison

When considering investment in SPDW, it’s helpful to compare it with similar ETFs. Some of its close competitors include the iShares Core MSCI Total International Stock ETF (IXUS) and the Vanguard FTSE Developed Markets ETF (VEA).

While these funds also provide exposure to international developed markets, there are differences in their portfolio compositions, expense ratios, and performance. For instance, while SPDW has a lower expense ratio than IXUS, VEA offers a slightly higher dividend yield. The main differentiator here remains the lack of US allocation in the fund and lowered Tech exposure, which again, while winners in the prior cycle, may not be in the next one.

Conclusion

The SPDR Portfolio Developed World ex-US ETF (SPDW) offers a unique opportunity for investors seeking exposure to international equities. With a low expense ratio, a diversified portfolio, and a decent performance record, this ETF can be a valuable addition to an investor’s portfolio. However, as with any investment, it’s important to thoroughly research and consider the potential risks before investing in SPDW. Currency fluctuations can certainly throw off an international investing thesis, so just keep that in mind when considering how much risk to take in the fund.

Read the full article here