Please note all $ figures are in $CAD, not $USD, unless otherwise stated.

Introduction

Canada’s financial system is dominated by five major financial institutions (often referred to as the ‘Big Five’). However, there are other smaller players who fish in the same pond. While its breadth of services isn’t as large as some of the larger banks, EQB (TSX:EQB:CA) is a relatively well-known financial services company that has around $125 billion in assets under management and administration. With nearly as services offered digitally instead of through physical branches and locations, it offers everyday banking services through Equitable Bank (seventh-largest bank by assets) and also has a wealth management arm through ACM Advisors. Today, EQB serves over 670,000 customers and more than six million credit union members through its businesses.

Recent Results

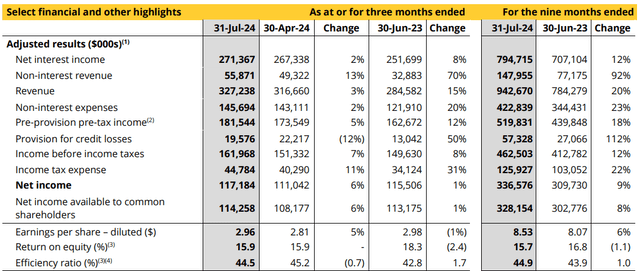

EQB reported its Q3’24 results on August 29th, which is one of the reasons I was recently intrigued to analyze the company in the first place. When looking at the latest quarterly results for EQB, the company reported Q3’24 adjusted EPS of $2.96 which was up 5% compared to Q2’24 but down 1% year over year. This was 7 cents ahead of consensus at $2.89. On net interest margins, the company’s 2.09% was in line with estimates, up 10% year over year.

Company Filings

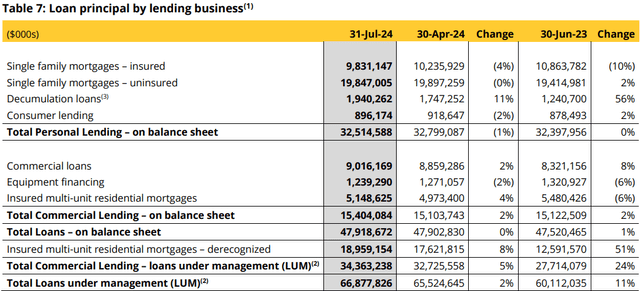

When looking at what contributed to results this quarter, EQB’s loans under management were in line at $66.9 billion, up 7% year to date, tracking in line with guidance for FY’24. On the earnings call, management noted that growth has been stronger than expected for, up 21% year to date versus guidance of 20-25%, but weaker for the higher margin areas of uninsured single family and commercial ex multi-unit.

With the CET 1 ratio improving 60bps year over year to 14.7%, the bank appears well-capitalized, but most of this can be attributed to earnings and muted loan growth. That said, the company still continues to grow its book value per share, increasing 3% sequentially against last quarter and 12% year over year. There was also a Limited Recourse Capital Note (LRCN) that helped to improve not CET 1 ratio, but the Tier 1 capital for the bank, which now sits at 16.6%, up 1.6% during the quarter as a result of the LRCN issuance.

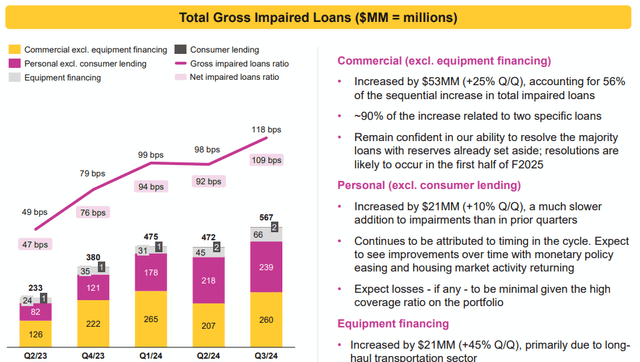

Other notable highlights include the fact that arrears continue to build, up 20% from Q2’24. PCLs of $19.6 million were down from $22.2 million, partially as a result of a $1.7 million adjustment lower (which detracts from earnings quality, in my view). Equipment finance (long-haul trucking leases) drove all the PCLs (commercial was modest and, surprisingly, personal loans had a recovery). Finally, gross impaired loans (GILs) were up 20%, thanks to those contributions from commercial and equipment finance.

Investor Presentation

Outlook

Overall EQB’s results were okay, but the company did lower its full-year EPS guide, and elevated arrears, hence why I think shares are trading 2% off where they were before the results were announced. Now, EPS guidance has moved towards consensus and is now $11.50-$11.75, versus $11.75- $12.25 previously (source: Bloomberg).

This isn’t a great sign. The improvement in loan growth, and lower PCLs, that management was expecting for the second half of this fiscal year have not materialized and played out as expected. This leads me to believe that going forward, loan growth will remain muted (at least for the short-term), NIMs to remain stable, elevated PCLs, and management continuing to focus on expense management and driving non-interest revenue.

In my view, EQB’s results are likely to come in on the low side of guidance. Why? When we look at loan growth this quarter, one of the things that has me worried is that the loan book isn’t likely to grow as fast going forward. In particular, looking at mortgages, single family mortgages (insured) were actually down 10% while the uninsured mortgages were up 2%. With decumulation loans rising 56%, I think the earnings quality has become poorer compared to last year.

Company Filings

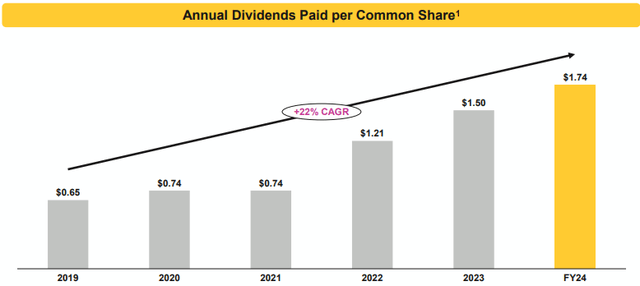

With slowing earnings growth, this could mean that the dividend growth rate of a 22% CAGR could start to come down. Even if management does maintain the growth rate, the payout is almost certain to increase from the current payout ratio of 14%. Nevertheless, the dividend looks very safe and is unlikely to be cut anytime soon.

Investor Presentation

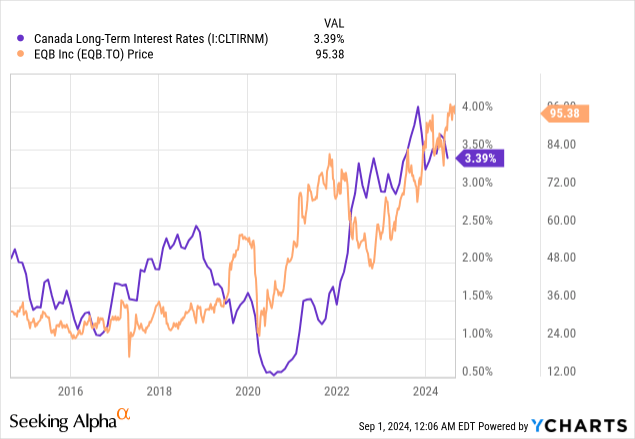

The second factor I see as a headwind for EQB is that rates are poised to come down over the next couple of years. The bond market is now pricing in an 80% probability of a 25bps cut on September 4, up from 77% before the latest data was released. Markets are also pricing in rate reductions later this year after the September decision.

As banks tend to do better in a rising rate environment, and conversely do poorly in a lower rate environment, I’m hesitant in terms of what this will mean for business performance growth going forward. To me, I don’t think stable (or even declining NIMs), lower PCLs, and flat to worsening operating leverage are out of the question going forward. Moreover, why this has me concerned is that I don’t think this being fully reflected in the company’s current valuation.

Valuation

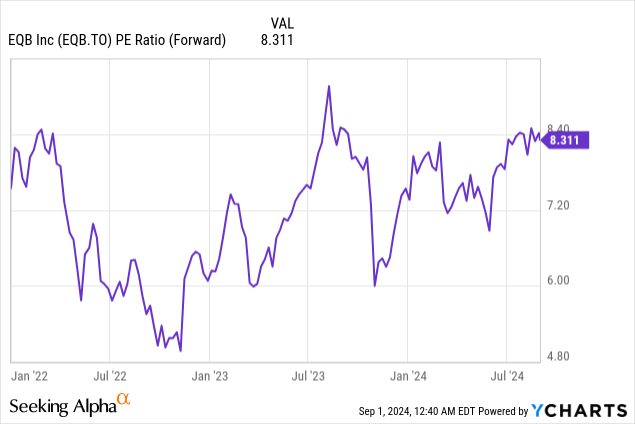

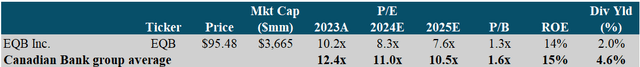

At the midpoint of EPS guidance for 2024, EQB is trading at 8.3x earnings. While that may not seem expensive at first glance, investors should consider the headwinds at play here.

Compared to the big banks, like TD (TD:CA), Royal Bank (RY:CA), BMO (BMO:CA), CIBC (CM:CA), and Scotiabank (BNS:CA), who have a peer group valuation of 11.0x, EQB is trading at a 24% discount to the big banks (source: S&P Capital IQ). I’m of the opinion that that gap isn’t likely to close anytime soon, particularly because I believe there are aspects of the big banks’ business (namely investment banking and wealth management) that deserve higher valuation multiples compared to EQB’s everyday banking and loan exposure. As such, EQB’s price to book multiple of 1.3x is lower than the peer group at 1.6x.

Author, based on data from S&P Capital IQ

In terms of the other risks to the investment thesis, I’ve discussed interest rates, but a slowdown in immigration going forward is likely one of the biggest headwinds for EQB (and the rest of the Canadian banking sector more broadly). Over the last two years, immigration across Canada has ballooned, now surpassing pre-pandemic levels. This has unquestionably been a driver of loan performance recently, as EQB earns revenues from alternative mortgages to those who might not otherwise qualify as a major financial institution. Given that, these loans are not only higher risk, but also are likely to slow down with the pace of slowing immigration going forward. Post 2026, it’s hard to see how record immigration continues, particularly as this hasn’t materialized in a meaningful way to support job creation and employment growth.

Already, Ottawa is set to tighten rules for temporary foreign workers to address labor shortages, and so I wouldn’t be surprised to see this eventually hit the number of immigrants Canada takes in. Right now, this is only in effect to temporary workers, as the government has pledged more measures to reduce the temporary resident population to 5% of Canada’s total population in three years (previously at 6.8% in April). For investors of EQB, monitoring how immigration levels change will be a key driver for loan growth, and thus the investment thesis going forward.

Conclusion

While EQB’s recent performance highlights good fundamentals and capital strength over the last twelve months, I believe the company’s near-term outlook appears less promising. Despite a slight increase in adjusted EPS and stable net interest margins in the latest quarter, the company’s revised EPS guidance and growing arrears suggest that growth might be slower than anticipated. This is something I don’t think investors have come to fully appreciate, given shares trading close to 52-week highs. In my view, challenges such as muted loan growth, potential interest rate cuts, and the impact of immigration trends on loan performance could weigh heavily on future results. Moreover, I think EQB deserves its lower valuation compared to the larger Canadian banks. Given these uncertainties, I believe investors should hold off on purchasing EQB shares for the time being and wait for clearer signals regarding earnings growth before making any investment decisions. For now, I rate shares as a ‘hold’.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here