Polaris Inc. (NYSE:PII), the off-road & on-road vehicle and marine manufacturer, reported the company’s Q2 results, also slashing the company’s 2024 financial guidance dramatically. Yet, the market has now seemingly priced in the industry’s headwinds, as the stock reacted relatively neutrally to the dramatic cut. With interest rates now starting to decline, the industry could soon start to see better times ahead after 2024 despite some persisting uncertainties.

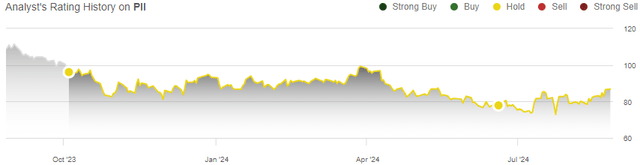

In my previous article on the stock, “Polaris: Valuation Is Starting To Get Attractive,” I still rated the stock at a Hold rating as the stock’s moderate undervaluation came with a fair margin of safety when considering the high likelihood of a 2024 guidance cut. Despite a notable guidance cut coming with the Q2 results, Polaris’ stock has returned 12% compared to the S&P 500’s (SP500) smaller 2% return after the article was published on the 19th of June.

My Rating History on PII (Seeking Alpha)

Q2 Report: Good Sequential Improvement, But Weakening 2024 Outlook

Polaris reported the company’s Q2 results on the 23rd of July. Revenues declined -11.5%, improving well sequentially from the -20.3% decline in Q1; while weak, the results were still a great improvement quarter-on-quarter. Despite that fact, the Q2 revenues of $1.96 billion missed Wall Street’s consensus by a wide $212 million as Wall Street was seemingly anticipating a recovery from dealers’ inventory balancing, also expecting a performance more in line with Polaris’ prior guidance.

With operating expenses near stagnant year-on-year due to great cost management mitigating inflation, Polaris’ decreasing sales were in part mitigated in earnings. However, despite the company’s efforts, there was still a -43% year-on-year adjusted EPS decline to $1.38, missing Wall Street’s consensus by $0.88 – understandably, with sales missing expectations, the profitability was also ultimately dragged by inverse operating leverage. I still believe that the cost management was at a reasonably good level despite the wide decline.

As could be expected, Polaris also pushed down the 2024 financial guidance, with industry pressures continuing longer than was previously thought. The company now expects sales to fall -17% to -20% compared to -5% to -7% previously. The EPS is now expected to decline -56% to -62% compared to a previous expectation of just -10% to -15% — the guidance slash was extremely dramatic. I already previously expected the guidance to be cut, and the market apparently thought the same as the stock only fell -5% to the Q2 report and rebounded in following days.

The results themselves showed a sequential improvement, but seemed to miss Wall Street’s expectations that were set too high by the prior guidance – the stock’s mild reaction speaks for the market’s expectations coming into the quarter. In my opinion, the results themselves were good, but the 2024 guidance cut was surprisingly dramatic.

Despite the significant cut to the financial outlook, the cut still seems to be from industry pressures instead of weak Polaris demand. BRP (DOOO) has shown similar trends with a guidance cut. Boat manufacturers such as Malibu Boats (MBUU), Marine Products (MPX), and MasterCraft (MCFT) are also expected to report increasing weakness in the Q2 period. I don’t think the cut is likely to be a sign of long-term issues, and is still reasonable in light of the industry’s weak macroeconomic background.

Macroeconomic & Industry Conditions Show a Mixed Image

The macroeconomic situation affecting recreational vehicles’ demand is mixed. On one side of the coin, interest rates have finally started to fall, likely having a good impact on the industry in the midterm; financing Polaris’ products is becoming cheaper for customers, and dealerships’ lower floorplan interest expenses start to incentivize keeping higher inventories.

Dealers have deleveraged inventories for a while now from an increasingly high Covid-time level, still impacting Polaris’ company sales by -4% in Q2 compared to retail-level sales. Polaris expects dealers to deleverage inventories further, even though the company communicated in the Q2 earnings call that dealer inventories are already below pre-Covid levels. This pushes a recovery from the lower interest rates beyond 2024, but likely will have a good effect in 2025 already from dealers’ inventory management and consumer demand.

On the other side of the coin, US consumer sentiment still trails at an incredibly low level after a notable fall in May. Consumers are still not confident in purchases, and recreational vehicles are at the very discretionary and cyclical end of consumer spending. The low consumer sentiment from May forward lines up with Polaris’ deteriorating 2024 guidance expectations after May, as Polaris has now seen macroeconomic headwinds driving demand lower than previously expected in the short term.

As such, while interest rates play a large role in Polaris’ demand and rates have started to decline, the macroeconomic outlook is still cloudy, especially in the short term. Recession worries have risen from the weak July unemployment figures, potentially prolonging Polaris’ weakness further. I still believe in a midterm recovery with slowing inflation, lower interest rates, and an eventual rebound in consumer spending. The H2 outlook has become even bleaker from H1, as Polaris’ new 2024 revenue guidance mid-point of -18.5% is weaker than the H1 decline of -15.9%.

Updated Valuation

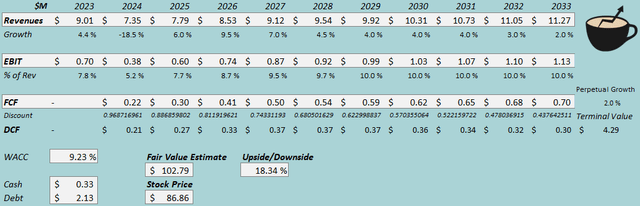

I updated my discounted cash flow [DCF] model to estimate a fair value for the stock. I have now pushed the financial recovery slightly further away, expecting an -18.5% revenue decline in 2024 being Polaris’ guidance’s mid-point. Afterward, I estimate a slightly stronger recovery from the weaker comparison point with a 7.5% revenue CAGR from 2024 to 2027 compared to 5.4% previously. The revenues now still end up at a slightly more conservative estimated level after the recovery.

With the revenues, I also estimate a slower EBIT margin recovery into still a 10% level with Polaris’ good cost management. The cash flow conversion outlook is moderate, with the longer-term growth likely requiring a good number of investments.

For more information on the estimates, I refer to my previous and initial articles on Polaris.

DCF Model (Author’s Calculation)

The estimates put Polaris’ fair value estimate at $102.79, 18% above the stock price at the time of writing – the stock still seems slightly undervalued, but again within a reasonable margin of safety. The band-aid has now been ripped in terms of the 2024 guidance, potentially acting as the bottom, though.

The estimate is up from $96.72 previously due to a lower used WACC.

CAPM

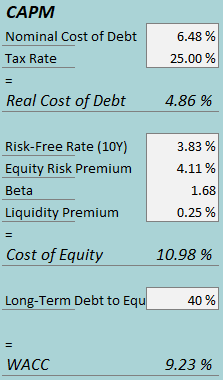

A weighted average cost of capital of 9.23% is used in the DCF model, down from 9.86% previously. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, Polaris had $34.6 million in interest expenses, making the company’s interest rate 6.48% with the current amount of interest-bearing debt. I now estimate a slightly lower 40% long-term debt-to-equity ratio, still at quite an elevated level.

To estimate the cost of equity, I use the 10-year bond yield of 3.83% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I have kept the beta estimate at 1.68. With a liquidity premium of 0.25%, the cost of equity stands at 10.98% and the WACC at 9.23%.

Takeaway

Polaris Inc.’s Q2 showed a sequential improvement from Q1, but still missed Wall Street’s expectations by a wide margin due to the company’s previously too optimistic guidance. The guidance was dramatically slashed with the Q2 report, beyond my prior expectations of a guidance cut, as macroeconomic worries have persisted longer than was previously thought. Interest rates have now begun declining, but the consumer sentiment remains low, leading dealers to continue inventory destocking – a midterm recovery still looks likely, but the short-term outlook is still increasingly cloudy.

As the valuation again comes with a mostly fair margin of safety, I remain with a Hold rating for Polaris.

Read the full article here