Executive Summary

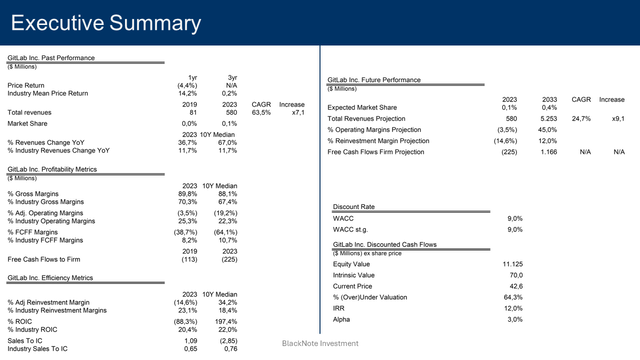

GitLab Inc. (NASDAQ:GTLB) stocks are currently trading below their fair market price.

GitLab’s success has to be found in its innovative approach to software development, focusing on security features and in an all-in-one platform covering the entire software development lifecycle.

We expect GitLab to continue penetrating the software development segment, expanding its niche presence by acquiring new enterprise customers and continue upselling its existing customers by realising new features.

As GitLab scales up, we expect it to significantly reduce S&M expenses, steadily improve profitability, and start delivering positive free cash flows in the next 5 to 7 years by leveraging on its business model which requires low capital investments.

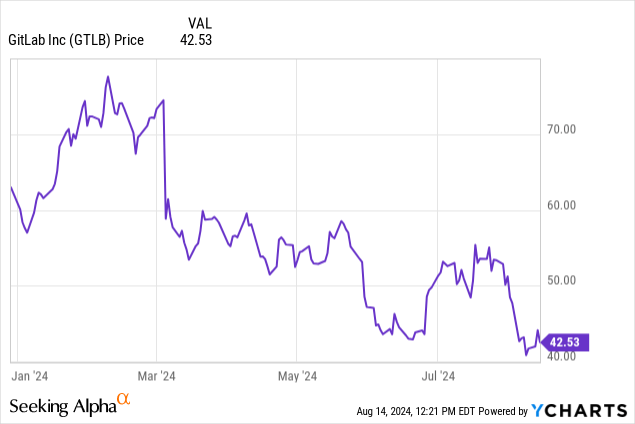

Despite a terrible first half of the year – with stock prices being down more than 30% after a disappointing FY2025 revenue guidance – our assumptions suggest that, at current prices, GitLab’s risk-reward profile has the potential to generate a positive excess return.

Source – Analyst’s computation

Operation Overview

GitLab offers a comprehensive platform that allows organisations to develop and update software solutions efficiently and in compliance with the current cybersecurity regulations.

The technical definition is the DevSecOps platform. Thanks to DevSecOps, software developers can integrate security practices into the more traditional DevOps, where all security controls usually occur after the development process.

Integrating security practices in the software development lifecycle – referred to as continuous integration and continuous delivery (CI/CD) – permits individuating security pitfalls in time, fixing issues continuously, therefore speeding up the whole software development process instead of waiting for the software application to be complete, and then have security professional auditing it. A significant waste of time, especially when security pitfalls need to be fixed, forcing one to repeat the whole process.

GitLab’s focus on offering tools to quickly and efficiently ensure security compliance represents a major driver for the adoption of its solutions among enterprise clients, like financial or health institutions, which are required to comply with stringent and increasing regulations.

Another major advantage of the GitLab platform, especially when compared to its direct rival GitHub, is that it offers an all-in-one CI/CD solution, permitting developers to have all the necessary tools to develop, test, deploy, and monitor their software applications in one place, instead of having to configure multiple tools from different vendors, helping them to save costs and make the entire software development process more efficient.

GitLab’s approach to security and the all-in-one platform was spot on as it boosts over 30 million total users and almost 9 thousand paying customers with at least $5,000 in annual recurring revenues (ARR). Of these, 1,025 contribute more than $100,000, with nearly 10% of them contributing more than $1 million in ARR.

Despite the presence of GitHub, the market leader accounting for more than 100 million users, GitLab users have grown fast over the years. While its innovative and comprehensive features are a key driver to attracting users, another major driver is GitLab’s open-source business model, notably loved by software developers as they can contribute to developing the platform and fixing issues.

Not only did being an open-source platform help the firm to attract users, but also helped its internal R&D team to speed up the release of new features, having more than 4000 users contributing to developing and innovating the platform.

In the future, the open source model will allow GitLab to have a more efficient investment strategy, requiring less capital investments, especially as regards R&D, as it can attract skilled professionals more easily and rely on a strong community to fix issues and develop new features.

Industry Overview

GitLab, with its $580 million in revenues in 2023, has established a niche presence in the software industry, representing 0.1% of the industry’s total revenues of $635.1 billion.

GitLab’s major rival is GitHub, owned by the software giant Microsoft, sitting on a market share of 0.2% with $1.4 billion in revenues in 2023.

Both firms offer similar solutions as their business models rely on Git technology, a distributed version control system that, said brutally, permits software developers to track the history of software, going back in time and seeing the changes made in each version saved. Other than a track record, Git technology permits saving the software code in a shared place where everyone can access it and create different versions of it that can be merged with the original one.

Differently from GitLab, GitHub is a closed-core platform relying on third-party applications to offer a comprehensive CI/CD platform, and with lower security features than GitLab. However, GitHub is by far the most popular Git repository in the world, boasting a community of 100 million users. In addition, GitHub can rely on the support of Microsoft, both in terms of capital funding and technology, a crucial advantage, especially as Microsoft can offer cutting-edge AI technologies.

Being invested in OpenAI too, Microsoft leveraged ChatGPT technology into its products, namely the AI assistant Copilot, which has been integrated into GitHub to help developers write better and more efficient code.

GitHub and GitLab are the two major players in their segment. However, there exist other smaller competitors like Bitbucket, a Git repository belonging to the Atlassian software family.

Industry Forecasts

As discussed in my previous articles covering software companies, like Palantir and Snowflake, from 2013 to 2023, the software industry’s revenues grew at a CAGR of 10.4%, increasing 2.7 times from $235.3 billion to $635.1 billion.

Software Industry Past Revenues (in $millions)

|

The blossom of the internet at the beginning of the 21st century and the mass adoption of cloud computing have been two major drivers for the rapid expansion of the software industry. Nowadays, given the ongoing digitalization trends and sprout of AI technologies, software solutions are embedded in people’s everyday lives more than ever.

Considering the collective investments made by software companies through the years, to support future growth, the 2024 expected growth rate for the industry is 14.07%. We projected the industry’s expected revenues 10 years from now, applying the expected growth rate of 14.07% and allowing it to slowly decline as the industry approaches the economy’s perpetual growth rate, represented in this case by the USD risk-free rate.

By 2033, the software industry revenues are expected to reach $1.4 trillion, increasing 2.2 times from the $635.1 billion registered in 2023 at a CAGR of 8%.

Software Industry Future Revenues (in $millions)

|

Company Growth Forecasts

Over the period 2019-2023, GitLab revenues grew at a CAGR of 63.5% increasing 7.1 times from $81 million to $580 million.

GitLab Revenues & Market Share (in $ millions)

|

YTD GitLab stocks scored a poor performance due to a disappointing FY2025 guidance, with revenue expected to grow 27% sitting around $740 million. Wall Street didn’t respond well to the guidance, especially as the management expressively stated that it was not conservative.

Despite Wall Street pessimism, 27% is still a pretty healthy growth rate, especially considering the challenging macroeconomic environment, seeing weak demand for enterprise software, as also blamed by Salesforce’s management in their Q1 earnings call.

The recent tech sell-offs indicate that analysts were probably expecting too much from tech companies, and are now overreacting to companies coming short of unrealistic expectations.

With that said, we expect GitLab to continue penetrating the software development segment, growing its user base thanks to its comprehensive suite of DevSecOps solutions, leveraging on its all-in-one platform and top-notch security tools to attract more and more enterprise customers.

Other than attracting new users, GitLab is expected to continue upselling its already existing customer base by continuously realising new features like the recently introduced GitLab Duo, an add-on solution bringing AI capabilities on top of GitLab’s already powerful software development platform. The 130% Net Retention Rate is a good indicator of the firm’s ability to upsell its existing customers.

With these assumptions, we expect GitLab to improve its niche market share from 0.1% to 0.4% by 2033, with revenues projected to reach $5.2 billion, increasing 9.1 times, steadily growing at a sustainable CAGR of 24.7% for the next 10 years.

GitLab Future Revenues & Market Share (in $ millions)

|

Free Cash Flows Forecasts

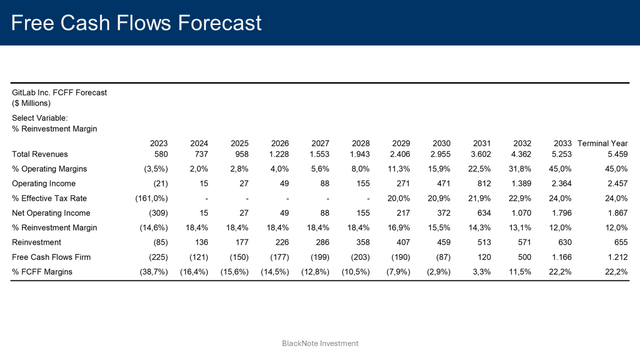

Since the firm turned public, it has yet to reach GAAP profitability, registering an operating loss of ($179) million in 2023, equal to a negative operating margin of (30.9%).

When looking at the gross profit though, GitLab reports a staggering 88% median gross margin, which places it at the top of almost any software company. For comparisons, top-tier companies like ServiceNow and Microsoft have median gross margins of 76% and 68% respectively.

Other than S&M expenses – needed to improve brand awareness and attract new customers – R&D expenses are another major cost center as GitLab needs to continuously develop and update its platform.

However, when capitalizing R&D over multiple years, instead of expensing them entirely in the year they occur – as R&D generates a return over future years – the 2023 operating loss adjusts to ($21) million or a negative operating margin of (3.5%). Whether looking at the GAAP operating margin or the adjusted figure, it has steadily improved over the years.

We expect the adjusted operating margin to turn positive in FY2025 and steadily improve until it reaches 45% by 2033. Starting from a nearly 90% gross margin, we assumed GitLab to gradually reduce its S&M expenses as the platform acquires more users, significantly reducing the overall operating expenses.

While R&D capitalization positively impacts the operating income, it has no effect on free cash flows to the firm (FCFFs), as in return for higher operating income, it increases the total reinvestments that must be subtracted to obtain the FCFFs.

In 2023, GitLab registered negative FCFFs of ($225) million, and we expect the firm to continue to deliver negative FCFFs for the next six to seven years as they scale up their operations. However, along with improved profitability due to lower marketing costs, we expect GitLab to reduce its reinvestment needs as its business model seems to require fewer investments in capital expenditure when compared to average software companies, and relatively lower R&D needs as the firm can benefit from its open-source business model.

The software industry median reinvestment margin – after capitalizing R&D – is 18.4%. We expect GitLab to have a reinvestment margin equal to the industry standard until 2028, as it scales up its platform, and then gradually reduce the reinvestment need to 12%, in line with more mature software companies like Salesforce, which boosts a median reinvestment margin of 12% after capitalizing R&D.

With these assumptions, GitLab’s FCFFs are projected to reach $1.2 billion by 2033, equal to an FCFF margin of 22%, significantly higher than the industry median FCFF margin of 10.7%.

Source – Analyst’s computation

Valuation

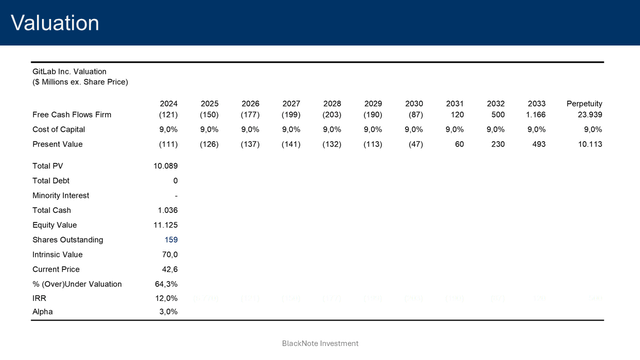

Applying a discount rate of 9% for the next 10 years and in perpetuity, we obtain that the present value of these cash flows – after adjusting for debt and cash on hand – is equal to $11.1 billion or $70 per share.

Compared to the current prices, GitLab stocks are undervalued by 64%.

To justify current stock prices, the implied rate of return would be equal to 12%.

It implies investing in GitLab at the current prices would deliver a positive alpha of 3% as it would generate higher returns compared to the actual return investors should expect – equal to the cost of capital of 9% – given the assumption on cash flows and risk made so far.

Source – Analyst’s computation

The street target for GitLab – based on 24 different analyst expectations – is sitting at $64.7 per share, as of the 12th of August 2024, with 16 street recommendations expressing the rating “Buy”.

Discount Rate

To determine the appropriate discount rate, we employ the WACC method, which considers both the cost of equity and the cost of debt.

The cost of equity – 9% – is derived using the USA equity risk premium of 4.5% – as of August 2024 – the current USD risk-free rate of 3.9%, and the company’s beta of XX. The company’s beta is based on the software industry’s unlevered beta of 1.13.

The cost of debt is not meaningful as the company has no debt outstanding. With a current Equity to EV of 100%, the discount rate for the next 10 years is 9%.

Conclusion

After a bullish IPO in late 2021, turning public at $120 per share, GitLab is currently down (64.5%), (32.2%) year-to-date.

Such depressive valuations have attracted the interest of big tech companies like Google – which owns 7.35% of the company being its second-largest shareholder – and Datadog – a software company offering observability solutions – which consider GitLab as a potential acquisition target.

Despite a possible acquisition is no more than market rumours at the moment, especially in light of Google’s charges related to monopolistic practices – likely discouraging it from further extending its market dominance by acquiring another key player – it is a strong indicator of GitLab undervaluation and market overreaction to the FY2025 guidance.

In conclusion, at current prices, our assumptions suggest that GitLab’s risk-reward profile has the potential to generate a positive return representing a good investment opportunity.

Read the full article here