Introduction

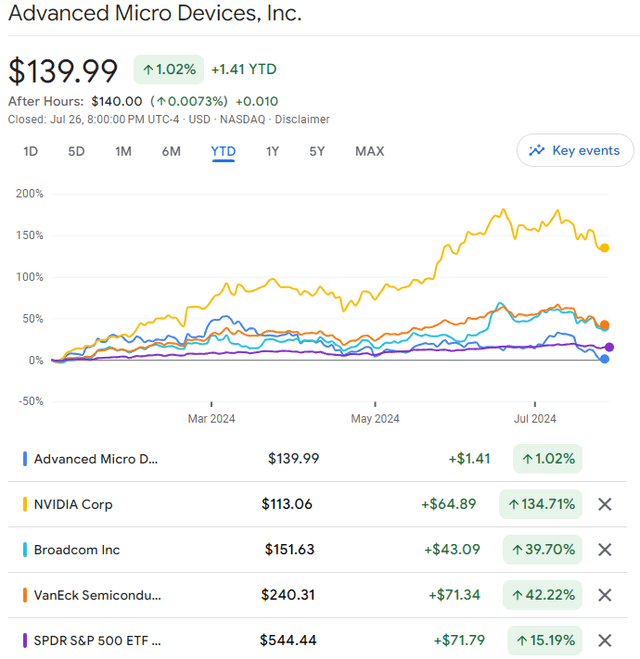

Since striking a blow-off top in early March, Advanced Micro Devices, Inc. (NASDAQ:AMD) stock has tumbled by nearly 40%. It is now trading virtually flat for the year going into today’s quarterly report — underperforming its semiconductor industry peers [Nvidia (NVDA), Broadcom (AVGO), VanEck Semiconductor ETF (SMH)], and the broader stock market [S&P-500 (SPY)].

GoogleFinance

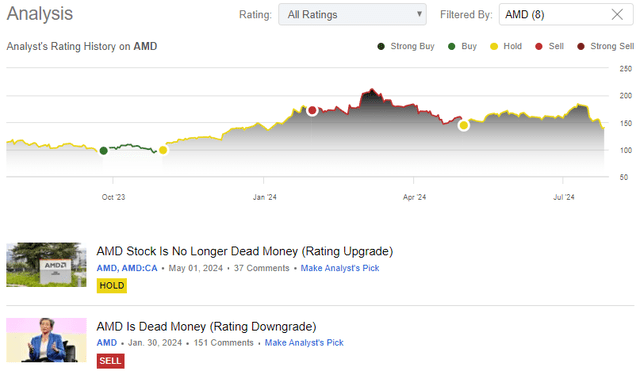

If you have been following my work on AMD, you know that I was “bearish” on this semiconductor giant from late January ($170s) until early May ($140s) due to its elevated valuation and a lack of AI-powered hypergrowth to support that valuation. Then, in my previous report, I upgraded AMD stock to a “Hold/Neutral” rating. Here’s what I wrote at the time –

From a fundamental perspective, AMD is reporting green shoots in its Data Center business, driven by demand for its AI GPUs. The CAPEX guidance from cloud hyperscalers serves as a positive read through for AI chipmakers. While AMD is a distant second right now (given Nvidia’s dominance in the AI GPU market), I think AMD can carve out a sizeable market share in this rapidly growing market as enterprise customers will require an alternative provider to limit Nvidia’s dominance.

In my mind, AMD remains a show-me story after its Q1 2024 earnings report, with the stock still running ahead of business fundamentals, albeit the gap is much narrower now compared to just a few months ago.

Considering improving business trends and the seismic shift in long-term risk/reward (after a big price decline), I am upgrading AMD stock from “Sell” to “Hold/Neutral” in the $140s. While I am still not a buyer, you can expect me to become one, if AMD stock were to slide down to the low-$100s.

Source: AMD Stock Is No Longer Dead Money (Rating Upgrade).

SeekingAlpha

In today’s note, we shall preview AMD’s upcoming report and re-evaluate the stock using TQI’s Quantamental Analysis process to see if it’s a buy/sell/hold at current levels.

What Is The Earnings Forecast For AMD?

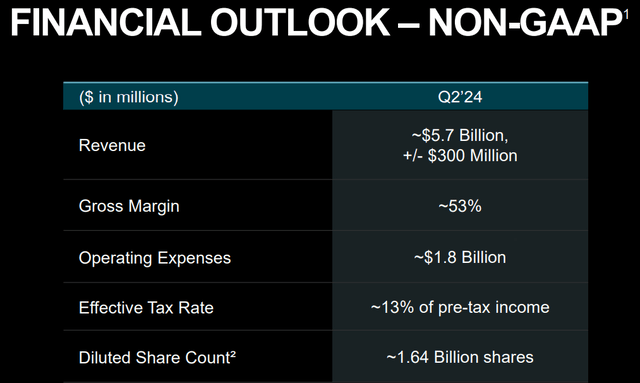

In their Q1 2024 earning press release, AMD’s management guided for Q2 2024 revenues to be in the range of $5.4-$6B, implying +6% y/y and +4% q/q growth at the midpoint of the guidance range. While AMD’s business is expected to keep re-accelerating in Q2, the consensus estimates for Q2 going into the Q1 2024 report stood at $5.73B, which means AMD’s guide was more or less in line with consensus estimates.

AMD Q1 2024 Earnings Material

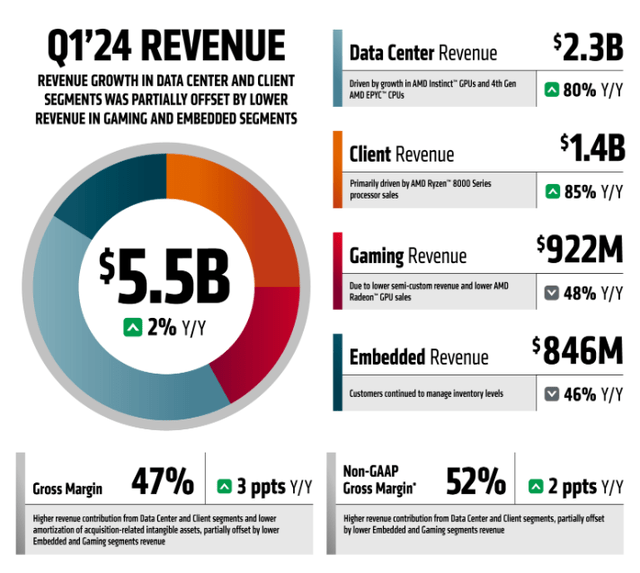

Now, in comparison to peers such as Nvidia and Super Micro Computer (SMCI), AMD’s current revenue growth rates are paltry. However, AMD’s management provided positive demand signals for the rest of 2024 during the Q1 earnings call, with AI GPU demand outstripping supply and the embedded segment projected to stabilize in Q2 (emphasis added).

On the Q1 2024 earnings call, CEO Lisa Su reiterated that the MI300 accelerator ramp is on track, and shared that MI300 has become the fastest product in AMD’s history to ramp to >$1B in annual sales [over the past couple of quarters]. More importantly, Su highlighted the strong demand for AMD’s AI GPUs and raised 2024 data center GPU revenue guidance to $4B (up from $3.5B in Q4 2023 and $2B in Q3 2023):

“MI300 demand continues to strengthen. And based on our expanding customer engagements, we netback data center GPU revenue to exceed $4 billion in 2024, up from the $3.5 billion we guided in January. Long term, we are increasingly working closer with our cloud and enterprise customers as we expand and accelerate our AI hardware and software road maps and grow our data center GPU footprint.”

In my view, the secular trends (AI, cloud computing, 5G/IoT) powering AMD and the semiconductor industry are going to remain strong for years to come. While its near-term financial performance could continue to look underwhelming due to its non-Data Center business segments, AMD’s Data Center revenues grew by +80% y/y in Q1. This momentum is likely to pick up in upcoming quarters, with newer, more powerful AI chips from AMD on the way for 2025-26. Hence, at some point in the near future, I expect AMD’s AI GPUs [Data Center] revenues to start pushing overall top-line growth rates into the double digits.

While Alphabet (GOOGL, GOOG) isn’t currently offering AMD’s AI chips to its cloud customers, the read-through from Alphabet’s Q2 2024 earnings report for AI infrastructure CAPEX spending was mighty positive for semiconductor giants supplying AI GPUs. I shared my take on this subject in this recent earnings review report:

- Google: A Wafer-Thin Q2 Double Beat Meets Lofty Valuation – Buy, Sell, Or Hold?

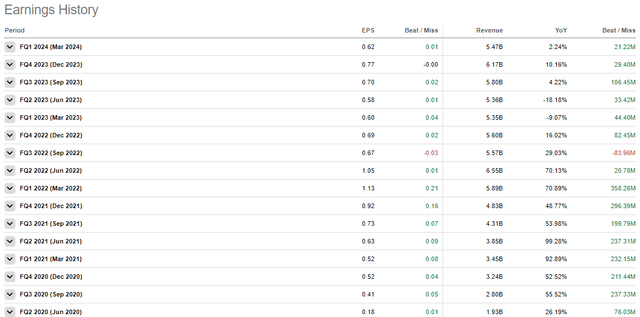

Furthermore, AMD’s management has a track record of under-promising and over-delivering, as evidenced by a string of top and bottom-line beats:

SeekingAlpha

Consequently, we may see better-than-expected results from Advanced Micro Devices when the company reports Q2 numbers later today. Before we look into consensus analyst estimates for Q2 2024, let’s briefly review AMD’s Q1 2024 earnings report to understand ongoing business trends.

How Was AMD’s Previous Earning Report?

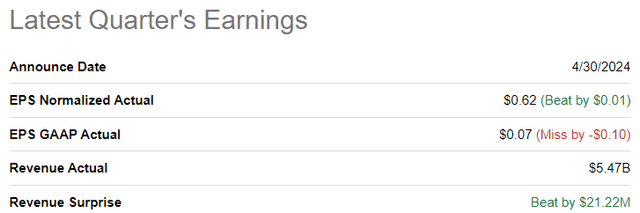

In Q1 2024, Advanced Micro Devices’ revenues grew by +2% y/y to $5.47B, with explosive growth in its Data Center and Client segments masking the weakness in Gaming and Embedded business segments. While AMD delivered a marginal beat on revenues, GAAP EPS fell short of expectations.

SeekingAlpha

AMD Q1 2024 Earning Materials

While I have highlighted the lack of AI-powered hypergrowth as a reason to avoid AMD stock in the midst of a parabolic run-up in the past, the +80% y/y jump in Data Center revenues is indicative of a strong ramp for AMD’s MI300 AI GPU accelerators. Unfortunately, the recent growth in AMD’s AI GPU revenue hasn’t been adequate to move the needle for AMD’s business overall.

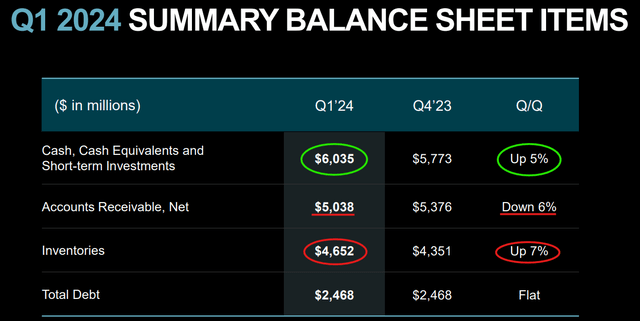

On a positive note, AMD’s non-GAAP gross margin improved to 52% in Q1 and is set to rise further to ~53% in Q2 2024. With operating expenses now growing at 10% y/y (only slightly faster than gross profits), AMD’s operating leverage should improve in the upcoming quarters. Powered by positive revenue growth and margin improvement, AMD generated $379M in free cash flow (margin: +7%) last quarter.

AMD Q1 2024 Earning Materials

As of the end of Q1, AMD’s net cash balance stood at $6.03B (up +5% q/q), giving the chip giant a strong financial foundation. With AMD likely to deliver increasing amounts of free cash flows in upcoming quarters, I see no liquidity issues for the foreseeable future.

Now, AMD’s Q1 results were more or less in line with street expectations, and management did not provide superlative guidance for Q2. With that in mind, let’s review consensus estimates now.

Is AMD Expected To Beat Earnings?

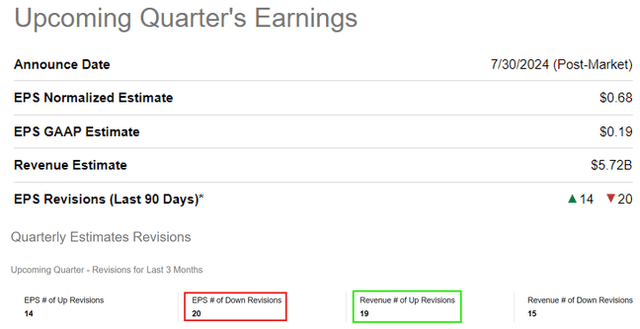

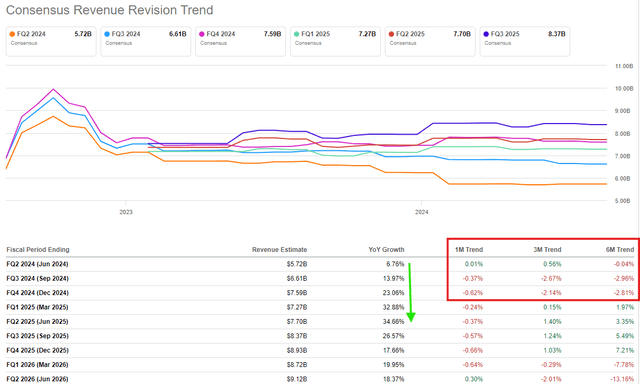

According to consensus analyst estimates, AMD is set to deliver total revenue of $5.72B (+6.76% y/y) for Q2 2024, and the range of these estimates is from $5.68-5.89B (lower than the upper end of management’s guidance range of $5.4-6B for this quarter). Hence, the consensus view on AMD seems subdued.

SeekingAlpha

Over the last three months, AMD has received 19 upward and 24 downward revisions for Q2 2024 revenue, with consensus estimates roughly flat over the last month, three months, and six months. As of today, the consensus analyst estimate for AMD’s Q2 revenue sits at $5.72B (slightly higher than the midpoint of management’s guidance range). While revenue revision trends aren’t inspiring, analyst estimates do project continued re-acceleration for AMD, with y/y revenue growth rate expected to pick up from 6.7% in Q2 2024 to 34% in Q2 2025.

AMD Revenue estimates (SeekingAlpha)

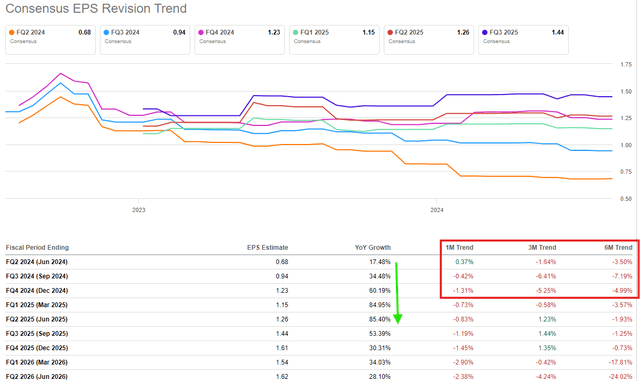

On the earnings front, the consensus outlook suggests a return to rapid growth in EPS for AMD despite slightly negative revision trends.

AMD EPS estimates (SeekingAlpha)

Based on recent business trends, management’s guidance, consensus estimates, and earning revision trends, I do not expect to see any major fireworks from AMD in Q2 2024.

Is AMD Stock A Buy, Sell, or Hold?

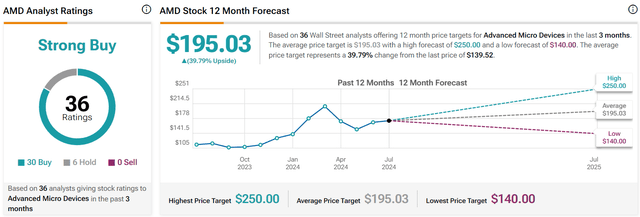

Heading into a pivotal quarterly report, Wall Street analysts remain bullish on AMD stock, with 30 out of 36 analysts covering AMD [nearly 85%] rating the stock as a “Buy” right now. With the remaining six analysts rating AMD a “Hold,” there are no “Sell” ratings from Wall Street firms on AMD at this time.

TipRanks

While the 12-month price target range for AMD is expansive [$140-250], the consensus estimate of $195 points to an upside potential of ~40% from current levels!

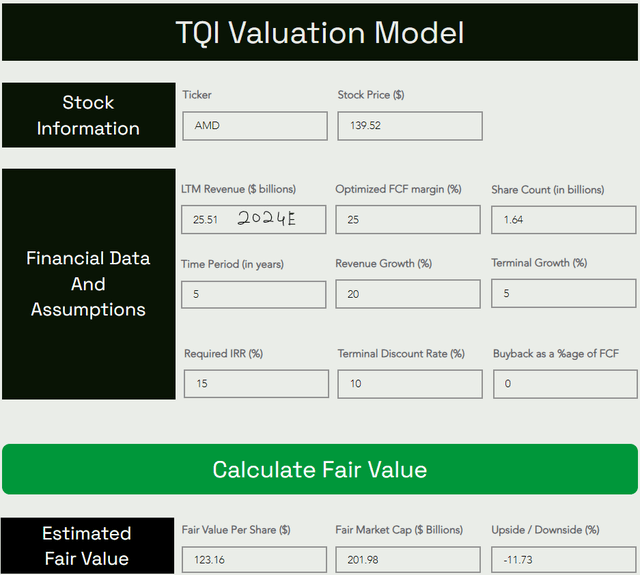

However, using reasonable assumptions for future growth and margins in our proprietary valuation model, we determined that AMD stock is still overvalued at current levels. As of now, TQI’s fair value estimate for AMD stands at ~$123 per share. If you would like to understand our assumptions in more detail, check my prior report.

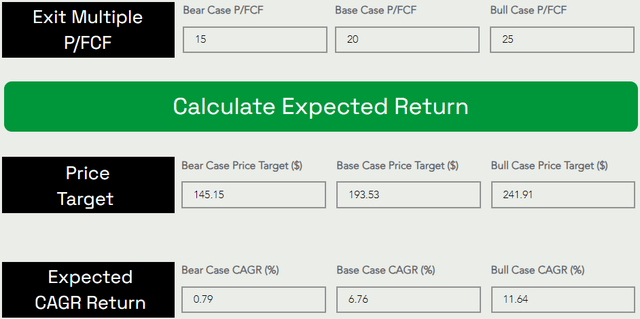

TQI Valuation Model (Free to use at TQIG.org)

Assuming a base case P/FCF exit multiple of ~20x, we get to a 5-year price target of ~$194 per share, which implies a CAGR return of ~6.8%.

TQI Valuation Model (Free to use at TQIG.org)

With AMD’s base case expected CAGR falling well short of my investment hurdle rate (of 15%) and slightly lower than long-term market (S&P-500) returns (of 8%-10% per year), I do not view AMD as an attractive investment at current levels.

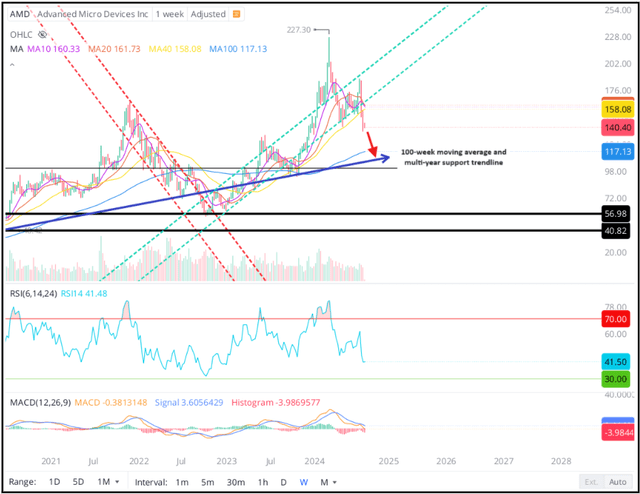

Technically, AMD stock has lost momentum and decisively broken under its rising channel. Given the ongoing rollover in momentum indicators — Weekly RSI and MACD — the next logical destination for AMD stock is in the low-$100s, which happens to be our intrinsic value estimate for the business.

AMD stock chart (WeBull Desktop)

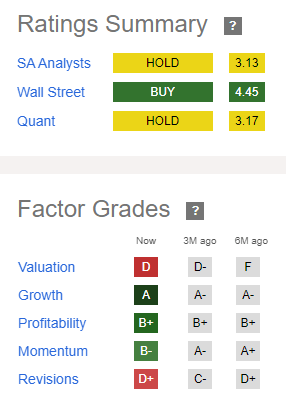

Furthermore, AMD’s quant factor grades remain unsupportive for fresh buying, despite its “Growth” and “Valuation” grades going from “A- to A” and “F to D” over the last six months.

AMD Quant Factor Grades (SeekingAlpha)

While AMD’s “Profitability” grade has held up at “B+”, its “Momentum” and “Revisions” grades have deteriorated from “A+ to B-” and “C- to D+” over the same period.

Considering AMD’s fundamental, quantitative, valuation, and technical data, I am sticking to my “Hold/Neutral” rating.

Concluding Thoughts

Advanced Micro Devices is a fundamentally sound business that I want to own long-term; however, in the absence of AI-powered hypergrowth, I find it difficult to justify paying up a premium for AMD stock ahead of its Q2 report. Based on recent business trends, management’s guidance, consensus estimates, and earning revision trends, I do not expect to see any major fireworks from AMD later tonight; however, I will be happy to re-evaluate my “Hold/Neutral” rating on AMD stock if we get a blowout quarter, superlative guidance, and/or a significant post-ER decline.

Key Takeaway: I continue to rate Advanced Micro Devices, Inc. stock “Hold/Neutral” at ~$139.52 per share.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Read the full article here