Something is afoot at Warner Bros. Discovery, Inc. (NASDAQ:WBD). First, Bank of America Analysts suggest that the company should spin-off its cable assets and offload debt. Then swiftly after, the FT reports that the company is entertaining that idea. I’ll argue why this is a bad idea that destroys shareholder value in the long term.

A Deal for WBD’s Legacy Assets is Unfeasible

FT reports that management is considering attaching the company’s debt with the legacy assets. With $42.5 billion in gross debt, this likely rules out a sale. In my opinion, it will be impossible to find someone willing to take on that amount of debt and pay for the equity value of those assets. It is worth noting that the whole of Paramount (legacy and studio) could have sold for a high of $25 billion. That’s slightly more than half the debt WBD would offload. To me, that puts in perspective how highly unlikely someone would buy WBD’s legacy assets with that level of debt included.

And even if the unit finds a buyer, the amount received will probably be too low compared to the unit’s cash flows, that the company is probably better off managing its decline and paying off the debt itself. With a starting point of $9 billion in EBITDA, I think it’s easy for management to manage the decline in cash flows while paying for the capex, $2 billion in interest payments, and using whatever is left to pay down debt or fund growth.

This leaves out the option to spin off the unit as a separately traded company. And the question in this scenario is how much would that stock sell for in the open market? I think it is surely going to be a terrible performer for shareholders. The counter-argument is this will be more made up by the revaluation of the growth parts of the business. But this is yet another issue.

WBD’s Growth Businesses Are Not Growing

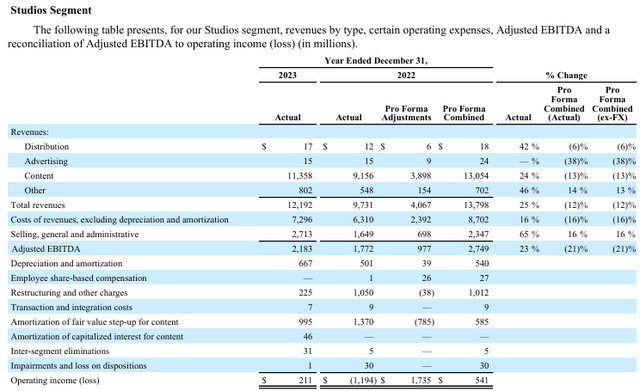

WBD’s studios segment is another secularly-challenged business (Company’s sec fillings)

Last year, the studios segment reported a revenue and EBITDA decline of 12% and 21% respectively. And that’s in a year when they had the highest grossing movie and video game of the year. Q1 of this year? EBITDA is down a massive 70%, with revenue down another 13%.

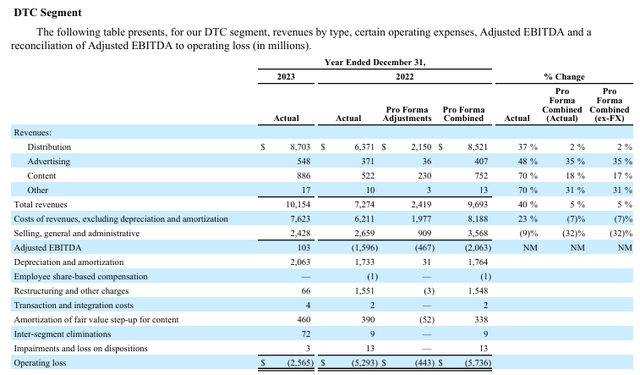

DTC is certainly the best performing unit, but it has its own challenges as well (company filings)

DTC for its part has shown remarkable growth in EBITDA. But that is mainly due to spending less on content and marketing. Revenue was only up 5% in 2023. It was also flat in Q1 2024. It’s also unclear how much EBITDA grows once it hits management’s target of $1 billion. But if revenue is growing mid-single digits, EBITDA will not be able to outgrow that for long.

Despite the uninspiring growth rates, there are some encouraging signs under the hood. Growth in advertising has been really strong at 35% in 2023 and 70% in Q1 of 2024. This indicates that growth in streaming is really strong, but may be from a low base, with HBO’s cable struggles offsetting that growth.

At the end of the day, both units have secular challenges. HBO is facing chord-cutting, just like the legacy business. Meanwhile, the studio segment has a host of issues. Firstly, streaming has disrupted their business, and they might not be able to generate the same revenue from theatrical releases as pre-pandemic. The second is that content sales are likely to come down as consolidation in streaming continues. The spin-off essentially guarantees underperformance of spinco’s stock without any assurances that remainco would hit it on all cylinders, especially given the secular challenges the latter is likely to continue to face. In fact, there is a case the spinoff would deprive the studio and DTC of crucial capital the networks generate through its cash flows.

The Logic of the WBD Merger Has Been Lost in the Stock’s Underperformance

There were two main advantages of merging WarnerMedia and Discovery. The first, was that the company was going to be more efficient. Here is CFO Gunnar Wiedenfels in the merger’s investor call:

we expect at least $3 billion of cost synergy alone phased in post close and that will likely take around 2 years to complete. Note, this is cost capture alone and does not factor in any of the harder to quantify, but potentially significant, upside from synergistic revenue opportunities that we may be able to capture as we bring these valuable products to consumers and where we can look at cross-promotion and marketing, joint development and production and unlock new content franchises and opportunities across the vast library of iconic IP. As you may recall, following our Scripps Discovery merger, we ultimately delivered synergies significantly above our initial cost synergy estimate, and the opportunity here is so much larger.

Management delivered on that, with $5 billion in cost savings. But the most important strategic rationale for the merger was that both companies’ content was synergistic. David Zaslav from the same call:

Broad global reach in over 200 countries with a wide owned and operated marketing funnel. A consistency of franchise tent poles. Big, loud films that act as beacons to bring viewers in. And a deep and wide offering of genres, verticals and formats to keep consumers engaged and nourished on the platform.

The idea was that WarnerMedia had the big shows that attract millions of customers, while Discovery had the low-budget shows that would keep those customers. For some reason, the stock was down 75% and many analysts and reporters have decided that the merger doesn’t work. Now it might not, but the reality is, the company is still in the process of building out its distribution. How could WarnerMedia’s shows attract millions of viewers, if the company is still in the process of rolling out the Max streaming service worldwide?

It is also worth taking the stock decline with a grain of salt as it involved the selling of AT&T investors who were more dividend investors, this was followed by doubts around streaming when Netflix missed its subscriber numbers, then there were legacy advertising driving earnings misses in the stock. But cable advertising is not why this merger made sense, it is the opportunity to take that premium content direct to consumers. Right now, there is no sign of that not working, and it’s why I’m reiterating my buy rating. The rollout will be largely complete in 2025 and it’s after that when investors can truly judge the success of the merger. JB Perrette from Q4 2023 earnings call:

We are excited that in 2024, we’re getting back to growth in new market rollouts, which is the first time in two years as we’ve been, obviously, hard at work retooling the platform and the technology and getting it right in the US, with LatAm launch next week, Europe starting in the second quarter with two brand-new markets in France and Belgium starting in the second quarter. Asia and Australasia will likely be more by 2025. And then the rest of the European markets for now slated more for 2026.

That year will also see the rollout of the Harry Potter show. That will be the first tent pole show where streaming’s distribution is ready. If the company fails to attract millions of new customers on the back of that show, then the merger has failed. But before then, it is too soon to make judgements, even with the stock underperforming.

Read the full article here