The iShares U.S. Regional Banks ETF (NYSEARCA:IAT) is highly exposed to loans to commercial real estate, namely offices, leading to larger charge-offs for those loans as companies make reserves for losses that can be expected over the coming periods as massive quantities of CRE (commercial real estate) debt matures. While regional banks have been seeing NII growth thanks to higher rates and the sector is discounted at a 10x PE, we don’t want to directly in the way of the next possible systemic risk for the US economy. It doesn’t help that this relatively narrow ETF also carries a rather high 0.4% expense ratio.

IAT Breakdown

Expense ratios are around 0.4%, which is quite high due to the ETF targeting a relatively narrow part of the market. It’s lower than the average expense ratio of ETF focused on financial equities, but still eats into earnings yield of around 10% considerably (inverse of PE).

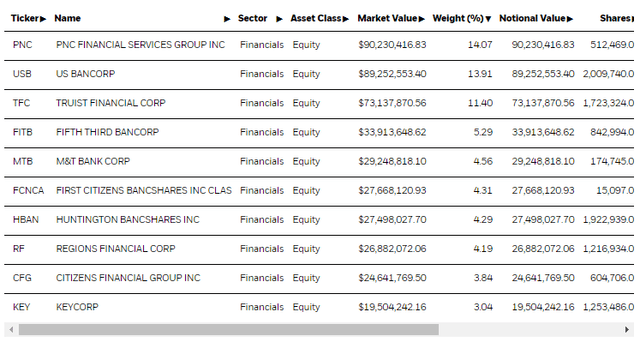

IAT Holdings (iShares.com)

In being narrow, the ETF is also skewed towards a couple of highly weighted assets, namely PNC Financial (PNC), U.S. Bancorp (USB), and Truist Financial (TFC). Ultimately, the exposure across the board is listed regional banks.

Like everything, the share of assets in the financial system follows a scale free or pareto distribution, where regional banks command a pretty marginal share of the overall financial assets in the US despite being far more numerous. About 15% of the assets are controlled by regional banks, with the rest being commanded by the national banks whose balance sheets are larger than $100 billion.

The issue is that a lot of those assets are commercial real estate loans. They have an outsized presence on the balance sheet of regional banks. Over the next three years, $2.2 trillion is coming due in CRE loans, and the overall assets of regional banks are around $3 trillion. In just one year, it might be around $500 billion. A big part of commercial real estate is office. Again, regional banks have large exposures here since with their regional presence, they’ve been expected and able to assess assets in their domestic markets in real estate to produce loans.

With this massive maturity wall looming and interest rates high, there is a significant chance of problems. Signs haven’t been showing as of yet because lenders require some interest reserves with debtors, but those will be continuously running dry for debtors with large office real estate portfolios, that remain low in vacancies in all but the most marquee markets. Even midtown Manhattan isn’t good enough. Distressed loans in offices stand at around $40 billion as of the first quarter in 2024. While more a problem with the national banks pertaining to high payout ratio REITs, the composition of this debt also matters, with some being in credit facilities that typically get drawn down at once. With the systemic and leveraged nature of these assets, the correlation between demand for credit facilities and the distress of the assets exacerbates potential dangers. It hasn’t helped that regional banks had been aggressive with CRE lending in general leading up to this high-yield period, including demanding less down payments.

Banks are awake to this, and so are the Fed, which likely consider these factors in what, we believe, is premature dialogue as to whether to cut rates. In the case of the banks, USB cut its dividend and started to hoard cash since it believes the risk of bad loans is real enough to risk serious investor worry, which is how a bank run starts. That’s of course, an unacceptable risk. Charge-offs are up for office real estate.

Bottom Line

The PE of the ETF is 10x, so a 10% earnings yield. There are plenty of equities on the international markets that offer that sort of yield. Why take regional banks that are going to go through a period of stress over the next couple of years. We know that they are facing a maturity wall. While markets may be taking this into account to some extent, there is a systematic bias of underestimating network effects.

Read the full article here