When it comes to the US telecommunications space, there’s no denying that Verizon Communications (NYSE:VZ) (NEOE:VZ:CA) is one of the big players. It’s a company that I am well aware of, having been a customer of it for my cell phone service ever since I first got a cell phone back in 2008. Having said that, I have not, historically speaking, been the biggest fan of the company from an investment perspective. I have long preferred its rival, AT&T (T) which I currently own shares of.

This does not mean, however, that the picture cannot change. You see, back in October of last year, I ended up rating Verizon Communications a ‘hold’. At the time, I was focused on the safety of its dividend and its valuation. Since then, the stock has outperformed even my own expectations, seeing upside of 33.4% compared to the 25.3% rise seen by the S&P 500 over the same window of time. There have been signs of weakness at the business. However, there have also been signs of strength. Shares remain cheap and leverage is under control. Given these factors and in spite of my previous rating for the stock, I believe it’s appropriate to upgrade it to a ‘buy’ at this time.

Time for an upgrade

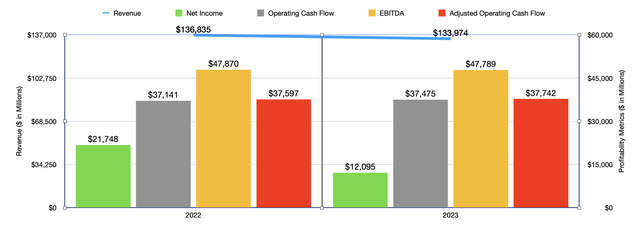

Author – SEC EDGAR Data

When I last wrote about Verizon Communications late last year, investors only had data covering through the second quarter of the company’s 2023 fiscal year. That data now extends through the first quarter of 2024. Before we get to the most recent results for the business, I think it would be appropriate to see how the firm finished 2023 and how that compares to the 2022 results. During 2023, Verizon Communications generated revenue of $133.97 billion. That’s actually a decline from the $136.84 billion the company generated one year earlier.

This drop in revenue was driven by a couple of key factors. For starters, its Consumer segment reported a 1.8% decline in revenue, with sales dropping from $103.51 billion to $101.63 billion. Even though service revenue managed to rise by 2.4% from $73.14 billion to $74.87 billion, the company saw significant weakness elsewhere. Wireless equipment sales, for instance, dropped by 10.9%, plunging from $23.17 billion to $20.65 billion. This decline, according to management, was driven largely by a $3.9 billion hit associated with lower volume of wireless devices sold by the company. This was because of a 26% reduction in upgrades on a year-over-year basis. The picture would have been worse had it not been for a $1.4 billion benefit that the firm received because of higher pricing on its equipment. Other revenue, meanwhile, dropped 15.2% from $7.20 billion to $6.11 billion. This drop was because of a $1.2 billion decline stemming from a larger allocation of administrative and telecommunications recovery charges.

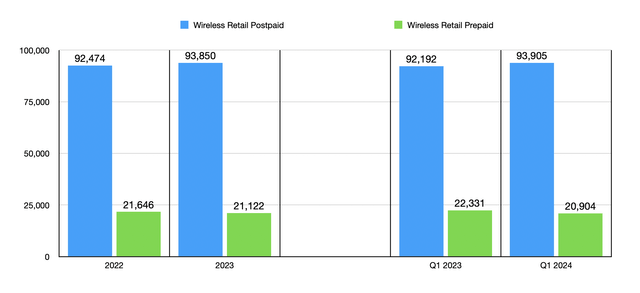

Author – SEC EDGAR Data

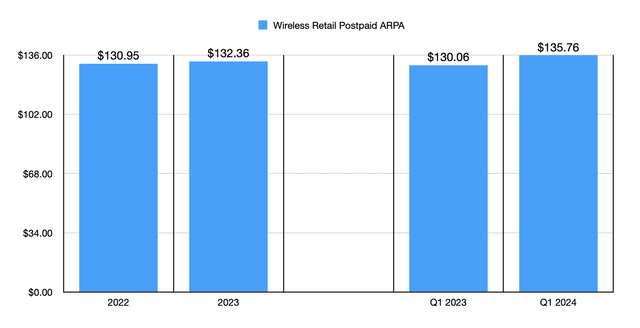

As painful as these declines were, the most important thing is the aforementioned increase in service revenue. This was mostly attributable to a $1.7 billion benefit because of postpaid plans that management was able to charge more for than they were able to charge the year prior.

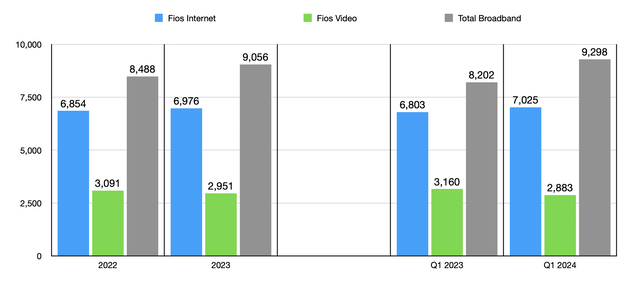

Author – SEC EDGAR Data

It helps that the number of wireless retail postpaid connections managed to grow from 91.86 million to 93.85 million. This more than offset the decline in wireless retail prepaid connections from 22.66 million to 21.12 million. For the segment as a whole, there were some other bright spots for investors to enjoy. For instance, Fios internet subscribers grew from 6.74 million to 6.98 million, while total broadband subscribers expanded from 7.90 million to 9.06 million. I think it’s also worth noting that wireless retail postpaid ARPA (average revenue per account) jumped by 5.1% from $125.97 to $132.36. This is the aforementioned price increase that the company benefited from.

Author – SEC EDGAR Data

There is more to the business than just this. Its Business segment reported a 3.1% drop, with revenue falling from $31.07 billion to $30.12 billion. The biggest pain from this segment came from a 4.3% decline in revenue for its Enterprise and Public Sector operations, with sales falling from $15.69 billion to $15.08 billion. While the number of broadband connections under this segment expanded from 1.04 million to 1.66 million, and the number of wireless retail postpaid connections grew from 28.73 million to 29.78 million, the company suffered from a decline in wireline networking revenue and traditional data and voice communication services. Professional services that it provides also took a hit because of what management describes as ‘secular pressures’ in the market.

With revenue dropping, it should not be a surprise to see profitability for the business suffer. Net income actually plunged from $21.75 billion to $12.10 billion. The drop in revenue certainly didn’t help. However, there were other factors that proved problematic as well. Higher interest rates caused interest expense to jump from $3.61 billion to $5.52 billion. In addition to this, the company incurred a $5.84 billion impairment charge in 2023. Other profitability metrics were far better off. Operating cash flow, for instance, rose from $37.14 billion to $37.48 billion. If we adjust for changes in working capital, we get a slight increase from $37.60 billion to $37.74 billion. Meanwhile, EBITDA for the company contracted from $47.87 billion to $47.79 billion.

Author – SEC EDGAR Data

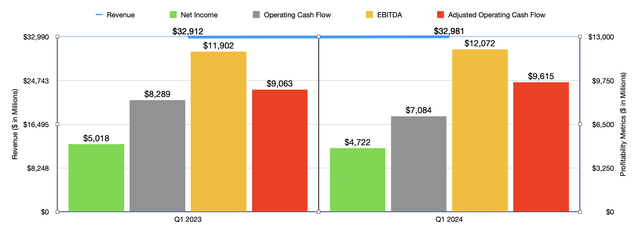

As disappointing as 2023 might have been to some investors, there are some bright spots when it comes to the 2024 fiscal year. Revenue in the first quarter, for instance, totaled $32.98 billion. That is marginally above the $32.91 billion generated one year earlier. This was due solely to growth on the Consumer side of things, with revenue inching up by 0.8% from $24.86 billion to $25.06 billion. Digging a bit deeper, we can see that wireless equipment sales actually fell by 8% year over year. However, service revenue popped up by 2.9%, growing from $18.46 billion to just under $19 billion. This was mostly because of wireless service revenue growing by 3.4% from $15.60 billion to $16.13 billion.

The company benefited from an increase in the number of wireless retail postpaid connections from 92.19 million to 93.91 million. In addition to this, Fios internet connections grew from 6.80 million to 7.03 million, while total broadband connections jumped 13.4% from 8.20 million to 9.30 million. On the pricing front, when it comes to the wireless retail postpaid connections, the company benefited from an increase from $130.06 to $135.75. As a note, these figures are on a monthly basis.

The bottom line for the company was largely better on a year-over-year basis. It is true the net income fell from $5.02 billion to $4.72 billion. Operating cash flow also fell, dropping from $8.29 billion to $7.08 billion. But if we adjust for changes in working capital, we get an improvement from $9.06 billion to $9.62 billion. Meanwhile, EBITDA for the company expanded from $11.90 billion to $12.07 billion.

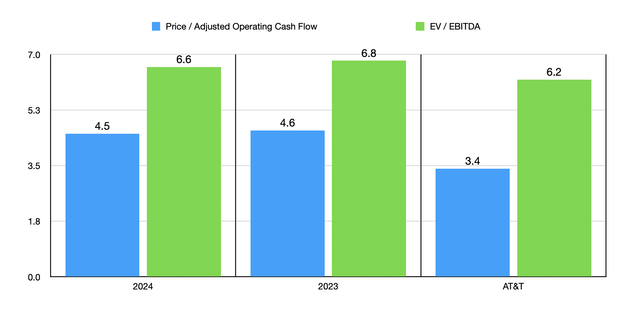

When it comes to valuing the company, it is worth at least talking about management’s expectations for the 2024 fiscal year. They currently anticipate wireless service revenue to grow by between 2% and 2.5%. This should help EBITDA to expand by between 1% and 3%. If we take the midpoint of this growth and apply it to adjusted operating cash flow, we would get a reading of $38.50 billion. Meanwhile, this would translate to EBITDA of $48.75 billion.

Author – SEC EDGAR Data

Taking these figures, I then valued the company as shown in the chart above. This is based on historical results for 2023 and projected figures for 2024. At present, Verizon Communications does look attractively priced, with the company trading at multiples in the low to mid-single digit range. But as I stated at the start of this article, the firm I like more has got to be AT&T. Part of this is because, as that same chart shows, AT&T is trading cheaper than Verizon Communications is currently going for. Don’t get me wrong. Both companies are very attractively priced. But of the two, AT&T is more appealing.

Author – SEC EDGAR Data

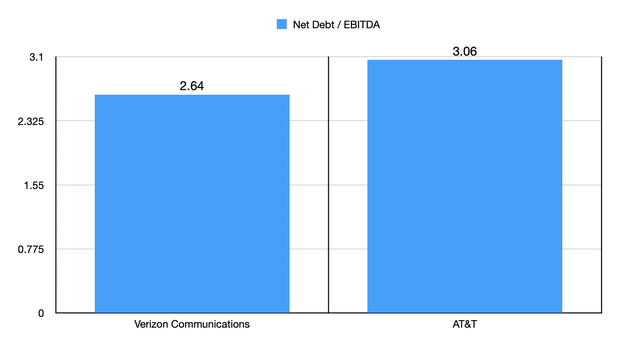

We should also be focused some on quality. And perhaps the easiest way to do this is to look at leverage. As of the end of the most recent quarter, Verizon Communications had net debt of $149.33 billion. It’s important to note that $23.3 billion of this debt is actually collateralized by certain receivables. If we strip this out, net debt falls to approximately $126.03 billion. This gives us, using the 2023 figures, a net leverage ratio for the company of 2.64. By comparison, AT&T is higher, with a net leverage ratio of 3.06. But I wouldn’t call that a significant disparity. This difference means that AT&T would only need to reduce net debt by $17.74 billion in order to be at parity with Verizon Communications. With the company having generated $42.24 billion of EBITDA last year and management focused on debt reduction this year, it won’t be long before the two firms are comparable on this basis. And while Verizon Communications is expected to grow its EBITDA at between 1% and 3% this year, AT&T’s management team is calling for a solid 3% growth.

Takeaway

All things considered, Verizon Communications is doing pretty well for itself. The company has seen some weak spots, such as when it came to the sale of certain equipment and when it came to its Business segment. Profits are also on the decline, though some cash flow metrics have risen nicely. The stock is certainly attractively priced on an absolute basis, and leverage is lower than rival AT&T. When you add all of this together, and consider that I currently have a ‘strong buy’ rating on AT&T, I think it only appropriate that I upgrade Verizon Communications to a ‘buy.’

Read the full article here