I took some time to assess the mortgage real estate investment trust (mREIT) subsector. While embarking on my journey, I analyzed Annaly Capital Management, Inc. (NLY), as I believe its makeup is well suited for discussion, given the current interest rate environment.

Although I have covered numerous mREITs, I have yet to cover Annaly. The vehicle has various idiosyncrasies that distinguish it from other mREITs. Moreover, despite lower implied interest rates, I think Annaly remains a good asset; here’s why.

What Is Annaly Capital Management?

Annaly Capital Management is an mREIT that operates through three pillars: Agency Mortgages (“Agency”), Non-Agency Residential Credit (“ARC”), and Mortgage Servicing Rights (“MSR”).

Aside: For those unaware, agency mortgages are insured by government agencies, whereas non-agency mortgages aren’t. Moreover, Mortgage Servicing Rights mean that the MREIT handles servicing activities instead of merely receiving the income from the underlying securities.

Key Features (Annaly Capital Management)

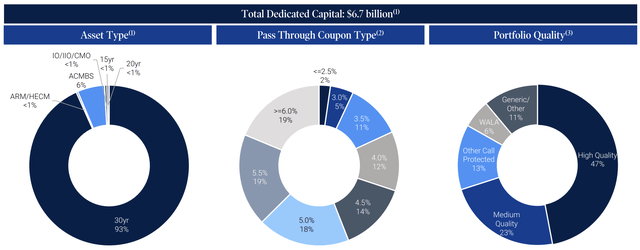

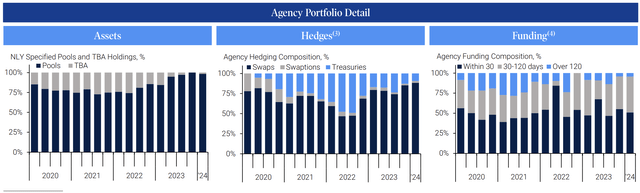

Approximately 93% of Annaly Capital’s agency portfolio consists of 30-year mortgages and about 56% of the portfolio has coupon yields above 5%. Moreover, 47% of the mortgages are high-quality specified pools, and 23% are medium-quality specified pools.

AMBS Portfolio (Annaly Capital Management)

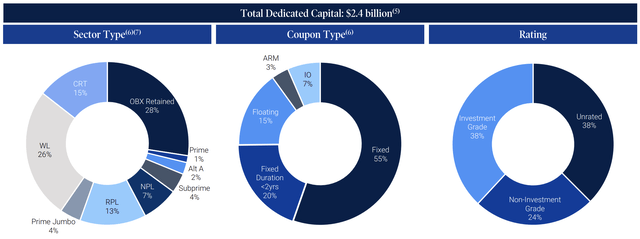

Annaly’s residential loan book is 55% fixed and 38% investment grade. No explicit data is provided on average coupon rates and maturities. However, a summary is discussed later in the article to consolidate Annaly’s influence on the residential loans segment.

Residential Loans (Annaly Capital Management)

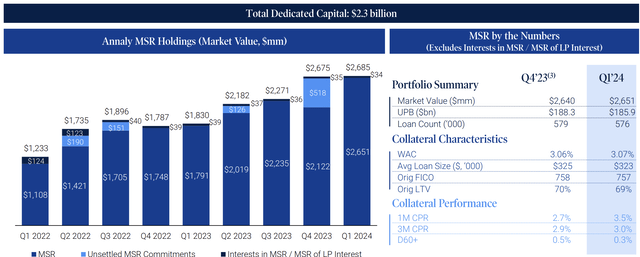

Lastly, Annaly Capital’s MSR business has about $2.3 billion in dedicated capital. As with Residential Loans, the firm didn’t provide specific income-based data latest data. However, it revealed rising asset value, higher collateral cost, lower FICO scores, and faster implied prepayments.

MSR Business (Annaly Capital Management)

Why I’m Positive

Duration Outlook

Unlike many fixed-income products, mortgages can have negative durations, meaning their valuations are positively correlated to interest rates. This presents an issue to risk-averse investors because a mortgage’s income and value components are directly linked instead of inversely correlated (like most fixed-income instruments).

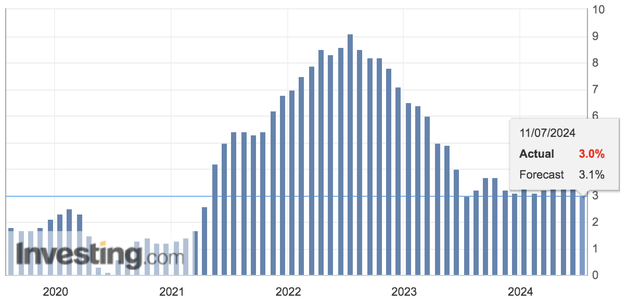

I highlight the above because the average 30-year mortgage rate has slipped to 6.77%, its lowest level since March. Moreover, U.S. inflation is stagnated, meaning implied interest rates are more likely to drop than increase.

U.S. CPI (Investing.com)

Despite the recent mortgage rate activity, I see a few mitigating factors that could lend Annaly Capital support at its asset level.

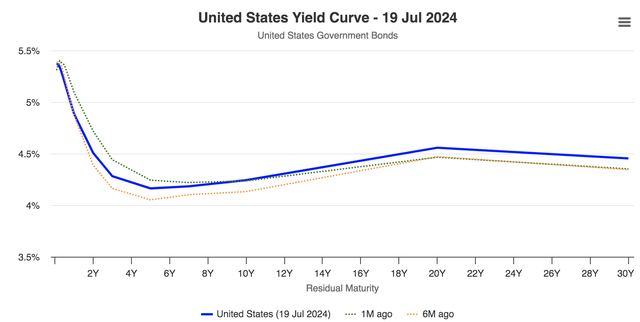

Firstly, the U.S. yield curve has dropped in the past month amid lower inflation numbers. However, interestingly, the drop has occurred at the short end while the longer end has remained unchanged. This is a sign of bullish steepening, which is a typical occurrence when the market anticipates a short-term rate cut to emerge. Remember that most of Annaly Capital’s asset base consists of 30-year MBSs, meaning further steepening could add support to its asset level via higher duration-matched implied interest rates.

U.S. Yield Curve (worldgovernmentbonds.com)

Option-adjusted spreads have decreased significantly year-over-year. We might see an increase in spreads if additional bullish steepening occurred (credit spreads and interest rates are usually inversely related). This could result in lower long-term spreads, limiting some of the abovementioned steepening benefits. Nevertheless, I think prepayments and duration remain less of a risk than most believe.

OAS (St.Louis Fed)

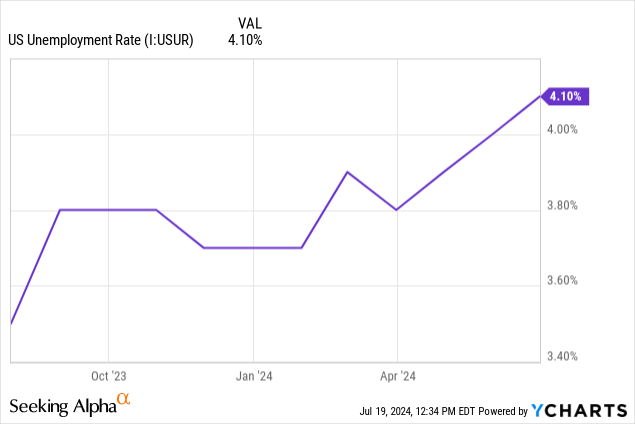

In essence, I think prepayment risk and subsequent mortgage devaluations (and lower income) are overplayed at this time, especially if we combine the aforementioned risk premiums with real economic factors such as an increasing U.S. unemployment rate, volatile PMI, and waning consumer sentiment. Real economic factors often signal borrowers’ ability to enter into new, more favorable loans once mortgage rates recede.

Funding Cost Outlook

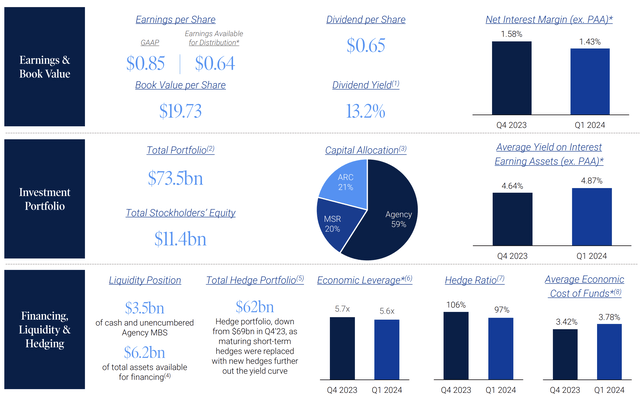

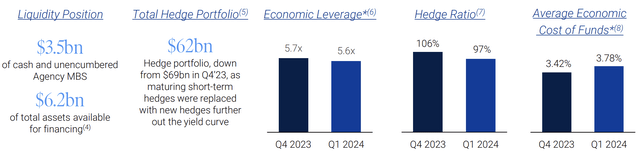

Annaly Capital Management revealed an average cost of funds of 3.78% in Q1, noticeably lower than its average yield on interest-earning assets of 4.87%. Moreover, the fund reduced its leverage to 5.6x in Q1 from 5.7x (a quarter ago) and dropped its hedge ratio by 900 basis points.

Liabilities (Annaly Capital Management)

Annaly primarily uses short-term asset financing, whereby it engages in bilateral repo and broker-based repo, meaning it either trades its collateral asset base for cash or securities. Regardless of the idiosyncrasies, the fund relies on the short end of the curve as a lower short end reduces funding costs via 1) lower repo rates and 2) higher collateral value.

Annaly Capital Management

I think lower implied interest rates will allow the fund to access cheaper capital and allocate into longer-term assets to realize profits. Moreover, lower rates might enhance its collateral value, allowing it access to a more significant amount of funds (due to increased valuations on securities proposed as collateral).

Yields

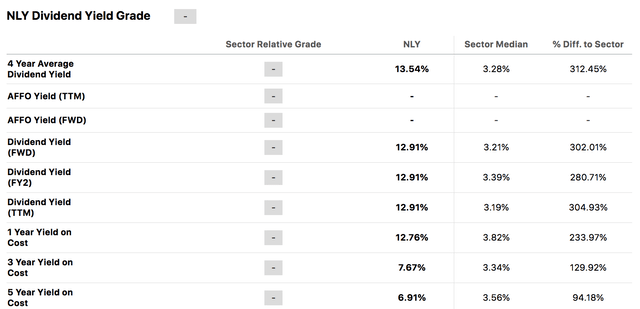

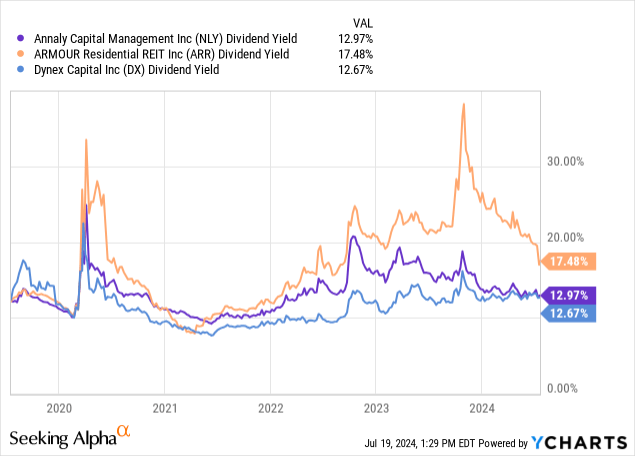

Annaly Capital has a forward dividend yield of approximately 12.91%, which I deem favorable, especially considering the aforementioned fundamentals. Lower interest rates and credit spreads might eventually curb its dividend. However, derailing this asset’s income-generating prospects would take some doing.

Seeking Alpha

The following diagram illustrates Annaly Capital’s dividend yield versus industry peers Armour Residential (ARR) and Dynex Capital (DX). We covered its peers in previous articles, assigning a bullish rating to ARR and a Hold rating to DX. However, we see additional positivity in Annaly’s dividend sustainability due to its diversified operations and favorable asset-funding level spreads.

Risks

Valuation

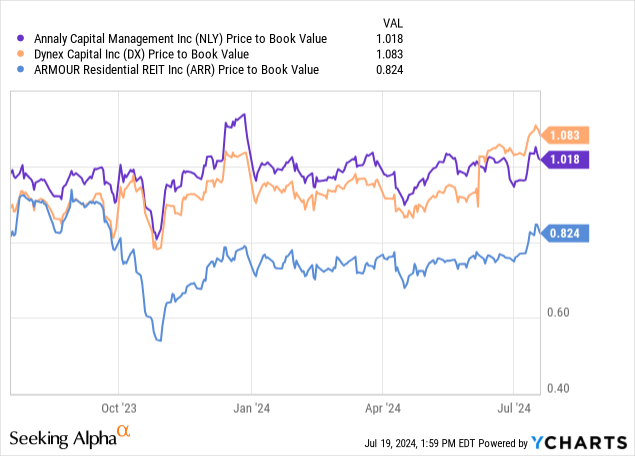

Annaly Capital recorded a book value per share of $19.73 in Q1, which places its price-to-book ratio at 1.02x if its opening price of $20.12 on July 19th is used. Although this doesn’t convey that the stock is overvalued, I would have liked to have seen a price-to-book value below one.

Mortgage REITs like ARR have much lower PB values. Although there are idiosyncratic differences between the vehicles, I’m merely highlighting that better relative value opportunities exist.

Basis Risk

In my view, Annaly has basis risk in the form of a disparity between the performance of its hedging instruments and hedged assets. Additionally, the firm manages a lean asset-liability structure, which means basis risk can occur if a volatile interest rate environment unfolds.

As discussed before, the economic and interest rate environments are volatile, meaning basis risk could occur, especially regarding Annaly’s collateral assets and subsequent repo rate predictions.

Conclusion

After assessing Annaly Capital Management, Inc., I noticed sensitivity to interest rate volatility and the mortgage rate outlook. However, I believe Annaly might benefit if the yield curve achieves bullish steepening, enabling it to invest long-term and fund its endeavors with short-term collateralized borrowing. Furthermore, the mREIT’s dividend yield seems solid, which likely trumps its valuation-based concerns, allowing investors to benefit from the vehicle’s total returns.

Given the above, I deem Annaly Capital Management a Buy.

Read the full article here