I’ve now moved to a neutral outlook on Mammoth Energy Services (NASDAQ:TUSK) at its current share price.

Mammoth’s shares have gone up approximately 12% since I looked at it at the beginning of May 2024. Meanwhile, the near-term natural gas pricing environment has deteriorated a bit more, increasing the risk of a further delay in the demand recovery for Mammoth’s well completion services.

This may leave Mammoth with a low amount of liquidity by late 2024 to early 2025. While it has not yet announced any equity offerings, it did file an S-3 in June and could do an offering to bolster its liquidity.

I am now estimating Mammoth’s value at $3.50 to $4.00 per share, which is $0.50 less than before. This reflects the increased risk of a delay in significant demand recovery into mid-2025.

Natural Gas Prices

Mammoth’s well completion services division primarily is dependent on business from Appalachian natural gas operators.

I had previously expected this division to show signs of increased demand by late 2024, with a significant rebound in demand in 1H 2025. However, continued high natural gas storage levels and low near-term futures prices for natural gas may delay this demand rebound further.

While December 2024 NYMEX natural gas futures prices are still above $3, that has gone down by around 25 cents compared to early May 2024. Futures for early 2025 have also gone down around 20 to 25 cents, resulting in the six-month strip (from December 2024 to May 2025) now averaging $3.17.

Natural gas storage levels remained a bit above the five-year maximum at last report, and the recent Freeport LNG outage (from Hurricane Beryl damage) hasn’t helped matters.

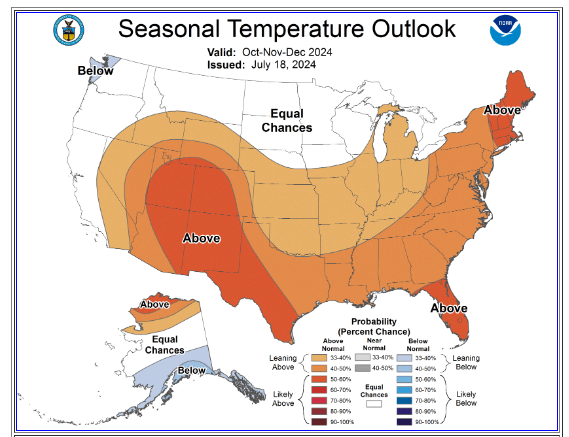

There also appears to be a significant risk of a warm start to the winter heating season (defined as October to March) as well, which would result in below-average natural gas demand for that time of the year. The NOAA’s current October to December outlook calls for above-average temperatures for most of the Continental US.

October to December Temperature Forecast (noaa.gov (Three Month Forecasts))

Long-range forecasts do have accuracy issues, but this does point to a greater than 50/50 chance of warmer-than-usual weather in October to December.

Notes On Free Cash Flow

I now believe that continued weakness in well completion services demand (with no signs of recovery in 2024) could result in Mammoth ending up with around negative $20 million to negative $25 million in free cash flow during the last three quarters of 2024.

Mammoth reported having $13.6 million in credit facility borrowing capacity at the end of April 2024 along with $15.5 million in cash on hand (for $29.1 million in liquidity). Thus, if it ends up with around $20 million in cash burn between May and December 2024, it would essentially use up its cash on hand and end up with a bit of credit facility borrowings.

Theoretically, Mammoth would have a bit of liquidity remaining at the end of 2024 in this scenario, but I’d expect Mammoth to do an equity offering before its liquidity became too low.

Potential For An Equity Offering

Mammoth filed a Form S-3 in June. While it has not announced an equity offering yet, I believe there is a good chance of a 2024 equity offering if it doesn’t receive more PREPA payments in the next several months.

Additional payments from PREPA over the next few months would likely give Mammoth enough breathing room to choose to delay an equity offering.

If Mammoth issues 7 million shares at $3 per share (as an example), that should give it a bit over $20 million in net proceeds, allowing it to weather a well completion services demand rebound that gets pushed into mid-to-late 2025.

Notes On Valuation

I have reduced my estimate of Mammoth’s value to $3.50 to $4.00 per share now, a $0.50 reduction from when I last looked at it. This lower estimated value factors in the dilution from a potential equity offering and my expectations around cash burn during the rest of 2024.

Mammoth’s share price is currently at $3.43, which is 2% below the low end of that valuation range and 9% below the midpoint of that valuation range. I am now moving to a neutral/hold rating on Mammoth due to the relatively limited upside.

Conclusion

Natural gas storage levels remain slightly above the five-year high for this time of year, while early forecasts call for a warm start to the winter heating season. This is reflected in relatively low near-term natural gas strip prices.

If the warm start to the winter heating season does materialize, it seems likely that demand for Mammoth’s well completion services won’t rebound until mid-to-late 2025. This would keep Mammoth in a cash burning position.

Thus if Mammoth doesn’t receive further PREPA payments over the next few months, I can see it doing an equity offering in 2024 to bolster its liquidity. The potential for an equity offering and the potential for continued weak demand for Mammoth’s well completion services results in a reduction in my estimated value for Mammoth to $3.50 to $4.00 per share.

Read the full article here